Summary:

- The “Year of Efficiency” is bearing fruit: The company posted a 40% operating margin in the latest quarter.

- The company has successfully dealt with competitive threats and moved on from the iOS data privacy changes.

- Meta Platforms is proving to be a prime beneficiary of generative AI, and I expect generative AI to increase the value of its Family of Apps.

- I reiterate my strong buy rating with a $600 price target.

Win McNamee

Meta Platforms (NASDAQ:META) has bounced strongly from the lows as the company simultaneously dealt with the TikTok competitive threat while overcoming the tough macro environment. Based on the still-discounted stock valuations, Wall Street appears fearful that the “year of efficiency” was a one-time deal. Wall Street sometimes gets a bad rap for being too focused on the near term, and I believe that this is yet another example of that. META’s heavy investment in Reality Labs is detracting from the value in the near to medium term, but the company is generating strong margins even inclusive of those losses – thanks to the increased focus on operational efficiency. I expect META to be a key generative AI beneficiary as it makes advertising on its platform even more valuable and easy for advertisers. The stock is still trading too cheap given the high quality business model, net cash balance sheet, and high profitability. I reiterate my strong buy rating, META remains one of my top picks in the market today.

META Stock Price

It may be hard to believe but META reached a multi-year bottom just around 1 year ago, briefly trading below $90 per share. At the time, the market was concerned about the company’s ability to handle both TikTok competitive threats as well as the rising interest rate environment. Can we say that META has passed the test?

I last covered META in September, where I rated the stock a strong buy as an “overlooked generative AI beneficiary.” Some investors may be wary about buying a stock that is so much higher than recent lows, but the stock arguably never should have traded so low in the first place – I see solid upside ahead.

META Stock Key Metrics

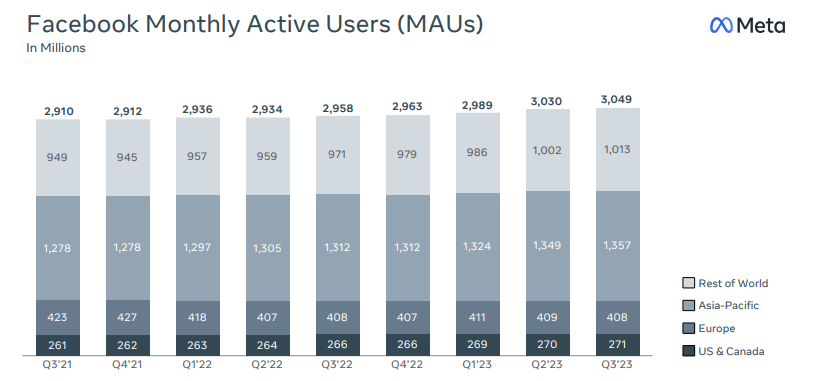

In its most recent quarter, META was able to grow Facebook monthly active users (‘MAUs’) by 0.6% sequentially, a solid result given the size of the business.

2023 Q3 Presentation

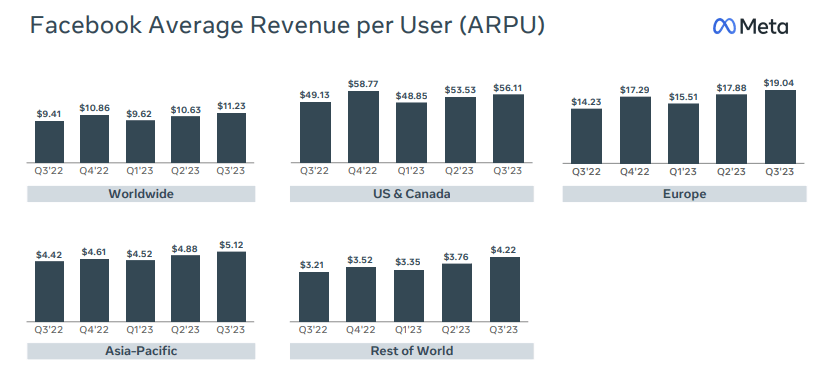

META coupled user growth with gains in average revenue per user (‘ARPU’). While some social media peers are seeing ARPU struggle especially in the US, META saw gains in all reported regions.

