Summary:

- When Meta’s revenue declined in 2022, some investors were quick to jump to the conclusion that its best days were behind it. The company has already proven the critics wrong.

- There is a common misconception that WhatsApp is still in the pre-revenue stage even after years of Meta’s strategic investments to develop the platform into what it is today.

- During the Q3 2022 earnings call, Mark Zuckerberg revealed that click-to-WhatsApp ads had hit an annual revenue run rate of $1.5 billion. Growth has been thick and fast since then.

- Going by the comments of Meta executives in recent earnings calls, the company seems to be looking at two main ways to monetize WhatsApp. Running ads is not one.

- In this article, I am sharing some of the latest product development and user acquisition highlights that point to better monetization of WhatsApp in the future.

kenneth-cheung

I love investing in small-cap stocks. That is because identifying a growth company during its early stages will often lead to multibagger returns. I am careful to not let my love for small companies cloud my judgment, however, because large companies, at times, tend to be grossly mispriced in the market. The best kind of large companies are the ones that are continuing to grow despite their size. Meta Platforms, Inc. (NASDAQ:META) is my favorite big tech giant – it has been for a number of years. Whenever the opportunity presented to invest in META at seemingly fair or cheap prices (think of late 2018, March 2020, and for most parts of 2022), I never missed out.

When Meta’s revenue declined in 2022, some investors were quick to jump to the conclusion that its best days were behind it. I thought the opposite, as my research suggested Meta’s best days are yet to come with many of its key assets including Instagram and WhatsApp being nowhere near their full monetization potential. Meta has made a strong comeback this year, with the company reporting YoY revenue growth in each quarter. Even more interestingly, growth has accelerated from 2.64% in Q1 to 11% in Q2 to 23% in the third quarter. Mr. Market has not been oblivious to this stellar comeback – Meta’s stock is up more than 160% this year.

My investment thesis for Meta is centered around a few key assumptions, including the monetization of WhatsApp. In this analysis, I will share some of my recent findings that suggest Meta is moving in the right direction with WhatsApp monetization.

WhatsApp Is Already Generating Revenue

There is a common misconception that WhatsApp is still in the pre-revenue stage even after years of Meta’s strategic investments to develop the platform into what it is today. Let’s clear the air first. WhatsApp is no longer sitting idle.

One of Meta’s fastest-growing ad products today is its click-to-message business. The company rolled out this product with a focus on enabling businesses to run ads on Facebook and Instagram that direct potential customers to start a new chat with the business on Messenger, WhatsApp, or Instagram Direct. Out of these three messaging platforms, Messenger is by far the biggest and most active, so Meta naturally focused on growing the click-to-Messenger side of the business first. During the Q3 2022 earnings call, Mark Zuckerberg revealed that this ad product had reached a $9 billion annual revenue run rate. Elaborating further, he said:

This revenue is mostly on click to Messenger today since we started there first, but click to WhatsApp just passed a $1.5 billion run rate and growing more than 80% year-over-year.

During the Q4 2022 earnings call, Meta’s CEO revealed that the annual revenue run rate for the click-to-message product has surpassed $10 billion. There has been no mention of WhatsApp’s contribution to this growth since, but going by the remarks in recent quarters, we can infer that click-to-WhatsApp product is growing fast – probably outpacing the growth of other click-to-message products in some key regions such as India. During the third-quarter earnings call, Zuckerberg said:

Click-to-WhatsApp ad revenue continues to grow very quickly in particular and is already at a multi-billion dollar annual run-rate. We’re progressing on our work to enable further down the funnel conversions, and longer-term, we’re excited about the potential of AI to help businesses message with customers more efficiently at scale.

Going by the comments of Meta executives on the recent earnings calls, the company seems to be looking at two main ways to monetize WhatsApp.

- Click-to-WhatsApp ads

- Paid messaging

Building on my earlier discussion of how click-to-WhatsApp ads work and the revenue the company is generating from this product, let’s look at how paid messaging works.

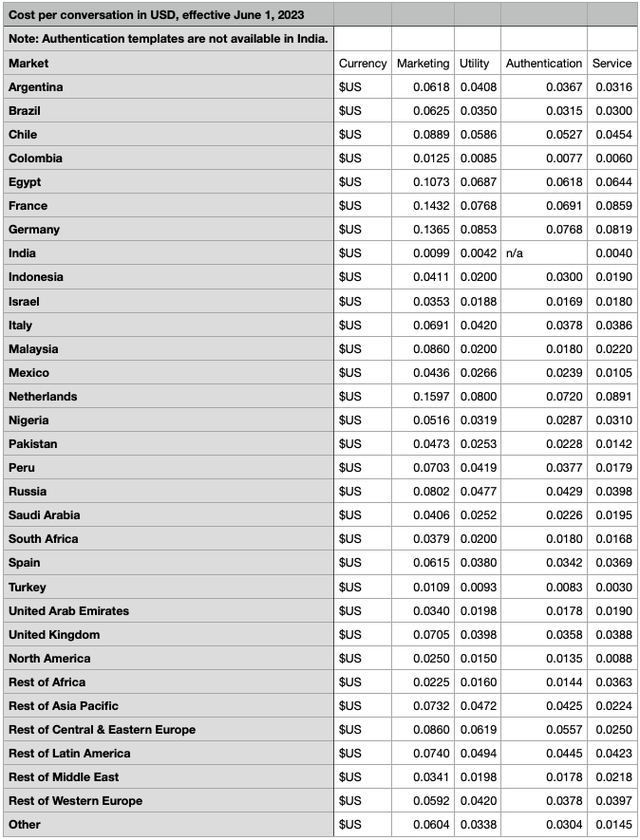

Meta has introduced a conversation-based pricing model to charge businesses per conversation. According to the official pricing document published by Meta, conversations are categorized into four unique categories.

