Summary:

- Facebook added 37 mn DAU (now >2 Bn) and 26 mn MAU last quarter.

- Meta is making a bet on an open ecosystem for LLM-based products.

- Meta continues to buy back in excess of FCF which is great to see given the depressed stock price.

Derick Hudson

Originally posted on April 26, 2023

There are two major technological waves driving our road map: a huge AI wave today, and a building metaverse wave for the future.”

– Mark Zuckerberg (Source: Q1 2023 Earnings Call)

Here are my notes from April 26th earnings.

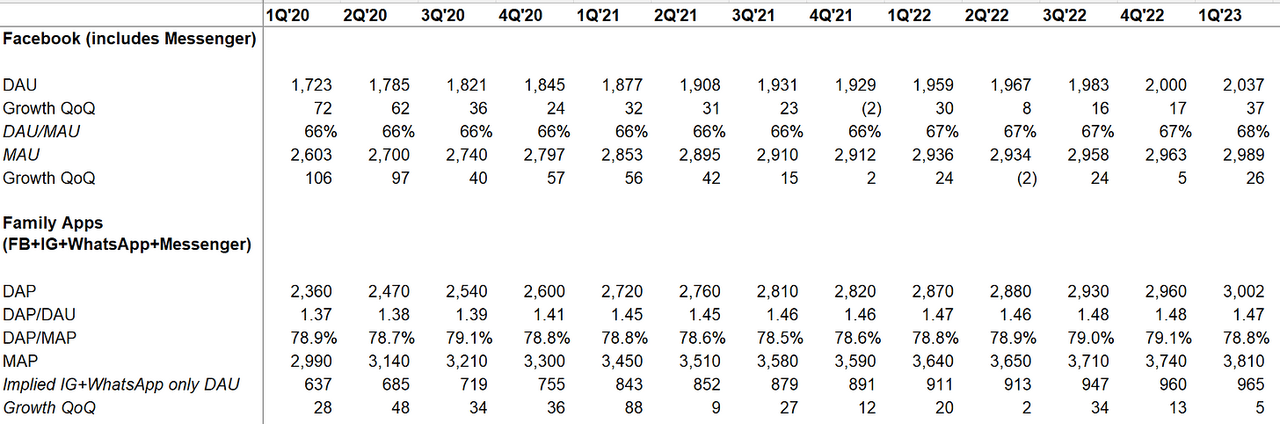

Users

When Facebook’s (NASDAQ:META) DAU declined in 4Q’21 and MAU declined in 2Q’22 for the first time in its history, some feared (hoped?) for Facebook’s gradual decline to irrelevance. Facebook added 37 mn DAU (now >2 Bn) and 26 mn MAU last quarter.

~3 Bn people now use one of Meta’s apps daily.

