Summary:

- Meta Platforms’ stock has risen significantly this year, but the company still faces structural issues and threats from competition and privacy concerns.

- The company’s profitability has been impacted by its investments in the Reality Labs segment, which will continue to burn billions of dollars for the next decade.

- While Meta’s advertising revenues have shown growth, monetization issues and competition from TikTok have affected its ability to generate higher profits.

Urupong

Investment Thesis

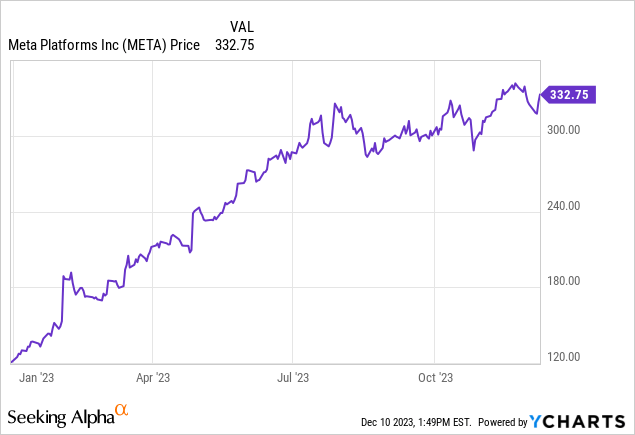

Meta Platforms’ (NASDAQ:META) stock has risen 176% year to date and 272% since the bottom of November 2022 – when it was trading around $90 per share – almost reaching its all-time high of $380.

Such a U-turn in valuations, after more than a year of being aggressively beaten down by Wall Street, primarily originated from an industry-wide recovery from the grinding halt in online advertising spending featured last year, and secondly, by a tangible change of course made by Meta on its metaverse bet – which really strained the company’s profitability in 2022 – by significantly reducing the investments.

While Meta’s stocks seem to have finally exited their most depressed period since the IPO, Meta Platforms’ structural issues are far from over and could pose a serious threat to long-term investors willing to buy the company at current prices.

With Meta going all in with the Reality Labs segment, profitability levels dropped considerably as the new business line burns more than $10 billion a year. But what’s worse is the company clearly stated in the latest 10Q:

Many of our Reality Labs investments are directed toward long-term, cutting-edge R&D for products for the metaverse that may only be fully realized in the next decade.

This means Meta will have to keep pouring billions for the next 10 years before seeing any tangible result.

Since the beginning of the year, Meta has made a big step back in terms of metaverse spending – laying off thousands of employees, especially from R&D segments – in a desperate attempt to stop the bleeding and heal its wounds. However, despite witnessing a significant improvement in operating margin this year, in the long term, as long as the company pursues the way of the metaverse is unlikely it will ever recover its historical profitability levels.

Other than internal issues, external factors like increasing competition from TikTok – which forced the company to introduce short-video formats which notably decreased ad monetization – and the tightening in privacy concerns by Apple and International Institutions – which severely impacted the collection of user data for advertising purposes – represent a serious threat to Meta’s ability to keep running its operations as freely as it used in the past, and more importantly, with the same result.

While competition and privacy concerns will constitute a menace to Meta’s capacity to preserve its market share in the online advertising industry, the Reality Labs segment will slowly erode it from the inside until its metaverse bet will finally pay off, if ever it will.

Despite its stocks soaring since the start of the year, given the gloomy outlook, at today’s prices, Meta Platforms is too expensive to represent a good long-term investment opportunity.

Business Model – Moat & Profitability

As of the nine months ended in 2023, Meta’s primary source of revenue is represented by advertising services which account for $93.9 billion or 99% of total revenues. The remaining part is derived from the Reality Labs segment – equal to $825 million – down 42% from 2022 results.

The advertising revenues grew 13% YoY, a charming result – even if compared to the 20.1% median growth rate of the industry – however, considering ad revenues were stagnant last year, the rediscovered momentum in growth is mostly imputable to the recovery of the online advertising industry taking place this year. On the other hand, the downfall of Reality Labs must be imputed to a demand lag as customers were waiting for the release of the new headset, the Meta Quest 3, which took place at the beginning of October 2023. Overall, total revenues – equal to $94.7 billion for the last nine months – grew 12% YoY.

