Summary:

- Meta Platforms plunged after its latest earnings release due to disappointment over increased investments in artificial intelligence.

- The company is underappreciated as one of the biggest beneficiaries of AI, with AI-powered chatbots being one immediate driver of incremental value.

- I explain why Meta Platforms appears to have an “Amazon moat.”

- Meta Platforms stock remains a top pick and I reiterate my “strong buy” rating.

Anna Moneymaker/Getty Images News

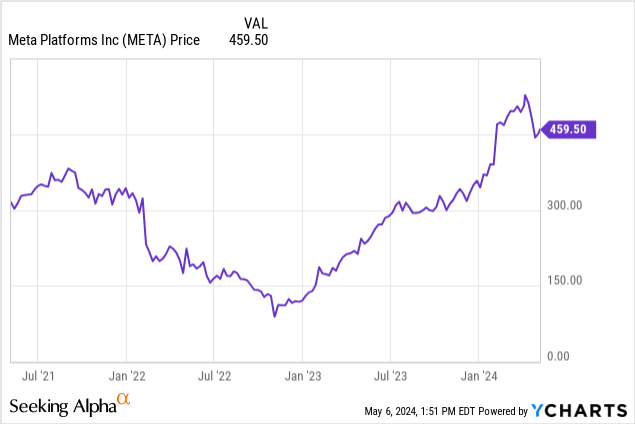

It isn’t always a welcome sight when our stocks go up. A soaring stock price can make it hard to keep holding on to high-quality compounders. Meta Platforms (NASDAQ:META) was approaching such a predicament but then it “fortunately” traded sharply lower after its latest earnings release. The market appeared disappointed by management’s plans to ramp-up investments in artificial intelligence. It appears that many investors may have been more focused on the near-term profits from “Year of Efficiency” and less on the company’s long-term growth opportunity. Investors are right to be skeptical about ongoing investments in the metaverse, but I expect investments in artificial intelligence to pay big dividends in strengthening the growth story as well as earning a higher stock valuation. Investors should view this recent slide as a solid buying opportunity – I reiterate my strong buy rating on the stock.

META Stock Price

I last covered META in March, where I explained why I was sticking by the name in spite of the strong stock performance. I was surprised to see the company dip after it reported solid results and outlined expectations to further increase their competitive advantages through accelerated investments.

This is an opportunity to add to a long-term winner.

META Stock Key Metrics

Generative AI hype may be beginning to fade just as the winners are becoming apparent. META is often ignored as an AI play due to not being a cloud operator, but it is arguably one of the biggest AI beneficiaries due to its ability to integrate AI across its platforms. One visible example is AI-powered chatbots to help its advertising clients connect with customers (among other use cases).

As mentioned on the conference call, 30% of content generated on the Facebook feed (and 50% on Instagram) is powered by AI. I continue to view META as being one of the more underappreciated AI plays in the market today and believe that it will ultimately be the customers of AI that prove to be the biggest beneficiaries of generative AI.

