Summary:

- There were some mixed signals on Meta’s Q2 2023 call to keep both bulls and bears interested.

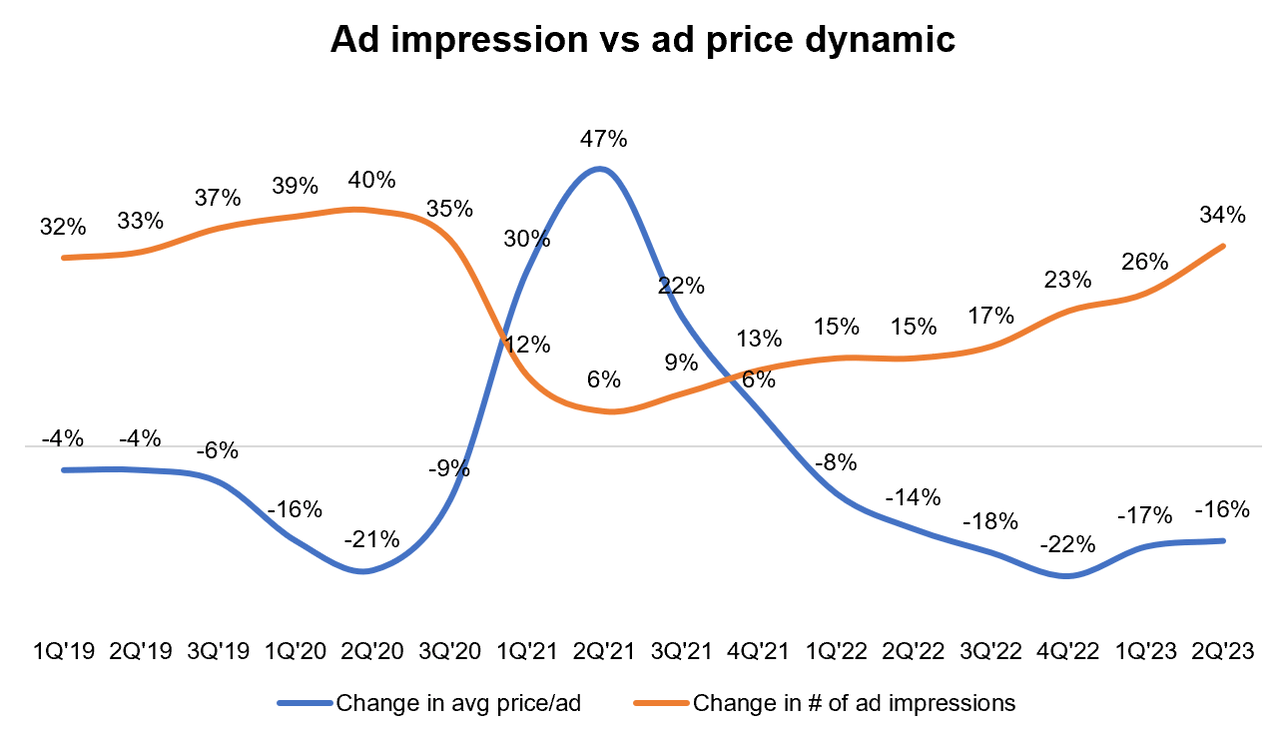

- For the second consecutive quarters, number of ad impression growth and change in average price per ad is moving in the same direction.

- 75% of Meta’s advertisers are now using Reels. Annual revenue run rate from Reels exceeded $10 bn in 2Q’23, which was $3 bn last fall.

- The CEO mentioned the initial reaction to Threads exceeded their expectations, and their main focus is on retention now.

Derick Hudson

While Meta (NASDAQ:META) stock was up +6-7% after-hours, I found some mixed signals on this call to keep both bulls and bears interested. In any case, I have never found Meta’s earnings calls monotonous!

