Summary:

- Meta Platforms’ stock has been on a blistering rally this year.

- This rally has fueled skepticism surrounding the stock and the business behind it.

- The company showed in their Q3 earnings report that they are continuing to rapidly expand operating margins and increase net income.

- Meta has a massive user base and troves of data, which will become increasingly valuable in the age of AI.

- We believe that Meta is currently undervalued, but risks remain.

Justin Sullivan

Thesis

Meta Platforms (NASDAQ:META) is continuing to prove the doubters wrong. The company is becomingly increasingly efficient and has shown massive growth in operating margins and net income. Despite some of the uncertainties surrounding their advertising business and Reality Labs losses, we believe the company is positioned to thrive during the upcoming “AI revolution”.

Third Quarter Earnings

Since our last article on Meta the company has reported their Q3 earnings. We are even more bullish now for two reasons. The first is that Meta has exceeded our expectations for efficiency gains. The second is that the usage and hype of AI applications is continuing to grow, benefitting those with the data and compute (such as Meta).

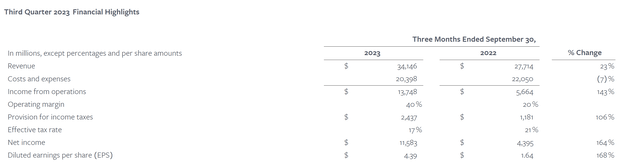

The company was able to reduce costs from the year ago period as well as show a healthy amount of revenue growth. The result was a massive explosion in profitability, with operating margins doubling from 20% to 40%. Net income grew 168% in the quarter. While it’s highly unlikely that net income will continue to accelerate at this pace, the company is demonstrating that their actions taken during the “year of efficiency” are continuing to bear fruit.

Financial Highlights (Meta’s Q3 Earnings Release)

The financial performance of today can largely be attributed to efficiency gains at Meta. As investors, what we care most about is future financial performance and how a company will continue to grow. As far as Meta is concerned the future appears bright. The company has a massive user base that generates troves of data. Meta is continuing to build out the computing power required to process, analyze, and act upon all of the data. As data grows in value, Meta is poised to benefit.

The Value of Users, Data, and Compute

Meta’s ecosystem relies on various social media platforms, WhatsApp, and the metaverse (Reality Labs). Meta properties are a major hub of online interaction. Billions of users spend countless hours within their ecosystem every day, and generate data every time they perform (or don’t perform) an action within that ecosystem. Their platforms are currently monetized primarily through advertising, however this does not always have to be the case. We believe in the future there will be the potential to monetize the data in other ways, or create new ways to add value to the user’s experience and charge money for that added value.

A company operating on the internet often receives a large part of their valuation from intangibles rather than fixed assets such as buildings or equipment. Meta is one of the companies where this is the most true. Platform companies such as Meta possess a lot of flexibility with how they create value within their ecosystem, as well as how they monetize it. This can be both a blessing and a curse as the most optimal path forward is often unclear. The monetary value of a user or a data point is entirely dependent on how the company chooses to conduct their operations. Keeping this in mind, here are two things we know about Meta:

They have a massive user base that is creating a constant stream of data.

They are building out the computing power required to create value from that data.

One thing we know about the world:

“AI” is going to (eventually) transform many businesses, and data/compute are the primary ingredients required to fuel this transformation.

Bearish observers of Meta often point to the potential for their main advertising business to be negatively impacted by a recession or regulatory/competitive threats. These investors may also point to large Reality Labs related losses and the potential for those expenses to never accrue a benefit for the company. While these are very real risks, focusing too much on them can miss the larger factors at play. In the game of network effects, it’s winner take all. Thanks to their multiple successful platforms (FB, IG, WA, and potentially RL) Meta remains the social media company with the strongest network effect, despite efforts from competition to displace them. Due to the nature of the business model, investors are required to believe that management teams can effectively monetize their intangible assets in a dynamic environment. Given this reality we would rather place our bets on the undisputed winners in social platforms (Meta and Alphabet (GOOGL) (GOOG)) rather than the underdogs. There will be opportunities available for these companies that we can’t perceive or evaluate at the moment because adjacent technologies need to fall into place first. Those in a position of strength have the most to work with. For Meta it will likely end up being a case of right place, right time.

Meta currently has all the tools and materials to engineer their future success, the onus is on the company to get it done.

Price Action and Valuation

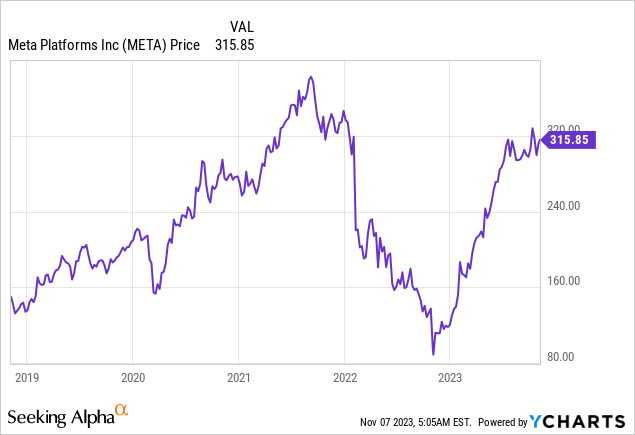

Meta’s stock is nearing its all-time high reached in late 2021. The rebound from the lows has been nothing short of spectacular, and the stock has considerable momentum behind it. We believe that Meta will make new all-time highs next year as the company continues to roll out new AI initiatives and becomes more efficient internally.

