Summary:

- Meta’s AI investment is paying off as the company has shown strong improvement in ad impressions and price per ad.

- Wall Street is cautious about the aggressive forward capex plans of Meta but the company could show better than expected results as new AI tools are monetized.

- Meta’s Reels, Threads, and WhatsApp platforms are also showing strong tailwinds as competitors face new challenges.

- Meta stock has shown over 50% YTD growth but it is still trading at 21.8X forward PE (fiscal year ending 2025) and only 19X forward PE(fiscal year ending 2026).

- Meta is still one of the more reasonably priced stock within big tech companies and it has good growth runway as AI tools show bigger improvement.

Buda Mendes/Getty Images News

Meta Platforms (NASDAQ:META) stock continues to diverge from other Big Tech companies after the recent earnings. The strong quarterly results of Meta have helped deliver another bullish swing for the stock and it is now up over 50% YTD. One of the key metrics reported by Meta has been 10% price per ad growth. The massive investment in AI chips and building new tools has helped Meta deliver better ads to customers. This in turn has increased the attraction of the platform for advertisers. If Meta can continue to deliver double-digit growth in price per ad, it would justify the massive investment in AI and also improve the overall margins and EPS trajectory. In a previous article, it was mentioned that Meta is building a strong lead in the VR space, and Apple (AAPL) or other new entrants would find it difficult to dethrone Meta.

Meta is also showing strong tailwinds for Reels, Threads, and WhatsApp platforms. There is still a lot of time spent by customers on competitor platforms. Improvement in these platforms should help Meta improve its daily active people or DAP and also increase the ad impressions delivered over the long run.

Despite 50% YTD growth in the stock, Meta is still trading at only 21.8X PE ratio for next year and 19X PE ratio for fiscal year ending 2026 according to consensus EPS estimates. The consensus EPS estimate for both 2025 and 2026 shows close to 15% EPS growth. Meta provides a reasonable valuation multiple compared to other big peers and has good tailwinds which will increase the growth runway for the company.

Rapid monetization of AI investment

All the big tech companies have ramped up their AI investments in order to build new AI tools. However, Meta has been able to deliver a better monetization path compared to other peers. New AI tools built by Meta can instantly be used to deliver better ads and search results. Meta does not have to wait to gain customer traction for new AI tools. This is a massive advantage for the company which is not priced in. We have already seen Meta outperforming other big tech peers in recent earnings.

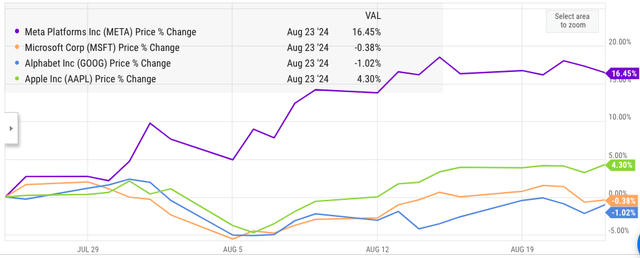

Figure: Price movement in big tech after recent earnings. Source: Ycharts

In the above chart we can see Meta outperforming all other peers since the recent earnings. In the YTD, Meta stock has risen by 50% compared to 10%-18% for Microsoft, Google and Apple.

One of the key reasons has been the strong growth in important metrics like price per ads and number of ad impressions, both of which grew by 10% YoY.