Despite the pleasant return of growth, the management expressed their concerns on monetization levels with the average price per ad down 6% from last year’s Q3. Monetization issues are a direct consequence of both adverse privacy policies, which limited the ability of Meta to collect the personal data of its users, and the introduction of Reels – short video content introduced to compete against TikTok – which still underperform the monetization levels of Stories and Posts.

The underperformance of new content formats is an ongoing issue for Meta, it happened with Stories, as they copied it from Snapchat after the acquisition plan failed, and now it’s happening with Reels, as they are trying to recover ground from TikTok after its absurdly fast rise in popularity in the social media industry.

Even though Reels will eventually catch up with other formats’ monetization levels, Meta has entered a vicious circle of stealing competitors’ new ideas – after failing to acquire them as also happened with TikTok – and leveraging on its huge user base – accounting for more than 3 billion users – to monetize on the new format. The strategy of copying competitors might work once or twice, but if Meta doesn’t start to innovate again, it will eventually encounter a competitor able to threaten its dominant position in the social media industry. TikTok, among all, is a very suitable candidate for the throne.

The metaverse bet can be considered an innovation attempt – as Meta wants to free itself from hardware manufacturers, like Apple (AAPL), who can decide which users’ data can be collected and which not – but as reported by the company itself, tangible returns on investments will only be realizable in the next decade. Therefore, if Meta doesn’t come up with innovative solutions for its Family of Apps, competition will continue to drag down revenues and market shares.

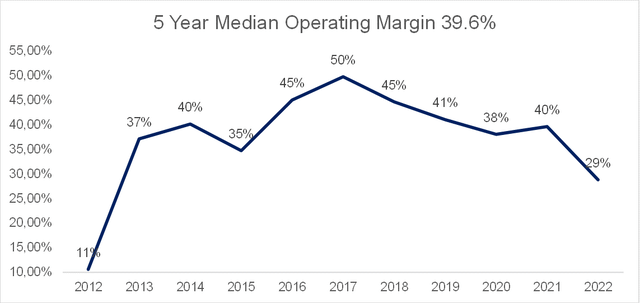

Moving on to profitability, the operating margin for the nine months ended 2023 is equal to 32%, lower than the company’s 5-year median value of 39.6% but still better than the industry median value of 25%.

5-year median operating margin (Personal Data)

Meta Platforms totalled an operating profit of $30.3 billion for the period, growing 35% YoY, a shocking result at first glance, but again, considering the operating margin declined 28.2% in 2022, it just shows the company has partially recovered its historical profitability.

Netting out the negative influence of the Reality Labs business line – a loss of $11.4 billion – Meta’s operating profit for the period would have been equal to almost $42 billion, equal to an operating margin of 44%.

After the billions of dollars invested in 2022 in the Reality Labs segment, this year the management has opted for a more cautious approach notably cutting R&D expenses and laying off thousands of employees. The results – positively influenced by the comeback of revenue growth – are visible with the operating income up 35% compared to the nine months ended in 2022.

However, as Meta went all in with the metaverse, the weight of its bet is still evident in the company’s overall profitability. The Reality Labs segment is burning tens of billions of dollars every year, and it will likely continue this trend in the foreseeable future until the metaverse reaches mass adoption.

Combining the decreasing monetization levels – due to increasing privacy concerns and competition – with the billions of dollars required to sustain the primordial metaverse infrastructure, Meta’s operating margins will likely be lower than its historical values in the coming years. That doesn’t mean Meta won’t maintain top-tier profitability if compared to the industry in which it operates but it will hardly reach its pre-Reality Labs levels again.