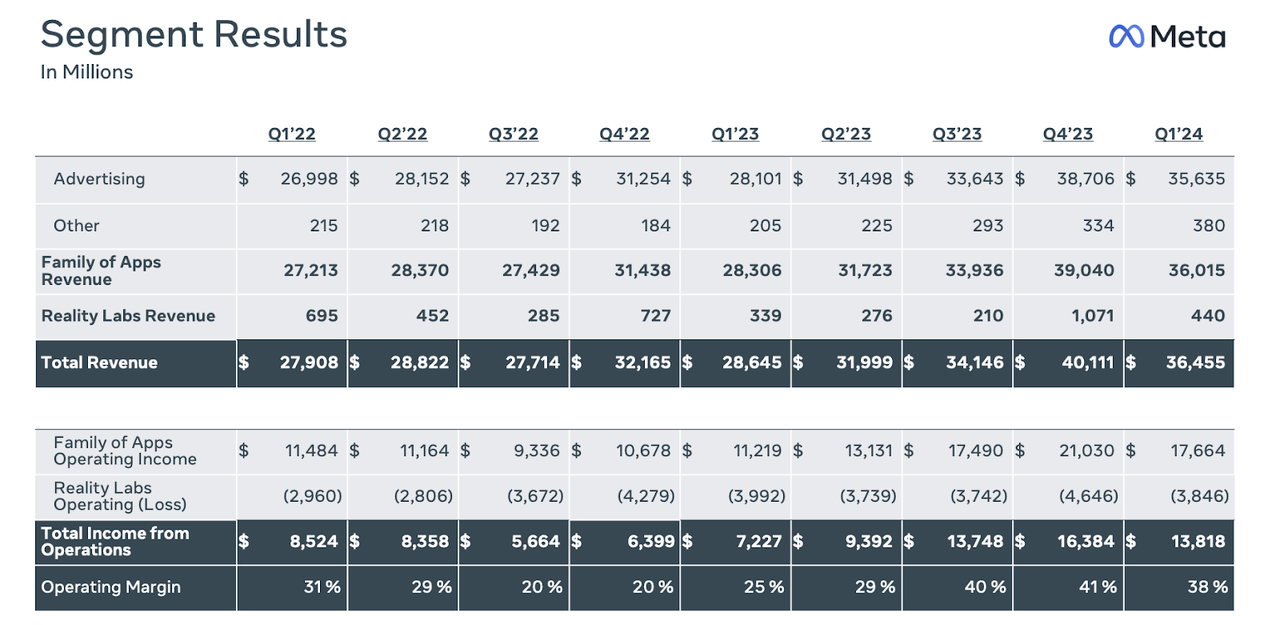

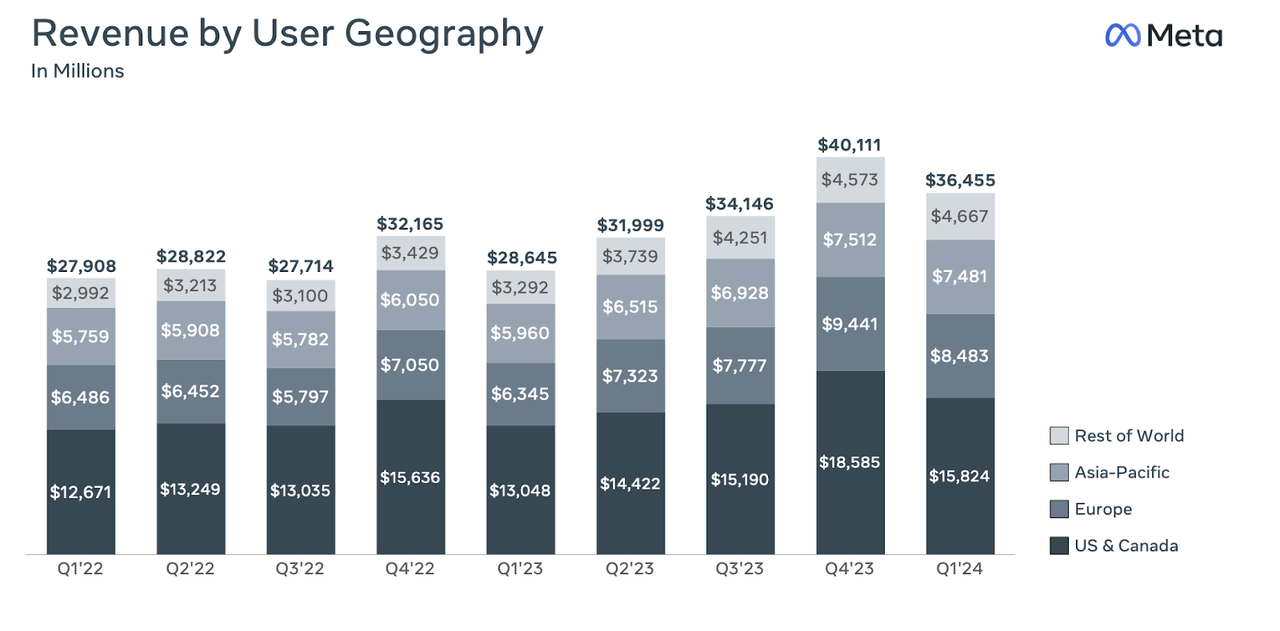

In its latest quarter, META delivered 27.6% YoY revenue growth to $36.5 billion, coming in at the high end of guidance of $34.5 billion to $37 billion. These are stunning results especially for a company of this size, but even this bullish investor must remind readers that the company is benefitting from lapping easy comparables, as the online advertising market was weak following the rise in interest rates. For reference, revenues grew by only 2.5% YoY in the first quarter of 2023. These comparables will become more difficult beginning in the third quarter, as the third quarter of 2023 saw revenues grow by 23% YoY.

