Summary:

- Meta will begin offering a subscription service aimed at content creators wishing to have their accounts verified.

- The service is not expected to be a major near-term growth driver but has broader implications for the company’s long-term strategy.

- Opportunities to add features and enhance the subscription value proposition to a wider audience can add to earnings potential going forward.

Justin Sullivan/Getty Images News

Meta Platforms, Inc. (NASDAQ:META) is moving to introduce a new “Meta Verified” subscription service for its Facebook and Instagram platforms. The idea likely takes some inspiration from a similar move by “Twitter”, with CEO Elon Musk citing a need to democratize the verified status, long associated with a blue checkmark reserved for notable public figures and organizations.

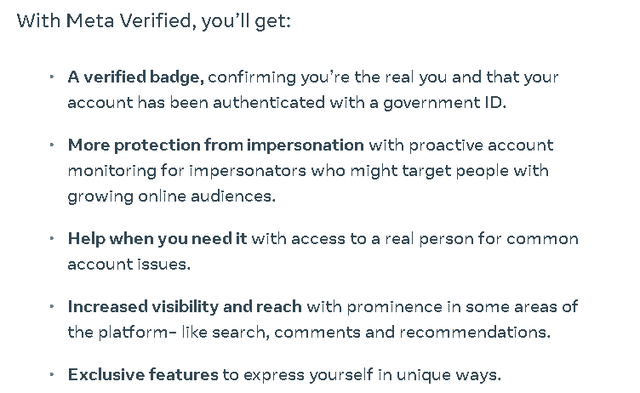

With Meta, the official explanation cites the benefit of account authentication through a government-issued ID, providing access to priority customer support, along with enhanced content visibility. The expectation is that features will be added over the long term that enhance the value proposition from the initial launch with a monthly subscription price of $11.99 on the web or $14.99 when purchased from mobile devices.

From an investor’s perspective, there are several key takeaways:

- First, the service likely doesn’t move the needle in terms of firm-wide financials for the foreseeable future given the expected scale of targeted users.

- At the same time, the move is very important as a first step for the company to eventually build on an expanded subscription offering that could eventually represent a real growth driver.

By this measure, we don’t see Meta Verified as a catalyst for 2023 revenue or earnings but it does work to highlight a new strategic direction the company is going as it attempts to diversify the business beyond “advertising”. Either way, we’re bullish on META stock and this new program is still a net-net positive.

source: company IR

Meta Verified In Numbers

It’s important to recognize that Meta Verified appears to be intended as a niche service directed primarily at content creators, or more specifically, up-and-coming creators looking to establish their presence.

From the current 3 billion monthly active users (MAUs) on Facebook or an estimated 1.4 billion on Instagram worldwide, there is simply not a good reason for 99.99% of those groups to pay upwards of $180 per year to access a platform that remains completely free to access.

While detailed numbers are not available, it is estimated that Twitter Blue has grown to around 300K paid users since launching last November. In contrast with the Meta program, the offering from Twitter is priced at just $7.99 per month ($11 when purchased from mobile) and provides subscribers with some extra features like the ability to create longer texts, tweet editing, and large file uploads.

The distinction we have here is that the Twitter platform serves a different function compared to Facebook and Instagram as a sort of discussion town square can be seen as more “active” compared to the more content creator-centric model of Instagram and Facebook where the typical user may browse often, but does not regularly post to a public audience.

By this measure, we’d expect Meta to capture proportionally fewer “casual” users signing up to its current verified program compared to Twitter where the idea could make more sense to a larger group of users wanting to be seen in the discussions. Also consider, that some of the most active and high-profile creators are already verified through the legacy system.

It remains to be seen how many people sign up on Meta, but let’s assume a very generous 1 million subscriber figure is reached in the first year. At that level, Meta Platforms would be capturing approximately $144 million of incremental annual revenue.

