Summary:

- Meta Platforms crashed after releasing earnings, but has come roaring back.

- Wall Street is focused on the plunging profit margins.

- Wall Street is ignoring the track record of strong execution and the sizable impact of ongoing share repurchases.

- The stock is trading too cheap here at just over a $300 billion market cap.

Wachiwit/iStock Editorial via Getty Images

Meta Platforms (NASDAQ:META) is a name which some may be surprised to see struggling amidst this tech crash. Sure, growth has slowed down considerably but the company continues to generate positive GAAP earnings. Net income has come down but that is mainly due to aggressive investment in growth. The stock is now trading at value multiples in spite of the potential to return to secular growth. META represents a compelling “fat pitch” investment proposition.

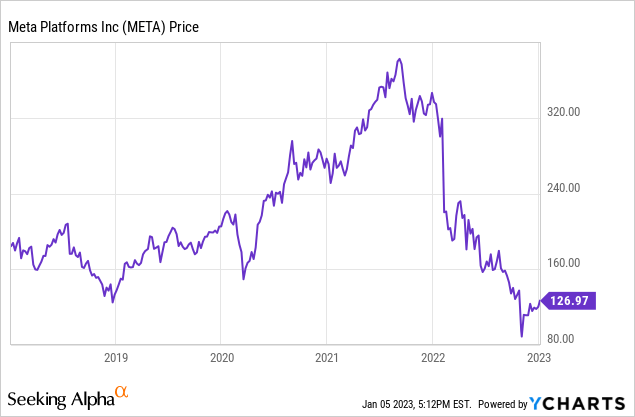

META Stock Price

After this ongoing plunge, META trades lower than even the depths of its Cambridge Analytica data privacy scandal.

I last covered META in October where I rated the stock a strong buy based on valuation. With the stock down even more since then, that value proposition has only improved further.

META Stock Key Metrics

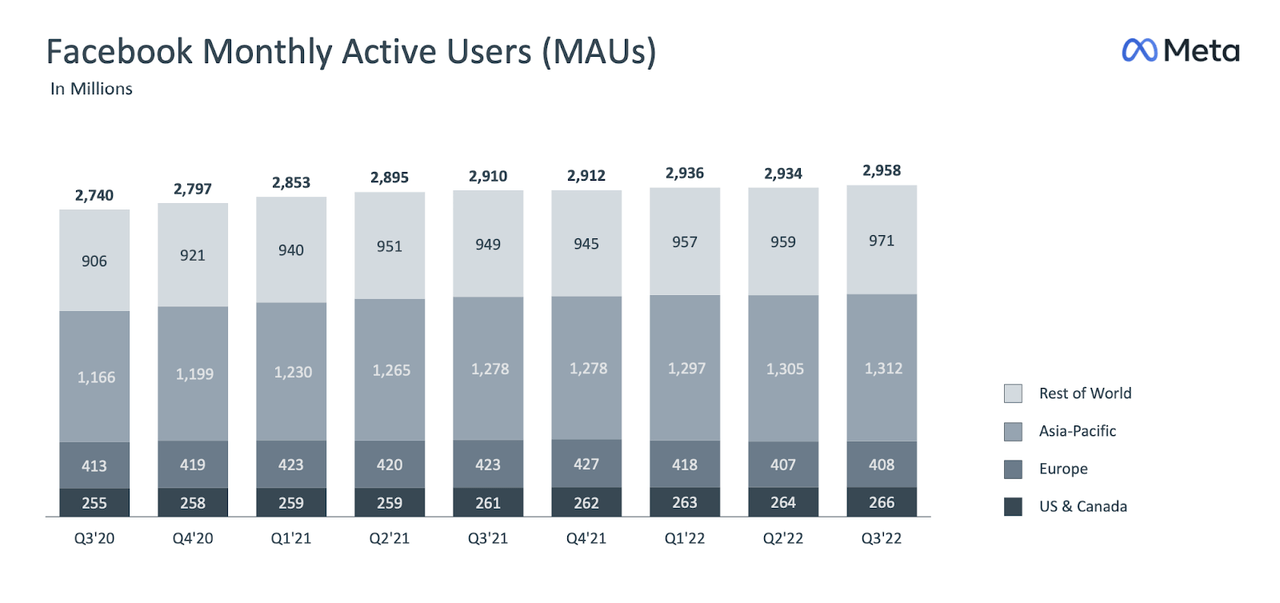

A more understanding market might not have reacted so strongly to the earnings report, as there were arguably enough positive tidbits to offset the profit shortfalls. META grew Facebook MAUs sequentially – a critical detail after MAUs declined last quarter.