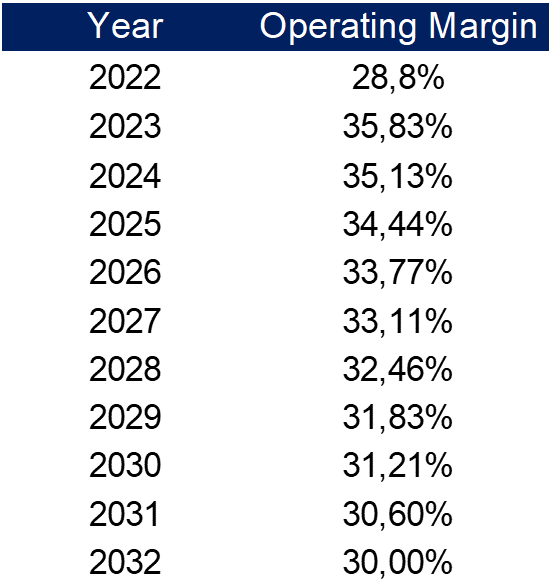

With that said, I do expect the operating margin to sit around 30% by 2032, still higher than the industry median operating margin of 25%, but way lower than Meta’s 5-year median operating margin of 39.6%.

Expected operating margin (Personal Data)

Industry Overview – Risks & Growth

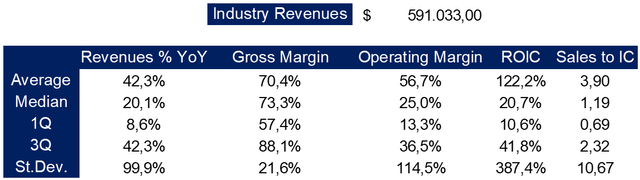

Meta Platforms operates in the Interactive Media industry, an industry characterized by high growth – with a median revenue growth rate of 20.1% – and high profitability totalizing a median gross margin of 73.3% and median operating margin of 25%.

Interactive Media industry data (Personal Data)

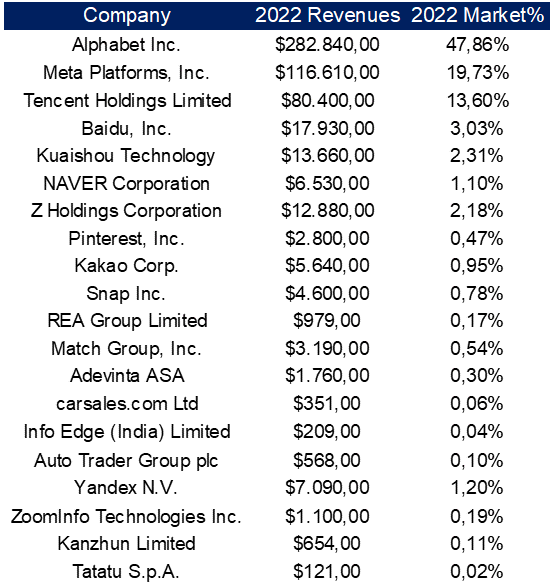

With its $116 billion in revenues in 2022, Meta alone accounted for 19.7% of the industry’s total revenues equal to $591 billion. Its biggest competitor when it comes to advertising services is Google (GOOG) – which owns a whopping 47.8% market share – however, the two companies don’t directly compete as Meta’s business model revolves around its social media platforms while the core business of Google is its search engine.

The sole exception would be YouTube, as it competes against Facebook and Instagram for users’ watch time, although other than a direct match between Reels and YouTube shorts, the content offered on the two platforms – and the way people use them – is very different.

Interactive Media top 20 companies by market share (Personal Data)

Currently, the biggest threat to Meta in the social media industry is TikTok, the Chinese social media, that with over 1.6 billion users suddenly emerged as the third largest platform by user base, behind YouTube and Meta. While 1.6 billion users are still not even half of Meta’s user base – totalling 3.1 billion daily active people and 3.9 billion monthly – the speed at which TikTok is growing truly represents the biggest threat to Meta, going from 700 million in 2020 to 1.6 billion in 2023.

In less than 4 years, TikTok’s popularity has grown immensely to the point it pressured a titan like Meta into copying its short video format – in a desperate attempt to stop its users from flying to the new Chinese app – and making it struggle to monetize on it.

However, when it comes to revenues TikTok has a long way to go to catch up with Meta, reporting around $9.4 billion in 2022 – for 1.36 billion users in 2022 – which would be equal to a 1.6% market share.