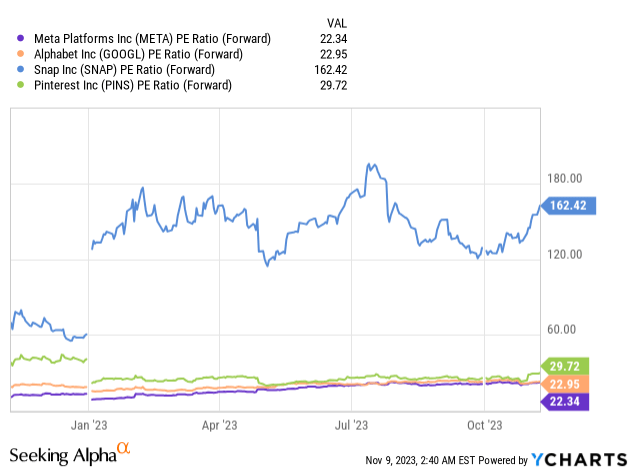

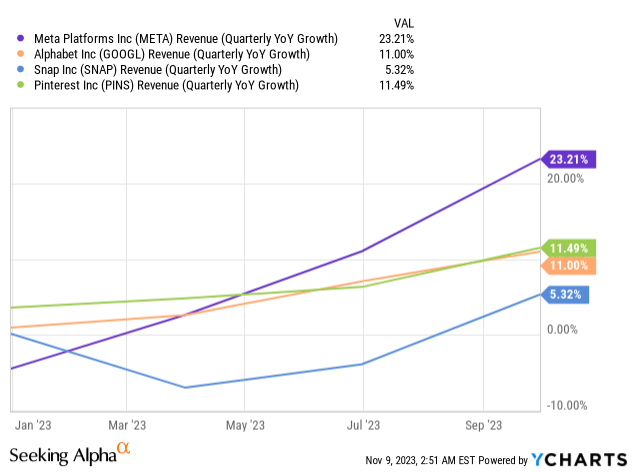

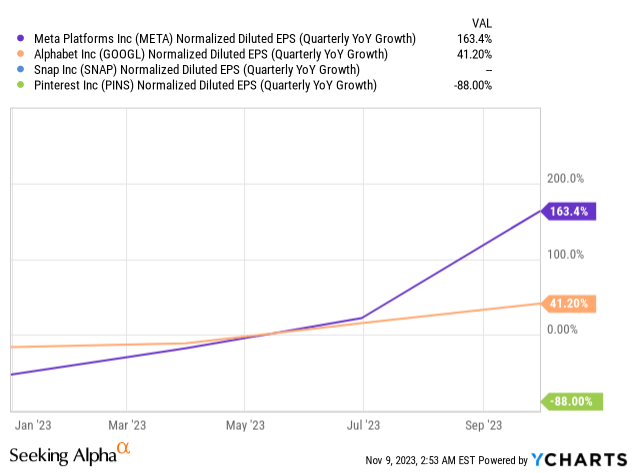

Meta is currently trading at an attractive forward PE multiple relative to their social media peers (except for Alphabet, which we are also bullish on). This seems a bit puzzling as Meta is also growing revenue faster than their peers. When we look at EPS growth the delta is even wider, with no peer even coming close. Meta has fundamental momentum on their side but the market is not attaching a valuation premium to the company.

We believe that analyst consensus forward EPS is a little light, and our expectation is for Meta to earn closer to $18 a share over the next twelve months. This would put the forward PE at around 17.5. We believe that a forward PE of 25 is reasonable for the stock, arriving at this multiple by applying a premium of roughly 10% to the Nasdaq’s forward PE of 23. This reflects our belief that Meta has better fundamental prospects than the tech-heavy index as a whole. A forward PE of 25 would bring the share price to $450 based on our estimate for earnings.

Risks

Regulation and competition are the two primary threats to Meta. On the regulatory front, the company is continuing to face monopoly allegations as well as probes into consumer harm caused by their platforms. It’s difficult to assess the outcomes of the various legal proceedings against the company, but it’s generally a safe assumption that whatever happens it will be a long and drawn out process with multiple appeals. By that time Meta may have already addressed the issues at hand.

Competition from ByteDance and other social media companies remains a concern. We believe that Meta will ultimately be able to resist most of the competitive pressure due to their large user base and massive network effects.

We view the risk/reward as being favorable, especially given the valuation Meta is trading at. That being said, there remains the potential for the company to take a beating on the legislative and regulatory front. Investors would do well to limit position sizing for this reason, as the business could be fundamentally impaired if they are unable to effectively monetize their platform due to government restrictions.

Key Takeaway

Meta is poised to succeed in the age of AI thanks to their sizable amount of data and compute. We believe the company is undervalued relative to their fundamentals and growth potential. That being said, investors should respect the risks at play and limit position sizing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to META, GOOGL, and GOOG. UFD Capital, LLC manages a hedge fund and does not provide investment advice. Nothing contained in this article is investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions. Nothing contained in this article should be interpreted as a solicitation to buy or an offer to sell securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.