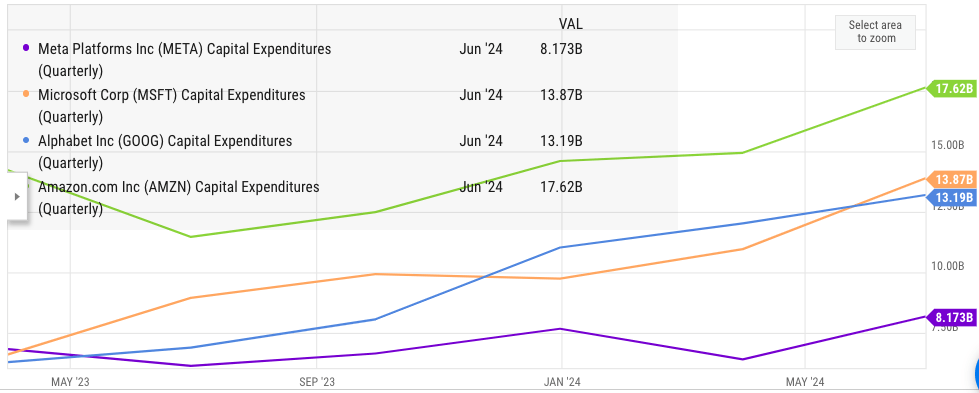

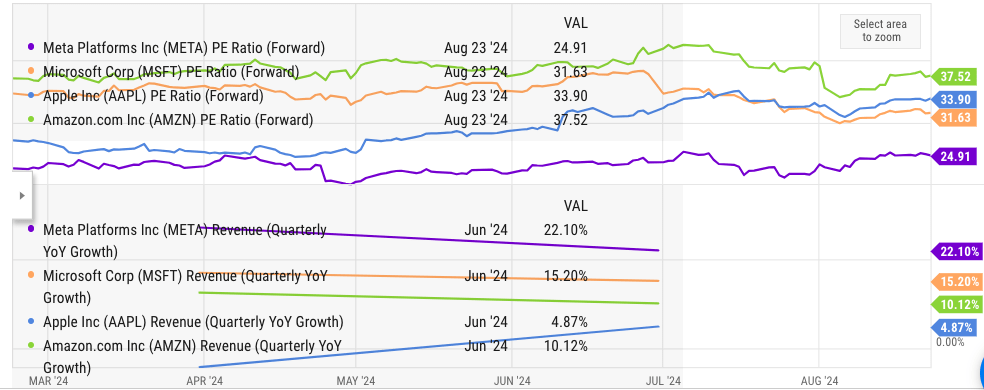

Ycharts

Figure: Increase in Capex by big tech companies. Source: Ycharts

Both Microsoft (MSFT) and Google (GOOG) have been in the lead in terms of investment in AI and their capex has increased to over $50 billion on an annualized basis. Meta has also increased its forward capex estimate and is looking to spend close to $40 billion annually on capex. However, the big difference between Meta and other peers is that Meta has been able to monetize the investment in AI quickly. The AI chips have been very expensive and most of the big tech companies have bought them in bulk. They hope to utilize them over the next few quarters.

In a previous earnings report, Nvidia has mentioned that close to half of its data management revenue comes from selling AI chips to large cloud providers like Microsoft, Amazon (AMZN), and Google. This is equal to $10 billion in revenue in a single quarter. However, these large cloud operators have not been able to show a massive revenue and margin boost by using these AI chips. They need to build new AI tools for their cloud operations and then convince clients to pay a premium for these tools. This is a long process and the cloud operators have not shown a big boost in fundamental metrics due to these investments. Wall Street is getting cautious due to these massive investments and we have already seen some bearish signs in these big tech companies in the recent months.

Meta’s rapid monetization of its AI investment can set it apart from other big tech companies and make the stock outperform the rest over the next few quarters.

Strong tailwinds for Reels, Threads, and WhatsApp

Meta is also showing tailwinds in key platforms like Reels, Threads, and WhatsApp. We already know that TikTok is facing a major challenge in US. There is bipartisan agreement to ban or limit TikTok. The court will hear the case in September. However, it seems highly unlikely that TikTok can prevail in the face of these regulatory challenges. National security is becoming a key priority and the regulators would like to have strong control over the social media platforms. Bloomberg has mentioned that TikTok is facing greater scrutiny after it failed to limit negative content on its platform during the recent UK riots. Despite intense lobbying by TikTok, we could see a complete or partial ban on the app in US and other Western markets.

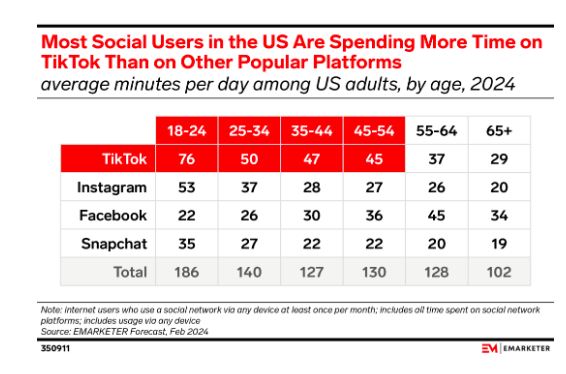

eMarketer

Figure: TikTok’s performance in US compared to other platforms. Source: eMarketer

A recent eMarketer report has mentioned that TikTok has a massive presence within US. The time spent on TikTok easily surpasses Instagram and Facebook for most age groups. If a TikTok ban is finalized in US and other Western markets, it will be a major boost for Reels which is increasing in popularity. Greater time spent on Reels should allow Meta to increase its ad impressions and also charge a higher price per ad from advertisers. TikTok posted $16 billion in revenue in US in 2023. Even if 50% of these users migrate to Instagram, Meta could see a big boost. It is highly likely that Meta would be able to monetize the customers better than TikTok due to its AI tools and the entire social media ecosystem.

