Summary:

- I have been a long-term bull for Meta Platforms, Inc.

- My bull thesis was really simple: the value of its social platforms and its AI potential were mispriced.

- However, recent developments made me change my ratings to a HOLD.

- The top concerns involved in this downgrade are the implications of the DOJ-Google antitrust trial, profitability headwinds ahead, and also expanded valuation.

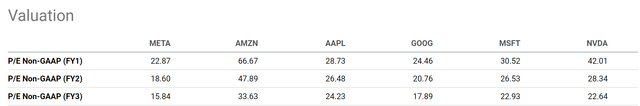

- Its P/E is on the cheaper end among major AI stocks, but the lack of immediate catalysts limits its return potential in the next few years.

Zerbor

META: Take Some profit at near-record prices

Readers following my articles know that I have been arguing a bullish case for Meta Platforms, Inc. (NASDAQ:META) in the past ~2 years or so. My bullish argument was really simple: the value of its social platforms and its AI potential were mispriced (an example shown in the chart below). However, recent developments have prompted me to rethink my thesis. And my conclusion from this reevaluation is that now is a good time to take some profit as its stock prices hover near an all-time peak. In the remainder of this article, I will detail my considerations for my rating downgrade (from BUY to HOLD).

In a nutshell, I see that the value-price gap has largely closed by now. It is true that despite the large price rallies, its P/E is on the cheaper end among major AI stocks (see the next chart below). But I do not see any major positive catalysts ahead. I anticipate such a lack of immediate catalysts, when combined with the narrow value-price gap, to limit its return potential in the next few years (as to be elaborated on in the final section). In the meantime, there are a few ongoing headwinds that could potentially pressure its profitability and growth in the midterm or even long term. I will detail the top two in my mind immediately below: the DOJ-Google antitrust trial and operation headwinds.

Potential impacts from Department of Justice Vs. Google antitrust case

For readers unfamiliar with the background, Google (GOOG) is currently involved in an antitrust trial against the U.S. Department of Justice (“DOJ”). It is widely regarded as the largest antitrust trial of the digital era since Microsoft’s antitrust trial about 30 years ago. The key issues surround GOOG’s dominance in online search. If Google is found to have violated antitrust laws, it could be forced to divest some of its assets or change its business practices in a way that reduces its market power. This could lead to more competition in the AI industry, which could benefit consumers and businesses. In the meantime, GOOG also faces litigation over competitive practices in Europe and challenges in the U.S. over its advertising business.

Investing is all about second order thinking. Linear thinking would tell us that GOOG’s loss would be META’s gain, since they are competitors. But on the contrary, I anticipate several ways that the above antitrust cases could impact META.

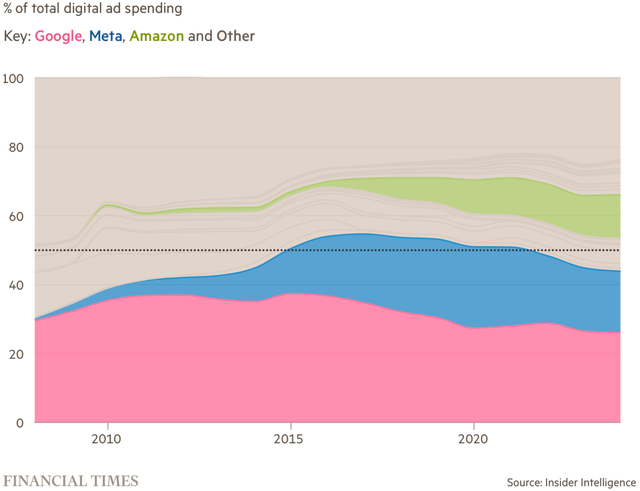

First and foremost, META could face a similar trial, too. In my mind, the DOJ could apply the same arguments on META’s dominance on social networks and digital ads. The DOJ’s key argument is that Google has violated antitrust laws by using its dominance in the search engine market to harm competition in other markets, such as the online advertising market. As the dominant player in the social media market and digit ad (see the chart below), META could face similar allegations, arguing that its dominance in the social networking market has allowed it to harm competition, such as digital ads and the online marketplace.

Second, even if META does not face an antitrust trial itself, the GOOG case also can indirectly impact its operations and growth, especially in future areas such as AI and virtual reality. For example, in the case Google is forced to divest assets or change its business practices, this could lead to increased costs for businesses and consumers who use Google’s AI products and services, including META. Moreover, a case like this could drag on for a long time. The uncertainties created in a lengthy showdown could delay the development and adoption of innovations, such as AI technologies and virtual reality, areas in which META has placed heavy bets.