Here are my highlights from Wednesday’s call:

Users

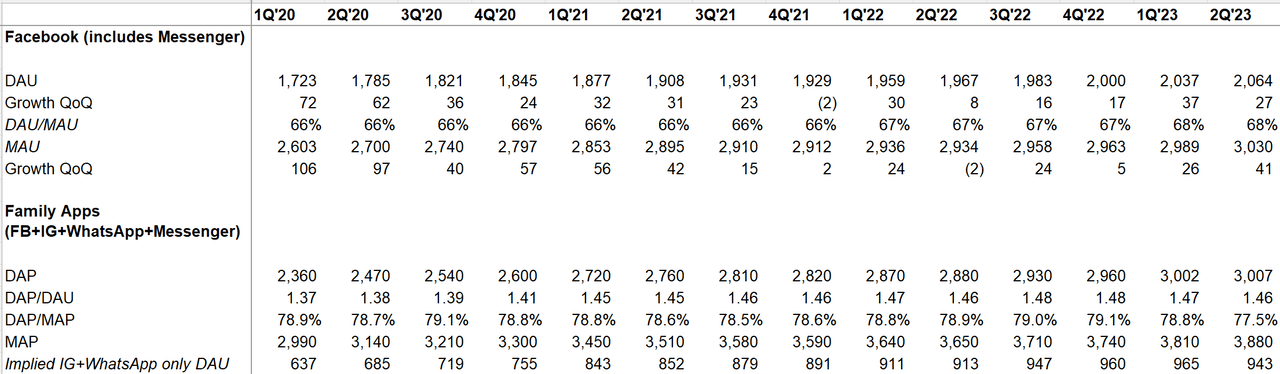

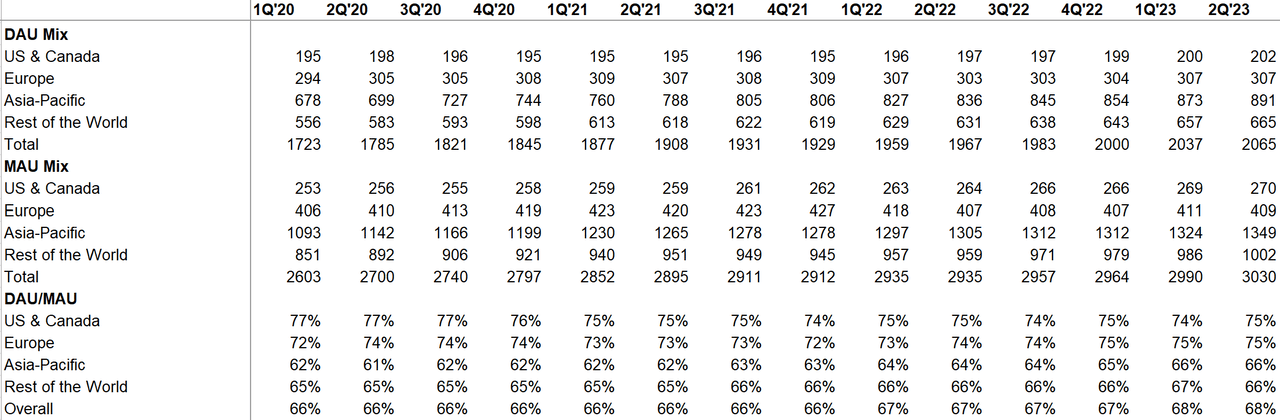

Facebook exceeded 3 bn MAU for the first time, and MAP is now approaching 4 bn.

Company Filings, MBI Deep Dives

Engagement

DAU/MAU engagement looks steady across all regions.

Company Filings, MBI Deep Dives

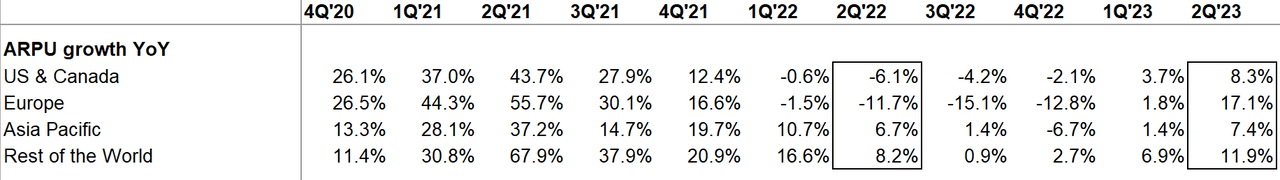

ARPU

While ARPU exhibited considerable strength, please note the material weakness in YoY comparison. One interesting thing is Europe, APAC, and RoW had higher ARPU in 2Q’23 than they had in 4Q’22, which is a holiday season!

