Summary:

- Less than a year ago, Meta stock was sitting at $90/share. Today, the stock is within 15% from its all-time highs.

- Q2 earnings results confirmed a complete turnaround for the company.

- Revenue is accelerating, margins are improving, and the outlook for the company is brighter than ever.

- While I’m long-term bullish, the rally may be losing steam.

Kelly Sullivan

Investment Thesis

A year ago, Meta (NASDAQ:META) was struggling due to Apple’s (AAPL) privacy changes, which sent the stock crashing 75%. But fast forward to today, Meta is up 150%+ year to date and is almost back to its all-time highs.

And recently, the company posted blowout Q2 earnings results, which saw the stock making another 52-week high.

Revenue is accelerating, margins are improving, and the outlook looks bright ahead.

This marks one of the most incredible turnaround stories, spanning just a few quarters.

But the rally may have gone a little too far in my view, so a slight pullback may be on the horizon.

Growth

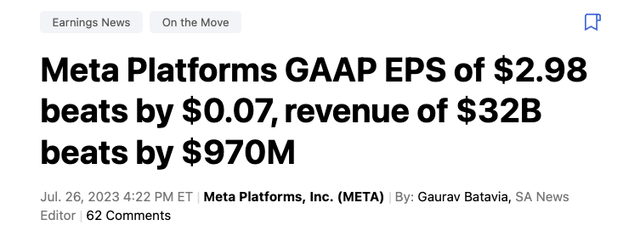

In Q2, Meta beat analyst expectations on both earnings per share and revenue, by 7 cents and almost $1 billion, respectively.

After posting 3 consecutive quarters of revenue declines in 2022, Meta is back in growth mode with revenue accelerating by 11% yoy, generating $32 billion of Revenue in Q2. The return to growth was due to easier YoY comps as well as a strong recovery in global advertising demand.

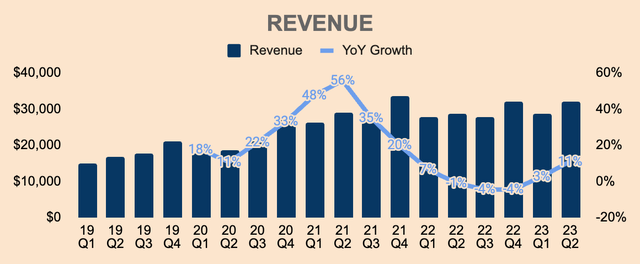

Meta generates most of its Revenue from advertising, and as you can see, Advertising Revenue from its Family of Apps was struggling in the better part of 2022, due to the Apple iOS privacy changes, competition from other social media platforms like TikTok, as well as the rapid growth of Reels, which pretty much shifted users attention away from higher-monetized surfaces like Feeds or Stories.

However, things are getting better with FoA Revenue accelerating back to growth mode. In Q2, FoA Revenue was $31.7 billion, which is up 12% YoY, due to strong ad demand in the e-commerce sector.

In Q2, ad impressions increased by 34% YoY while the average price per ad decreased by 16% YoY. The increase in ad impressions was driven by rapid growth in less mature markets as well as Reels, which both have lower monetization, which is why the average price per ad dropped YoY. That said, I expect monetization to improve with each passing quarter.

This is especially true for Reels, which currently has an annual revenue run rate exceeding $10 billion, which is up from $3 billion last fall. In other words, Reels engagement and monetization are growing exponentially.

Reels plays exceed 200 billion per day across Facebook and Instagram. We’re seeing good progress on Reels monetization as well with the annual revenue run-rate across our apps now exceeding $10 billion, up from $3 billion last fall.

(CEO Mark Zuckerberg – Meta Platforms FY2023 Q2 Earnings Call).

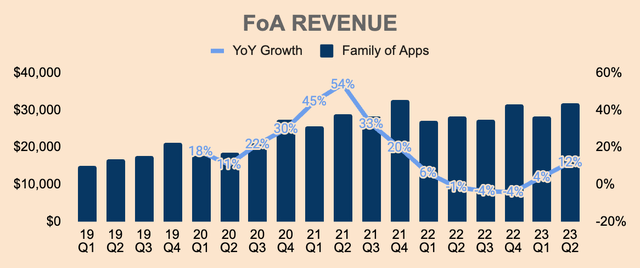

As a reference, TikTok generated $9.9 billion of Revenue in 2022 and is expected to grow to $22 billion by 2025, so we can probably expect the same kind of trajectory for Reels, which is going to be a major revenue contributor for Meta.