The Family of Apps (this includes Facebook and Instagram) posted typically strong operating margins at 49.2%, representing nearly 1,000 bps expansion YoY. The strong profit margins seen in the business help to offset the deep losses in Reality Labs, leading to a consolidated operating margin of 38%. It is interesting to see the company burn $3.8 billion in Reality Labs operating losses in the latest quarter yet still post an operating margin that would place it in the upper echelon of the tech sector (and the market overall).

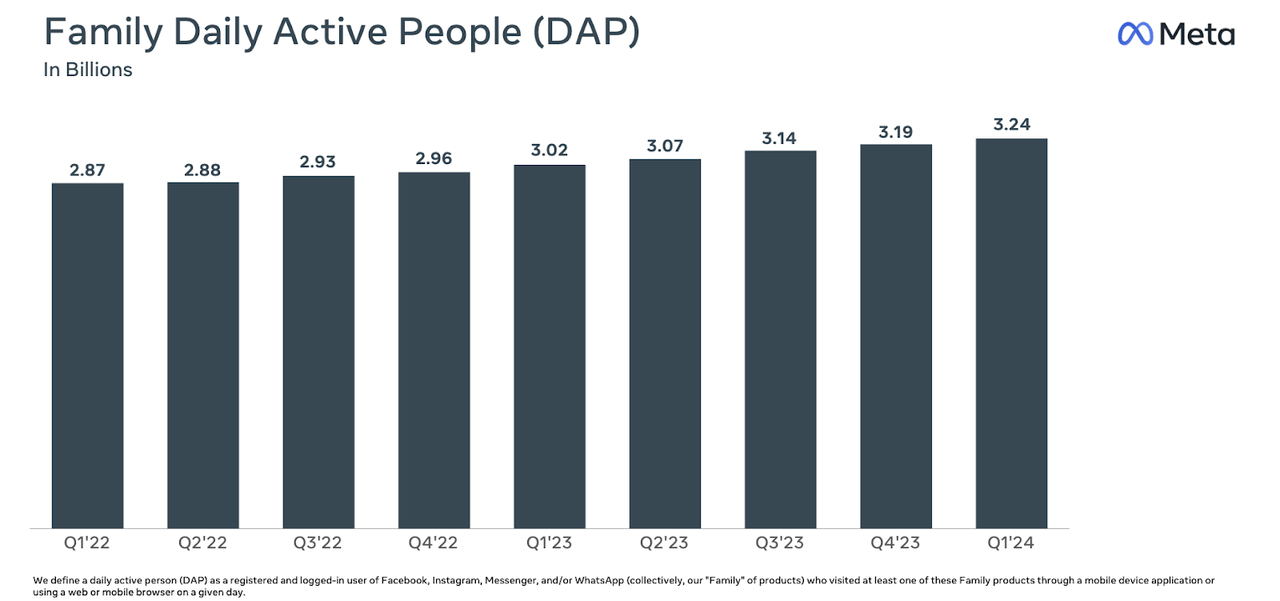

I was disappointed to see META stop disclosing user metrics for Facebook, but this may make some sense given the company’s other social media platforms. Family daily active people showed healthy growth at 7.2% YoY and 1.6% QoQ, indicating that the company’s platforms remain as relevant as ever. I would be concerned if DAP growth turned negative, even if profits continue to grow, as such a scenario might indicate existential issues ahead – but this isn’t the case here.