Company Filings, MBI Deep Dives

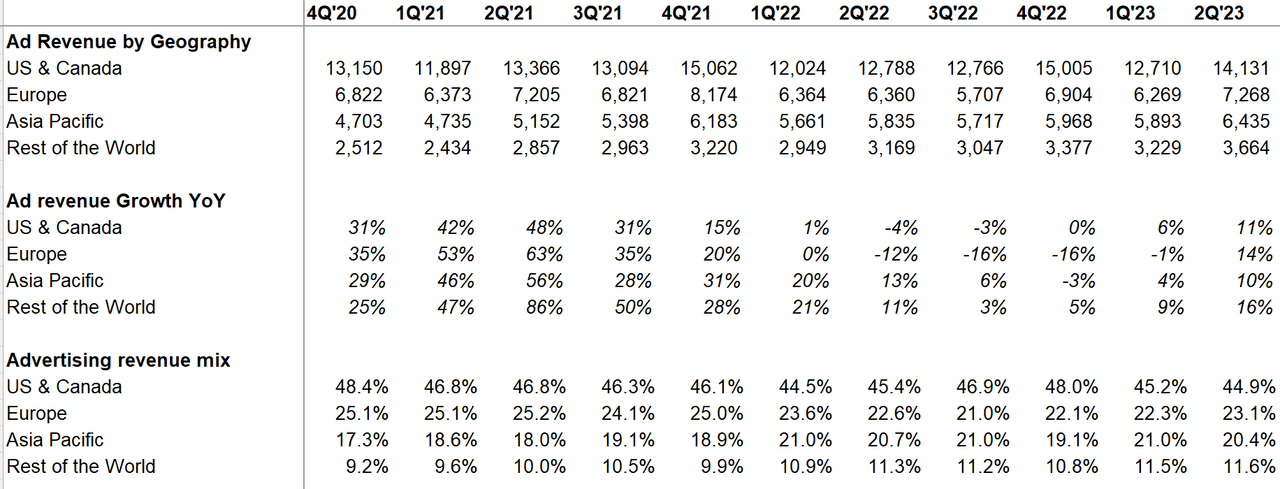

Ad revenue

For the second consecutive quarters, number of ad impression growth and change in average price per ad is moving in the same direction; it’s the derivative that matters!

Lower price is driven by higher impression growth in APAC and RoW, as well as lower monetizing surfaces (i.e., Reels).

Company Filings, MBI Deep Dives Company Filings, MBI Deep Dives

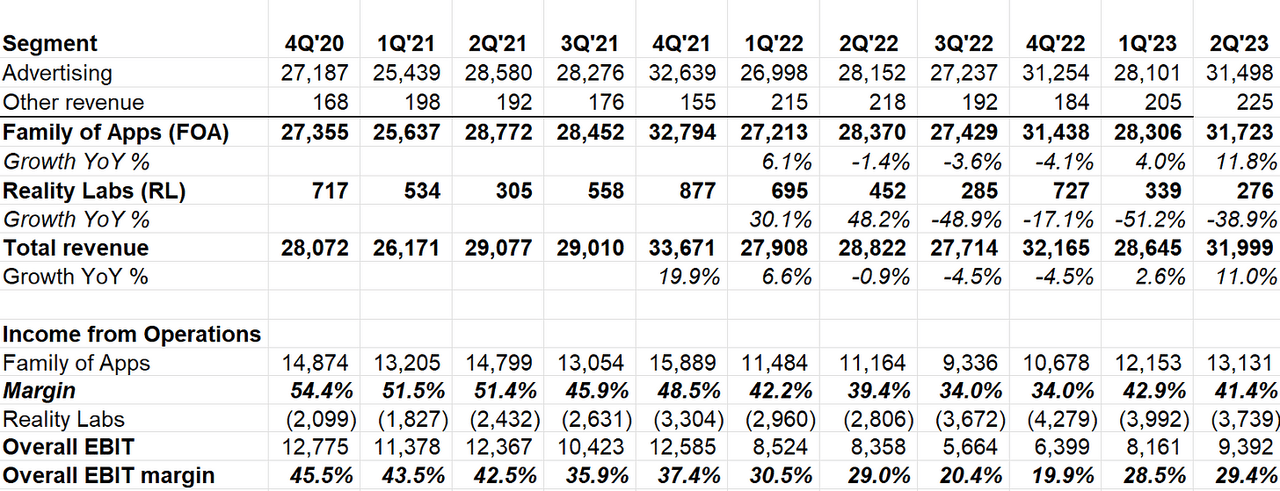

Segment Reporting

Topline grew by 11% (1% FX headwind). Reality Labs (RL) revenue declined by 39% YoY and lost $3.7 bn this quarter. 2023 RL losses are still expected to exceed 2023 losses, which will be higher than 2022’s.