Company Filings, MBI Deep Dives, Daloopa

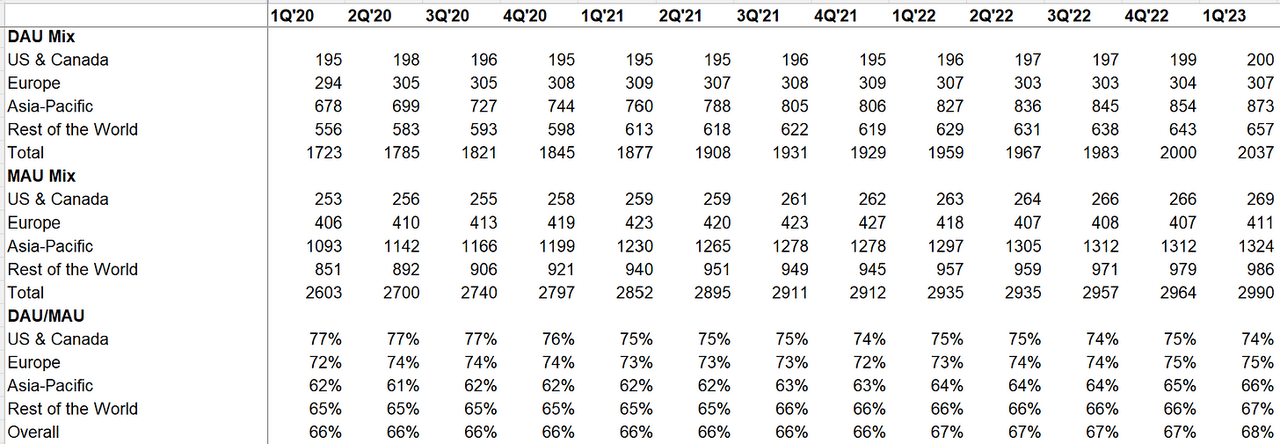

Engagement

US & Canada Facebook DAU reached 200 mn. DAU/MAU trends continue to be strong across regions.

Company Filings, MBI Deep Dives, Daloopa

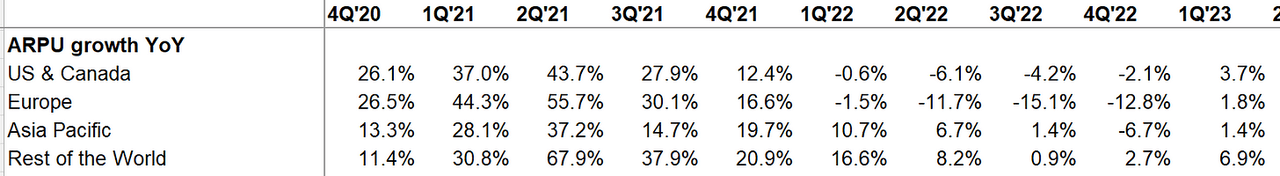

ARPU

ARPU was positive across regions too. Rest of the World (RoW) continues to lead ARPU growth, followed by US & Canada.

Company Filings, MBI Deep Dives, Daloopa

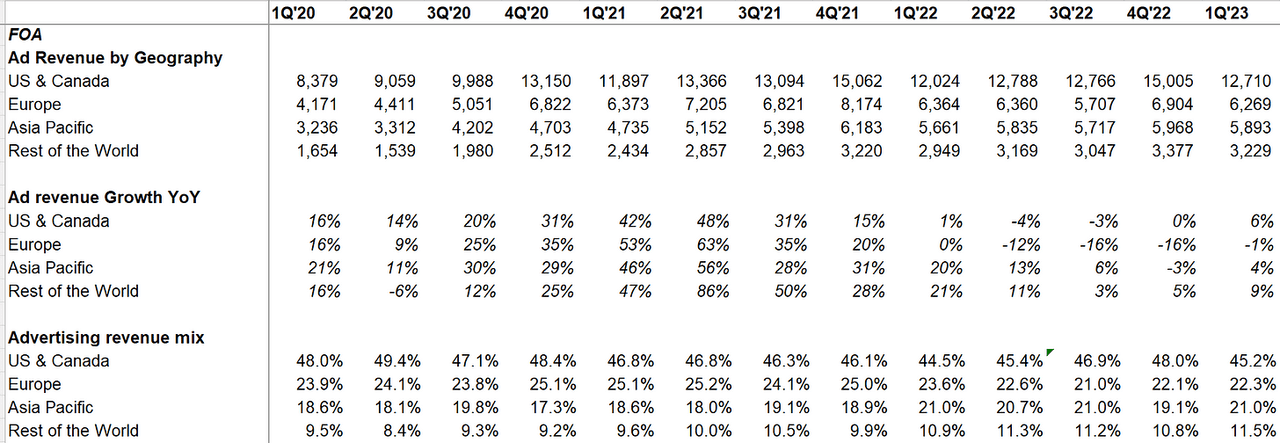

Ad revenue

In 1Q’23, the number of ad impressions was +26% YoY while the average price per ad was -17% due to strong impressions in lower monetizing services such as Reels and in lower ARPU regions as well as FX.