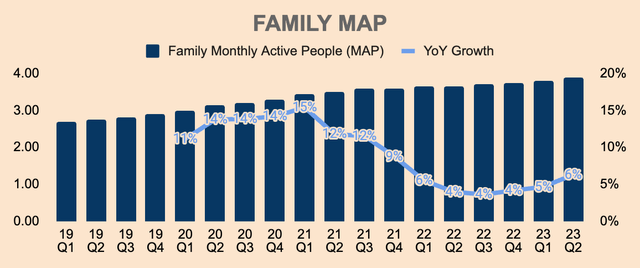

Moving on, Family Monthly Active People, which includes Facebook, Instagram, WhatsApp, and Messenger, grew by 6% YoY to 3.88 billion in Q2, which really destroys the narrative that “Meta is a slowing and dying social media giant”.

And to give you a little bit of perspective of how significant this is, 6% yoy growth is 230 million users added which is roughly two-thirds of the US population.

In addition, Daily Active People as a % of Monthly Active People remains at 79%, which shows really high engagement rates across Meta’s family of apps.

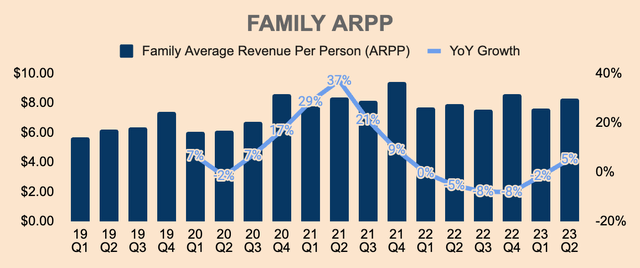

Here, you can see how Family Average Revenue Per Person has trended over the last few quarters. In Q2, ARPP was $8.32, which is up 5% yoy, due to better ad supply and demand dynamics, as well as Reels monetization picking up.

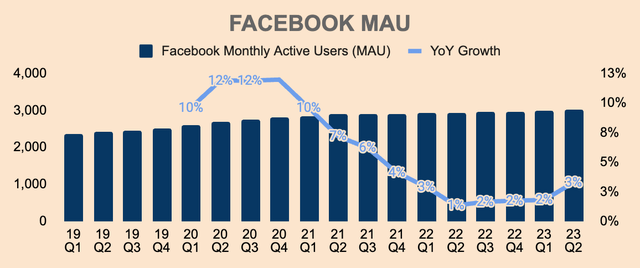

In addition, Facebook Monthly Active Users, which only includes figures from Facebook, grew by 3% in Q2, to slightly more than 3 billion Facebook users, which again destroys the narrative that “Facebook is dead”.

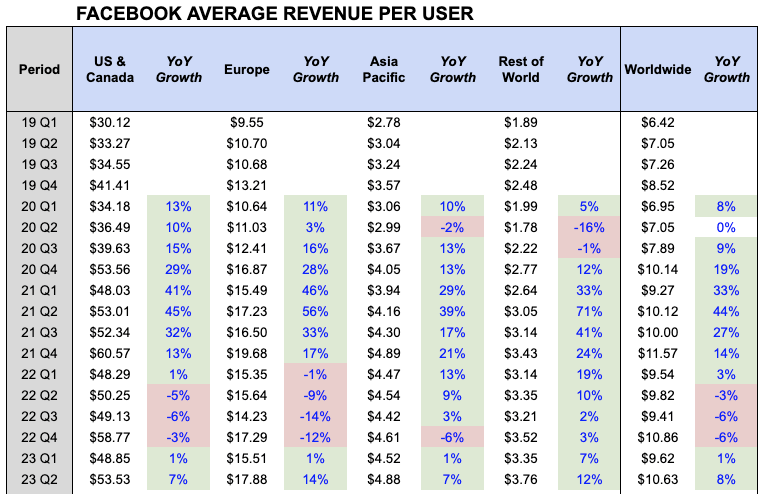

Facebook’s Average Revenue Per User is also accelerating, with a Worldwide ARPU of $10.63, which is up 8% yoy, driven by strength across all regions.

