Summary:

- Meta Platforms is in the midst of surgical job cuts to potentially match the 11,000 employees cut back in November.

- The tech giant could cut another $5 billion from operating expenses and still leave a lot of cost reductions ahead in Reality Labs.

- META stock trades at 16x ’24 EPS targets while the company has an earnings potential of up to $20 per share.

t_kimura/iStock via Getty Images

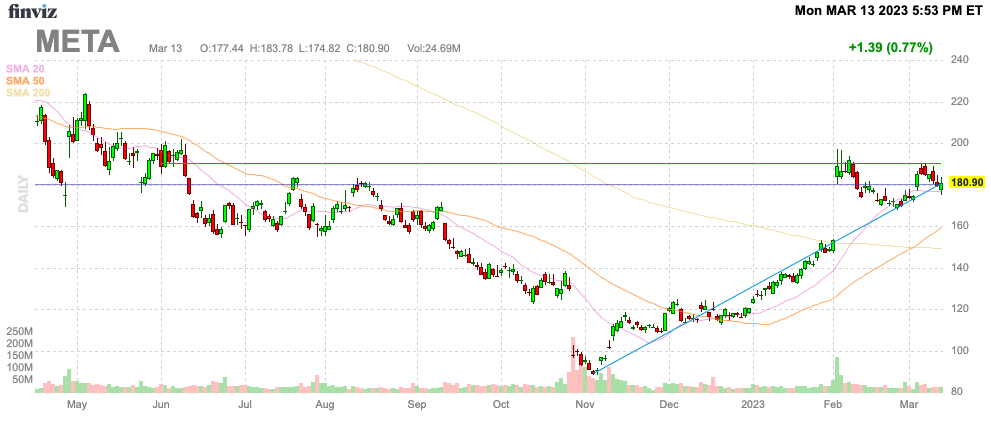

With Silicon Valley in collapse mode after massive job cuts and now the primary bank for startups closing, Meta Platforms (NASDAQ:META) is now in a strong position to prudently cut costs. The social media giant is poised to complete another massive job cut saving billions in costs. My investment thesis remains ultra Bullish on the stock even after the quick rally to $180, though a gap close below $160 would be a prime purchase point.

Source: Finviz

Surgical Job Cuts

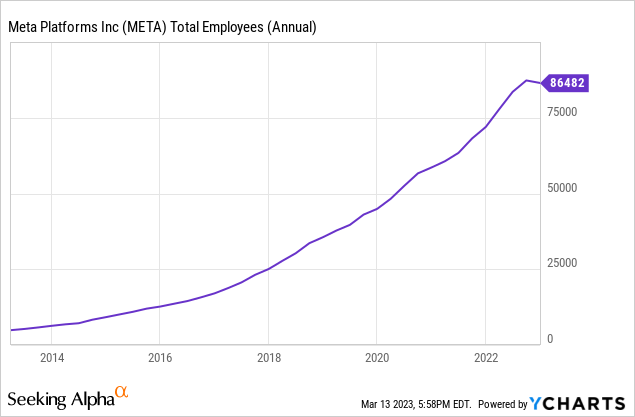

Last week, media outlets started reporting the possibility that Meta would match the job cuts from last year. Back in November, the company cut ~11,000 employees reducing the employee count to just below 87,000 to end 2022.

A big key regarding the majority of the job cuts in the tech sector to end 2022 were the relatively limited reduction to actual employee totals. A lot of the job cuts only eliminated the employees hired in the last few quarters and didn’t necessarily preclude the tech giants from hiring additional employees in other areas. A prime example was Meta reporting a year-end employee count up 20% from the start of year.

Per The Washington Post, this set of job cuts will trickle down in multiple phases over several months as follows:

- March – Recruiting

- April – Technical workers

- May – Non-technical workers

The company is likely to cut divisions and products no longer key to the business, such as the news today about divesting Kustomer due to higher costs of the business messaging service. The news didn’t get a lot of attention due to the failures of SVB Financial Group (SIVB) and Signature Bank (SBNY) over the 3-day weekend period.

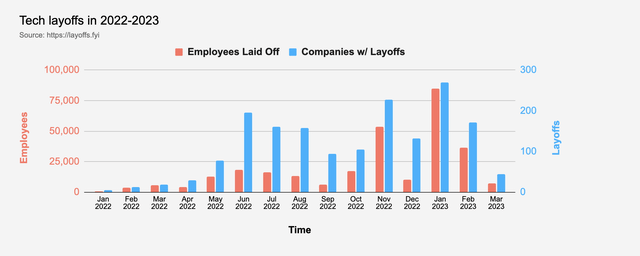

According to Layoffs.fyi, tech companies have laid off 128K employees in 2023 after only laying off 161K in all of 2022. In a lot of cases, the workers cut by one firm were hired by another company like Meta Platforms until the big layoffs last November.

