Summary:

- TikTok’s potential ban could bring a positive catalyst to Meta and I see the upside potential as a call option.

- Meta’s overall engagement trends have seen improvements, with Facebook and Instagram seeing accelerating engagement trends.

- In fact, Meta is regaining time spent share from TikTok, further providing evidence that the ramp up of Reels is bringing incremental engagement to Meta’s family of apps.

- The company laid out plans to reduce headcount by 10,000 and improve productivity and focus investments on AI.

- My price target for Meta is $261, implying an upside potential of 22% from current levels.

panida wijitpanya

This article was first posted in Outperforming the Market on April 5, 2023.

After the initial update on Meta Platforms (NASDAQ:META) in February, I thought that it is timely to provide a second update given there has been some huge movements in the stock.

The Barbell Portfolio’s position in Meta is currently up +45%. I have shared with members of Outperforming the Market why I think that the investment thesis for Meta is playing out very nicely after the contrarian position we took in the company when sentiment was at an all-time low in late 2022.

As a reminder, this was a contrarian play based on the fact that sentiment on Meta was still rather weak late 2022, while I saw that the business fundamentals were improving. I was seeing that management placed its short form video format, Reels, as its top priority and that there were early signs that Reels was bringing in incremental engagement on the Meta Family of Apps. Furthermore, Meta was recalibrating its Reality Labs strategy and taking a more conservative approach to investing in the opportunity. Lastly, as part of the Year of Efficiency for Meta, there has been margins and earnings upside as a result of headcount reductions and efficiency improvements.

A potential TikTok ban

Earlier in March, the Committee on Foreign Investment in the US threatened a ban on TikTok in the US unless ByteDance divests TikTok. This came after the announcement of the Restrict Act the week before, TikTok’s $1.5 billion reorganization plan in the US and its Project Texas, which is its Oracle (ORCL) datacenter build. On top of that, the US also banned TikTok across all federal devices.

If TikTok were to be banned in the US, this is undoubtedly a positive for all its social network competitors like Meta and Snapchat (SNAP).

Although a ban has not yet been decided yet and it remains unclear which path the Committee on Foreign Investment in the US will take, it is clear from TikTok CEO Chew’s testimony before Congress on 23 March that it is a tough battle for TikTok as many US lawmakers see the threat TikTok brings including Chinese influence and child safety.

While a ban is possible, and positive for Meta, it is a good option to have when investing in Meta. That said, I think that apart from the ban of TikTok, we have seen that Meta’s own engagement trends have improved significantly from a year ago.

Meta’s engagement trends continue to improve

In the fourth quarter of 2022, we saw the highest ever daily users on Facebook, Instagram and WhatsApp, highlighting the improving engagement trends. Furthermore, Reels played was rising more than two times year on year in the fourth quarter of 2022.

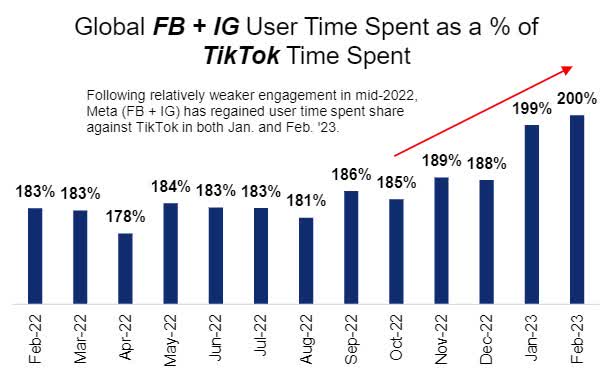

Not just that, there are signs that Meta is gaining on time spent share over TikTok. I believe that this is a result of increasing adoption of Reels and the incremental engagement it brings across Meta’s family of apps.

In February of 2023, time spent on Facebook and Instagram grew 11% year on year, faster than TikTok’s 2% year on year growth. This, to me, is an early sign of Meta regaining engagement share from TikTok as its efforts to ramp up Reels pays fruit.