Company Filings, MBI Deep Dives, Daloopa

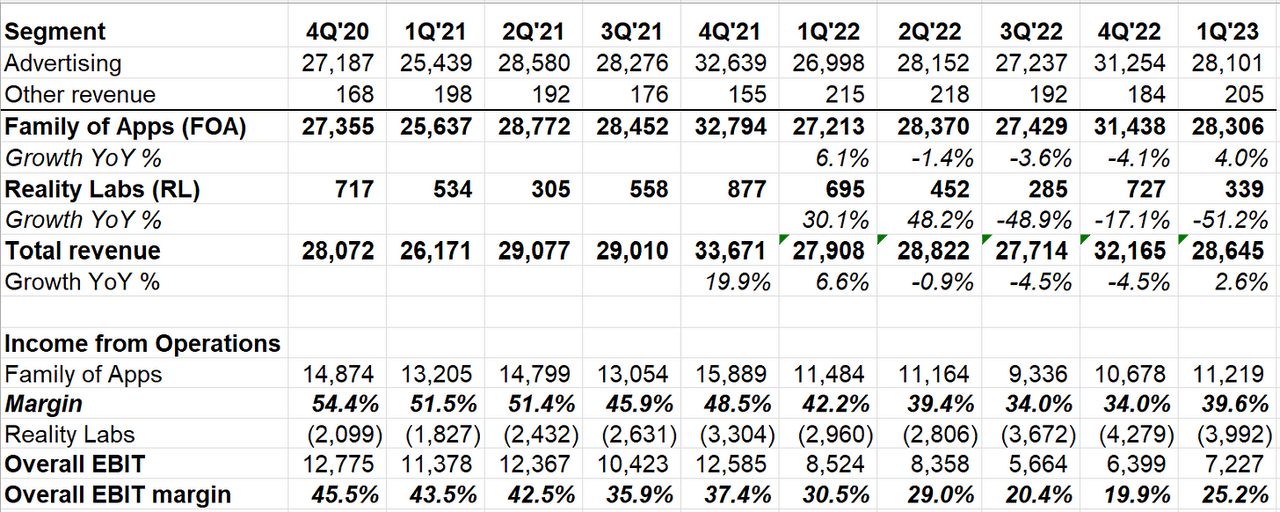

Segment Reporting

In 1Q’23, overall revenue was +6% FXN while FOA was +7% FXN

After two quarters of ~mid-30s FOA operating margin, now it is back to ~40%. Ex-restructuring, FOA operating margins would be 42.9% in 1Q’23.

Overall restructuring cost was $1.1 Bn in 1Q’23. RL losses $4 Bn (+1 Bn YoY).

Company Filings, MBI Deep Dives, Daloopa

Reels

In 3Q’22, Meta mentioned 1 Bn Reels was shared via DMs on IG every day. That number is 2 Bn now.

While the battle is not over with TikTok, my hats off to Meta for building such a compelling product and scaling it so quickly. They just aren’t as fragile as many so intently seem to believe.

Reels seems to be driving incremental engagement:

Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram.”

Reels monetization trend is also positive while Advantage+ is doing its magic:

Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ shopping campaigns is up 7x in the last 6 months.

While Reels is driving incremental time spent, important to remember the nuances in this format and not get carried away by what incremental minutes may mean for revenue in the long run:

There are structural supply constraints with the Reels format as people view a Reel for a longer time than a piece of Feed or Stories content, which results in fewer opportunities to serve ads in between posts. That will make it likely more challenging to close the monetization efficiency gap than it was with Stories.

…we’re working down the headwind to revenue from the growth of Reels cannibalizing some time that is spent on our more mature ad surfaces, Feed and Stories. And basically, we have been balancing the 2 factors here, which is the degree to which Reels is driving incremental engagement on the platform versus the lower monetization efficiency of Reels relative to the Feed and Stories engagement that it cannibalizes. And ultimately, the overall economics of Reels is really going to be determined by the combination of those 2 things.so while we’re on track to Reels becoming neutral to revenue by end of year or early next year, I do think it’s important to call out that Reels is structurally different from Feed and Stories. And so we don’t have line of sight of getting Reels to monetization parity per time with Feed or Stories anytime soon because of those structural differences.