The news is good for Meta shareholders due to the huge costs for tech workers in Silicon Valley. The social media company should not only be able to cut employees, but the extra benefits and wages for existing employees could now fall from very elevated levels.

Meta forecast a 2023 operating expense level at $89 to $93 billion. The company likely has billions in expenses that could be eliminated after cutting the 2023 expense outlook by $5 billion from the levels projected with the Q3’22 earnings report.

Just cutting 11,000 employees at an average cost of $150k would cut $1.65 billion in wage and benefits alone. Meta can probably reduce costs by another $5 billion annually by slashing those employee counts.

Profit Machine

Meta planning to divest a big money losing business and slash more employees is a massive positive sign for the bottom line. Besides, all of the layoffs in the tech space should slow down the competitive push to develop new products.

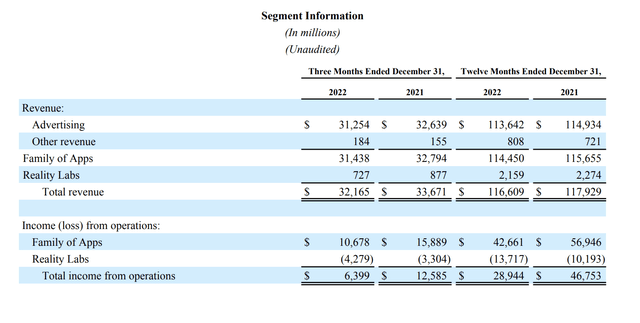

The tech giant earned $13.77 back in 2021 before embarking on the overly aggressive Metaverse spending right as the digital ad market weakened. The good news is that CEO Zuckerberg is now aggressively cutting costs, but the founder still has outlined plans to continue investing aggressively in areas like the Metaverse and AI.

Investors want the tech giant to continue investing. The key though is to cut the massive spending on the Metaverse after spending an unsustainable $4.3 billion in Q4 alone amounting to an annualized loss rate of $17.2 billion.

Source: Meta Platforms Q4’22 earnings release

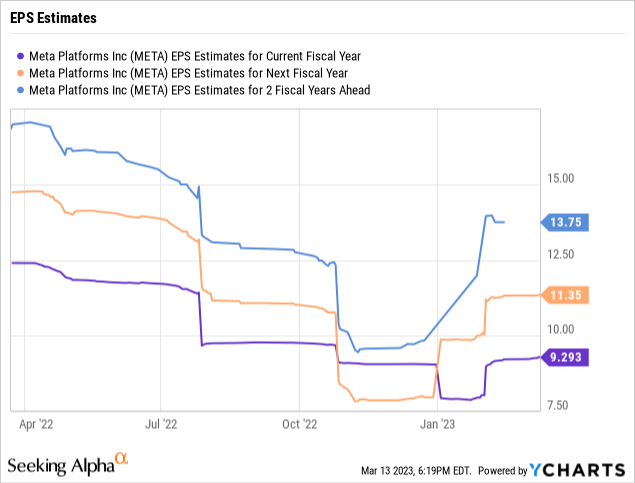

Analysts have already started jacking up EPS targets for the next couple of years. The 2024 EPS estimate has topped $11 and 2025 is now approaching $14.

The tech giant has 2.64 billion shares outstanding. The Meta eliminating the large Metaverse losses alone would contribute up to a $5+ boost to EPS, even after excluding taxes.

Remember, our previous research had highlighted the path to a $20 EPS in just 2024 based on the tech giant slashing costs while returning to revenue growth. Analysts currently have 2024 revenue estimates of just $136 billion, down from the $143 billion target back in last October.

Meta cutting operating expenses by $5 billion would easily cover the lost revenues with the only key to massive profits by next year being the ability of the social media giant to grow revenues over 10% annually while making these large expense reductions. The company would generate massive leverage after a couple of years with deleveraging due to lost ad revenues while aggressively spending on the Metaverse.

Takeaway

The key investor takeaway is that Meta Platforms is still a cheap stock after the big rally to $180 due to the stock still trading at 16x 2024 conservative EPS estimates. The social media giant still has the ability to boost profits to $20 per share on reduced Metaverse losses while digital ad revenues rebound.

The stock could potentially close the gap down below $160 providing a prime opportunity to really get Meta Platforms on the cheap.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts, and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the outsized risk of high-flying stocks.