There’s still a large variance in ARPU when we look at them on a geographic basis, which means a massive opportunity for Meta to increase monetization in regions outside of North America since there are so much more people outside the region.

Seeking Alpha

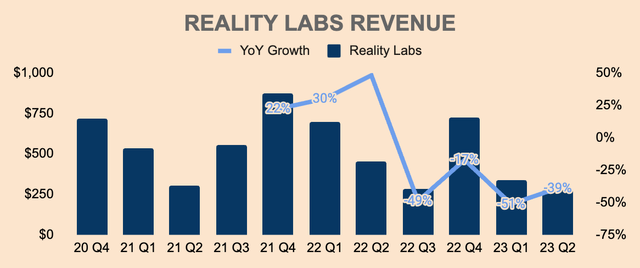

Moving on the Reality Labs, the RL segment generated $276 million of Revenue in Q2, which is down 39% YoY, which is quite concerning given that the company has invested tons of money into the metaverse.

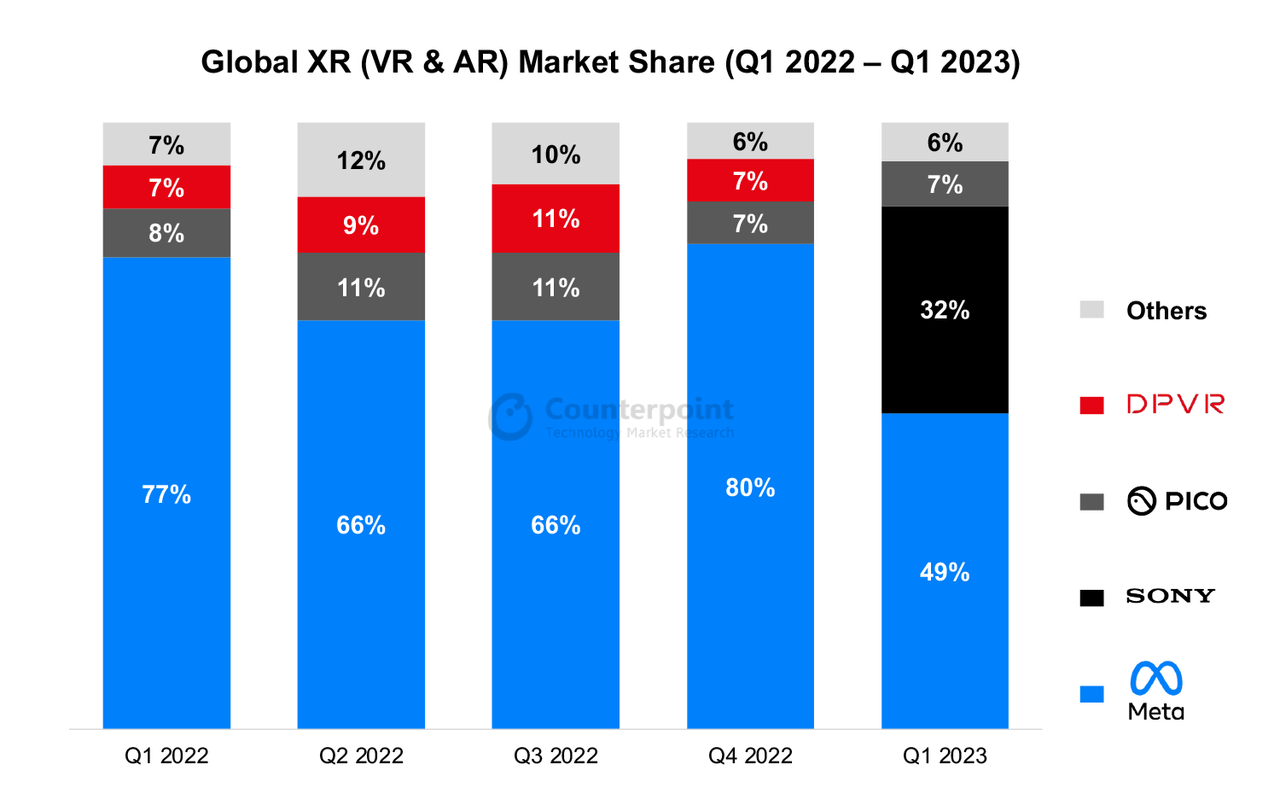

A major reason why Reality Labs sales are down is due to the recently launched Sony PlayStation VR2, which is Sony’s successor to its 2016 PlayStation VR headset.

