Summary:

- Interest-rate fears have affected tech stocks, including Meta Platforms (parent company of Facebook), but it may be a good time to consider a new position.

- Meta’s dominance in the social media space, room for growth in users and engagement, and immense profitability are strong upside catalysts, but ad market trends remain uncertain.

- The company is managing to deliver 20%+ EPS growth due to a double-digit reduction in headcount. Revenue is also being held up by strong increases in ad impressions.

- At an 18x FY24 EPS multiple, Meta is neither cheap nor expensive; so it’s best to watch and wait from the sidelines.

grinvalds

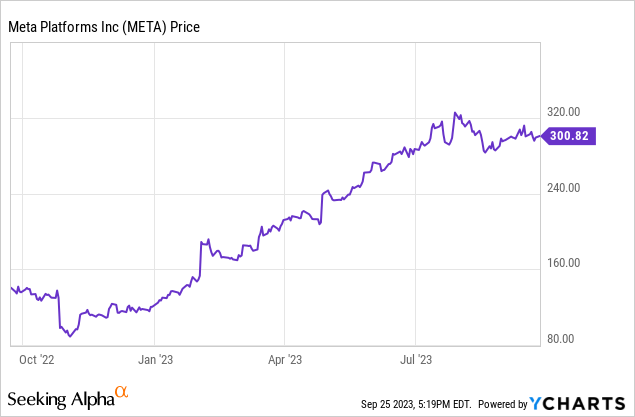

Interest-rate fears since the start of June have sapped a lot of YTD gains and momentum for many tech stocks, including Meta Platforms (NASDAQ:META), the parent company behind Facebook. It may be a good time to use the volatility to explore a new position in this stock, which is up more than 2x YTD even after recent downside.

At $300, Meta is a balanced bull and bear case

A mea culpa here: I made a bad bearish call on Meta earlier this year when the stock was trading just under $200. At the time, I had based my negative outlook on a number of drivers: declining ARPUs driven by ad market weakness, weaker user growth trends, and low current-year estimates that led to what looked like an inflated valuation.

Since then, Meta has surprised us to the upside, delivering a return to revenue growth, double-digit EPS gains, solid user numbers, and a continued commitment to prioritizing profitability, which has driven a nearly unstoppable rally this year. I am now reversing my bearish call on Meta, and though I’m not convinced yet enough to be fully bullish, my take on Meta is now neutral. At current share prices, I view the stock to be a relatively balanced bag of positives and negatives.

On the bright side for Meta:

- The combination of Facebook and Instagram’s dominance is unparalleled. Facebook has the leading market share of any social media platform on the planet and has dominated the space for nearly two decades. New introductions like Threads and Reels showcase Instagram’s ability to jump on newer trends and compete directly with hot startups.

- Room to grow in absolute users, including and especially in lucrative developed markets. Meta continues to grow daily active users and engagement even in the U.S., which has been a problem spot for many fellow smaller social media companies like Snap and Pinterest.

- Room to grow in engagement. Whether we like it or not, we’re glued to our phones now, and the emerging Gen Z has never experienced life before the smartphone. Meta is delivering double-digit y/y growth in ad impressions, which will continue to trend upward the more time we spend on social media.

- Immensely profitable. Especially now as Meta turns its focus to the bottom line, rich 20%+ GAAP net margins are coming to the forefront and delivering healthy EPS growth in a company once thought to be growing at all costs.

Still, we should be worried about a number of less-sanguine factors looming on the horizon:

- Advertising recovery will be a multi-quarter struggle. Though ad impressions are growing, price per ad is still declining sharply. Belt-tightening by large companies, especially in a highly discretionary marketing budget, may last throughout next year. Meta may have to turn to increased ad load to make up for the decline in ad rates, which may come at a risk to its platform.