Another major threat, affecting not only Meta but the whole industry, is the increasing concerns over privacy protection. From mobile operating systems and browser providers, like Apple and Google, and international regulations, like the European Union’s General Data Protection Regulation, many are the class actions taking place to prevent tech giants – especially Meta Platforms – from inappropriately collecting personal data for their advertising purposes.

Any sort of tightening in privacy policies will limit the ability of companies to collect users’ data needed to tailor targeted advertising campaigns. Meta, among other players, has been hit hard by the new policies, especially as it bears a sort of double tightening as it isn’t only subjected to institutional regulations but also to the ones of Apple and Google, which add their layer of protection, further limiting Meta’s ability to collect relevant data from its user base.

Despite increasing privacy concerns, the Interactive Media industry seems to have fully recovered from the delusional performance of 2022, when the industry’s total revenues registered a mere revenue growth rate of 4.59% against its 5-year median growth rate of 20.1%.

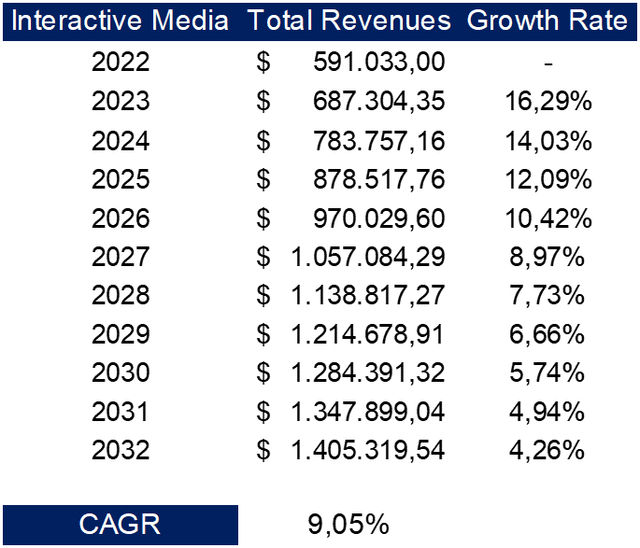

With that said, I do expect the Interactive Media industry to keep growing strong in the coming years. The expected growth rate for the industry – based on the reinvestments made by the companies operating in the sector – is 16.3%. A detailed explanation of how I came up with the industry’s expected growth rate, as well as many more useful industry data, can be found on my website.

Therefore, by 2032 Interactive Media revenues are expected to reach $1.4 trillion, increasing 2.4 times by the $591 billion registered in 2022 at a CAGR of 9.05%. I projected the industry’s expected revenues 10 years from now applying the expected growth rate of 16.3% and letting it slowly decline as the industry approaches the economy’s perpetual growth rate represented in this case by the USD risk-free rate.

Interactive Media expected revenues (Personal Data)

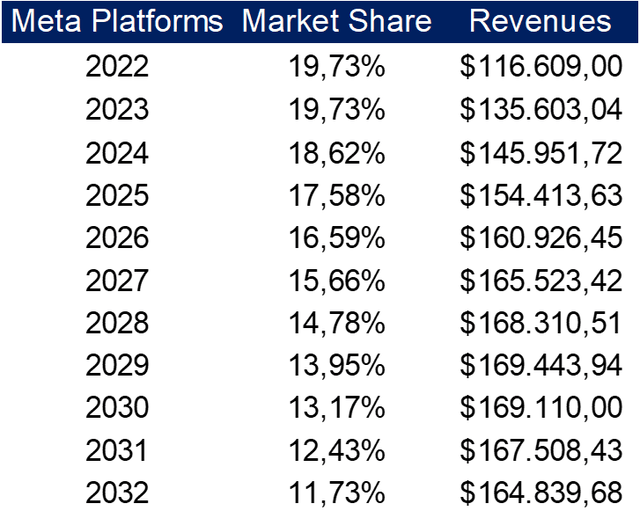

As regards Meta Platforms, considering all the headwinds the company will face, I assumed its market share to decline considerably over the years, from 19.7% in 2022 to 11.7% by 2032. Despite remaining among the top companies in the online advertising industry, I expect the deadly mix of adverse privacy regulations, increasing competition, and lower monetization capabilities to reduce Meta’s historical dominance of the industry, as other players like Google – less impacted by privacy concerns – and TikTok – thanks to its growing popularity – will further expand their market shares.