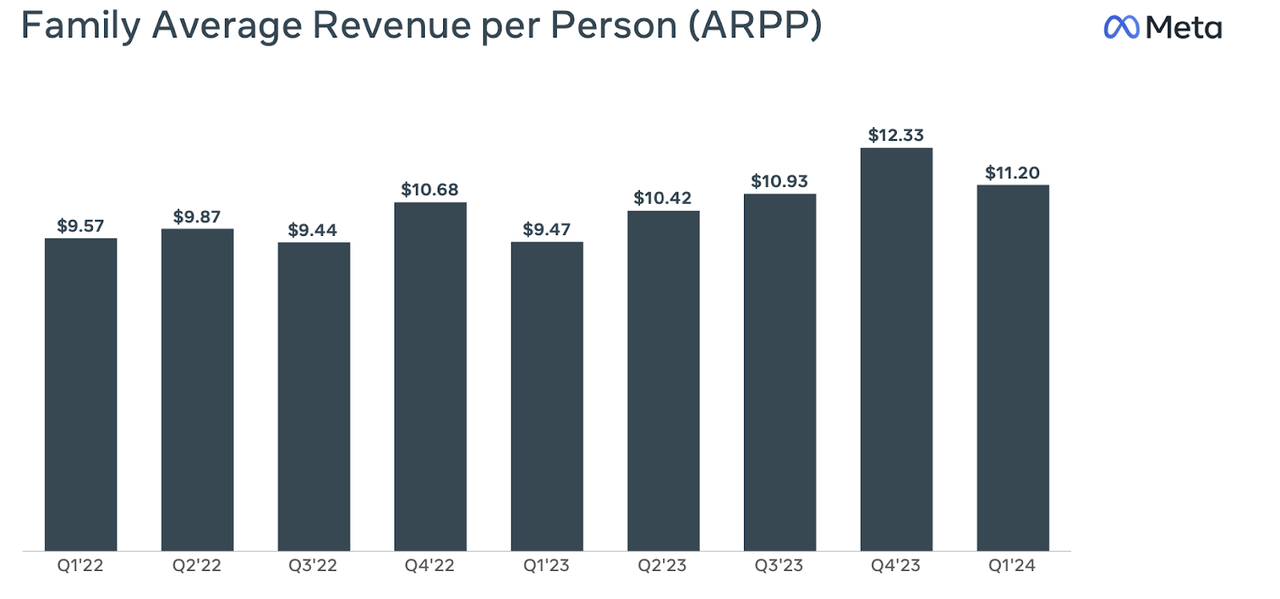

After seeing growth in average revenue per person (‘ARPP’) briefly struggle in 2023, the company is back to showing solid growth in this metric.

Management showed that they can balance investing in growth with rewarding shareholders, spending $14.64 billion on share repurchases and $1.27 billion on dividends. Total returns to shareholders outpaced $12.4 billion of GAAP net income – the company is a true “cash cow.” META ended the quarter with $58 billion of cash versus $18.4 billion of debt, representing a bulletproof balance sheet.