As you can see, Sony took massive market share from Meta, which saw Meta’s share decline to just 49% in Q1.

That said, the metaverse is still in its early stages so Meta’s RL revenue will be quite volatile, but moving forward, VR and metaverse adoption should continue to grow, which should be a tailwind for Meta’s RL Segment.

All in all, Meta’s return to growth mode is really encouraging to see. In particular, growth in its social media business is reaccelerating, which is an incredible turnaround given the challenges that Meta faced over the last few years.

At the same time, the company is investing heavily in AI, which is already improving overall user engagement and monetization.

And not forgetting to mention, the company is still laser-focused on developing the next-generation social media platform through the metaverse. So all in all, a really great quarter for Meta.

Profitability

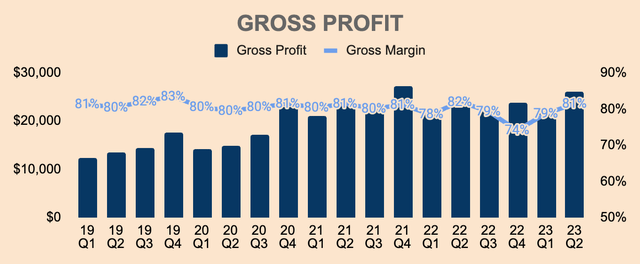

Turning to the profitability of the company, Meta generated $26.1 billion of Gross Profit, which is an 81% Gross Margin.

As you can see, Gross Margin has been improving over the last few quarters and is now back to its prior levels of about 80%. Maintaining such a high Gross Margin means strong pricing power, strong demand for its products, and high earnings potential for investors.

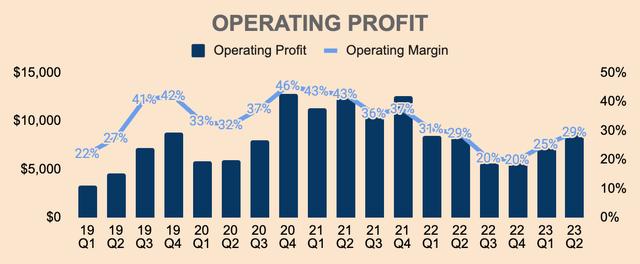

Operating Profit is also improving, which was $9.4 billion in Q2, representing a 29% Operating Margin.

This includes accrued legal expenses of $1.87 billion and restructuring charges of $780 million, so without these expenses, Operating Margins would have been much higher.

That said, Margins are trending in the right direction, primarily due to layoffs. As of the end of Q2, Meta has about 71,000 employees, which is down 7% sequentially from Q1.

Meta is almost done with its layoffs, so we could see Margins continue to improve and eventually stabilize in the mid-30s as the year of efficiency resumes.

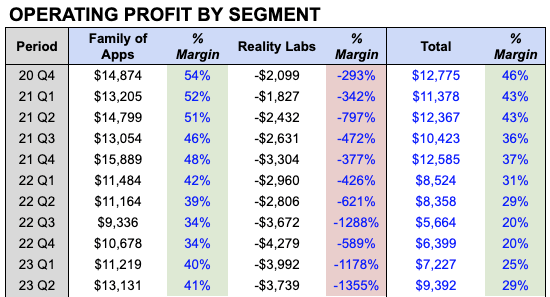

And if not for the Reality Labs segment, Operating Margins would have been as high as 40%.

As you can see, FoA Operating Margin was 41% in Q2 and it was also as high as 50% a few years ago.

On the other hand, the RL segment is severely unprofitable, burning around $4 billion per quarter, and as of Q2, the RL segment has an Operating Margin of negative 1000%+.

Fortunately, Meta has the family of apps business to cover up the losses from Reality Labs, and this is likely going to be the case moving forward, at least for the next 3 years or so.

Author’s Analysis

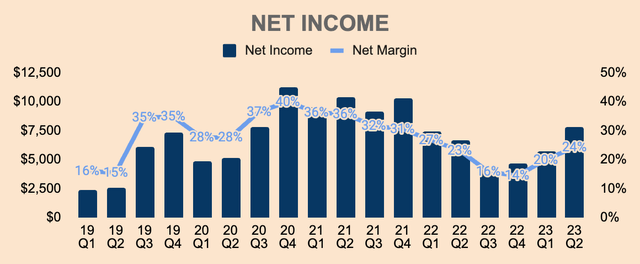

Finally, Meta’s bottom line is also improving, with $7.8 billion of Net Income in Q2, which represents a 24% Net Margin, and this should continue to trend upwards, most likely to the mid-30s level.