- Meta’s cost initiatives may come at the risk of its “moonshots”. Let’s face it: Facebook, Instagram, and WhatsApp, though wildly popular, are what we could consider “sustaining” businesses in the tech industry. As we’ve seen from the rapid ascent of rival platform TikTok, it doesn’t take much for a new upstart to rapidly go viral and steal the spotlight from the existing social media giants. To defend against this, Meta really needs its innovation arm – particularly in the Metaverse, which has long been Mark Zuckerberg’s vision for the internet – to thrive. But in a cost-down environment, these unprofitable and multi-year efforts may see big delays, which in the long run may serve to accelerate Meta ceding ground to competitors.

Valuation checkup

With estimates creeping up for Meta, the stock isn’t exactly expensive by consensus standards. For next year FY24, Wall Street analysts are expecting Meta to deliver $16.66 in pro forma EPS, which would represent 25% y/y earnings growth, on top of $149.1 billion in revenue (+13% y/y). Consensus is effectively calling for revenue growth rates to stay in line with current trends, while continued operating efficiency delivers the balance of the EPS growth.

Taking earnings estimates at face value, at current share prices near $300, Meta trades at 18.0x FY24 P/E, which is roughly in line with the broader S&P 500. Considering 25% expected EPS growth, however, Meta’s PEG ratio is 0.7x, so it’s cheap by that measure.

All in all – I certainly don’t see much downside for Meta, but considering expectations are already calling for aggressive earnings growth, I don’t see much of a path upward either. So to me, a neutral “watch and wait” stance is the best strategy for this stock.

ARPU, US users experience sequential recovery

Though I’m not advocating for an immediate buy on this name, it’s worth acknowledging the turnaround in fundamental metrics that Meta has notched since the start of the year.

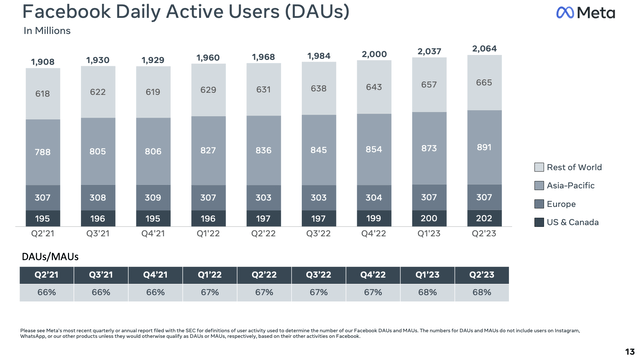

The user trends are shown in the charts below:

Meta DAUs (Meta Q2 earnings deck)

The company added 35 million sequential DAUs to land the quarter at a record of 2.06 billion, up 5% y/y. This represents acceleration relative to Q1’s 4% y/y DAU growth rate.

Furthermore: the company managed to add 2 million sequential new users in the U.S. and Canada, the company’s most lucrative region – which is a relief after two quarters of relative stagnation.

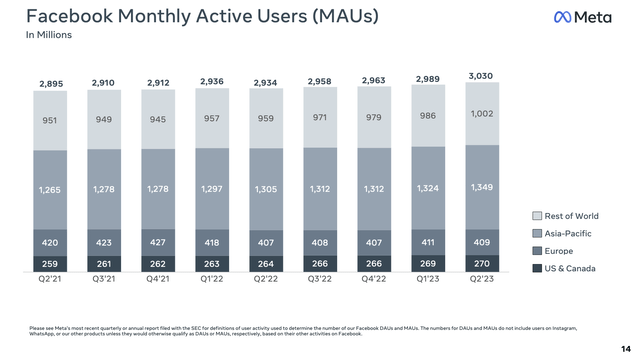

The MAU story is similar, with overall company MAUs growing 3% y/y to 3.03 billion, accelerating versus Q1’s 2% y/y MAU growth rate.

