Summary:

- Zuckerberg has leveraged his impressive collection of social media assets to weather a highly uncomfortable macroeconomic storm and once again demonstrate his abilities as a top-line executive.

- The very same erratic market sentiment that reset its valuation to five-year lows has completely swung to the other side and now threatens to push Meta beyond its all-time highs.

- After years of recognizing Meta as one of the best opportunities in the market, the recent stratospheric rise in the share price forces me to reanalyze my position on it.

- With a fair value estimate of $370 per share, it has become increasingly clear that Mark Zuckerberg and his team’s pivoting have plugged the valuation gap, with much of the gains having already been made.

- While Meta’s assets can still be leveraged to generate reasonable returns in the upcoming years, with the current price in mind, the margin of safety has effectively been erased, and above-average market returns have become far from guaranteed.

Chip Somodevilla

The past two years have marked a traumatic and rather unexpected journey for Meta Platforms, Inc. (NASDAQ:META), which has been a well-respected company that was widely recognized and hailed as one of the best investment opportunities in the last decade, only for the market to turn on it in a single night after a problematic earnings report. The first night of after-hours trading shreds hundreds of billions of its market cap, marking the beginning of a year-long process in which the “efficient market” proceeded with erasing a total of $700 billion in Meta’s market cap.

This has caught my attention, and I’ve started writing a series of articles arguing that the market at the time overreacted and that even though there was certainly some merit to the bear arguments, a sell-off of this magnitude was ultimately irrational and fundamentally unjustified. The social media hegemon demonstrated an even more impressive recovery in terms of size and scope when compared to the prior year, following a low point and a brief period of trading in double digits in November of last year. Alongside the rest of the “magnificent seven,” the company proceeded to nearly triple from its bottom, almost completely recuperating all the previous losses.

Recognizing the reality of the sentiment swings we have witnessed since the onset of the year, I do believe it is possible that the stock will continue to perform rather well and deliver some further gains to patient investors. Meta is, once again, one of the most attractive and sought-after investments in the market. On the other hand, given the current exorbitant price tag of $340 per share, I am also no longer convinced that there is a sufficient margin of safety associated with the investment or that Meta’s fundamentals will support further positive price action. Henceforth, I now believe that the price gap has been closed and that Meta no longer represents a “strong buy” at these levels.

Meta’s Recent Price Recovery (Seeking Alpha)

How Mark Zuckerberg Closed The Gap

What may be the most peculiar aspect of this turnaround story is that, as a whole, not many fundamental changes have been made to the company since the initial crash, at least not nearly substantial enough to justify such massive swings in the pendulum. The ship has, for the most part, stayed on the same steady course since.

The crash occurred amidst worsening macroeconomic conditions in early ’22 that no longer supported a “stocks go up” market environment, leading many investors to question Meta’s position as one of the most expensive companies in the S&P 500 (SPY) alongside the overall valuations of some of the companies leading the index.

Concerns over Meta’s over-reliance on dwindling ad revenue were increasing, and the company’s “aging” app lineup’s growth prospects were making matters worse. TikTok and Snapchat, two competitors, were threatening Meta’s dominant position in the industry, or at least that was the general market consensus at the time.

A newly revived focus on data privacy driven by Apple Inc. (AAPL) through its iOS policy changes and Mark Zuckerberg’s growing fixation on his billion-dollar Metaverse pet project have served to further attract negative attention from both analysts and the public alike. I have gone through particular details about these challenges in my previous articles.

In short, developments throughout the entire ’22 have built a perfect storm of negativity surrounding the stock, significantly impacting the overall market sentiment towards Meta. This process culminated in November of last year when investors had a chance to buy shares of the firm in the $80-$90 range for the first time in almost a decade.

For all the negativity his public image was forced to face, the developments of the past two years lead us to the conclusion that Mark Zuckerberg remains a highly effective executive who is able to circumnavigate the negative spotlight and come out of the challenge as a winner.

His unchecked reign over the social media empire that was enabled through his super-voting shares has so far played largely to the advantage of “sidelined” shareholders. Management kept an ear to the ground and started a very early process of combating these challenges and rebuilding the public image of Meta as an “investable growth company.”

In what was dubbed the “year of efficiency,” the company placed significant emphasis on stabilizing its core business operations with an increased focus on profitability. Through a series of shareholder accretive actions, such as the restructuring of the organization that saw 21000 jobs slashed, canceling lower-priority projects, and limiting capex spending, but also demonstrating its sheer force through issuing an impressive $40 billion buyback program, Zuckerberg strategically moved his pieces around the board.

Impressive operational results ensued from these tough measures, with many of the plans proceeding ahead of schedule. Meta has launched “Reels,” a short form of Instagram videos that is designed to close and counteract TikTok influence. Additionally, it took advantage of the challenges surrounding Elon Musk, the owner of Tesla, Inc. (TSLA), taking over Twitter to present “Threads,” an alternative to the short-post format. Perhaps most interestingly, it further accelerated plans to monetize the often-overlooked WhatsApp.