2022 Q3 Presentation

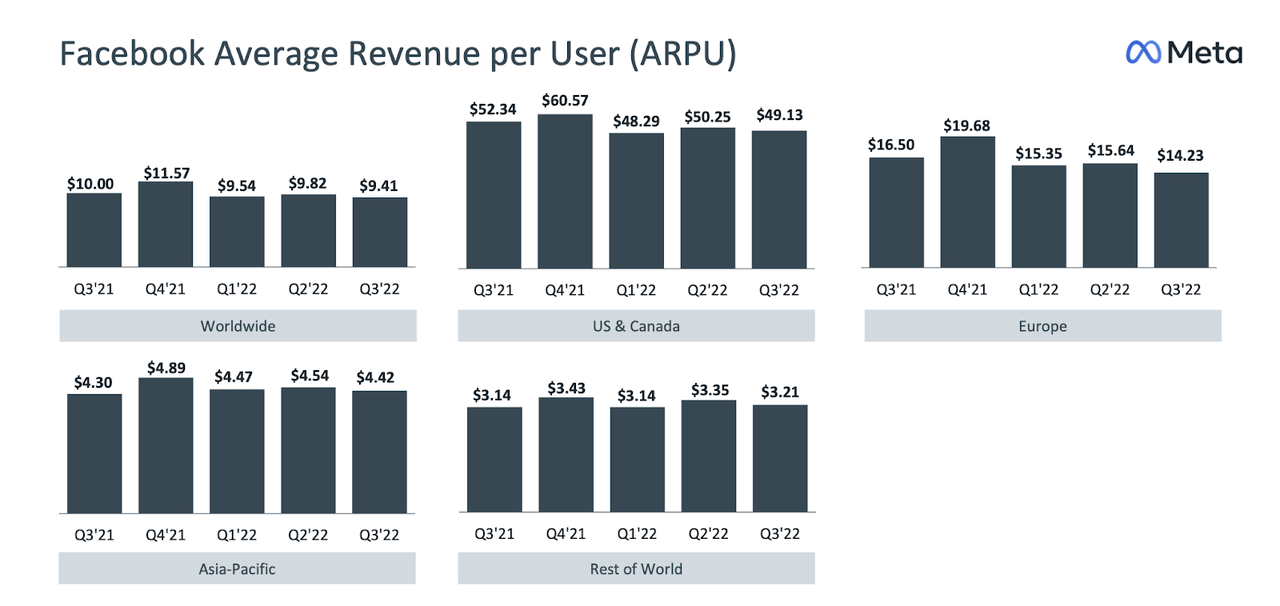

Average revenue per user (‘ARPU’) declined YOY due to increased Reels engagement, which has a lower monetization rate.

2022 Q3 Presentation

On the conference call, management also cited strong impression growth from lower priced regions and lower advertising demand.