There’s a clear trend that profitability will return to where it was and this should eliminate fears about the company’s profitability.

That said, Meta is a highly profitable business with high earnings potential, and as a shareholder, I’m really happy with how well management has executed so far.

Financial Health

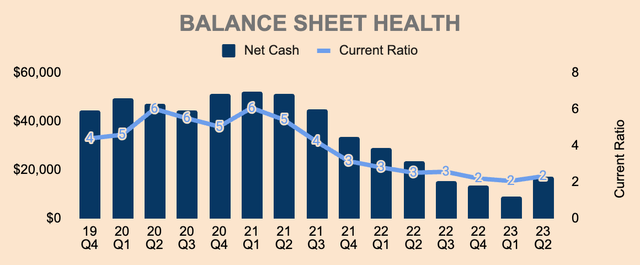

Moving on, Meta has a strong balance sheet with $53.4 billion of Cash and Short-term Investments, with a Total Debt of about $36.2 billion, which puts its Net Cash position at a comfortable $17.2 billion.

And although Net Cash has dropped over the years, I think we can see net cash building back up as the company focuses on efficiency.

That will be possible through strong free cash flow generation.

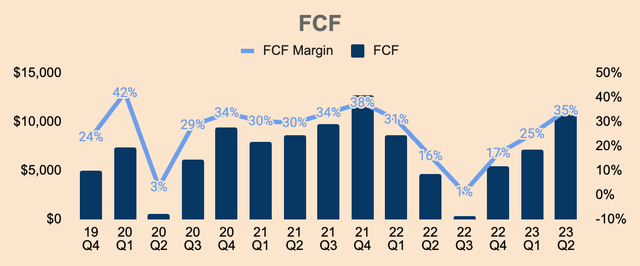

In Q2, Free Cash Flow was $11.1b, which represents a 35% Free Cash Flow Margin.

While Free Cash Flow improved significantly, do note that this is due to a deferral of income taxes that will be paid in the fourth quarter, so I think Free Cash Flow Margins should dip slightly in the next few quarters.

That said, Meta repurchased $793 million of its stock in Q2, which is tiny compared to previous quarters, but this is reasonable given the recent rally.

Nonetheless, Meta still has $40.9 billion of share buyback capacity at its disposal, so I expect aggressive buybacks if we see a correction in the near future.

Outlook

Management expects Q3 Revenue to be in the range of $32 to $34.5 billion, which represents a 20% yoy growth if we take the midpoint guidance.

This is an acceleration from Q1’s 11% growth, and this reacceleration is due to a foreign currency tailwind of approximately 3%, easy YoY comps, as well as increasing monetization across its apps.

That said, a 20% growth in Q3 is really impressive, which is also why I think the stock is up after Q2 earnings.

As for expenses, management expects full-year 2023 total expenses to be in the range of $88 to 91 billion, which is an increase from its prior range of $86 to $90 billion, due to legal-related expenses and a $4 billion restructuring cost.

The company also expects Reality Labs Operating Losses to increase YoY in 2023 as the company continues to invest in AI and the metaverse.

In other news, paid messaging is also taking off, which could be Meta’s next growth engine. According to Mark Zuckerberg, there are 200 million users using WhatsApp Business who will now be able to create Click-to WhatsApp ads, and the number of businesses using paid messaging products has doubled YoY.

Business messaging is another key piece of our monetization strategy and we recently announced that the 200 million users of our WhatsApp Business app will now be able to create Click-to-WhatsApp ads for Facebook and Instagram without needing a Facebook account. This is a pretty big unlock, particularly in countries where WhatsApp is often the first step to bring their business online. Paid messaging is a bit earlier, but it’s also showing good adoption. The number of businesses using our paid messaging products has doubled year-over-year.

(CEO Mark Zuckerberg – Meta Platforms FY2023 Q2 Earnings Call)

This is a really exciting development given that WhatsApp runs a virtual monopoly in some markets, particularly those in developing countries like Indonesia and Brazil.