Messaging

The number of businesses using paid messaging on WhatsApp grew by +40% QoQ.

click-to-message ads continue to grow and bring incremental demand onto our platform. This format is mostly used by smaller advertisers today in Southeast Asia and Latin America, and one of the exciting opportunities ahead is to expand adoption to larger advertisers in more markets by investing in increased automation and reporting to help businesses more easily manage messages and measure results at scale.

Expect AI agents to be available on Meta’s messaging apps over time. While Messaging has been perennially under-monetized, I wonder whether generative AI will be a big unlock for monetization. Meta is very well positioned here with two separate >1 Bn MAU messaging apps:

I think that there is an opportunity to introduce AI agents to billions of people in ways that will be useful and meaningful. We’re exploring chat experiences in WhatsApp and Messenger, visual creation tools for posts and Facebook and Instagram and ads, overtime video and multimodal experiences as well. I expect that these tools will be valuable for everyone from regular people to creators to businesses. For example, I expect that a lot of interest in AI agents for business messaging and customer support will come once we nail that experience. Now over time, this will extend to our work on the Metaverse too, where people will much more easily be able to create avatars, objects, worlds and code to tie all them together.

I also think that there’s going to be a very interesting convergence between some of the AI agents in messaging and business messaging, where right now, we see a lot of the places where business messaging is most successful are places where a lot of businesses can afford to basically have people answering a lot of questions for people and engaging with them in chat. And obviously, once you light up the ability for tens of millions of small businesses to have AI agents acting on their behalf, you’ll have way more businesses that can afford to have someone engaging in chat with customers. So I think that, that could be a pretty big opportunity, too.

We’ve introduced new features like in-thread payments and other commerce tools. So we think that there’s a big opportunity here. We’re trying to make every part of the experience for advertisers, easier, better and more performance.

AI

Meta is making a bet on an open ecosystem for LLM-based products:

Right now, most of the companies that are training large language models have business models that lead them to a closed approach to development. And I think that there’s an important opportunity in the industry to help create an open ecosystem. And if we can help be a part of this, then much of the industry, I think, will standardize on using these open tools and help improve them further. So this will make it easier for other companies to integrate with our products and platforms as we enable more integrations, and that will help our product to stay at the leading edge as well.

…I think to some degree, we’re just playing a different game on the infrastructure than companies like Google or Microsoft or Amazon, and that creates different incentives for us. So overall, I think that, that’s going to lead us to do more work in terms of open sourcing some of the lower-level models and tools. But of course, a lot of the product work itself is going to be specific and integrated with the things that we do. So it’s not that everything we do is going to be open. Obviously, a bunch of this needs to be developed in a way that creates unique value for our products. But I think in terms of the basic models, I would expect us to be pushing and helping to build out an open ecosystem here, which I think is something that’s going to be important.

Metaverse

Meta called out the nonsense in several Media that are propagating Meta is shying away from “Metaverse”:

A narrative has developed that we’re somehow moving away from focusing on the Metaverse vision. So I just want to say upfront that, that’s not accurate. We’ve been focusing on both AI and the Metaverse for years now, and we will continue to focus on both. The 2 areas are also related. Breakthrough in computer vision was what enabled us to ship the first stand-alone VR device. Mixed reality is built on a stack of AI technologies for understanding the physical world and blending it with digital objects. Being able to procedurally generate worlds will be important for delivering compelling experiences at scale. And our vision for AR glasses involves an AI-centric operating system that we think will be the basis for the next generation of computing.

Since last year, the number of apps with ~$25 Mn revenue has doubled on the Quest store. More than half of Quest daily actives now spend more than an hour using their device. But Meta didn’t mention how many daily actives Quest has.

Efficiency

There’s a growing narrative that Meta may have cut to the bone to appease the Street. Meta doesn’t think so:

A lot of this efficiency work that we’ve been undertaking and especially this year, is driven not sort of by solely financial imperative, but really with the focus of increasing operational efficiency. And that really includes more carefully scrutinizing road maps, winding down projects that are no longer at the top of our priority list, reprioritizing investments. That’s really a muscle that, I think, we have spent a lot of time building over the last half year, and I expect that we will be carrying that discipline into the way that we assess our product road maps going forward.