Profitability pressure likely to persist

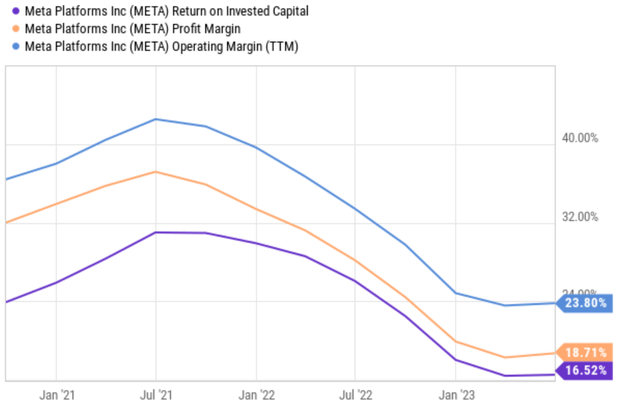

In addition to the above uncertainties, META has also been facing some profitability pressure recently. As seen in the chart below, its profitability metrics have been in retreat across the board in the past 1~2 years. All major metrics such as ROIC (return on invested capital), operating margin, and profitability margin have declined by a factor of about 2x since their peak values in July 2021. To wit, its ROIC declined from a peak value of 42% in July 2021 to the current level of 24%. And operating margin declined by a similar degree, from a peak value of 37% in July 2021 to the current level of ~19%.

Looking ahead, I don’t see these profitability headwinds dissipating anytime soon. The company (and the IT sector in general as well) has been facing substantial increases in personnel salaries lately due to a range of factors. These factors included high inflation and also a tight labor market. I anticipate high operation costs to persist as inflation remains elevated.

Limited return potential

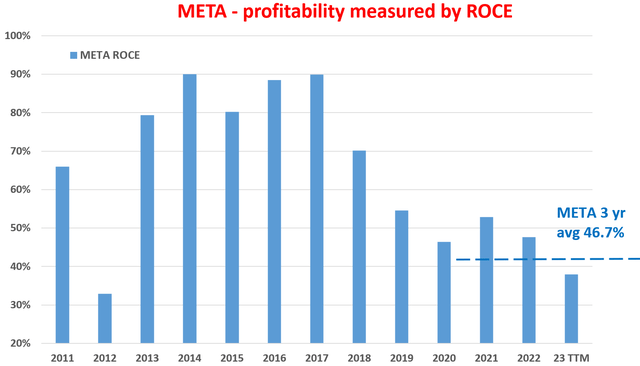

The above profitability headwinds are also reflected in its ROCE (return on capital employed), the most important profitability metric in our view. For readers new to the concept, my earlier article has detailed discussions on the importance of ROCE and its differences compared to other profitability metrics such as ROIC and ROE. As seen in the next chart below, META’s ROCE has averaged around 46.7% in the past 3 years. And its current ROCE hovers around 37%, far below the 3-year average due to the challenges mentioned above.

As detailed in my earlier writings, I regard ROCE as the most important profitability metric because it’s a fundamental governing force for a business’ long-term growth. In the long term, sustainable growth rates are governed by the product of ROCE and reinvestment rate (RR, aka, the plow-back ratio). More specifically, Long-Term Growth Rate equals the product of ROCE and RR.

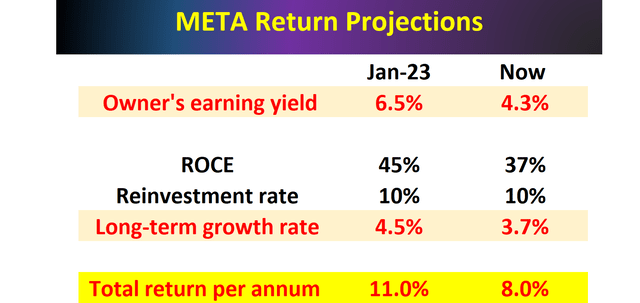

The next table shows my projected growth for META and the long-term return potential based on the above framework. Its RR was taken to be 10% based on my analysis of its growth CAPEX in the past 12 months. With an ROCE of 37% and an RR of 10%, it could maintain a 3.7% organic growth rate (i.e., real growth rate). At its current P/E multiples (around 23x, if you recall from the chart in Section 1), META offers an owner’s earnings yield (“OEY”) of around 4.3%. Hence, the total annual return potential adds up to about 8%. In comparison, its return potential at the beginning of 2023 is in the double-digit, when its P/E was much lower and ROCE much higher (around 11%). With an 11% return potential, I see very favorable odds for market-beating performance (which it has indeed delivered). But with the current 8% expected return, the odds are much worse now.

Other risks and final thoughts

The article so far has focused on the negative catalysts. There are a few positive catalysts worth mentioning. As aforementioned, shrinking operating margin has been one of my main concerns. There are efforts undergoing at META to control expenses, which would likely combat the issue and support profitability. Moreover, despite profitability pressure, the company has been reporting moderate user growth, which ought to at least support the top-line growth. Finally, the company keeps investing in new technologies and rolling out new products. For example, it has recently introduced Threads, a new app for sharing text updates and joining public conversations. These investments and new products should pay off over time.

All told, I do not see any compelling reasons for these catalysts to outweigh my concerns. To recap, my top concerns are threefold. First, the DOJ-Google antitrust trial could create 2nd order impact for META, both in the mid and long-term. Secondly, I see several of the profitability headwinds persisting. And finally, the recent valuation expansion, combined with the ROCE decline, has limited its upside potential substantially. Based on these considerations, this article downgrades my thesis from BUY to HOLD. Given the macroscopic uncertainty and META’s historical price volatility, I suggest potential investors exercise some patience and wait for a better entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.