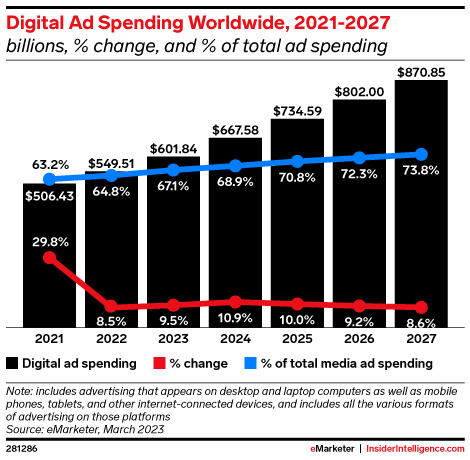

That aside, digital ad spending worldwide is expected to continue to grow as the world becomes increasingly digital, with that figure expanding to $870 billion by 2027.

Naturally, this should be a tailwind for Meta as the company holds some of the most valuable digital platforms in the world including Facebook, Instagram, and WhatsApp.

Insider Intelligence

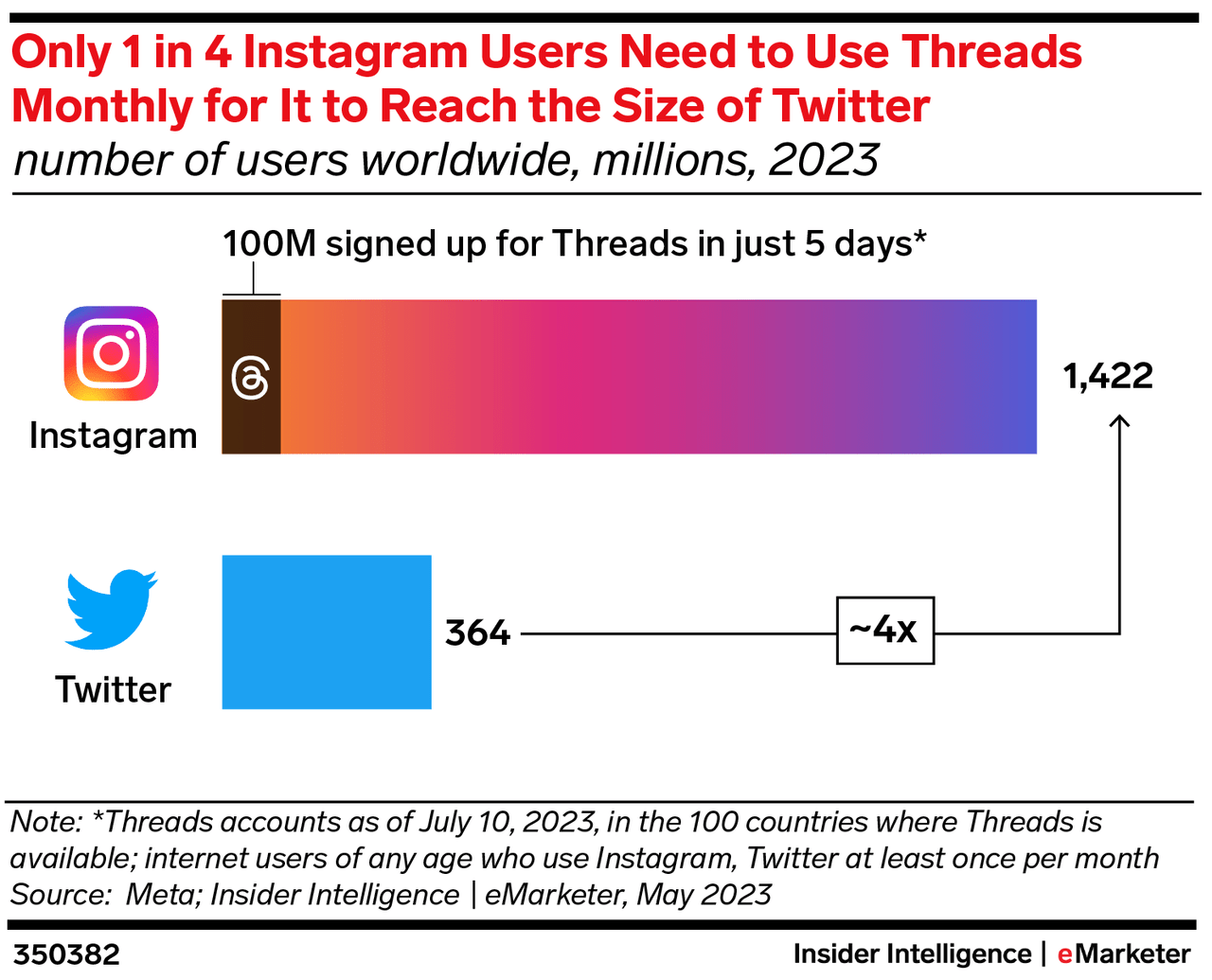

Meta also recently introduced its Twitter competitor, Threads, which could also be a major growth engine for Meta one day.