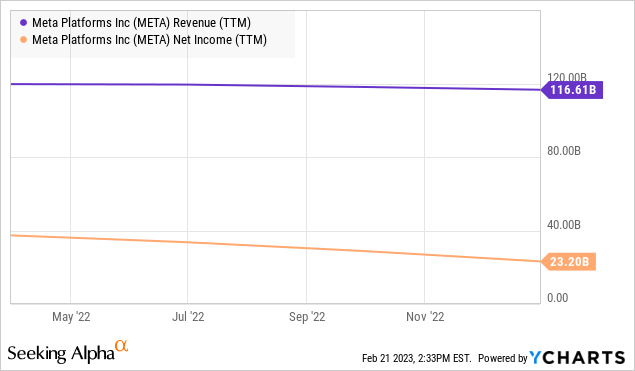

The reality here is that $144 million is a drop in the bucket for a company that reported $117 billion in revenue in its past year and $23.2 billion in net income. By our calculation, for simplicity assuming all 1 million subscribers are from North America, the impact on the region’s average revenue per user (ARPU), would increase 1% in Q4 from $58.77 to $59.36. Again, this would be super-users or emerging content creators looking to stand out with that verified badge paying $12 a month.

We’d also assume upwards of 70% of that Meta Verified business is directly accretive to earnings, after considering some modest effort to expand customer support to deal with the priority access. On this point, no one will turn down an extra $100 million in operating income, based on our 1 million subscriber forecast, but it’s still not significant. In our view, the program only begins to turn material in a scenario approaching 3-5 million subscribers.

Meta Verified Is a Bigger Story Long-Term

From the Meta Verified press-release announcement, the quote that stood out to us previews what is the bigger plan from the company to develop a more comprehensive offering.

Long term, we want to build a subscription offering that’s valuable to everyone, including creators, businesses and our community at large.

Investors can look forward to the service eventually adding features that have a broader appeal and help enhance the user experience. We can only speculate what direction it will go but the first option that comes to mind would be a move to “bundle” services that are accessed through Facebook and Instagram.

Presumably, deals could be reached with internet publishers including newspapers, that are currently behind a paywall, to grant access to Meta Verified subscribers. Facebook and Instagram could use the ecosystem to grow their e-commerce marketplace providing sellers with listing deals or shipping discounts for items. This is where the offering can start to gain mass market appeal with ambitions in the tens of millions of paying users that would work to diversify the entire business model.

It becomes interesting when we start considering the existing Meta ecosystem that includes WhatsApp along with what can still be considered other under-developed products. With Meta essentially taking a page from Twitter, the playbook from Amazon.com (AMZN) with “Prime” or even Apple Inc (AAPL) could be on the table. We won’t be surprised if the subscription service becomes the entry point for the company’s metaverse ambitions over the next decade.

What’s Next for META?

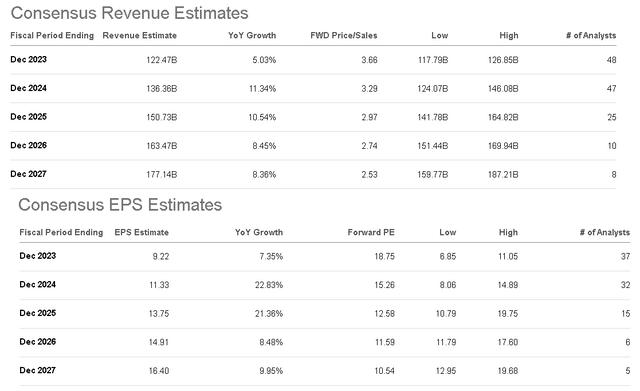

Putting it all together, the development adds to META’s growth potential and can work to bump up long-term revenue and earnings. According to the current consensus, revenues are expected to average a 9% annual increase through 2027, while EPS is a bit higher at 14%. The bullish case is that this outlook proves to be too conservative, opening the door for the company to exceed expectations.

A theme from the last earnings report was the near-term effort to re-focus on profitability with support for margins through cost-cutting and efficiency initiatives. We expect that trend to continue through 2023.

If anything, the positive headlines surrounding the rollout of the Meta Verified services over the next few weeks with updates from management describing an early wave of signups should be positive for some renewed momentum.

Seeking Alpha

There’s room to be bullish on META, but it’s important to recognize that the stock has already been a big winner to start the year, running higher following the better-than-expected Q4, and now up nearly 100% from its 2022 low. By this measure, our forecast is for some near-term consolidation of the recent gains into the next quarterly update.

Hitting some technical resistance around $195, the latest pullback coincides with a new round of market volatility, focusing on uncertainties in the macro outlook between stubborn inflation and the next steps in Fed policy. The risk here is that a deeper deterioration of the economic environment brings to hit Meta on the demand side of core operating drivers like advertising demand.

Ultimately, we believe META can outperform the broader market but will need sentiment toward tech and growth stocks to cooperate. To the downside, it will be important for the $150 level of support, representing the “gap” from the breakout to hold to keep bulls in control.

Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.