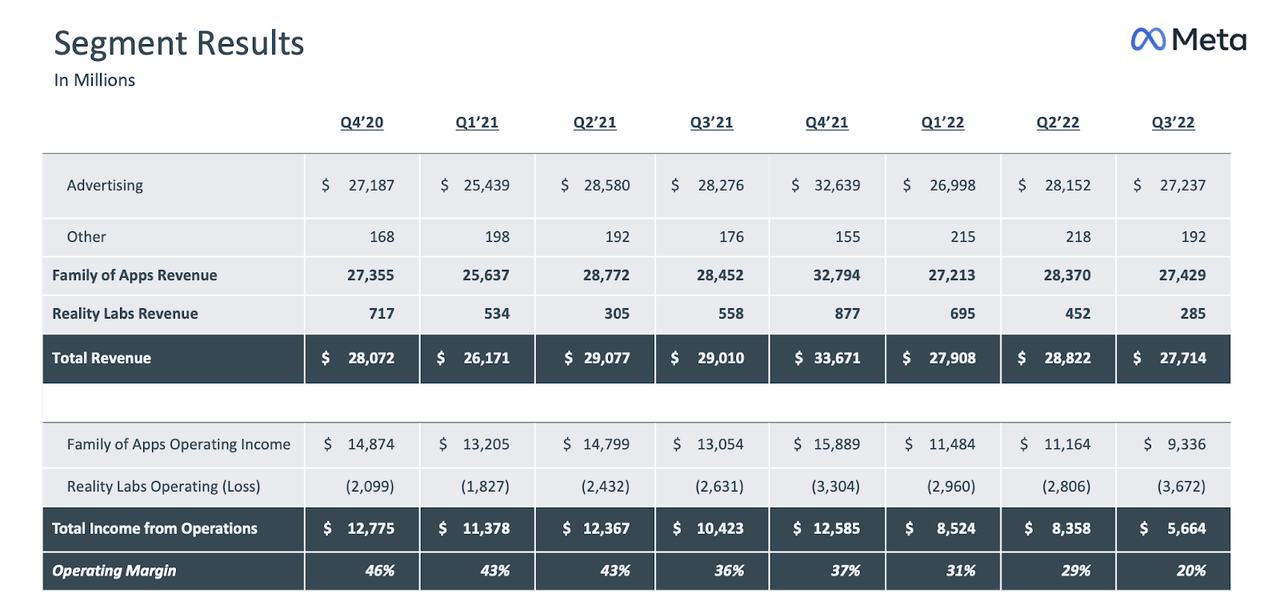

The market was seemingly dissatisfied primarily with one thing: profits. Operating margin declined to 20%, as Family of Apps operating margin declined to 33.9% and the company burned through $3.7 billion of Reality Labs operating losses in the quarter.

2022 Q3 Presentation

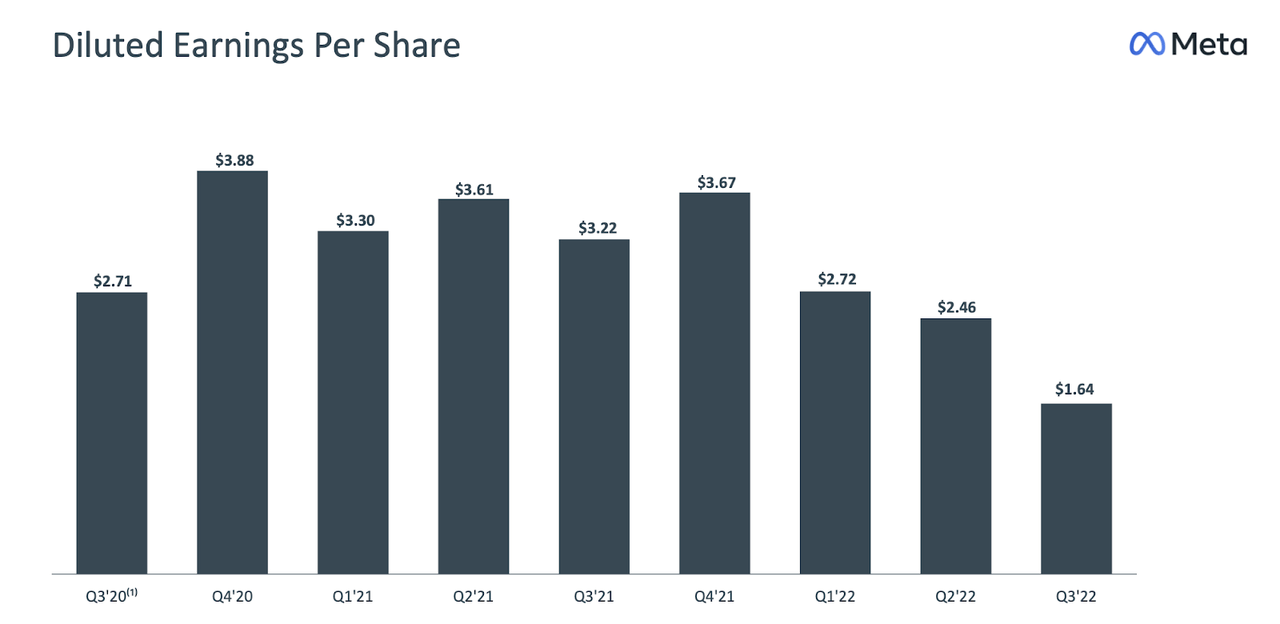

Earnings declined by 49% to $1.64 per share.

