Summary:

- Meta Platforms is having success growing CTM revenue.

- Meta’s earnings estimates have been upgraded for 2023 & 2024.

- META stock is reasonably valued, which should allow the stock to rise on continued positive earnings growth.

Kelly Sullivan

Meta Platforms (NASDAQ:META) did have its challenges at the end of 2021 and for most of 2022. The stock plunged sharply during that time, sparked by disappointing earnings reports. Meta was probably negatively impacted from Apple’s (AAPL) privacy policy changes during 2021.

However, Meta’s stock has been rallying since November 2022 on a brighter outlook for the future. Meta reported a positive Q4 2022 with results that were better than feared. CEO, Mark Zuckerberg, declared 2023 to be the ‘Year of Efficiency’ as the company did some restructuring for operational improvements.

Earnings Upgrades Driving Stock Growth

Meta’s restructuring led analysts to make a series of earnings upgrades. The company received 26 earnings upgrades over the past 3 months. EPS estimates for 2023 went from $7.94 to $9.79 within the last 3 months. That is an increase of 23% for Meta’s 2023 earnings estimates.

Meta is now expected to achieve earnings growth of 14% in 2023 and 24% for 2024. It is positive to see the acceleration of earnings growth from 2023 into 2024. Revenue growth is also expected to accelerate from about 5% in 2023 to 11% in 2024.

Positive earnings upgrades tend to drive stock prices higher. Earnings revisions are one of Seeking Alpha’s quant ratings, which tends to drive strong stock performance. Meta has an A- rating for revisions and an overall ‘Strong Buy’ quant rating for the company on Seeking Alpha. Meta’s strong stock recovery from $88 to $210 since November 2022 was largely driven by the significant increase in earnings upgrades and the positive outlook for the company.

What is Driving the Earnings Upgrades?

Meta Platforms is looking positive for 2023 and 2024 because of a few factors. One positive factor is the company’s restructuring which is designed to have the company run more efficiently. This involved layoffs of about 21,000 workers. The restructuring also involves canceling lower priority projects and reducing hiring rates. These efforts are expected to drive down total expenses.

Another factor is the buzz surrounding Meta’s incorporation of AI (artificial intelligence) into Facebook and Instagram. The company is increasingly using AI to show more relevant content for users in feeds. This includes the use of the fast growing Reels (short videos) format. The use of AI can help drive effective marketing within feeds. This can help drive revenue growth for Meta. Meta has an opportunity to increase the monetization of Reels since this format is growing rapidly.

CTM ads (click-to-message) are a growth driver for Meta. CTM ads allow businesses to place ads with an action button that can open to a direct chat within Facebook and Instagram feeds. Meta just added this feature to Reels this past week.

CTM can be a strong growth driver for the monetization of Facebook Messenger and WhatsApp since they each have over 2 billion users. CTM ads replaced the revenue that was lost to Apple’s privacy policy changes.

Mark Mahaney, an analyst from Evercore, highlighted the importance of CTM ads and their potential to drive ongoing advertising solutions for businesses in developing markets. Mahaney has a price target of $305 for Meta. This would be 44% upside from the current price of $212.

Stephen Ju, an analyst from Credit Suisse, has a lower price target of $251, implying 18% upside. Ju states that the most recent relevant update is Instagram offering advertisements within search results. He believes that this will add a new stream of high-margin revenue.

Strong Profitability Metrics

Meta’s strong profitability metrics allow the company to achieve strong earnings growth to help drive the stock higher. Meta has a high gross margin of 79.6% vs. the sector median of 50%. The net income margin of about 20% is also much higher than the sector median of 3.4%.

Meta also achieves strong returns. Meta has an ROE of 18.5%, ROIC of 14%, and ROA of 12.5%. These outperform the sector median ROE of 3%, ROIC of 3.5%, and ROA of 1.6%.

These strong metrics can help Meta achieve the strong double-digit earnings growth that the company is expected to achieve over the next two years.

Reasonable Valuation

I typically like to use the PEG ratio to analyze Meta’s valuation. The PEG takes multiple years of future growth into account instead of just looking one year ahead. Meta is currently trading with a PEG of 1.71. This is based on Meta’s 3 to 5 year expected CAGR for earnings growth of 12% to 13%.