2023 Q3 Presentation

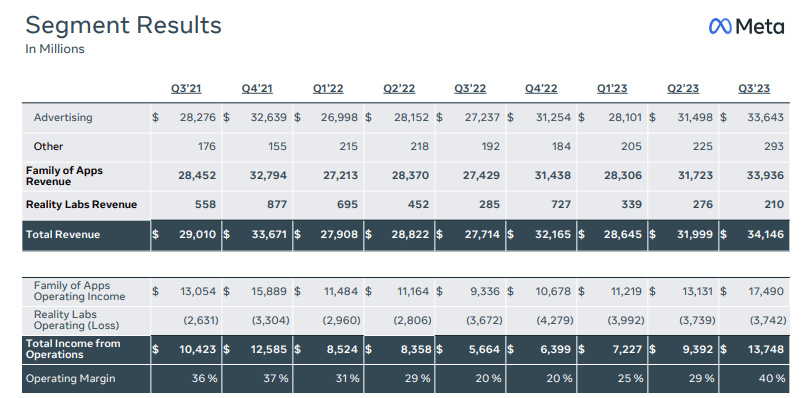

These led to META reporting $34.1 billion in revenue, coming in at the high end of guidance for $32 billion to $34.5 billion.

2023 Q3 Presentation

The company generated a 40% operating margin – and I note that this is inclusive of losses from Reality Labs. The company hasn’t generated that kind of profitability since the second quarter of 2021, and even then 40% to 42% operating margin was a high watermark for the company. Excluding Reality Labs, the company generated a remarkable 51.5% operating margin from Family of Apps – the “year of efficiency” is more than just talk.

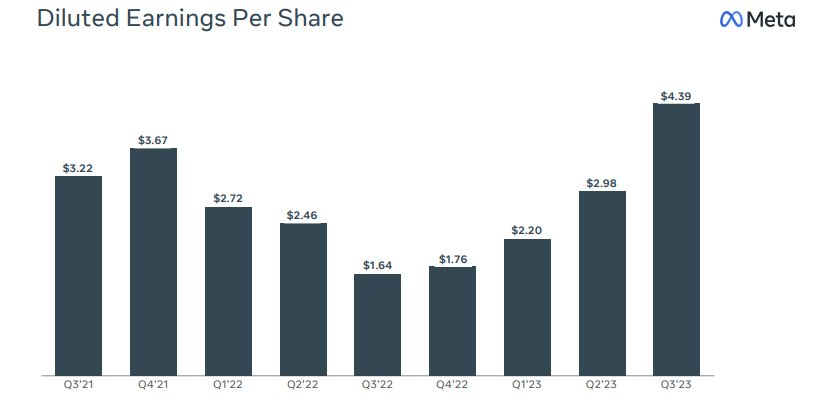

Throw in the benefits from aggressively repurchasing shares over the last several quarters, and META was able to deliver an extraordinary 168% YoY gain in earnings per share.

2023 Q3 Presentation

META ended the quarter with $61 billion of cash and $6 billion of non-marketable securities versus $18.4 billion of debt. The company spent $3.6 billion on share repurchases – it is notable that the pace of buybacks have slowed down considerably over the last several quarters.

Looking forward, management has guided for fourth quarter revenues between $36.5 billion and $40 billion, representing between 13.4% and 24% YoY growth. While some media outlets lamented about the wide range (which was blamed on the Israel-Palestinian war), I am of the view that most investors are probably more than content with 13.4% being the bottom end of guidance.

Instead, investors may have been concerned about guidance for 2024 total expenses to jump to between $94 billion and $99 billion – up from the projected $89 billion in 2023. On the conference call, management noted that Reality Labs operating expenses (and losses) would increase significantly next year, but the majority of the ramp up in OpEx would be from higher infrastructure and technical headcount for Family of Apps. It is interesting that Wall Street can be simultaneously bullish on generative AI but at the same time concerned about the company investing in generative AI infrastructure. Perhaps Wall Street is not concerned with the immediate guidance, but instead fearful that management (perhaps most importantly CEO Mark Zuckerberg) might veer off course and ramp up Reality Labs expenses indefinitely, with little to show for it.

Management noted that their investment in AI has paid off and that AI will be their “biggest investment area in 2024.” Management estimates that Reels has driven a greater than 40% increase in time spent on Instagram since launch. Reels has previously been dilutive from a monetization perspective but management notes that it is now “neutral to overall revenue.” You don’t hear much about it now, but there was once a time when Wall Street was very fearful about disruption from TikTok – it appears that META has innovated its way through such challenges.

Management estimates that AI has helped drive a “7% increase in time spent on Facebook and a 6% increase on Instagram” through better search recommendations. There was also a time when Wall Street was worried that the Apple (AAPL) data privacy changes would render the business model obsolete. AI appears to have helped address these concerns as well.