…The goals of our efficiency work are to make us a stronger technology company that builds better products faster and to improve our financial performance to give us the space in a difficult environment to execute our ambitious long-term vision. When we started this work last year, our business wasn’t performing as well as I wanted. But now we’re increasingly doing this work from a position of strength. Even as our financial position improves, I continue to believe that slowing hiring, flattening our management structure, increasing the percent of our company that is technical and more rigorously prioritizing projects will improve the speed and quality of our work. I also believe that a stronger financial position will enable us to weather a volatile environment while remaining focused on our longer-term priorities.

There was a question on a recent media report on 1-2% headcount growth going forward. Meta indicated headcount growth will likely exceed 1-2% from the base of post-layoff headcount at least in 2024.

Regulation

Some uncertainty remains around the EU-US privacy framework, but one interesting data point was only ~10% of revenue comes from EU countries.

I honestly expected more questions around data privacy regulation as I do think it is a long-term risk to the business.

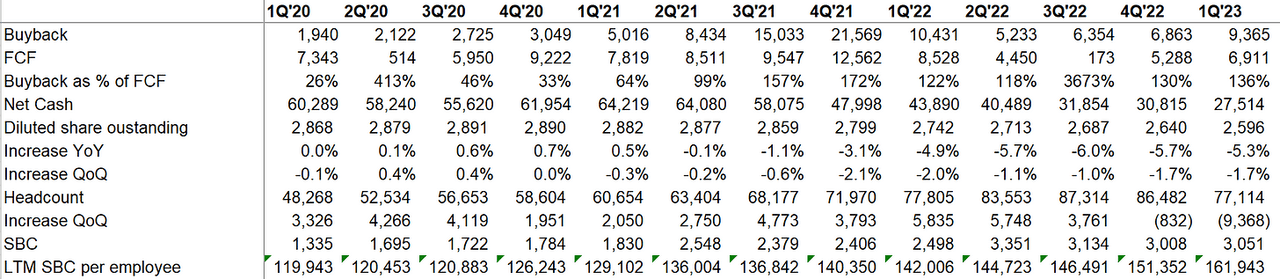

Capital Allocation

Meta continues to buy back in excess of FCF which is great to see given the depressed stock price. Share count declined by 1.7% QoQ and 5.3% YoY.

Meta still has ~$28 Bn net cash on the balance sheet. CFO Susan Li even indicated a better-optimized capital structure over time:

As we look forward, I also expect that we will modestly evolve our capital structure over time to improve our overall cost of capital. We expect to do so through periodically accessing the debt markets to diversify our funding sources while still maintaining a positive or neutral net cash balance over time.

1Q’23 headcount reflects the November layoff but doesn’t reflect the March layoff yet as they are being done in April-May.