2022 Q3 Presentation

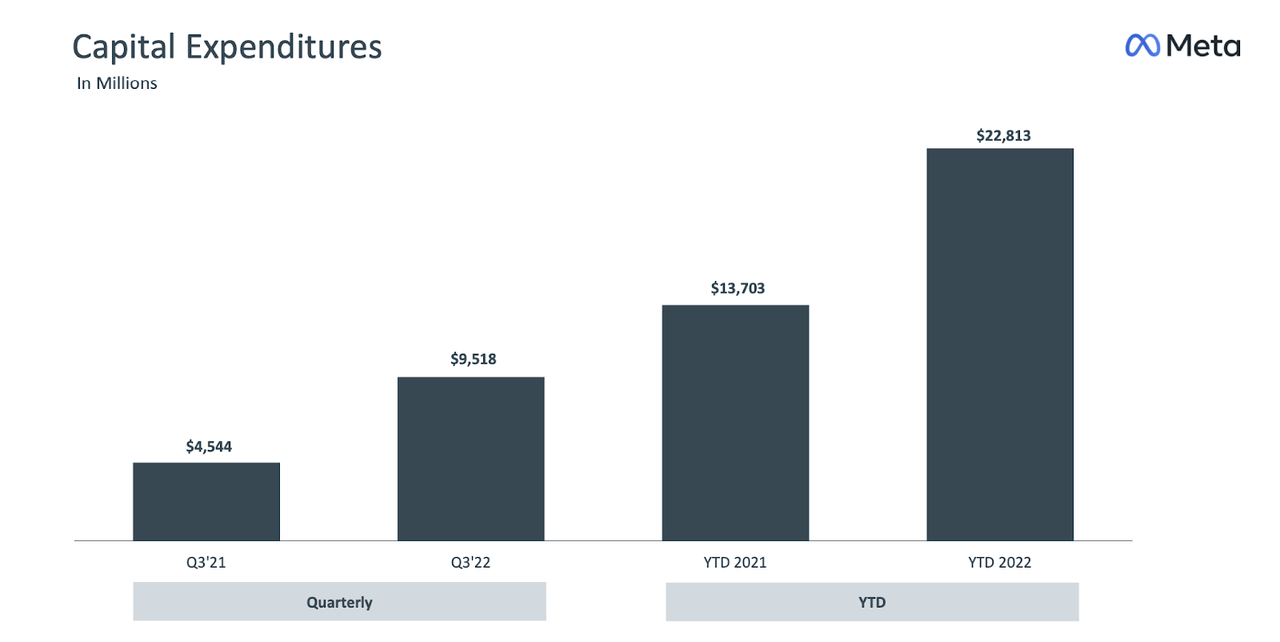

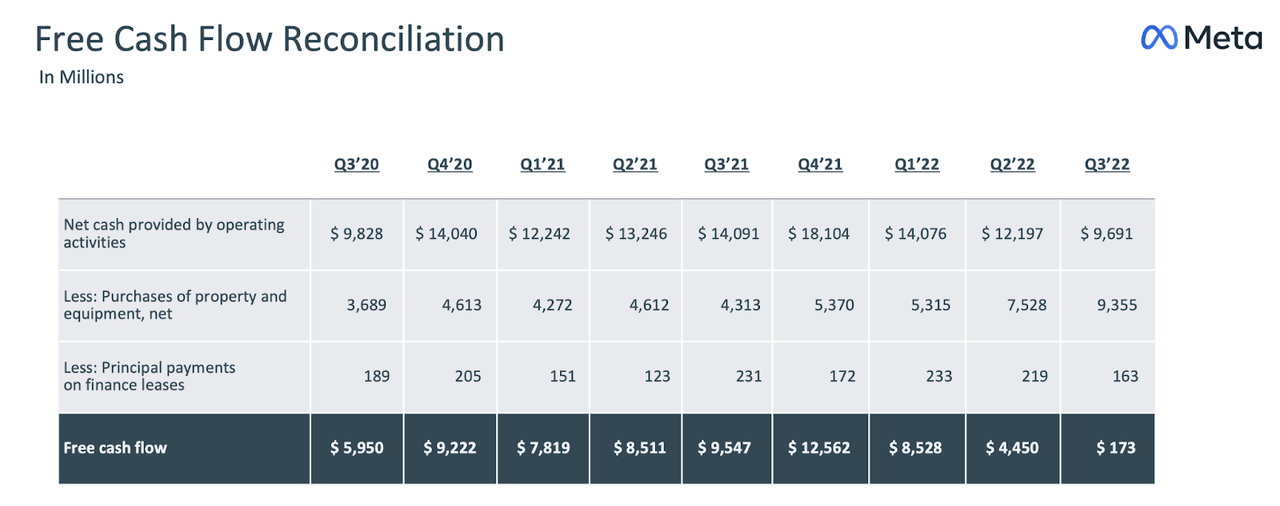

The company also ramped up capital expenditures.