With these assumptions, Meta’s revenues from advertising services will sit around $165 billion by 2032, one and a half times the 2022 revenues of $116 billion.

Family of Apps’ expected revenues (Personal Data)

However, advertising is not the sole stream of revenue for Meta.

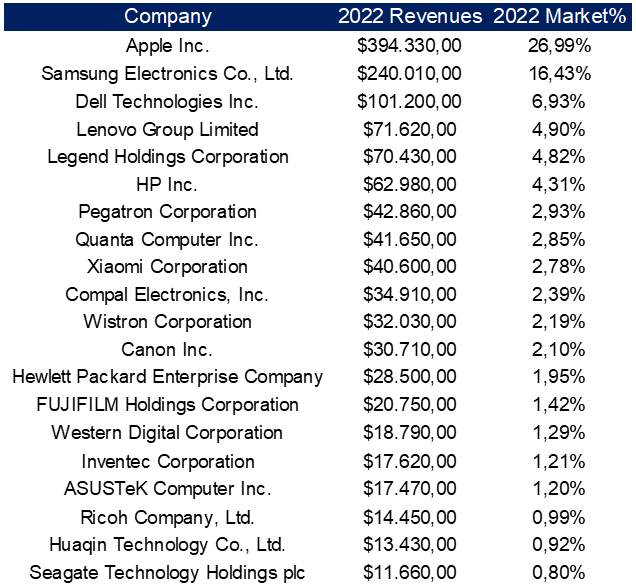

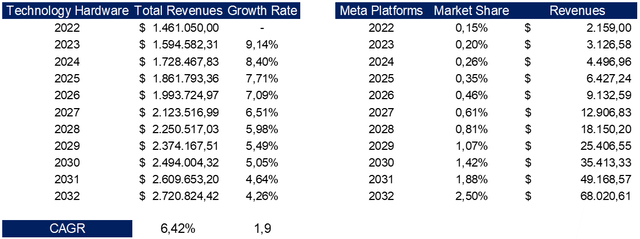

Since the acquisition of Oculus in 2014, Meta started to develop and sell hardware products under the Meta Quest brand. In 2022, its headset business line generated $2.1 billion in revenues, representing a mere 0.15% of the Technology Hardware industry’s total revenues of $1.4 trillion in 2022.

The leaders in the Technology Hardware industry are Apple and Samsung, which together generate 43% of total revenues, while the top 10 companies in the industry account for 75% of the total.

Technology Hardware top 20 companies bymarket share (Personal Data)

As Meta has bet its future on the metaverse, when it will eventually enter its mass adoption, we can reasonably expect Meta’s headset products – currently the highest-selling augmented and virtual reality headsets in the world – to be the primary go-to for people willing to enter this new era.

For this reason, I expect Meta’s market share in the Technology Hardware industry to increase significantly over the years – as headset hardware enters our daily life like smartwatches and tablets did – going from an insignificant 0.15% in 2022 to 2.5% by 2032, placing Meta in the top 10 of hardware products manufactures by revenues contribution.

Assuming Technology Hardware’s revenues reach $2.7 trillion by 2032 – I applied the same approach used to forecast the Interactive Media revenues, using this time an expected growth rate of 6.65% – Meta’s market share of 2.5% would be equal to $68 billion in revenues generated by the Reality Labs business line.