Company Filings, MBI Deep Dives

AI-recommended content led to 7% increase in overall time spent on Facebook.

Reels

In the 3Q’22 call, Meta mentioned there are 140 bn Reels played across Facebook and Instagram each day. That number exceeded 200 bn last quarter.

75% of Meta’s advertisers are now using Reels. Annual revenue run rate from Reels exceeded $10 bn in 2Q’23, which was $3 bn last fall. TikTok (BDNCE) reportedly generated $10 bn revenue in 2022; it is perhaps not aggressive to think that Reels may exceed TikTok revenue by next year.

Meta is routinely under the wrath of investors (often by its own shareholders), but I have to take a moment and applaud what they achieved here. Admittedly, I was a bit nervous about the rise of TikTok and whether Meta will be able to rearchitect FOA properties to build a compelling alternative. They clearly have exceeded my expectations.

However, increased time spent will not grow revenue linearly:

we continue to expect time on Reels will monetize at a lower rate than Stories and feed for the foreseeable future since people scroll more slowly through video content.

WhatsApp Business now has 200 mn users who will “be able to create click to WhatsApp ads for Facebook and Instagram without needing a Facebook account. This is a pretty big unlock, particularly in countries where WhatsApp is often the first step to bring a business online.”

The number of businesses using our paid messaging products has doubled year-over-year.click-to-WhatsApp ads revenue continues to grow very quickly at over 80% year-over-year.

Threads

Zuck mentioned the initial reaction to Threads exceeded their expectations, and their main focus is on retention now. Don’t model Threads monetization too soon; Meta indicated they want to reach “hundreds of millions” users before thinking about monetization.

Zuck hopes Threads might be the 5th big app of Meta’s FOA properties:

I do think it has been sort of this weird anomalous thing in the tech industry that there hasn’t been an app for public discussions like this that has reached 1 billion people.

As expected, there was a lot of discussion on AI.

AI for Advertisers

Almost all our advertisers are using at least one of our AI-driven products. We’ve also deployed Meta Lattice, a new model architecture that learns to predict ads performance across a variety of data sets and optimization goals. And we introduced AI Sandbox, a testing playground for generative AI-powered tools like automatic text variation, background generation and image outcropping.

One thing that stood out to me was why Meta thinks “AI agent” may finally launch the messaging monetization spigot:

You can imagine a world on this where over time, every business has as an AI agent that basically people can message and interact with.it should alleviate one of the biggest issues that we’re currently having around messaging monetization is that in order for a person to interact with a business, it’s quite human labor-intensive for a person to be on the other side of that interaction, which is one of the reasons why we’ve seen this take off in some countries where the cost of labor is relatively low.But you can imagine in a world where every business has an AI agent, that we can see the kind of success that we’re seeing in Thailand or Vietnam with business messaging could kind of spread everywhere.

My brother runs an SMB which often deals with this issue; they receive far more messages (at times in a very short window if they have a discount offer going on) that any human(s) can deal with. Meta’s rationale makes intuitive sense, and it can indeed be gamechanger if the “AI agent” is well-executed.

AI for Consumers

On a consumer level, Meta’s plans are also quite expansive, but there will be more clarity and product launches later this year:

We are also building a number of new products ourselves using Llama that will work across our services. I’m going to share more details on that later this year. But you can imagine lots of ways that AI can help people connect and express themselves in our apps. Creative tools that make it easier and more fun to share content, agents that act as assistance, coaches that can help you interact with businesses and creators and more. And these new products will improve everything that we do across both mobile apps and the metaverse, helping people create worlds and the avatars and objects that inhabit them as well.

If Snap’s (SNAP) “My AI’ learnings is any indication, this can get quite interesting; if this takes off, I expect Meta to take some digital ads market share from Google (GOOG, GOOGL).

Llama and Open Source

Why open source?

Llama is an open source project, which is a little bit different from building out a developer platform, although there will be an ecosystem around this. What we’ve seen around open source work that we’ve done, which we’ve done a lot of in our core infrastructure work, design of servers and data centers and basic infrastructure as well as in AI. And I pointed out some of these in my remarks upfront, like PyTorch and just a bunch of other models that we’ve released recently. One of the things that we’ve seen is that when you release these projects publicly and open source, there tend to be a few categories of innovations that the community makes. So on the 1 hand, I think it’s just good to get the community standardized on the work that we’re doing. That helps with recruiting because a lot of the best people want to come and work at the place that is building the things that everyone else uses. It makes sense that people are used to these tools from wherever else they’re working. They can come here and build here.

