Summary:

- Meta Platforms, Inc. continues to show impressive performance.

- The potential TikTok ban in the U.S. could boost Meta’s short-form video market share, adding billions in additional revenue.

- Favorable macro conditions and a dominant position in the digital advertising market suggest Meta will sustain double-digit growth and create shareholder value in the years ahead.

- Despite risks like Reality Labs’ losses and regulatory challenges, Meta remains a BUY right now.

COM & O

It appears that nothing can stop the Meta Platforms, Inc. (NASDAQ:META) growth story for now. The company continues to show impressive results, and a potential favorable environment ahead almost guarantees that Meta will be able to show a stellar performance in the upcoming quarters. The potential ban of TikTok in the United States in January also creates an opportunity for the company to capture a greater share of the short-form video market. This should help the overall business boost revenues and create additional shareholder value along the way.

While some macro and other risks remain, it appears that the growth opportunities will outweigh the potential risks in the foreseeable future. This is why Meta remains a BUY for me.

Meta Platforms Continues To Impress Investors

Back in August, I noted that Meta has everything going for it to continue to grow at a double-digit rate and create additional shareholder value. Since that time, its shares have appreciated by ~12% and outperformed the broader market. While this is certainly a positive development for investors, the company’s latest earnings results indicate that Meta’s growth story is far from over.

The Q3 earnings report, which came out in late October, showed that the company managed to increase its revenues by 18.9% Y/Y to $40.59 billion, above expectations by $280 million. At the same time, the GAAP EPS of $6.03 was above the expectations by $0.74. Going forward, it’s safe to assume that Meta will be able to continue to show such great results in the upcoming quarters.

One of the reasons why I’m optimistic about Meta’s future is because the overall digital advertising is expected to grow in the coming months and years. In 2024, the market alone is expected to be worth $740.3 billion, while most of the spending will be generated in the United States. At the same time, the majority of ad spending is expected to be generated through mobile. Meta’s dominant position in the United States and on mobile devices creates an opportunity for the company to generate solid results for years to come.

We already saw the effects of a favorable environment kicking in during Q3. Meta’s daily active people increased by 5% Y/Y to 3.29 billion, while ad impressions and average spending per ad on its platforms increased by 7% Y/Y and 11% Y/Y, respectively.

Moreover, the potential ban of TikTok in the United States in less than two months also makes it possible for Meta to increase its share in the lucrative short-form video market. This year, TikTok is expected to generate $7.7 billion in revenues in the United States alone, an increase of 25% Y/Y. Considering that Instagram Reels continues to gain traction, Meta’s product could become the biggest winner from TikTok’s ban in the United States and add a few billion dollars of additional revenue for the overall company next year.

In addition to that, there’s an indication that Meta is also working on the creation of its search engine, which is expected to include the company’s AI chatbot. While it’s unlikely to quickly undermine the monopoly of Google (GOOG, GOOGL) over the search market, it could nevertheless benefit from the increased ad spending within the search segment of the digital advertising market in the foreseeable future.

Finally, the overall macro environment also favors Meta’s business and its stock. The latest forecast report by Goldman Sachs (GS) indicates that the S&P 500 will continue its run in 2025 and generate a total return of ~10% by the end of next year. The American GDP is also expected to grow at 2.5% as recession fears have subsided and inflation is going back toward the Fed’s 2% rate for now.

Considering all of this, there’s nothing not to like about Meta at this stage. Despite increased capital expenditures that are used on scaling the company’s AI infrastructure, the company’s unlevered FCF margins in Q3 increased to an impressive 40% and Meta has a sizable net cash position to ensure that its business continues to flourish. Given how many favorable growth catalysts Meta has going for it, it’s more than likely that the company will reach or even exceed its Q4 revenue guidance of $45 billion to $48 billion.

What’s Next For Meta’s Shares?

Such an outlook indicates that Meta’s growth story is far from over. Back in August, when my latest article on the company was published, Meta was trading at around $526 per share and my valuation model showed that its far value is $533.75 per share. Given the stellar performance in Q3 and Wall Street’s latest upward revisions, I decided to update my model as well.