It is by far the fastest-growing platform today, with 100 million signups in just 5 days. The second fastest app to reach 100 million users was ChatGPT, which took 2 months to get to that figure.

I doubt that Threads is currently monetized, but that is the monetization strategy that Meta usually takes.

First, Meta tries to get as many signups as possible. Second, they try to drive maximum engagement and retention within the platform. Finally, once the platform scales, Threads can begin monetization.

The company ran this playbook with Instagram, Reels, and WhatsApp, and Threads will be no different.

We can take a look at Twitter to gauge the Revenue potential for Threads. In 2022, Twitter did about $4.4 billion in Revenue, with about 360 million users.

Threads could surpass Twitter in terms of the number of users and Threads could potentially deliver that kind of Revenue number if Threads actually becomes a real thing that people actually use, rather than a one-time signup, in my view.

In addition, Meta is expected to launch its updated Quest 3 headset this fall, which I think a lot of consumers are waiting for, so we can expect Reality Labs Revenue to ramp up in Q3 and Q4.

With that being said, I think there’s a lot of exciting developments happening in Meta and I think the outlook for the company is looking really great.

Valuation

Meta has rallied about 250% ever since its bottom in November, so that’s a lot of gains in less than a year.

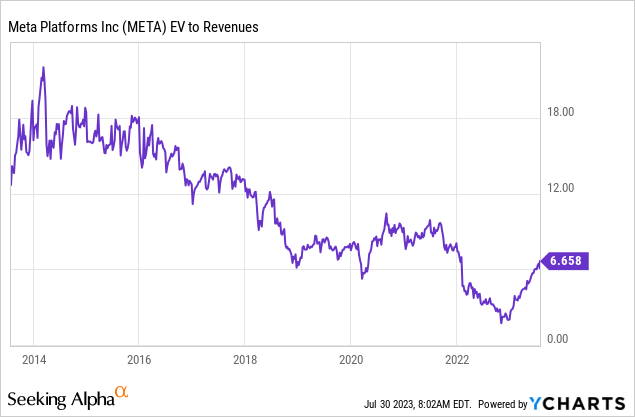

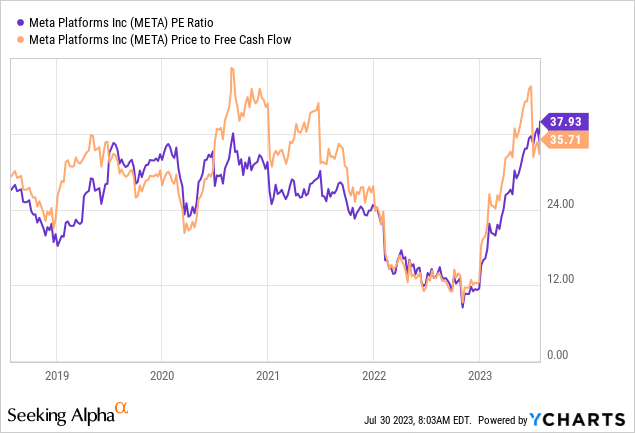

Looking at valuation multiples, we can see that Meta trades at an EV/Revenue multiple of just 6.6x, which is well below its 10-year average of about 10x, so statistically speaking, Meta still looks cheap.

But things look expensive when we look at its P/E ratio and Price/FCF. As you can see, both metrics are trading at the upper end of their 5-year ranges, with a P/E ratio of 38x and a Price/FCF ratio of 34x, so definitely not cheap at all.

So from a valuation multiple perspective, I don’t think there’s much value for Meta stock today.