Technology Hardware & Reality Labs’ expected revenues (Personal Data)

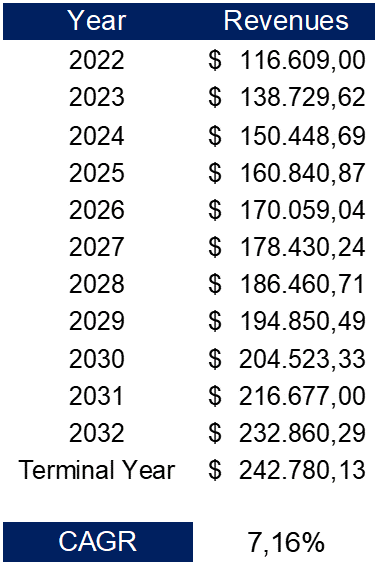

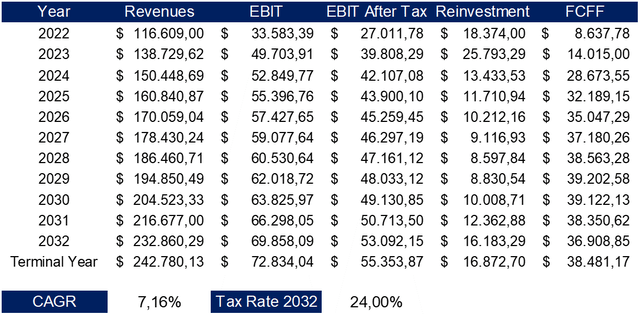

Combining advertising revenues with Reality Labs ones, by 2032 Meta revenues are expected to sit around $232 billion, doubling from the $116 billion reported in 2022 at a CAGR of 7.16% in ten years. Advertising revenues will still be the core business of Meta – accounting for 70% of revenues by 2032 – but with 30% of total revenues, the Reality Labs segment will permit Meta to partially diversify its operations from the highly competitive and regulated online advertising sector.

Meta Platforms’ expected revenues (Personal Data)

Future Cash Flows – Efficiency & Reinvestment Needs

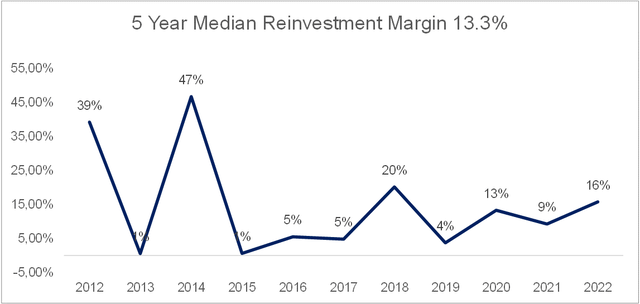

Meta Platforms ’s business model required significant reinvestments over the years. The 5-year median reinvestment margin is equal to 13.3% – comprising only capital expenditures and acquisition – however, treating R&D expenses as capital expenditures instead of operating expenses, as they generate a return over multiple years, the 5-year median reinvestment margin jumps to 24.9%.

5-year median reinvestment margin (Personal Data)

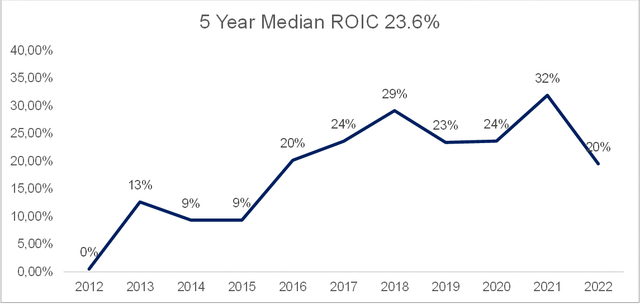

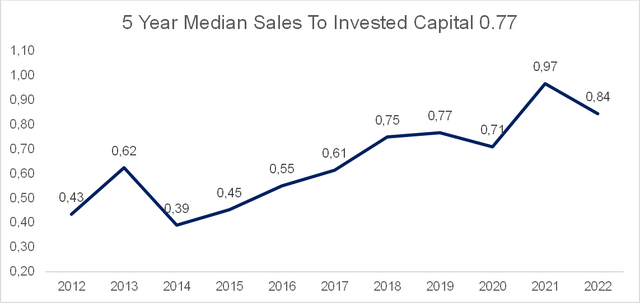

Looking at efficiency ratios, Meta’s 5-year median ROIC is 23.6% while the 5-year median sales to invested capital ratio is 0.77. The ROIC is slightly better than the industry median, equal to 20.7%, while the sales to invested capital ratio is way lower than the industry median value of 1.19.

