Summary:

- A potential ban on TikTok is again in the news.

- This is in addition to a new legislative bill introduced.

- This ban, if it materializes, is more about tomorrow than today for the likes of Meta Platforms, Inc.

- Meta Platforms’ transformation away from ad reliance right now relies on its ads.

Mario Tama/Getty Images News

Shares of Meta Platforms, Inc. (NASDAQ:META) are on the rise pre-market after a report that the U.S government is (once again) considering a ban on the TikTok app of ByteDance (BDNCE), as reported here by Seeking Alpha. What’s different this time is that TikTok faces a potential ban through two avenues:

- the U.S Government threatening a ban if the owners do not divest their stakes; and

- a legislative bill proposing a ban on adversarial technologies based in 6 countries, which includes TikTok’s origin, China.

If you are wondering why all this hoopla about a company which just hit $11 Billion in ad revenue, which is less than 10% of Meta’s own $116 Billion revenue in 2022, then the numbers and arguments below may surprise you.

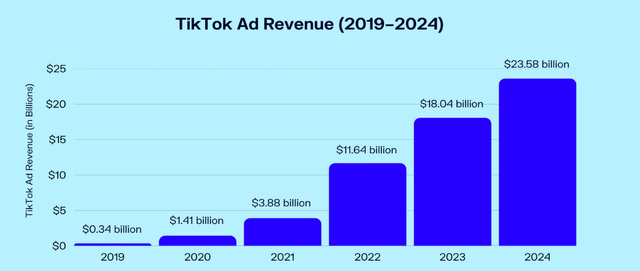

First up, the past leading to the present. If you are a Meta investor (or management or employee), the scariest part is TikTok’s growth trajectory, with its ad revenue going from about $1 Billion in 2020 to $11 Billion in 2022. Phew. A 1,100 % increase. Obviously, that scorching pace is not going to go on forever, but even the projected jump between 2022 and 2024 revenue is an impressive double.

Let’s assume things slow down from 2024 and give TikTok “just” a 20% CAGR and we are looking at nearly $60 Billion by 2029, more than half of Meta’s current revenue, while the company’s (Meta) future strategy is all over the place with questions around ads, Metaverse, and more recently, AI. If you think that growth rate is impossible, please note that it took a combination of COVID deceleration, high inflation, a hawkish Fed, a war, and worries about a recession for Meta Platforms to report its first-ever decline in revenue after 10 years as a public company.

TikTok Revenue Growth (Oberlo.com and Statista.com)