In case Llama indeed becomes the industry standard, Meta made sure their main competitors won’t use the model for free. Anyone with more than 700 mn users will have to pay fees to Meta to use and build on top of Llama:

one of the things that you might have noticed is in addition to making this open through the open source license, we did include a term that for the largest companies, specifically ones that are going to have public cloud offerings, that they don’t just get a free license to use this. They’ll need to come and make a business arrangement with us. And our intent there is we want everyone to be using this. We want this to be open. But if you’re someone like Microsoft or Amazon or Google and you’re going to basically be reselling these services, that’s something that we think we should get some portion of the revenue for. So those are the deals that we intend to be making, and we’ve started doing that a little bit. I don’t think that, that’s going to be a large amount of revenue in the near term. But over the long term, hopefully, that can be something.

Zuck is also aware that the conversation around AI safety is evolving, and he kept the door open to not make everything open source in case there is real danger, but also reminded that the companies who are in the business of selling their model may have vested interest in touting AI’s danger to make things “closed” source:

by open sourcing Llama now… we intentionally did not go out there and say we’re going to open source every single thing in the future because we do want to have the space to be able to look at how the safety landscape evolves. And if we think that we do cross some kind of critical threshold in the future, it may not be the right thing to open source it in the future. But for our business model at least, since we’re not selling access to this stuff, it’s a lot easier for us to share this with the community because it just makes our products better and other people, and that, I think, is a really healthy dynamic for the industry.

Metaverse

Quest 3 is going to be launched during this year’s Connect.

Quest 3 is going to be the first mainstream accessible device that we expect many millions of people will get to experience this technology with. The metaverse content and software vision continues coming together as well. We recently announced that Roblox is coming to Quest with an open beta on App Lab.

Quite a few pushbacks from the analysts on Meta’s Metaverse spending. Meta tried to defend:

a lot of the investment that’s driving the growth here is around conducting the fundamental R&D to solve hard technology problems…A lot of it is around clearing technical hurdles that will make subsequent devices smaller, cost less, weigh less, et cetera.

I guess the question that looms large on my mind is whether this is a capital question or a limitation of physics. Is throwing more money at the problem going to lead to solve the technical challenges in AR glass?

For a moment, Zuck seemed to acknowledge how things are not going according to their plan here:

… I’d say the signals that we’re getting from the market are it’s certainly not getting adopted a lot faster than we expected so that’s sort of the somewhat sobering signal.

Zuck is aware that investors are not quite fond of this bet:

At a deep level, I understand the discomfort that a lot of investors have with it because it’s just outside of the model of, I think, even most long-term investors how you would think about this. And look, I mean, I can’t guarantee you that I’m going to be right about this bet. I do think that this is the direction that the world is going in. There are 1 billion or 2 billion people who have glasses today. I think in the future, they’re all going to be smart glasses.

He reminded how the owners of the current mobile computing platforms made life difficult for Meta. Even though Meta is quite successful despite playing by the platforms’ rules, Zuck probably feels deeply uncomfortable in playing by their ever-changing, arbitrary rules:

we’ve been quite successful at building large-scale social experiences within the constraints of platforms that often our competitors are defining. I think we’re going to be able to do even better work. And there’s a lot of things that I would like to see us build that we just can’t because of the ways that we’re constrained by the competitors who build these platforms.

My guess is if Quest 3 is not successful (like selling less than 5 mn units in 6 quarters after launch), Meta may scale back on VR but will keep trying to solve AR glass.

But there seems to be bit of emotions involved here, so it is not a very high-confidence “guess”.

I know from an investor standpoint, most people aren’t investing on quite as long of a time horizon as we are here, so I kind of get that, a lot of investors might want to see us spending less here in the near term. My view is that we are leading in these areas. I believe that they’re going to be big over time. I think we’ve shown that we can deliver good business results in the near term while investing ambitiously in the long term. So I’m planning on continuing to do that, and I do continue to believe that over time, we will be happy that we did that.