Company Filings, MBI Deep Dives, Daloopa

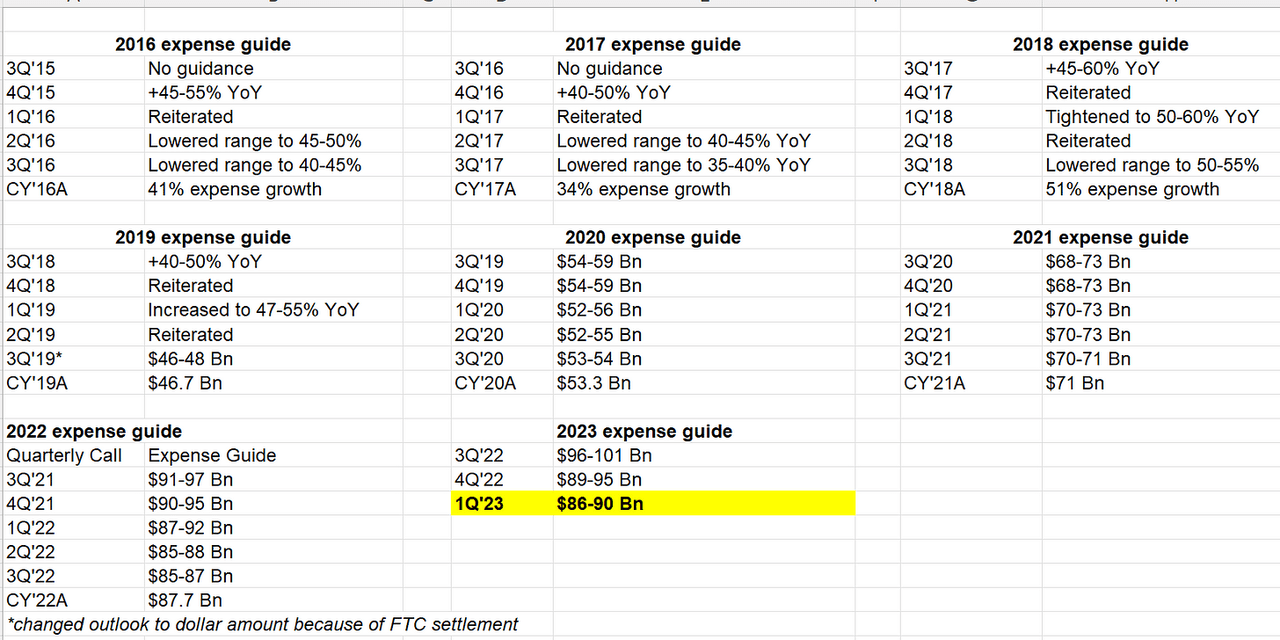

Opex Guide

After guiding ~$100 Bn Opex for 2023 initially, Meta’s opex guide range has come down by $6-15 Bn. Given the last few years’ trends, it is likely to be closer to $86 Bn (including $3-5 Bn restructuring costs).

While thankfully Meta omitted the word “significantly“, Reality Labs losses are still expected to increase in 2023.

Company Filings, MBI Deep Dives

Capex guide

Capex guide is unchanged at $30-33 Bn. I became a little excited after reading the following quote by Zuck and thought capex ramp-up is mostly behind us after 2023:

A couple of years ago, I asked our infra teams to put together ambitious plans to build out enough capacity to support not only our existing products but also enough buffer capacity for major new products as well. And this has been the main driver of our increased CapEx spending over the past couple of years. Now at this point, we are no longer behind in building out our AI infrastructure. And to the contrary, we now have the capacity to do leading work in this space at scale.

But as Susan later explained, capex is likely hinged on how transformative generative AI-related investments going to be:

…you can really think about our CapEx investment as having 3 broad buckets. The first, we’ve talked about before, non-AI compute needs. We do have ongoing general compute and storage needs to support the existing business, but this is an area where we’ve become much more efficient in terms of capital intensity and are very much focused on continuing to do so over time.

The second area is in our core AI investments, which is really most of our AI investment today, and that’s supporting the building of the discovery engine, ranking unconnected organic content, ranking ads, and we’re focused on measuring the return of those investments and making sure that we feel good about the ROI of our spend there, and that really will drive our future plans in terms of that core AI spend.

And then the third bucket is really around CapEx investments now to support gen AI. And this is an emerging opportunity for us. We’re still in the beginning stages of understanding the various applications and possible use cases. And I do think this may represent a significant investment opportunity for us that is earlier on the return curve relative to some of the other AI work that we’ve done. And it’s a little too early to say how this is going to impact our overall capital intensity in the near term.

Outlook

2Q’23 topline guide is $29.5-32 Bn, ~7% YoY at mid-point (vs consensus of $29.5 Bn) assuming 1% FX headwind

Since from 2Q’22-4Q’22 Meta reported negative topline growth, the comps get easier from here.

While the mudslinging between Meta bulls and bears continues, it is perhaps a good moment to reflect for everyone involved in this stock about the last 12 months of craziness in one of the most widely followed stocks in the world.

Disclosure: I own shares, and Jan 2025 call options of Meta

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.