Summary:

- I believe the market has overreacted to Meta’s guidance, creating a buying opportunity.

- Q1 earnings exceeded estimates, with revenue and net income growth.

- Meta’s user base continues to expand, and new products and AI initiatives offer growth potential.

Derick Hudson

I believe that the market has greatly overreacted to the relatively decent guidance that Meta Platforms (NASDAQ:META) provided last week, which resulted in the rapid depreciation of the company’s shares. Despite the turbulent macroeconomic environment, Meta is expected to continue to grow at a double-digit rate and scale its operations as its user base continues to expand. Add to all of this the fact that the company’s shares are undervalued against the broader market, and it creates even more reasons to be optimistic about the performance of Meta in the following quarters.

The Market Has Overreacted

Last month, I wrote a bullish article on Meta, in which I argued that the company has more than enough catalysts to create additional shareholder value in the foreseeable future. Unfortunately, since that time, the shares have underperformed against the broader market and depreciated by ~10% due to the updated guidance that the management offered a few days ago. Despite this, I still believe that Meta is a great investment and also think that the market has overreacted in the recent week, as there is every reason to believe that the company’s growth story is far from over.

If we look at Meta’s latest earnings report for Q1, which was released in recent days, we’ll see that its revenues increased by 27.3% Y/Y to $36.46 billion and were above the estimates by $240 million. The bottom-line performance was also great, as the GAAP EPS of $4.71 was above the estimates by $0.39, and the net income more than doubled to $12.37 billion.

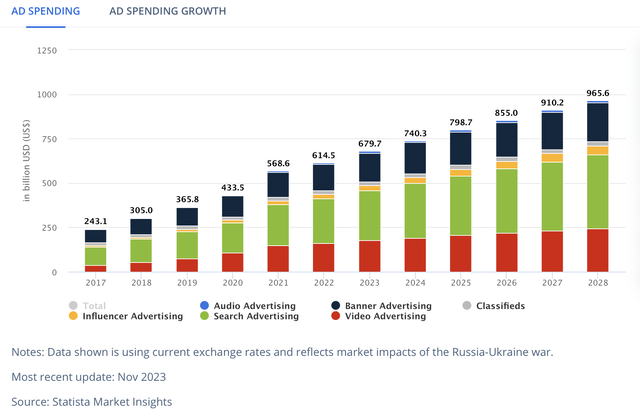

What’s more, is that Meta continues to increase its user base with each passing quarter. In March, it had 3.24 billion daily active people across its platforms, up 7% Y/Y, while the ad impressions during the quarter increased by 20% Y/Y. At the same time, the average price per ad increased by 6% Y/Y and the advertising revenue will likely continue to increase as the global ad spending is expected to increase over 8% in 2024 and reach $740.3 billion later this year.

Digital Advertising Market Ad Spending (Statista)

At the same time, there are reasons to believe that the monetization of new products should give Meta the ability to continue to aggressively scale its business in the foreseeable future. The short-form video product Reels is already responsible for ~50% of the time spent on Instagram, while the potential ban of TikTok in the United States in less than a year could attract even more users to Meta’s platforms.

On top of that, Meta’s ongoing efforts to monetize its messaging and text-based platforms also create new opportunities for the company to diversify its income streams. In less than a year since its launch, Meta’s Threads platform already reached 150 million monthly active users, while WhatsApp’s revenues are beginning to scale.

In addition to all of that, Meta’s decision to double down on expanding its AI infrastructure could also yield great results in the future. During the latest conference call, the management noted that its AI system is now responsible for a large part of recommendations on Instagram and Facebook. The more relevant content the AI recommends for the user, the more time that user stays on one of the company’s platforms and the more ads it sees. This in the end makes advertisers stick with Meta’s advertising tools and leads to greater revenues for the company.

The only issue with Meta’s AI initiatives is that they require a major increase in capital expenditures over the coming years to scale the AI infrastructure, and it could take a while for a significant portion of those initiatives to start generating meaningful returns. This was one of the reasons why Meta’s shares have greatly depreciated after the release of the latest earnings results last week.

At the same time, the market was also disappointed with the outlook for the upcoming quarter. In Q2, Meta expects to generate revenues in the range of $36.5 billion – to $39 billion, the midpoint below consensus for $38.3 billion. I would say that the outlook is decent given that the company has several growth catalysts going for it that could help it exceed those expectations in Q2 and beyond.