Efficiency

Zuck praised how a small team basically launched Threads and how that chimes well with Year of Efficiency. Zuck re-emphasized on the efficiency theme even though the worst seems to be behind them:

Over the next few months, we’re going to start planning for 2024. And I’m going to be focused on continuing to run the company as lean as possible for these cultural reasons, even though our financial results have improved. I expect that we’re still going to hire in key areas, but newly budgeted headcount growth is going to be relatively low.

However, the efficiency messaging has bit of a mixed signal. While headcount growth may be limited, expect payroll expenses to go up (AI folks are highly sought-after) and Metaverse losses will keep piling up (they did mention that in 1Q’23 as well, so not a new message in this call though):

we anticipate growth in payroll expenses as we evolve our workforce composition toward higher-cost technical roles. Finally, for Reality Labs, we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in AR, VR and our investments to further scale our ecosystem.

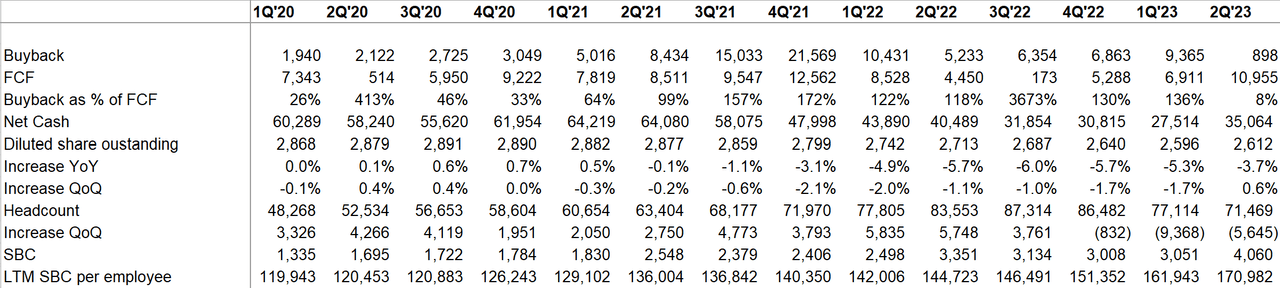

Capital Allocation

Meta mentioned they would like to be near-net cash neutral over time, which I am very glad to hear. Surprisingly, they hardly did much share buyback this quarter, and I’m not sure I understand why (analysts didn’t ask anything on this).

Like many investors, I often complained about Meta’s buyback decisions in the past. While there are certainly valid criticisms to make Meta’s buyback decisions in the 2021-22 period, in retrospect I think I have misunderstood the company’s broader buyback policy.

When it comes to buyback, there are two lenses to look at it: Return Of Capital, and Return On Capital. Supermajority of investors, including me in the past, seem obsessed with return on capital when it comes to buybacks. But the data seems pretty evident: Big Tech mostly doesn’t think deeply about return on capital in their buyback decisions; they just want to mostly return the capital back to shareholders, i.e., return of capital.

Let me share some data to put this in context. From 1Q’20 to 2Q’23, both Google and Microsoft (MSFT) generated ~$208 bn FCF (yes, same). Microsoft returned 76% of that in the form of dividends and buybacks, while Google returned 82% of FCF during this time in just buybacks.

Meta, on the other hand, generated $98 bn FCF from 1Q’20-2Q’23 and they bought back $99 bn in shares. Seeing in this light, we can see a clear theme in how Big Tech allocates capital to buyback. And if you really want Big Tech to focus on return on capital, be careful what you wish for. Let’s be honest: would we really want Big Tech to accumulate cash on their balance sheet in 2020-21 in the chance that we were on the bubble and they could buy back shares when the stock craters? Again, this is not a defense of Meta’s ill-timed buybacks in 2021, rather a general explanation of how I think Big Tech thinks about buybacks.