Meta MAUs (Meta Q2 earnings deck)

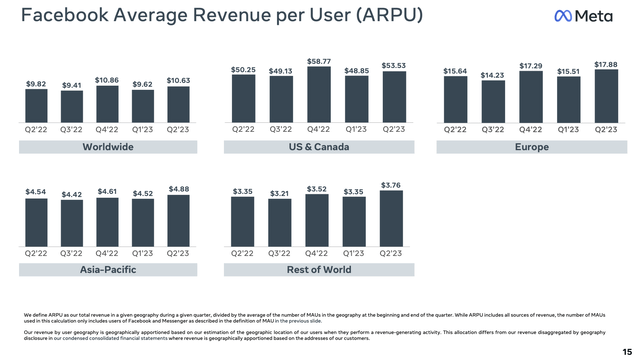

And the more aggressive DAU growth rate relative to MAUs is an indicator of how well Meta is driving engagement across its platforms, which is a key offset to weaker ad pricing. Total company ARPU jumped sequentially to $10.63, a 10% sequential increase and an 8% y/y increase, with the key U.S. market (with ARPUs at 5x the company average) also showing strong sequential growth.

Meta ARPU (Meta Q2 earnings deck)

Ad impressions served grew 34% y/y (a function of higher DAUs and daily social media activity) while price per ad declined -16% y/y. The way I see it, however, is that weaker ad pricing is more of a temporary phenomenon that may last through next year – but higher social media addiction rates may be a more permanent secular driver for revenue growth.

New app features are also a major driver for higher engagement, including the newer Threads product (Meta’s answer to X, formerly known as Twitter). X’s controversy post-Elon Musk’s buyout has evidently been a source of user growth for Meta, and on the Q2 earnings call CEO Mark Zuckerberg pointed out that this major product release was delivered by a relatively lean team:

On Threads briefly, I’m quite optimistic about our trajectory here. We saw unprecedented growth out-of-the-gate. And more importantly, we’re seeing more people coming back daily than I’d expected. And now we’re focused on retention and improving the basics. And then after that, we’ll focus on growing the community to the scale that we think is going to be possible. Only after that we are going to focus on monetization. We’ve run this playbook many times before with Facebook, Instagram, WhatsApp, Stories, Reels and more[…]

One note I want to mention about the Thread launch related to our year of efficiency is that, the product was built by a relatively small team on a tight timeline. We’ve already seen a number of examples of how our leaner organization and some of the cultural changes that we’ve made can build higher-quality products faster and this is probably the biggest example so far. The year of efficiency was always about two different goals, becoming an even stronger technology company and improving our financial results, so we can invest aggressively in our ambitious long-term roadmap.”

This efficiency mindset has also driven Meta to deliver a 29% GAAP operating margin – which, on top of 11% revenue growth for the quarter, squarely puts Meta in the “Rule of 40” club that is often used to measure growth and profitability balance for software companies. We note that Meta’s headcount of 71.5k was down -14% y/y, which is impressive for such a large company (and that June quarter-end headcount included some employees that are impacted by layoffs, so there’s more downside not yet reflected).

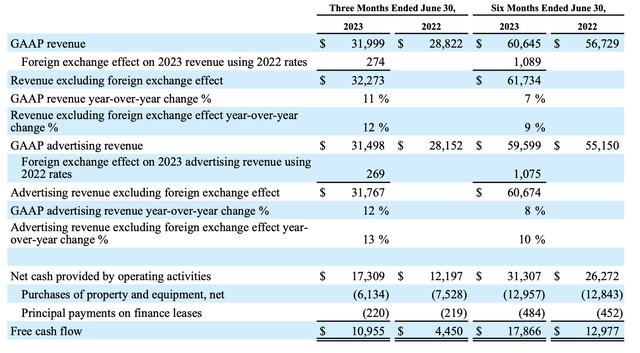

Pro forma EPS in Q2 grew 21% y/y to $2.98, dashing Street expectations at the time of $2.89, while free cash flow in the first half of FY23 grew 38% y/y to $17.9 billion:

Meta FCF (Meta Q2 earnings deck)

Key takeaways

With Meta showcasing both strong user engagement trends and fierce profitability growth since the start of the year (neither of which I, or many market-watchers, had anticipated earlier on in 2023), I’m no longer bearish on Meta – yet at an ~18x forward P/E with multiple near-term fundamental risks on the horizon, it’s not a screaming buy yet either. With risk-free interest rates topping 5%, we have to be more selective about the stocks we retain in our portfolios, and Meta doesn’t make the cut for me just yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.