Summary:

- Meta Platforms’ Q3 results showcased several growth catalysts, ranging from advancements in AI, daily active users, and ad monetization.

- However, the recent valuation expansion has limited its near-term upside potential.

- Reliance on ad income has further heightened uncertainties and potential volatility.

- As such, this article downgrades META stock to HOLD till its next earnings report scheduled on 1/31/2025.

- In the meantime, I suggest the consideration of options to hedge risks.

remco86

META stock: previous thesis and Q3 results

My last analysis on Meta Platforms stock (NASDAQ:META) was an earning preview for its Q3 results. The article is titled “Meta Platforms Q3 Preview: Double Compounding Expected To Continue”, published on Oct 28, 2024, and rated the stock as a buy. The double compounding mechanism I was referring to are share repurchases and profit growth. I expected the following catalysts from its Q3 reports to sustain such a mechanism:

Meta’s Q3 earnings are very likely to beat market consensus again due to recent developments on the AI front. In particular, the advancements in the development of self-taught evaluator AI models have overarching implications. They could further reduce human involvement, enhance productivity, and boost margins. These catalysts can sustain its ongoing double-compounding mechanism through aggressive share buybacks and strong growth capex investments.

Since then, the company has indeed reported strong operating results for its FY Q3 as you can see from the following chart below. Thus, it is the goal of this work to review its Q3 earnings and examine the changes surrounding the stock since then. In the end, you will see that these changes have led me to downgrade my rating to HOLD from the earlier buy rating. In particular, I will discuss some actionable ideas involving the use of options and ETF funds (such as XLC, The Communication Services Select Sector SPDR ETF Fund) to hedge uncertainties.

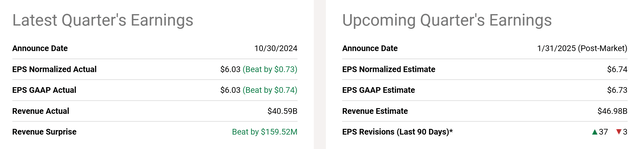

Let me start with some highlights of its Q3 results to prime the subsequent discussion. The top line advanced nicely to $40.6 billion, beating consensus and translating into ~22% YOY growth. Earnings per share advanced substantially too, to $6.03, also beating consensus and translating into ~19% YOY growth. Digging deeper, the key growth drivers are daily active users (which rose roughly 7% on an annual basis and reached a mind-boggling number of 3.27 billion). Ad impressions also showed a robust advancement of 10%. On the negative side, costs and expenses increased at a fairly moderate pace. However, as mentioned in my last article, my view is that the costs are under control and I expected margin expansion down the road.

Seeking Alpha

META stock: growth outlook and concerns

Looking further out, the market expects a favorable growth curve as seen in the next chart below. To wit, consensus sees an annual growth rate in the teens (around 12% to about 14% in the next 3 years) before EPS growth begins to slow. I share the optimism behind the expectation. The company remains well-positioned in the social media space, and ought to further benefit from an increasing number of daily active people and ad impressions. Investment in emerging technologies ought to bear fruit (such as the new AI models detailed in my last article).

Seeking Alpha

However, following the recent price run-up, my assessment is that favorable business prospects seem to be largely discounted by the recent valuation expansion already. As shown in the next chart, the stock price increased significantly after the Q3 report and currently hovers near a 52-week high (of around $638). The price rallies have pushed its forward P/E ratio to about 27.42. With the 12~13% EPS growth projection just mentioned, the PEG ratio is over 2x, far above the 1x threshold most GARP (Growth At Reasonable Price) investors consider attractive.

Seeking Alpha

As such, I think the near-term upside potential is limited and uncertainties heightened under current conditions. Investors also have to bear in mind that the stock is quite sensitive to macroeconomics and has experienced a couple of significant drawdowns in recent years. The fundamental reason is that almost all of its revenues are derived from advertising. A reduction in spending by marketers, which often comes in tandem with news that hints a slowing overall economy, would quickly result in a negative effect on the sentiment surrounding META.

META stock’s options

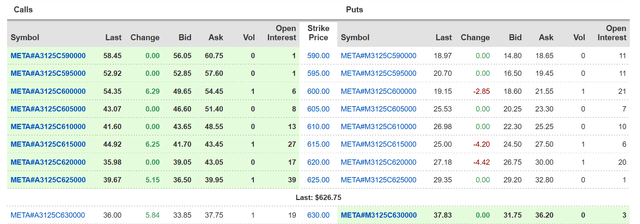

Given the above analyses, I think the primary focus for both existing investors and potential ones is to manage such uncertainties until its earnings report provides more information for the future. I consider the use of options with expiry close to its next earnings an effective hedging idea. If you recall from the first chart quoted above, META is scheduled to report its next earnings (which will be for its FY Q4 2024) on 1/31/2025. Given its currently high-flying prices and elevated PEG ratios, this upcoming earnings report might cause large price volatilities.

Thus, I think investors should consider the use of options to hedge such volatility risks. As an example, an idea for potential investors who want exposure, take a look at the call option below with expiry on 1/31/2025. As seen, for such a call with a strike price of $630 (i.e., a near-the-money call) lasted traded at $36. Thus, a potential investor “only” needs to lay out $3600 to gain exposure to 100 shares. I put only in quotation mark to emphasize that this is a small capital layout compared to the direct trading of shares (which would cost $62.6k to gain exposure to 100 shares). Existing investors could consider the use of covered put options. A near-the-money put option with $630 strike last traded around $38. So, these options would provide an effective yield of more than 6% in about 6 weeks of time, a non-negligible downside protection in my view.

Yahoo!

Other risks and final thoughts

I see both positives and negatives surrounding META stock after the updates provided in its Q3 earnings. To recap, the key positives include the robust user growth, ad monetization, advancements in its AI models, and also the overall strategic position in social media. The key negatives include rising expenses and costs, expanded P/E since my last writing, expensive PEG ratio, and its concentrated exposure to ad income and thus the sensitivity to economic conditions. Besides these risks, there are a few other regulatory and social risks that investors have to bear in mind. I expected increased scrutiny from regulators and privacy advocates on tech giants like META. In the longer term, I (as the parent of a teenager) have read my fair share of analyses – both in terms of peer-reviewed journal articles and media coverage – reporting the negative effects of social networking websites.

As a disclosure, I don’t have an explicit position on META. My META exposure is provided via index funds that certain accounts require me to buy and my more concentrated exposure to META is provided by a sizable position of XLC. XLC provides focused exposure (which is what I prefer) to a couple of companies in the telecom sector, with META and GOOG being the largest exposure. Each of them represents about 20% of the fund’s total assets. The top 10 holdings represent almost three quarters of the total assets. We understand most of these top holding well, wrote on many of them recently, and have good ratings (at least no sell ratings) for them. Thus, I consider XLC another approach that potential investors could consider gaining exposure to META (i.e., a somewhat diluted exposure).

All told, I do not see a clear bias of META’s reward/risk curve under current conditions. Instead, I am seeing a mix of positive and negative catalysts in the near term. Thus, this article downgrades my rating to HOLD from my earlier BUY rating.

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XLC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.