Company Filings, MBI Deep Dives

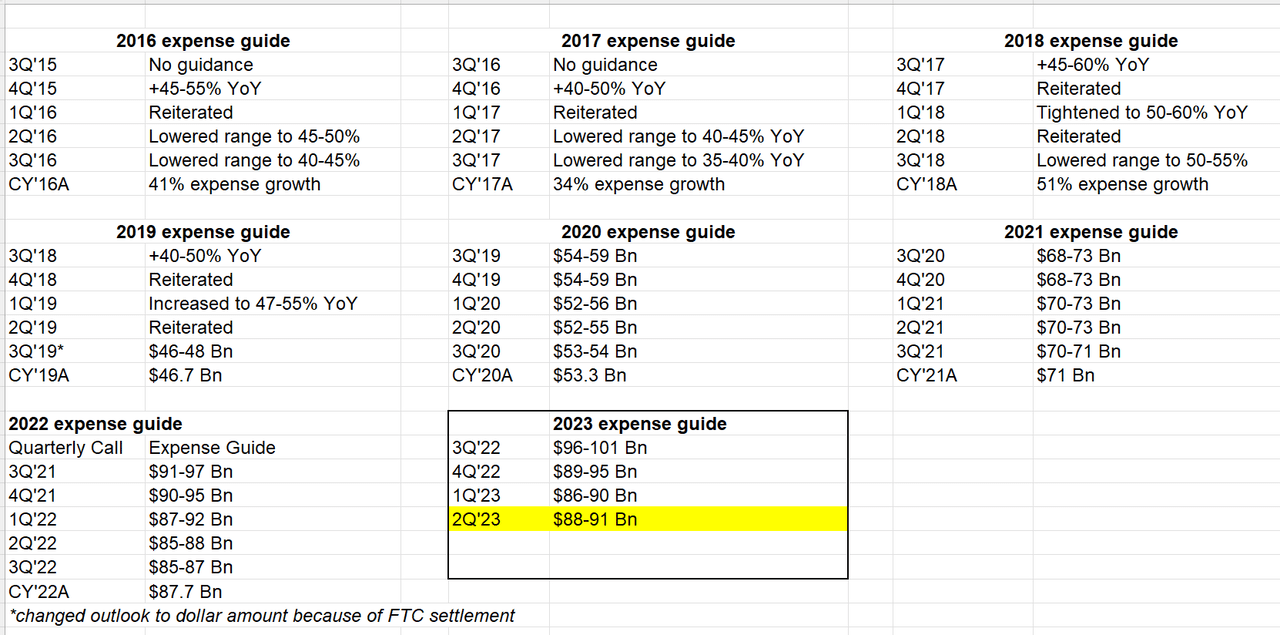

Opex Guide

Meta increased their opex guide range from $86-90 bn to $88-91 bn. Historically, they usually trim their opex guide over the course of the year, but they had a legal-related expense which probably contributed to the increased range.

Company Filings, MBI Deep Dives

Capex

Perhaps surprisingly, Meta lowered capex guide for this year, but it’s mostly just shifted to 2024:

… The other major budget point that we’re working through is what the right level of AI CapEx is to support our road map. Since we don’t know how quickly our new AI products will grow, we may not have a clear handle on this until later in the year. We expect capital expenditures to be in the range of $27 billion to $30 billion, lowered from our prior estimate of $30 billion to $33 billion. The reduced forecast is due to both cost savings, particularly on non-AI servers as well as shifts in CapEx into 2024 from delays in projects and equipment deliveries rather than a reduction in overall investment plans. Looking ahead, while we continue to refine our plans as we progress throughout the year, we currently expect total capital expenditures to grow in 2024, driven by our investments across both data centers and servers, particularly in support of our AI work…. we are mindful of our intention to reduce the capital intensity of these investments over time.

Regulation

The following bit (especially the bold line) stood out to me, and to my utter surprise, there was not a single question asked on this point during the call; this remains a pivotal risk for Meta’s business in the long term as the philosophy of “surveillance capitalism” becomes more mainstream:

With respect to EU-U.S. data transfers, we saw a positive development with the European Commission’s adoption of a final adequacy decision, which allows us to continue to provide our services in Europe. This is good news, though broadly speaking, we continue to see increasing legal and regulatory headwinds in the EU and the U.S. that could significantly impact our business and our financial results.

Outlook

Meta guided $32-34.5 bn for 3Q’22 (expectation was $31.2 bn); +20% YoY growth on the high-end. +3% FX tailwind expected in 3Q’23 and 3Q’22 was -4.5% topline quarter, so the YoY comparison is a lot easier. Nonetheless, the guide clearly indicates Meta’s relative strength today.

Closing Words

Overall, Meta is at an intriguing place today: on one hand, there are exciting opportunities on the near- to mid-term horizon (Reels, Messaging, and even AI can have material impact in relatively quick time), but on the other hand, Meta’s long-term bet on Metaverse continues to stand on quite fragile foundation.

Bears should marvel a little bit at Meta’s strength and continued ability to adapt at its core business, and bulls should wait a little bit before going euphoric due to near-term wins.

Disclosure: I own shares, and Jan 2025 $50 call options of Meta.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.