2022 Q3 Presentation

The combination of deteriorating margins and elevated CapEx spend led to free cash flow all but disappearing.

2022 Q3 Presentation

Management gave no indication that expenses would fall off moving forward – they actually gave commentary to the contrary as they intend to continue investing for growth. That has investors worried that the depressed margins are the new norm, with no bottom in sight.

I have written in the past that sentiment can influence interpretation of financial results. Given the same set of numbers, negative sentiment can make results look more disappointing than they really were. The company spent $6.55 billion on share repurchases in the quarter. I am impressed by the commitment to the share repurchase program even as free cash flow came down, as it shows that management aims to balance growth investments with actions to reward shareholders. The company ended the quarter with $41.78 billion of cash versus $9.92 billion of debt, representing a double digit percentage net cash position.

I have been labeled an optimist in the past and remain one even now. First, free cash flow should improve drastically as the company moves past this latest investment cycle. Management noted that the surge in CapEx is mainly due to building out their AI infrastructure, which should eventually also lead to a clear return on investment. META expects Reality Labs losses to increase again in 2023 before moderating in 2024. The market seemed to miss the implicit guidance of 2023 being an important checkpoint for the Reality Labs business – perhaps that may be the year that the great investments either pay off or the company pares back expenses.

The company also appears to be making ground in addressing the competitive threats from TikTok. Management notes that there are “now more than 140 billion Reels plays across Facebook and Instagram each day,” representing a 50% increase from 6 months ago.

Looking ahead, management guided for fourth quarter revenue to be in the range of $30 billion to $32.5 billion. That represents a 4% decline year over year but includes a 7% headwind from unfavorable currency exchange rates.

Is META Stock A Buy, Sell, or Hold?

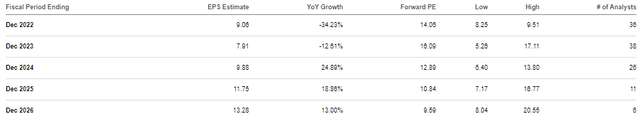

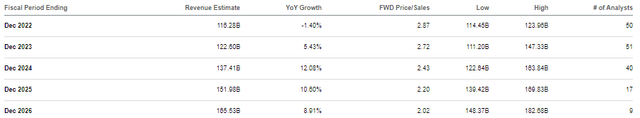

The market appears convinced of two things: first, that growth is over and second, that margins will continue to contract. Making matters worse, investors seem to think that CEO Zuckerberg is incinerating cash by investing in his metaverse pet project. Consensus estimates call for minimal earnings growth over the coming years.

Those projections look too pessimistic considering they are reflecting further margin contraction.

I am instead of the view that this is a company which has a long history of generating strong returns on investment. Sure, margins are coming down in the near term, but these are arguably some of the best engineers in the world being guided by a tech visionary leader. It is reasonable albeit contrarian to expect margin expansion as the company delivers on the heavy investment. Revenue growth may eventually accelerate as well – leading in turn to multiple expansion. Assuming a return to 15% top line growth, I could see the stock trading at 30x earnings – I realize that this may sound outlandish. But 15% top line growth may lead to 20% earnings growth – 30x earnings would thus reflect a conservative 1.5x price to earnings growth ratio (‘PEG ratio’). The stock might trade at $270 per share in such a scenario, representing over 112% upside.

What are the risks? Management has a strong track record but that is no guarantee that they may not stumble on these latest set of obstacles. Perhaps the company is unable to fend off the competitive threat from TikTok, or recover after the model changes from Apple (AAPL). In such an event, the current 14x earnings multiple can still present upside, but the value proposition would be much worse as the projected upside would vanish. I view the metaverse investments with a mixed bag – I am less pessimistic on it than others mainly due to the fact that the company can probably simply exit the business later if it doesn’t work, but the company admittedly has much to prove as I myself was not that impressed with the Oculus headset. There’s the risk that the company over-invests in Reality Labs – where Zuckerberg treats the company like his “piggy bank” to invest in side projects – which would be evidenced by lack of share repurchases and complete elimination of net income. I continue to rate META a strong buy as a higher conviction idea in the tech sector, one worth holding in sizable amounts amongst a diversified portfolio of beaten-down tech stocks.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed subscribers the Tech Stock Crash List (part 2 has been released), the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!