Management noted that their Twitter-lookalike Threads now has over 100 million MAUs. It isn’t clear if or when Threads will ever be significant from a financial perspective, but with the company posting 40% consolidated operating margins, it represents free upside.

Is META Stock A Buy, Sell, or Hold?

When one thinks about generative AI, names like Nvidia (NVDA) or Microsoft (MSFT) come first to mind. In my eyes, though, the customers of generative AI may be the biggest beneficiaries. META believes that generative AI can “change advertising in a big way,” outlining their vision for the new technology to help make developing advertisements much easier (generative AI can help generate creative text and images) which paired with their impressive AI recommendation technology has the potential to make the Family of Apps even more valuable than it already is today.

Some investors might look at where the stock used to be (far lower) and think that the stock is too expensive. I instead look at valuation to get an idea of where the stock is going in the future. At recent prices, the stock still traded more than reasonably.

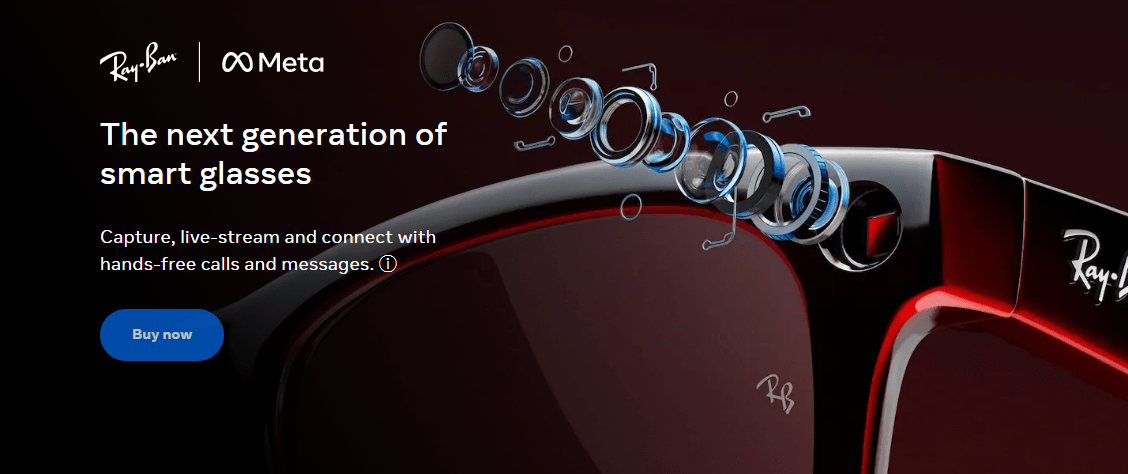

When one judges the stock on a price to earnings basis, they are assigning negative value to Reality Labs given that this segment is losing money. But is that such a reasonable assumption? Perhaps one believes that the metaverse is too early or that there is a limited market for the VR headsets (a debatable point given that Apple is making an entrance). But have investors seen the Ray-Ban Meta smart glasses? This product has received incredible reviews and management believes that it can benefit the Family of Apps ecosystem by helping to “create more engaging content for the content ecosystem.” That’s a pretty good benefit besides helping people feel like James Bond.

RayBan

If we assume $0 value for Reality Labs, and a 25x earnings multiple for Family of Apps, then we arrive at around $400 per share value. I note that I am being conservative in using trailing twelve-month numbers which have not incorporated the full benefits from the “year of efficiency.” On a forward basis and applying a 25x earnings multiple, we arrive at a fair value of around $604 per share (assumptions include 50% FoA operating margin, 21% corporate tax rate, and 10% forward revenue growth). Even after incredible upside from the lows, META is still offering strong upside potential from here.

What are the key risks? TikTok remains a risk, even if Wall Street appears to be briefly forgetting about the threat. While META has shown financial resiliency, there isn’t yet indication that TikTok is not still growing its user base rapidly among younger generations. While I am of the view that TikTok does not fully replace what is offered from the Family of Apps, it is possible that it changes in the future. Wall Street is likely more concerned about the possibility that Zuckerberg invests even more aggressively into Reality Labs. The 51% operating margin shown at Family of Apps is incredible, but may be wasted if the company proceeds to ramp up Reality Labs losses too aggressively. Ironically, investors may benefit if META loses out to AAPL in the metaverse war, but it is unclear how many billions of dollars will need to be sacrificed prior to an exit, if ever.

I reiterate my strong buy rating for META given the cheap valuation, net cash balance sheet, and rapidly improving fundamental picture.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!