Today’s big question is whether or not these course-correcting measures were impactful enough for Meta’s price to triple and creep back to all-time highs, or are we again dealing with market irrationalities? I believe that these surface-level changes amounted to little more than opportunistically moving items around the balance sheet with a design to combat the negative public image that surrounded the company. In the end, I would contend that erratic swings in market sentiment played a critical role in both the crash and the recovery that followed, despite the fact that some early and impressive benefits from these actions can already be measured.

Pendulum Swings The Other Way

I would also be willing to argue that this is the very same erratic market sentiment that is slowly tipping Meta’s share price beyond its all-time highs, with the sentiment pendulum clearly swinging to the other side. This change in sentiment has only gotten worse on the back of recently published positive-looking Q3 ’23 financial results.

Going back to last year and that problematic earnings release, we can highlight several key points that caused investors to rethink their position in the company. Among other issues, their top-line growth has decelerated, margins have gotten squeezed, a family of apps growth has effectively stopped, and cash flow has started to dry up. This painted a very bleak picture for Meta.

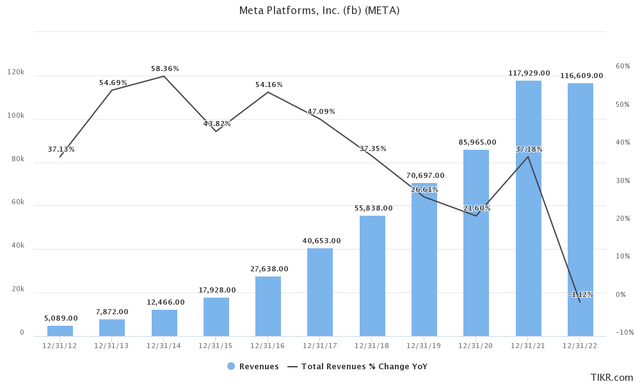

Meta’s Revenue Growth (TIKR Terminal – Capital IQ Data)

The company ended last year having generated $116.60 billion in revenues, which is remarkable since it marked the first year in its history as a public company in which Meta reported declining revenues. Its revenue was reported at $32.17 billion and $116.61 billion, down 4% and 1%, respectively, from the previous year, which in itself was a difficult comp.

Since then, the company’s top-line growth has reaccelerated even amid the rather difficult macroeconomic environment, as Facebook and Instagram proved valuable for advertisers, unlike other traditional media, which still suffer to this day. Reported revenue for Q3 ’23 was $34.15 billion, which represents an increase of 23% year-over-year, and combined with already published guidance for the next quarter, Meta should bring in around $132.2 billion for the year.

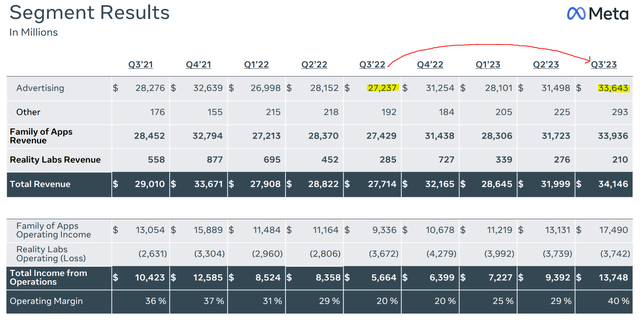

Meta’s Financial Results (Q3 ’23 Earnings Presentation)

The cost-cutting initiatives and the renewed focus on efficiency have yielded splendid results on paper and led to operating margins effectively doubling in a year, eliminating yet another key bear point.

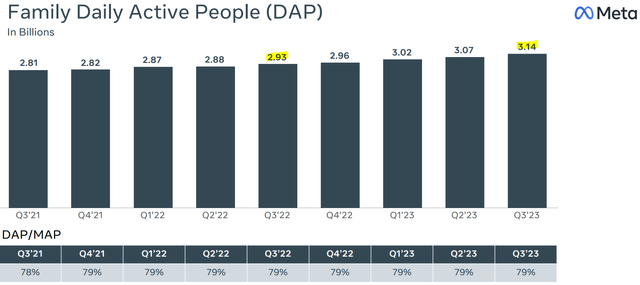

A key bear point within the DAP/MAP growth discussion was Facebook reporting declining users, indicating the increasing weakness in the family of apps segment. Meta displayed healthy and stable user growth across both groups, reporting a 7% increase year-over-year. The company now has 3.14 billion daily active users and 3.96 billion monthly active users.

Overall, I find the expectation of growth in this segment rather unreasonable, since the company’s family of apps already achieves an 80% penetration of world households with access to electricity and a stable internet connection.

Meta’s Daily Active People (Q3 ’23 Earning Presentation)

However, it remains clear that the company circumnavigated the declining ad market by simply forcing more ads through its ecosystem; henceforth, ad impressions increased by 31% year-over-year, while the average price per ad on the other end decreased by 6% year-over-year.