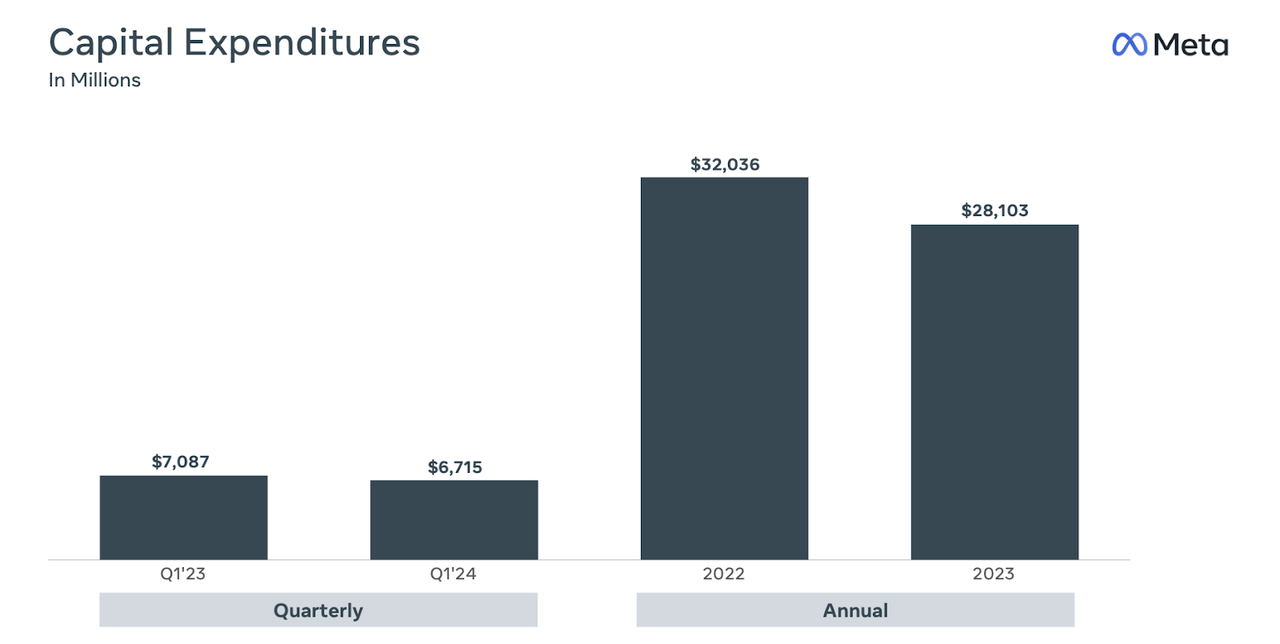

Looking ahead, management has guided for the second quarter to see revenue between $36.5 billion and $39 billion, representing 23.8% YoY growth at the high end. Consensus estimates call for $38.2 billion in revenues, which looks achievable from my view. The company saw CapEx decline in 2023, which appears to go hand-in-hand with the “Year of Efficiency.” However, as management discussed on the call, they intend to significantly increase CapEx spending moving forward in order to address the AI opportunity. Management raised 2024 CapEx guidance from $30 to $37 billion up to $35 to $40 billion, and further noted expectations for that number to increase in 2025 as well.

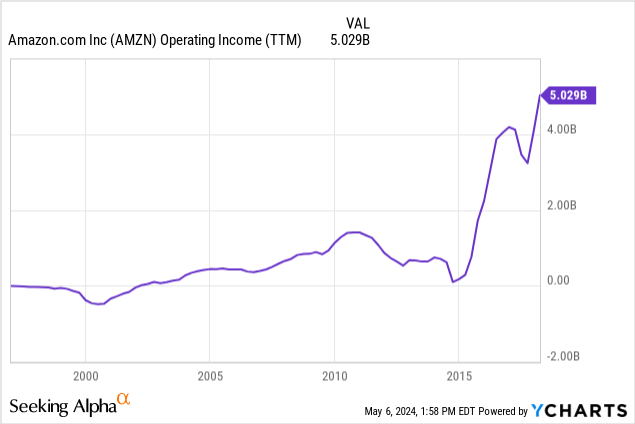

It isn’t just CapEx creep coming ahead for the company. Management outlined expectations to ramp up expenses as it grows headcount to invest in AI. Management noted that this may be similar to their prior investment periods such as Reels in which the company did not see an immediate ROI for quite some time. While this management team arguably deserves the benefit of the doubt given the ultra-high FoA operating margins, it appears that Wall Street is concerned that management is back-tracking the commitments stemming from the “Year of Efficiency.” Perhaps Wall Street is worried that the stunning losses seen in Reality Labs are beginning to contaminate margins in the core business for the long term. Yet, this is where I have fundamental disagreements with the market. Wall Street seems to dislike the potential near term margin compression at the company, but is missing the forest for the trees. Management’s ability – and willingness – to invest large amounts of capital in the potentially high ROI opportunity of artificial intelligence should be cheered, not punished. The most famous example is that of Amazon (AMZN), which invested heavily in its e-commerce operations over many decades, leading it to show minimal operating income for a long time until the company was unable to find enough investments to “offset” the growing operating income.

AMZN stock is up 10x since 2015 when operating income began inflecting sharply higher. The point here isn’t to imply 10x potential upside for META, but instead to illustrate that Wall Street sometimes rewards stocks only after the fruits of the investment are abundantly clear. Patient investors can choose to invest prior to this and potentially reap generous rewards.

I call this ability to invest high amounts of capital at high ROI the “Amazon Moat” and I am excited to see META management decide to invest aggressively in their AI capabilities, as suddenly this may become a clear competitive advantage relative to peers. Just several years ago, the market was concerned about TikTok competitive threats and META’s ability to cope with data privacy changes from Apple (AAPL). At the time, it certainly felt like META was facing challenges beyond its control. The company’s massive investments in AI may change that narrative and further secure the company’s future growth streams.

But perhaps it was some of management’s other commentary that pushed the market over the edge. Management did not dispute the notion that China was driving much of the growth, which may concern some investors given that some operators like PDD (PDD) appear to be spending aggressively to take market share in the United States. That said, the company does break out revenue by user geography, and growth outside of Asia-Pacific was actually stronger as Asia-Pacific growth (which includes Asian regions besides China) was slower at 25%.

AMZN stock is up 10x since 2015 when operating income began inflecting sharply higher. The point here isn’t to imply 10x potential upside for META but instead to illustrate that Wall Street sometimes rewards stocks only after the fruits of the investment are abundantly clear. Patient investors can choose to invest prior to this and potentially reap generous rewards.