Meta also mentioned that Threads has reached 200 million daily active users. Elon Musk’s X, formerly Twitter, has already faced advertiser backlash and has seen advertising plummet by more than two-thirds. Musk himself has made controversial comments recently which can push regulators to take firm action against the platform. Threads should gain from this trend as they see better customer traction.

WhatsApp has reached over 100 million active users in US. The device-agnostic app is gaining in popularity in US and other international regions. This should improve the social media ecosystem for Meta and improve the long term growth runway for the company.

Risks to the thesis

One of the biggest risks for Meta is that it is still dependent on Apple and other OEMs for the smooth running of its apps. We have already seen Apple create massive headwinds for Meta in 2021 by changing a few privacy settings. The rivalry between Meta and Apple is increasing with the launch of Vision Pro which competes against Meta’s Quest. It is certainly possible that Apple would create further changes that would harm Meta’s ability to monetize its user base. The negative impact on Meta could be sudden and this could cause a big dip in EPS in the short term. Meta is trying to build its own ecosystem of devices with Quest and smart glasses. However, it will take a long time before the devices gain significant customer traction.

Meta has had its own share of controversies regarding toxic content on its platform. The company has worked hard to reduce such information. But it is certainly possible that Meta will also see a regulatory pushback if negative content is found on its platforms.

Another major risk is the massive investment in Reality Labs. The company has already invested over $50 billion and the annual losses can easily cross $15 billion in the near term. This is a big investment for Meta and we have not seen a clear roadmap to monetization. Zuckerberg has a majority of voting power and investors would need to keep faith in the management to prudently use this investment.

Still a reasonably priced stock

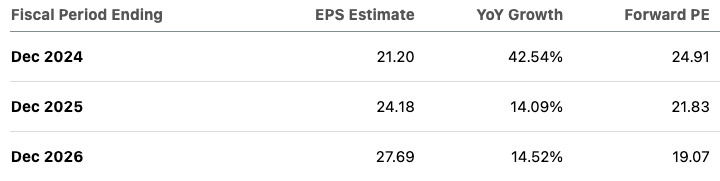

The EPS estimate for Meta for 2024 is $21.20 showing YoY growth of 40%. The EPS estimate for fiscal year ending 2025 is $24.18 with a forward PE ratio of 21.8. The EPS estimate for fiscal year ending 2026 is $27.69 with a forward PE ratio of 19. The consensus EPS estimate shows that Meta can deliver 15% YoY EPS growth in 2025 and 2026. This is a strong pace of growth and we could see some upward revisions if there is a TikTok ban.

Meta’s valuation looks reasonable when we look at the forward EPS growth projection. No other big tech company gives similar valuation and growth options.

Seeking Alpha

Figure: EPS estimates and PE metrics of Meta. Source: Seeking Alpha

Ycharts

Figure: Key metrics of Meta and other peers. Source: Ycharts

Meta has one of the lowest forward PE multiples and the highest YoY revenue growth among big tech companies. As mentioned above, Meta could also show strong monetization of its AI investment as it is able to rapidly deploy new AI tools to help advertisers which increases its price per ad. The recent 50% YTD growth in Meta stock can make some investors hesitant to invest in Meta as they think that the stock has priced in the future growth potential. However, the company has strong fundamentals and is showing a good EPS growth trajectory which makes its forward PE multiple very reasonable when compared to other peers.

Investor Takeaway

Meta’s AI investment is starting to show results as the stock diverges away from other big tech peers. The strong price per ad growth in Meta is an indication that its new AI tools for advertisers are gaining traction and the advertisers are willing to pay more for ad placement. We should also see strong tailwinds in other platforms like Reels, Threads and WhatsApp.

The forward PE ratio of Meta for fiscal year ending 2025 is only 21.8. This is quite reasonable when we look at the EPS growth trajectory of the company making it a good option at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.