- Marketing – Examples include new product announcements, feature announcements, and targeted promotions.

- Utility – Examples include delivery notifications, account updates, payment reminders, and feedback surveys.

- Authentications – Account verification and account recovery assistance.

- Service – Resolving customer queries.

Each WhatsApp Business account gets 1,000 free service conversations each month and free entry point conversations as well. Beyond that, WhatsApp Business accounts will be charged a fee based on their main operating currency. Below is the updated USD rate card published by Meta.

Exhibit 1: USD rate card for paid messaging for WhatsApp Business

WhatsApp is arguably at the very first stage of its monetization journey, and the early success of Meta’s efforts has convinced me that WhatsApp will prove to be a cash cow in the future.

Long Runway To Grow

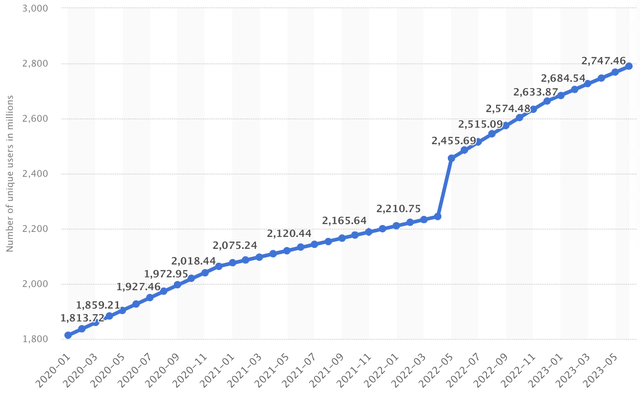

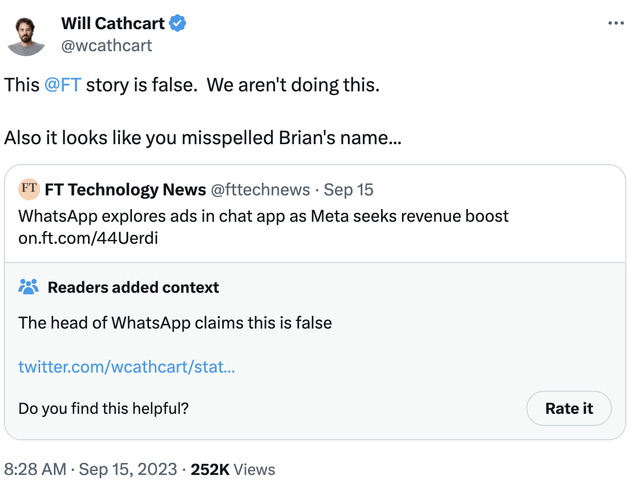

A few weeks ago, rumors surfaced that WhatsApp is planning to display advertisements to its users in a bid to monetize its growing user base. We are talking about more than 2 billion daily active users and close to 3 billion monthly active accounts.

Exhibit 2: Number of unique WhatsApp mobile users (millions)

Meta was quick to dismiss these rumors. The company clarified that WhatsApp is not testing any such strategy and that such a plan was not discussed internally. Here’s what WhatsApp head had to say about the rumors.

Exhibit 3: Will Cathcart’s Tweet

I would have been surprised if WhatsApp killed the user experience by introducing ads. Historically, Meta has been patient with its monetization strategy, and the key to its success with both Facebook and Instagram has been its ability to improve – not deteriorate – the user experience while monetizing the platforms.

WhatsApp’s monetization strategy, in my opinion, will revolve around WhatsApp Business, WhatsApp Pay, and WhatsApp Channels. Below are some of the latest product development and user acquisition highlights that point to better monetization of WhatsApp in the future.

- WhatsApp Business now has more than 200 million monthly active accounts, up from 50 million in 2020.

- Click-to-WhatsApp advertisements can now be created without having a Facebook account, which improves the appeal of WhatsApp as a standalone platform for businesses.

- WhatsApp Business now allows users to create and publish ads without leaving the WhatsApp ecosystem.

- WhatsApp has rolled out paid personalized messages to help businesses reach their target audience directly, for a fee.

- The platform can now be used to create a WhatsApp web page for a business.

- In Brazil and Singapore, WhatsApp users can directly pay merchants through the app, using WhatsApp Pay. Peer-to-peer transactions have been active for a while.

- WhatsApp Channels, which was launched to attract celebrities, creators, and businesses, has surpassed 500 million users in just seven weeks. Meta is exploring ways to integrate WhatsApp Pay into Channels.

With every quarter that passes, WhatsApp is coming up with a new product, a new way to enhance user experience, a new way for businesses to connect with their target audience, and a new way to monetize users. The company’s focus on WhatsApp reminds me of early-stage Facebook. Although WhatsApp may never scale enough to outgrow Facebook, I believe the messaging platform is likely to emerge as Meta’s growth engine in the next five years.

Takeaway

WhatsApp is no longer sleeping. Many investors doubted Meta’s decision to pay billions of dollars to buy WhatsApp a decade ago, but today, WhatsApp is well-positioned to drive revenue and earnings growth for the company. I believe WhatsApp’s continued progress in monetizing its user base will not only result in financial gains but also help the company attract premium valuation multiples in the market. Meta remains a buy-and-hold-forever stock for me as I believe the company will grow at a stellar pace in the foreseeable future to eventually return billions of dollars in capital to shareholders in the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!