But I found it puzzling to hear management say things like they view FoA and Reality Labs as “fundamentally the same business.” I think the stock has re-rated higher over the past 2 years, largely due to Wall Street focusing more on the FoA and being willing to overlook Reality Labs – somewhat similar to Alphabet (GOOGL) and its “Other Bets” segment. However, management’s continued insistence and commitment to Reality Labs may be causing some investors to question whether their understanding is correct. Whereas I am quite bullish on management’s planned investments in artificial intelligence, I remain conflicted on their ongoing investments in Reality Labs, as it is not immediately clear if the undeniably intriguing technology will be backed by an acceptable return on investment.

Is META Stock A Buy, Sell, or Hold?

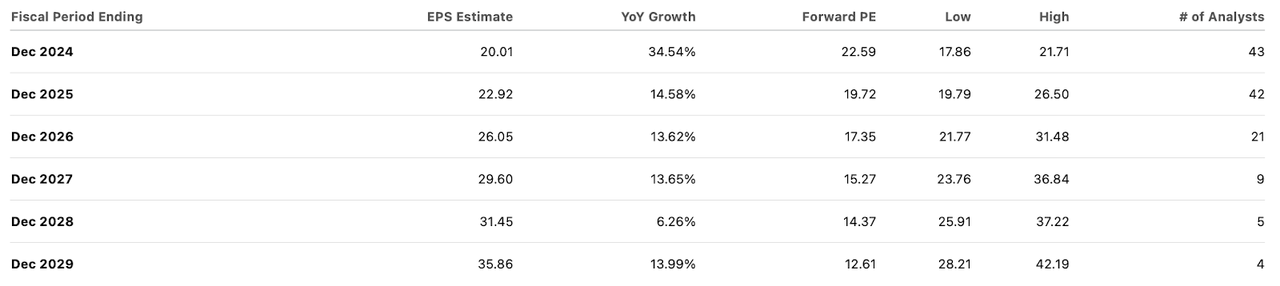

The 400% return in META since late 2022 may end up being one of the greatest recoveries among mega-cap stocks. Yet even after the run-up, the stock still trades at a compelling 23x earnings.

Reality Labs will likely detract at least 25% from consolidated earnings, implying around $25 in FoA EPS. Thus, if one believes that Reality Labs should be worth at least $0 and FoA should be worth 23x earnings, then the stock has around 25% potential upside from that alone. I am of the view that the company’s investments in AI will further its business model advantages – it already appears to be the most advertiser-friendly social media platform on the planet (as evidenced by the high ARPP metrics). If the company can sustain mid to high single-digit top-line growth, then that in conjunction with the net cash balance sheet arguably justify at least a 30x FoA earnings multiple – I base that valuation on where other high-quality stocks trade like Apple, REITs, and others. That could imply a 12-month price target of up to $750 per share, or 63% potential upside, but these kinds of quality theses may take several years to play out.

What are the key risks? I view the most pressing near term risk to be that of decelerating top-line growth rates. I suspect that most investors understand that the company is benefitting from lapping easier comparables and must see a deceleration in top-line growth at some point, but expectations often do not match reality in such transitions. Further, investors might not view META as being high quality as I do, which may imply that volatility is guaranteed over the next 2 to 3 quarters. Management might further their investments in Reality Labs or fail to deliver acceptable ROI even on their investments in AI. It is possible that the company’s exposure to China is greater than expected and for revenue growth to slow down dramatically over the coming quarters. I note that the TikTok competitive threat remains real, even if Wall Street seems to have forgotten about it. A “TikTok ban” has been passed by our legislators, but I find it highly doubtful for U.S. operations to cease (it seems more likely that TikTok would divest Chinese ownership interests instead of exiting the country, despite what management has been saying). This might not only impact top-line growth rates, but may also impact the stock’s ability to re-rate as expected.

Conclusion

Wall Street appears concerned about increased investments in AI, but as a long-term investor, I view the same data with contrarian bullishness. The bullish thesis is in motion, with the company capitalizing on its AI-powered content generation and advertiser support. The valuation still looks conservative given the quality of this business, and I see solid upside ahead between ongoing growth and multiple expansion potential. I reiterate my strong buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN, GOOGL, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!