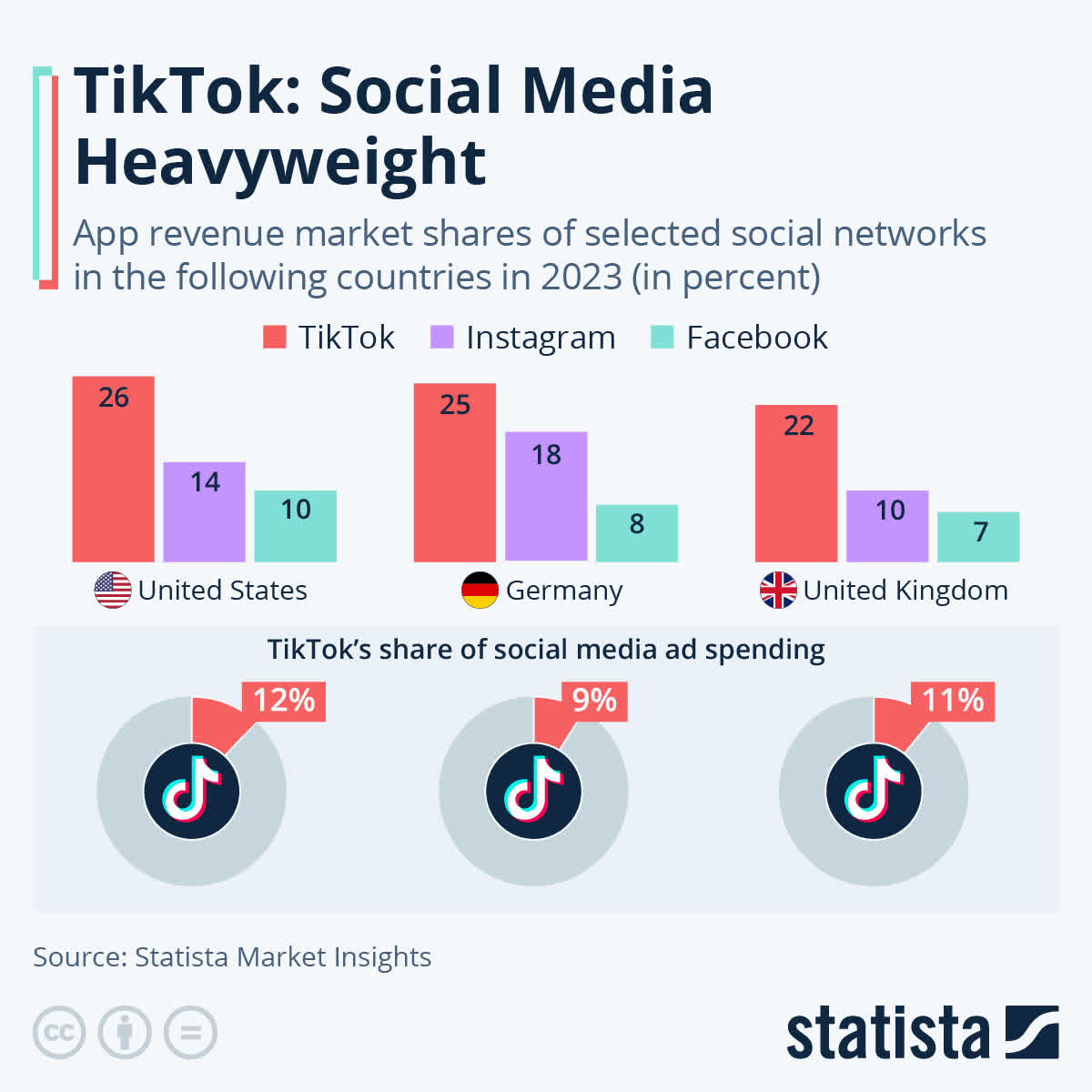

Second, the present leading to the future. TikTok is not just an upstart with impressive growth but a new, mature, and faster grower all molded into one. That is a hard combination to fight against. As an example, TikTok already is the heavyweight when it comes to Social Media app revenue market share. Their presence is so strong in the United States and United Kingdom that despite owning the 2nd and 3rd products in terms of share, Meta Platforms trails TikTok’s app revenue.

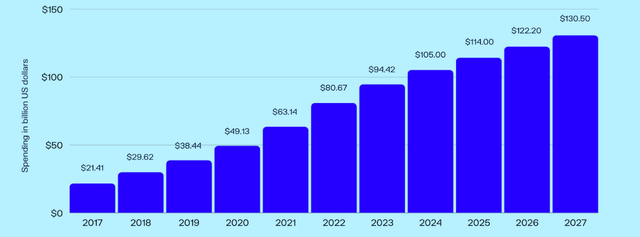

Taking the entire social media ad spending into account, TikTok holds a 12% share in the United States. That is 12% of a $90 Billion market in 2022, and this market is expected to grow to $130 Billion by 2027. Let’s say TikTok grows its share from 12% to a very reasonable 30%, that’s nearly $40 Billion that could potentially be up for grabs by 2027 for other platforms should TikTok get banned in the U.S. And who owns the 2nd and 3rd popular social media ad platforms? You guessed it, Meta Platforms.

I don’t want to spin your heads by throwing more numbers at you, but will leave you with the following statements:

- The present rumored ban is just in the U.S and so is the potential $40B for grabs mentioned above.

- All my assumed TikTok growth trajectories are conservative, meaning Meta Platforms could stand to gain (or not lose) a lot more should a ban come to fruition.

- In short, a potential ban on TikTok means a lot more to Meta Platforms’ future than it may seem right now.

TikTok Ad Share (statista.com) Social Media Ad $ (Oberlo.com and Statista.com)

Last, Meta’s future strategy. With Meta apparently realigning itself towards AI in addition to Metaverse, the less the company has to worry about keeping its existing market share in advertising, the better. After all, something and somebody need to send in the money to pay the bills and to keep the other experiments going. It is no secret that Meta Platforms is extremely reliant on ad revenues, and as a shareholder, I welcome any and all (responsible) efforts by the company to diversify itself. But growing and, at the very least, not losing, existing business is the key meanwhile. In a weird way, Meta needs its reliance on ad business to stay strong to push itself away from this reliance.

So, if Meta Platforms can bring more money in without lifting a finger (due to the potential TikTok ban), what’s not to like about it?

Conclusion

As much as I pretend to love a free market, when it comes to my investments, I love my virtual monopolies and duopolies. Hello, Altria Group, Inc. (MO) and The Coca-Cola Company (KO). With that admission out of the way, as a Meta Platforms shareholder, I am all for a TikTok ban one way or the other.

It is not the end of the world for Meta Platforms and its investors if the rumored ban does not materialize. I do expect a short-term sell-off and, quite frankly, that may not be a bad thing given the stock’s 60% rise YTD. I am looking forward to Meta Platform’s future as an investor as the company is finally getting what it means to operate in the interest of shareholders.

Disclosure: I/we have a beneficial long position in the shares of META, KO, MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.