5-year median ROIC (Personal Data) 5-year median sales to IC (Personal Data)

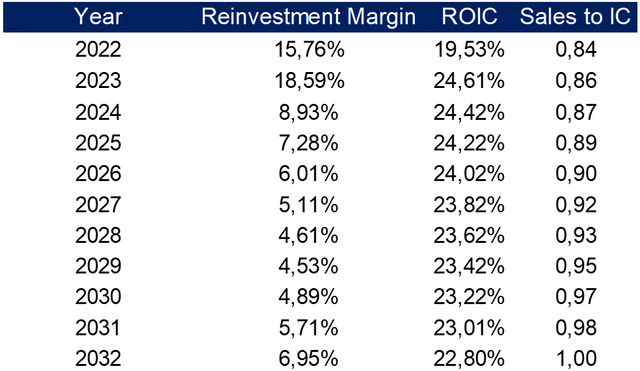

In the coming years, I do expect Meta to keep investing big in absolute terms – as it will have to pour billions into the new Reality Labs business to set the base for the future metaverse industry – however, in relative terms, as we have already seen throughout 2023, I assumed Meta to opt for a more cautious approach when it comes to reinvestments for future growth.

During both 2022 and 2023, the company laid off more than 20 thousand employees – especially from the R&D division – and for 2024 the management expressed its willingness to adopt an efficacy-focused approach to new hiring.

Despite the billions burnt by the Reality Labs segment, Meta still managed to improve its efficiency by improving its sales to invested capital ratio, which shows how much revenues are generated for each dollar invested into the company, from 0.75 in 2018 to 0.84 in 2022. For this reason, I assumed the sales to invested capital ratio to keep improving in the coming years – reaching 1 by 2032 – as Meta will adopt a more efficiency-focused approach to its investment strategies.

Despite the improvements in the sales to invested capital ratio, Meta will still have to reinvest consistently into its business model, especially in the new metaverse business line, with the reinvestment margin expected to be around 7% by 2032.

Expected ROIC, sales to IC, and reinvestment margin (Personal Data)

Combining all the assumptions made so far – declining market shares due to increased regulations and competition, lower profitability due to the metaverse bet, and high reinvestment needs despite improved efficiency – Meta’s free cash flows to the firm are expected to be around $37 billion by 2032.

Expected FCFF (Personal Data )

Valuation

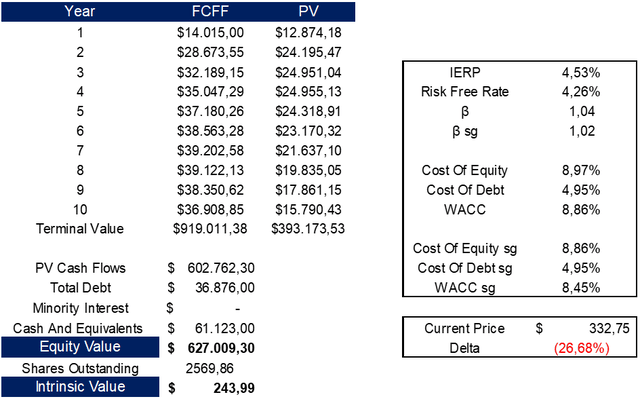

Applying a discount rate of 8.86%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $627 billion or $244 per share.

Compared to the current prices, Meta Platforms’ stocks result to be overvalued by 26.68%.

Meta Platforms’ intrinsic value (Personal Data)

Conclusion

Despite Meta’s stock skyrocketing since the start of the year, the outlook for the coming years doesn’t seem that bright. Many are the external factors tackling Meta’s ability to properly run its business as it used to do in the past, and the structural issues that emerged after the launch of the Reality Labs business line have seriously damaged Meta’s ability to generate solid cash flows for its investors.

In conclusion, given today’s prices, I think Meta Platforms is too expensive to represent a good long-term investment opportunity.

If you’re looking for in-depth analyses of stocks, follow me and turn on the notification button to avoid missing any new updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.