That’s why I believe that the latest depreciation of the company’s shares doesn’t make much sense. As such, I’ve decided to update my DCF model, which last month showed Meta’s fair value to be $483.03 per share. Back then, I said that there’s always a possibility that the company manages to capitalize on various growth opportunities, which would lead to the upward revision of assumptions in the model and result in a higher valuation.

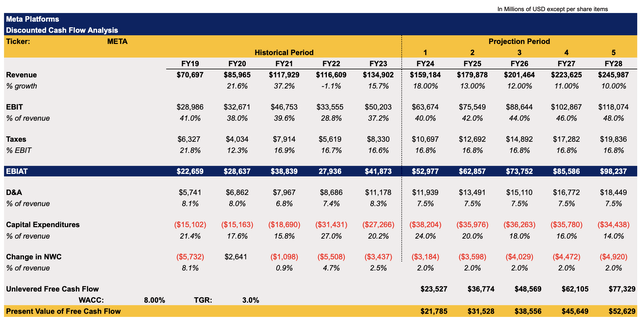

Considering the latest great performance in Q1 and the number of catalysts that Meta has going for it, it’s safe to say that its business will continue to grow at an impressive double-digit rate in the following years despite the latest mixed guidance for Q2 that led to the depreciation of its shares. The street believes that that’s going to be the case as well, and that’s why my revenue assumptions in the new model closely align with the overall expectations. The CapEx and tax rate assumptions closely correlate with the management’s expectations, while the assumptions for all the other metrics are mostly in-line with the company’s historical performance. The WACC in the model stays at 8%, while the terminal growth remains at 3%.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

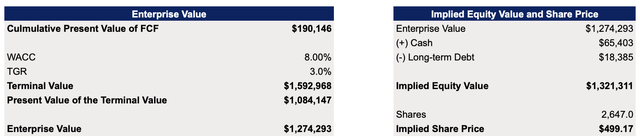

This new model shows that Meta’s fair value is $499.17 per share, above the previous estimates and the current market price.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

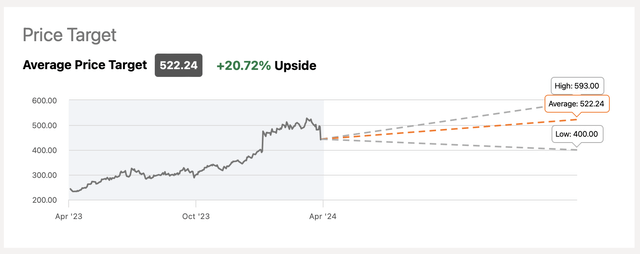

Considering that Meta trades at a forward P/E of ~22x, which is below the market’s P/E of ~27x, it makes sense to believe that the upside is still there. Add to this the fact that the consensus price target on the street is ~$522 per share, and it becomes obvious that the latest depreciation of Meta’s shares likely presents a good buying opportunity. This is why I decided to stick with my BUY rating for now.

Meta’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

At this stage, I see two risks associated with Meta’s shares. First of all, the company’s Reality Labs division that’s responsible for Meta’s metaverse projects is expected to continue to burn cash and is unlikely to recoup the losses anytime soon. In Q1, Reality Labs generated $440 million in revenues but recorded an operating loss of $3.8 billion. It’s safe to assume that the metaverse projects will continue to burn cash and negatively affect the company’s overall bottom-line performance.

At the same time, the relatively poor inflation data could create a much more uncertain macro environment that could depress the growth and lead to the further depreciation of shares. This has already happened back in 2022 when Meta’s shares were greatly underperforming and could happen again if the macro conditions deteriorate. But if that’s the case, then it would be outside of the company’s control.

Other than that, I see no other major risks to Meta’s bullish thesis.

Meta’s Stock Price (Seeking Alpha)

The Bottom Line

I believe that the latest depreciation of the company’s shares creates a great buying opportunity. This is due to the fact that Meta is now undervalued against the broader market, while the number of growth catalysts that its business has going for it will likely create additional shareholder value in the foreseeable future. At the same time, there’s also a possibility that the Q2 results could exceed even prior expectations, as was the case numerous times in the past, which could result in the rapid appreciation of shares since it appears that there’s already additional room for growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.