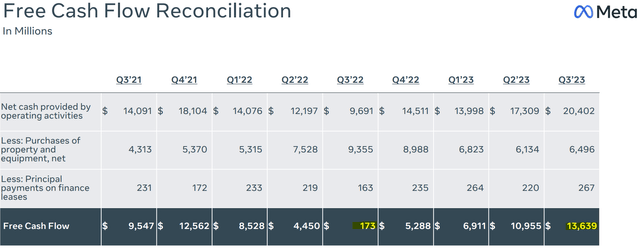

When discussing tough comps, nowhere can this be seen better than the firm’s reported free cash flow, which was barely positive in Q3 ’22. This quarter, free cash flows were nothing alike, and Meta reported $5.3 billion, already having generated $31.5 billion year-to-date. I find the company able to deliver more than $40 billion of FCF per year in its current state, but SBC should be taken into consideration, which chips away at around $10 billion per year.

Meta’s Free Cash Flow (Q3′ 23 Earnings Presentation)

Taking a step back and having an honest look at the financials, we can see from today’s point of view that much of the fears and uncertainties were vastly overexaggerated, and Meta’s competitive advantages, as well as the depth of the moat behind its family of apps segment, were highly underestimated.

Recent earnings signaled immense strength for the market, especially when taking into consideration the weak comps from last year. Meta demonstrated its strength across the board: top-line growth, app engagement and MAP/DAP growth, operating efficiencies and cash flow conversion, etc. In my view, this caused the pendulum to swing completely the other way, and the question of Meta’s valuation became increasingly complex.

The Value Gap Closing

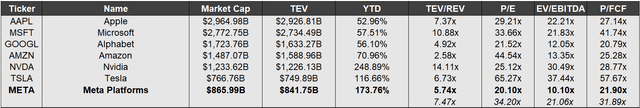

After the stratospheric rise in the share price, Meta’s valuation is slowly becoming somewhat stretched and no longer represents the same clearly attractive deal as it did before. At the time of the writing of this article, the social media company shares traded at around $340, implying the market is willing to pay a 10.10x NTM EV/EBITDA and a 20.90x NTM P/FCF for the company.

Meta and “Magnificent Seven” – Comparable Valuation (Author Spreadsheet – Capital IQ Data)

Ironically, even after gaining 173% year-to-date, when considering the price action of the rest of the “magnificent seven,” Meta still looks valued slightly on the more affordable end, or at least looks less pricey on paper than some of the other stocks seen above, such as NVIDIA Corporation (NVDA) or Amazon.com, Inc. (AMZN). The market’s willingness to price other social media competitors such as Snap Inc. (SNAP) and Pinterest, Inc. (PINS) with slightly higher multiples only serves to further emphasize this point.

However, I would find the market somewhat overly enthusiastic when it comes to the magnificent seven and would view the social media behemoth more in line with its fair value at around 23.50x its free cash flow, which would imply a share price of $370. In other words, while I still believe there might be some fundamentally-backed upside potential to the stock, much of the gains have “already been made,” as the value gap does appear to be closed for the time being.

Investors willing to pay much above that point would have to face a different problem relating to the nature of Meta’s capital allocation restrictions. With the share price slowly creeping up to the $400 per share mark, likely one of the best value investment opportunities is being slowly transformed into a “Peter to Paul” type of investment.

With a capital-light business model, the company is expected to generate north of $30 billion in free cash flow in the upcoming years but faces limited options as to how to deploy that cash. Arguably its best business decisions originated from aggressive M&A deals that aim to limit competition in the social media space. A brilliant example of this is the 2012 acquisition of Instagram, which is at the moment Meta’s most valuable asset. Given its size and influence over the social media space, ongoing negative publicity, and the negative political environment, this possibility is out of the question.

Meta could try to create value for shareholders by introducing a dividend, a decision that would make it the second FAANG stock that has decided to go down that road. Even if theoretically dedicating most, if not all, post-SBC available FCF to dividends, it would amount to little more than a token dividend. The company’s leadership was already previously criticized for executing “value-destructive” buyback initiatives the last time Meta traded around these prices.

It remains an open-ended question as to how Zuckerberg and the rest of the leadership will react, and probably a good problem to have at the end of the day. This entire situation creates a sort of “capital allocation conundrum,” with Meta’s most likely opting in to pursue further share buy-back initiatives; however, I would question if such commitments would be attractive to long-term-oriented shareholders.

Takeaway and Final Thoughts

As stated previously, after years of recognizing Meta as one of the best opportunities in the market, the recent price surge forced me to rethink and analyze my position. Zuckerberg has leveraged his impressive collection of often underestimated social media assets to weather a highly uncomfortable macroeconomic environment in a staunch display of resilience, perhaps in a way reminiscing of the old “Standard” or “Bell System” days. While these assets can still be further leveraged to generate fair returns in the upcoming years, it is my opinion that taking the current price in mind, the margin of safety has effectively been erased and that above-average market returns, even if possible, are no longer assured or guaranteed, as was the case earlier in the year when Meta traded humbly in double-digits.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While I am still long Meta Platforms, I have significantly decreased my holdings in recent weeks.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.