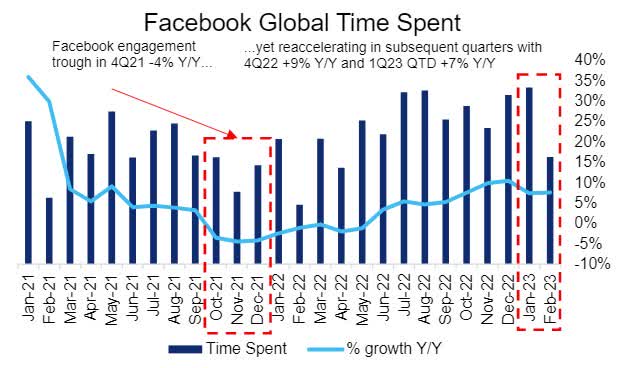

As can be seen below, Facebook quarter-to-date growth was at 7% year on year while 4Q22 growth was at 9% year on year. One year ago in 4Q21, Facebook engagement was down -4% year on year.

Facebook Global Time Spent (Sensor Tower)

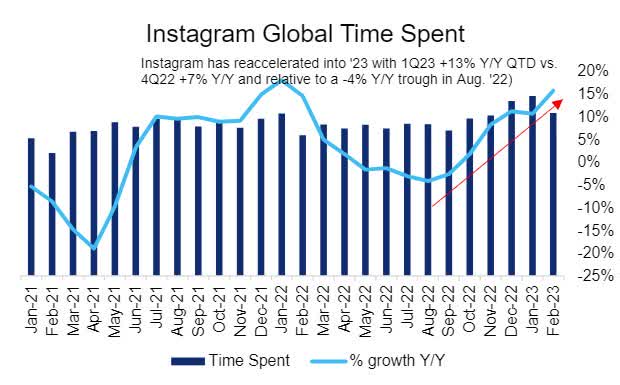

The same trend is seen for Instagram as global time spent year on year growth accelerated to 13% year on year growth for the quarter-to-date, while 4Q22 grew 7% year on year. This compared to the trough engagement in 4Q22 of -4% year on year.

Instagram Global Time Spent (Sensor Tower)

I think that the acceleration in engagement in 4Q22 and quarter-to-date show the incremental engagement that Reels bring to Meta’s Facebook and Instagram. It is clear to me now that the argument of cannibalism as a result of Reels ramp up no longer holds, as Reels is the main contributor to engagement growth today and resulted in Meta growing time spent at a faster rate than TikTok.

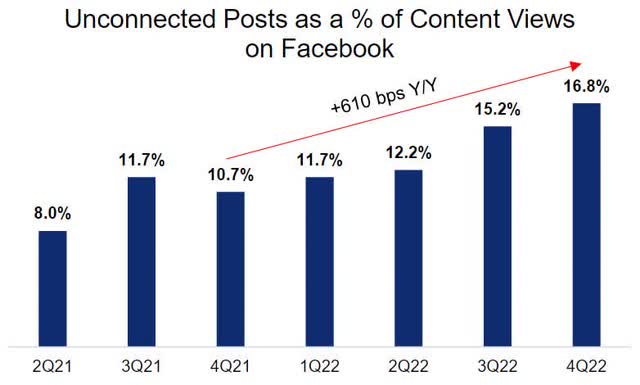

This was also helped by Meta’s AI-based content Discovery Engine which increasingly presents more relevant content to Meta’s users. Unconnected Posts now account for 16.8% of feed content viewed in 4Q22, compared to 8% in 2Q21.

Unconnected posts as a % of Content Views on Facebok (Sensor Tower)

For more concrete evidence on how Meta is regaining time spent share from TikTok, we can use the combined Facebook and Instagram global time spent and put that as a percentage of TikTok’s time spent. As can be seen, Meta has been clearly regaining time spent share since the second half of 2022.

Global FB & IG User Time Spent as a % of TikTok Time Spent (Sensor Tower)

Also, TikTok’s global time spent, and engagement metrics has decelerated as a result of the rising threat from Reels since early 2022.

TikTok Global Time Spent (Sensor Tower)

Progress on Year of Efficiency

I read Meta’s recent blog post that provided updates on its Year of Efficiency.

In the next few months, organization leaders will announce their restructuring plans. The moves here include flattening of the organization structure, cancelling projects deemed lower priority, and reducing hiring rates. In late April, Meta plans to announce restructuring and layoffs for its technology groups while its business groups will be affected in late May. After restructuring, Meta will then plan to lift hiring and transfer freezes in each group.