The growth stocks that I cover tend to be reasonably or fairly valued with PEG ratios between 1 and 2. Meta is currently trading in the upper portion of that zone, making the stock reasonably valued. At this level, the stock could easily increase approximately in-line with earnings growth.

Technical Perspective

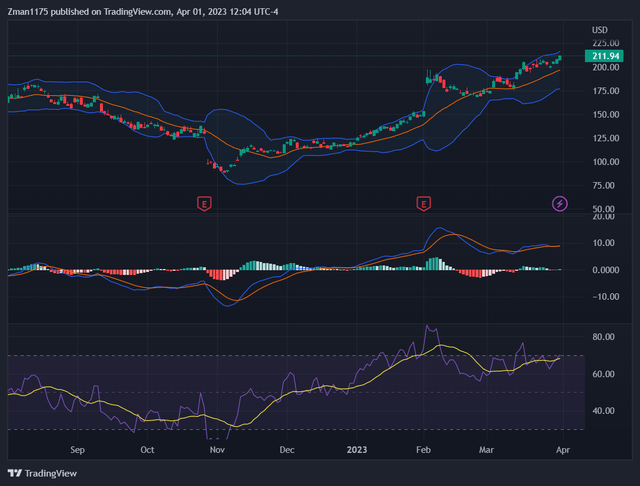

META stock price (tradingview.com)

Meta’s daily stock chart above shows the price making a strong recovery after the last 2 positive earnings reports (marked as red E on the chart). However, the stock price and purple RSI line at the bottom of the chart are showing bearish divergence since February (the stock rising, while the RSI is declining). While I don’t know exactly what will happen in the short-term, the stock might continue to increase in April. Then, we could see a sell in May and go away situation in a month. My reasoning for that is because the sentiment in the market and for Meta is positive right now.

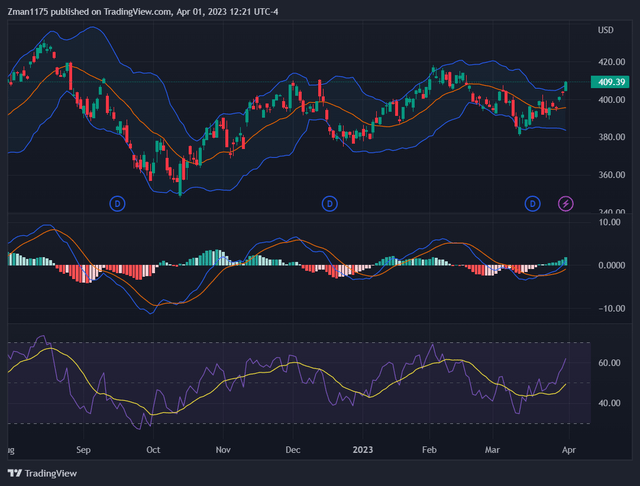

SPY price action (tradingview.com)

The broader market as measured by the S&P 500 (SPY) is nearing an overbought condition according to the purple RSI line. Meta’s stock is also nearing an overbought condition. However, the S&P 500 and Meta could continue to rally until a negative catalyst reverses the sentiment and price action. Or, a reversal could take place on profit taking if the S&P 500 and Meta’s stock reaches an extreme overbought level. My guess is that the market will continue to rally in April as the market sentiment and company outlook is currently positive.

Meta Platforms Outlook

Overall, Meta looks positive in 2023 and 2024 as earnings estimates have been upgraded. The potential for increased CTM revenue should continue to be a positive growth driver for the company.

The biggest risk that could derail the stock would be a significant recession which could lead to a decrease in Meta’s advertising revenue. Of course, a broader market correction could also lead to losses for the stock at any time.

Meta is trading at a reasonable valuation level, which should allow the stock to rise at least in-line with earnings growth in 2023 and 2024. That could mean a price target of $241 in about one year and about $300 in two years. That is based on expected earnings growth of 14% for 2023 and 24% for 2024. Of course, other analysts such as Mark Mahaney from Evercore are more bullish than that. Mahaney expects $300 to be reached within one year. So, we will have to see how things materialize for Meta in upcoming earnings reports. We will also have to keep up with the broader market sentiment which could affect Meta’s stock as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining Kirk Spano’s Margin of Safety Investing which offers a more in-depth analysis of individual companies.

Try Margin of Safety Investing free for two weeks and get your first year for 20% off.

Learn the 4-step investment process that top hedge funds use.

Invest with us in a changing world that demands a margin of safety.