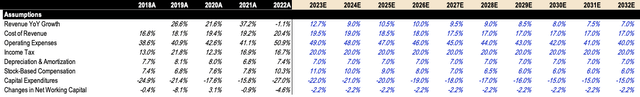

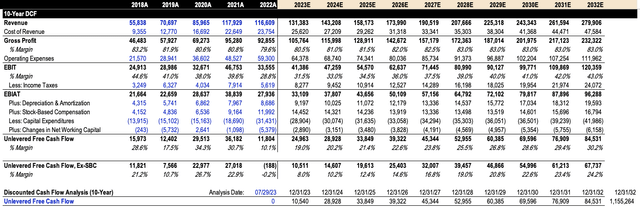

I’ve also done a DCF analysis on Meta and here are my key assumptions:

- Revenue Growth: for the first three years, I follow analyst estimates and then gradually decrease it to just 7% by the end of 2032.

- Cost of Revenue: I expect Cost of Revenue to drop as a % of Revenue, to just 17% by 2032, which means a long-term Gross Margin of 83%.

- Operating Expenses: I expect the same thing for Operating Expenses, which will continue to contract as a % of Revenue, down to just 40%, which Meta has achieved before in prior years. Combined together, Cost of Revenue and Operating Expenses turn out to be about $90 billion in 2023, which is right in line with management’s guidance.

- Capital Expenditures: As for capex, the company guided for $27 to $30 billion in 2023, so that is about 22% of Revenue. Consequently, I’m going to reduce the rate to just 15% of revenue by 2032.

With these assumptions, I project a $280 billion Revenue by 2032 at a Free Cash Flow Margin of about 30% which is attainable and sustainable in my opinion.

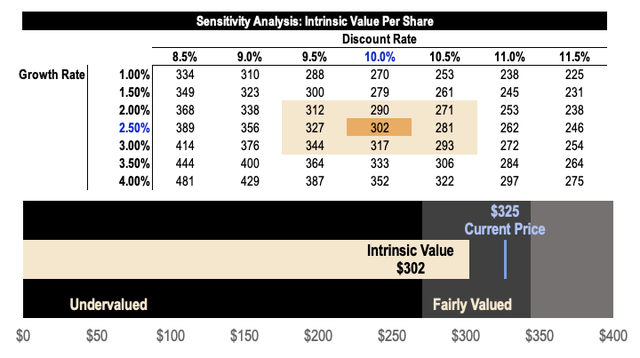

Based on a discount rate of 10% and a perpetual growth rate of 2.5%, I arrive at an intrinsic value per share of about $302 for Meta, which is lower than the average analyst price target of $348.

That said, Meta looks slightly overvalued based on its current price of $325 a share.

But what am I doing with the stock? Probably nothing for now.

But if prices continue to rally in the next few months, I might trim my position at about $360, which is 20% above my fair value estimate.

Risks

Competition

There are other platforms such as TikTok, Twitter, and YouTube that could take market share away from Meta.

However, as we’ve seen in Q2 results, Meta continues to add users to its family of apps, which means that Meta’s brand is just too strong and its switching costs are just too high for users.

Nonetheless, threats of competition are real and we can’t totally ignore them.

A potential threat for Meta would be Twitter, which recently rebranded to X, and the reason for the rebranding is that Elon Musk wanted to build an everything app, much like WeChat in China.

If that happens, Meta could be in big trouble.

On the other side, Reality Labs is also facing tough competition from Sony and Apple.

- Sony’s PlayStation has a huge library of games and die-hard PlayStation fans are more likely to invest in Sony’s VR headset than Meta Quest.

- In addition, Apple launched its own headset, called the Apple Vision Pro and even though I think the price is too ridiculous for mass adoption, we all know that Apple fans are not too price sensitive when it comes to Apple products.

Policy Changes

This includes policy changes within Apple iOS or Android and even government regulations affecting Meta. If we see major changes in policies and regulations, Meta could take a big hit once again.

Conclusion

This is probably one of the best turnaround stories ever. Zuckerberg is just incredible. Execution is just phenomenal. And as an investor, I couldn’t be happier.

The company is back in growth mode, margins are improving, the balance sheet is pristine, and there are so many exciting developments on the horizon including Threads, Meta Quest 3, Click-to-WhatsApp, and so on.

However, I think the rally has gone a little too far, and I think the valuation is a little bit stretched. Although I’m long-term bullish on the company, I expect a slight pullback in the near future before continuing its upward march to new highs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.