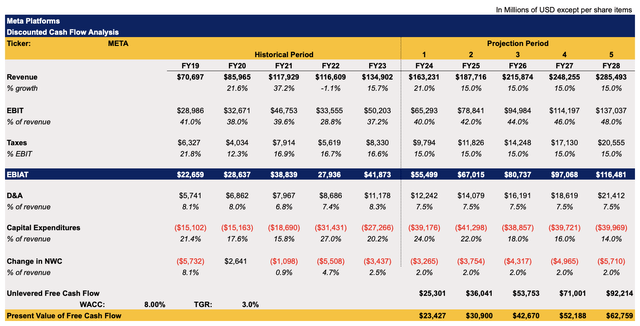

In the updated model below, the revenue growth assumptions for FY24 have been increased and currently are slightly above the overall expectations. At the same time, the model assumes that Meta will be able to grow its revenues at a double-digit rate in FY25 and beyond. This is because the company is unlikely to lose its status of being one of the biggest social media businesses in the world with a dominant position in the digital advertising market. Given the fact that Meta received over 50 upward revenue and earnings revisions in the last few months, it makes sense to believe that the business is likely to continue to grow at a solid rate.

The assumptions for EBIT mostly remained the same in comparison to the previous model. This is because, due to the nature of Meta business, its margins are expected to remain high in the foreseeable future. The tax rate has been slightly decreased since the potential tax reform under the Trump administration could decrease corporate taxes in the following years. The CapEx expectations in the model have been slightly increased since the management in the latest earnings call noted that they expect capital expenditure in 2024 to be in the range of $38 billion to $40 billion. The assumptions for other metrics mostly remained the same as before and closely correlated with Meta’s historical performance.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

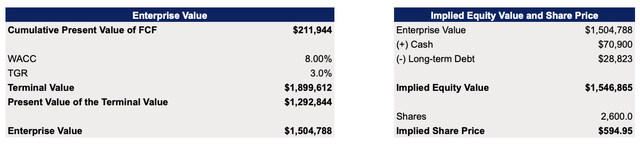

The updated model with newer assumptions indicates that Meta’s enterprise value is $1.5 trillion, which is close to Seeking Alpha’s estimates of $1.43 trillion. Thanks to the better revenue assumptions and lower tax expenses, my updated valuation model shows that Meta’s fair value is $594.95 per share, which indicates that shares have more room for growth.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

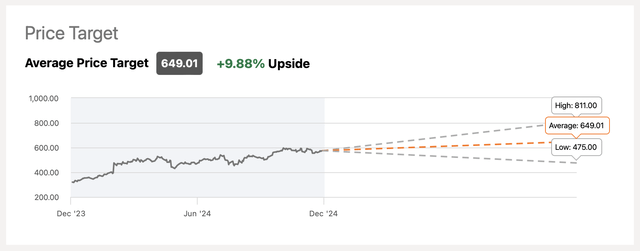

While the new fair value is greater in comparison to the previous model, the overall upside could be even greater since the consensus on the street is that Meta’s average price target is $649.01 per share. This is why Meta’s stock remains a solid BUY for me right now.

Meta’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

Despite all the growth catalysts, there are nevertheless certain risks that can undermine Meta’s performance in the future. As expected, the company’s metaverse project continues to bleed cash as Reality Labs’ loss from operations widened from $3.74 billion a year ago to $4.43 billion in Q3 even though the revenues were up Y/Y. Back in 2022, I said that Meta’s metaverse is doomed, and given how Reality Labs continues to underperform to this day and drag the overall bottom-line performance, it’s unlikely that improvement for this business division is on the horizon.

At the same time, there’s a possibility that President-elect Trump will try to halt the TikTok ban in the United States. If he succeeds, then Meta might potentially lose the ability to quickly expand its presence in the short-form video market and give a major boost to its overall revenues next year.

The regulatory environment is also not improving significantly, and Meta faces legal battles in the United States and the European Union, which could affect its performance in the future and drain its war chest over time.

The Bottom Line

At this stage, I believe that Meta’s risks are fairly limited while the upside is still there. It appears that nothing is going to undermine the company’s dominant position in the digital advertising market and social media space for now, while the potential ban of TikTok in the United States could create additional growth opportunities for the overall business. This is why I think that Meta remains a great investment right now and believe that its stock is a BUY.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.