As a while, Meta expects to reduce its workforce by 10,000 people and to close 5,000 new roles for which it has not yet hired. Meta expects to have total expenses come in between $86 billion to $92 billion for 2023, down from its previous guidance of $89 billion to $95 billion. This includes the anticipated layoffs highlighted above and the restructuring costs related to the facilities consolidation charges and severance costs.

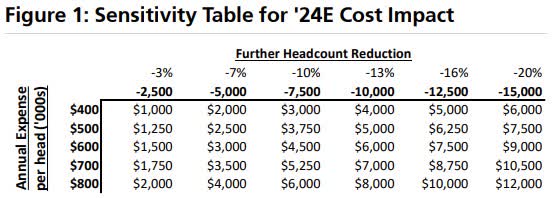

In terms of headcount reductions, I have come up with a sensitivity table shown below, we could see a $6 billion cost saving if Meta reduces its headcount by 13% and assuming an annual expense per head of $600k.

Sensitivity table for 2024 cost impact (Author generated)

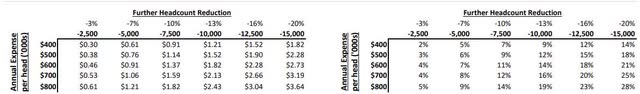

In terms of EPS impact and upside to EPS, the same assumption of 13% headcount reduction and assuming 600k annual expense per head, this implies 14% upside to EPS.

Sensitivity table for 2023 EPS and EPS upside % (Author generated)

The target will be to complete its analysis from its hybrid work year of learning so that it can further refine its distributed work model. Also, Meta looks to improve developer productivity and improve the utilization of each manager’s capacity. This is the reason for cancelling projects deemed lower priority or duplicative. As a result of efforts from the Year of Efficiency, Meta will also be returning to a more optimal ratio of engineers compared to other roles.

At the end of the day, this makes Meta a leaner and more efficient organization. It was highlighted that Meta is preparing for the scenario where this new economic reality of higher rates could run for longer and as a result, Meta’s Year of Efficiency will ensure that Meta remains able to be sustainably grow in the long-term for continued success. In the recent Meta’s blog post on its year of efficiency, the company’s key investments remain in advancing AI:

Our single largest investment is in advancing AI and building it into every one of our products.

Valuation

I value Meta using a blend of DCF and P/E multiple methods. I assume a target P/E multiple of 18x for Meta while using a discount rate of 9.5% for discounting of free cash flows.

My price target for Meta is $261, implying an upside potential of 22% from current levels. Meta still trades at an unassuming 17x 2024 P/E, with potential for EPS upside from the current efficiency initiatives. Taking into account the current relative valuation and the price target, I think that the risk-reward perspective for Meta continue to be positive.

Risks

Macroeconomic environment

As Meta’s main business is still an advertising business, if the macro backdrop worsens, we could see Meta’s business weaken as well. A weaker economic climate will mean lower global advertising budgets and thus affect Meta adversely.

Competition

While Meta may be currently showing signs of winning or regaining engagement share from TikTok, this is ultimately a long game and consumer trends change rapidly. As a result, TikTok and other social medica platforms remain a threat to Meta and it needs to invest and innovate to compete against these other players.

Reality Labs capital expenditures

In an economic climate as uncertain as this one, Meta needs to thread carefully about its communication to the market about its spending and investment in Reality Labs. Ideally, Meta should slow down the investments needed in the segment as the market has been cautious about Meta overspending on its metaverse ambitions.

Conclusion

I continue to like the Meta story as it is playing out nicely. While the potential ban of TikTok may be a strong positive catalyst for Meta, I continue to see this scenario as a call option in terms of the upside. For the more contrarian fundamental story, the improvement in engagement trends for Meta’s family of apps is the key here. One year ago, when I wrote more on the problems faced by Meta, the fundamentals situation was very different. The market was suddenly pricing in the increased competitive threat from TikTok as well as the difficult operating environment as a result of Apple (AAPL) privacy policy changes, which is calls IDFA. Today, Meta has lapped a full year contribution from the IDFA saga and found ways to go around it while its ramp up of Reels has been successful so far in bringing in incremental engagement. In addition, its investments into AI and its discovery engine have brought additional engagement on its Family of Apps.

My price target for Meta is $261, implying an upside potential of 22% from current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 51% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!