Summary:

- Meta Platforms, Inc. has emerged as a leader in AI with their open-source strategy and Llama 3.1 models, challenging closed models like OpenAI.

- The Llama 3.1 405B model allows developers to leverage advanced AI capabilities, leading to industry-standard adoption with key partners like Amazon and Nvidia.

- Despite investor concerns over CapEx, Meta’s open-source strategy is expected to democratize AI access and drive innovation, making them a strong AI stock investment.

- Their AI strategy allows Meta to benefit from market innovations without having to pay for expensive R&D.

- I think the stock is set up well going into Q2 earnings Wednesday.

Anna Moneymaker/Getty Images News

Investment Thesis

As the AI revolution approaches its two-year mark (kicked-off with the launch of ChatGPT), I believe the real winners and losers are now starting to stand out. Meta Platforms, Inc. (NASDAQ:META), in my opinion, has emerged as a notable leader by betting heavily on their open-source AI models. Their Llama 3.1 model family, unveiled in this month, is touted to lead the industry because of their performance, open-source nature, and cost-efficiency, according to the company. I believe Meta has paved the way for a broader trend where enterprises can benefit from open-source, allowing collaboration to compete against closed, proprietary systems like OpenAI.

The Llama 3.1 405B model is the first frontier-level open-source AI model (meaning it also beats closed models like OpenAI’s GPT 4o). It allows developers to leverage AI capabilities at a new level in various use cases, including for synthetic data generation and model distillation, which were previously unattainable at this scale in the open-source community.

Their collaborations with key industry partners like Amazon (AMZN)’s AWS, Nvidia (NVDA), Databricks, and others has facilitated the integration of the model across platforms. It’s a wise ecosystem approach, in my opinion, because it ensures that Llama models become the industry standard. With Llama being the industry standard for those who want to control the weights of their models, this brings exceptional benefits to Meta.

Heading into earnings on July 31st, I believe this new version of Llama is expected to democratize the public’s access to AI technology, especially for more developers and organizations to benefit from Meta’s advancements. The benefits for Meta themselves will be even greater than the benefits to developers.

As the company encourages widespread adoption and model customization, the improvements and innovations that feed back into Meta’s own development pipeline. CEO Mark Zuckerberg has a history of open-sourcing software tools to have the marketplace refine them, and for his company to use them. His strategy mirrors the historical success of open-source software like Linux, which became an industry standard due to its modifiability and ecosystem.

I am still a strong buy on Meta going into earnings. I believe this new strategy actually makes them the best AI stock investors can buy. Zuckerberg is playing a long game and leveraging the marketplace to accelerate innovation. I’m incredibly bullish.

Why I’m Doing Follow-Up Coverage

Since my last update, Meta’s shares have underperformed the market due to growing investor concerns over their substantial capital expenditures (CapEx). Despite reporting a record 1Q 2024 revenue of $36.5 billion in April 2024, a 27% increase year-over-year, shares fell by more than 15% following the announcement of increased spending on AI infrastructure. I think this is incredibly misguided.

Meta’s aggressive CapEx plans, projected to reach $35-40 billion, aim to enhance their AI capabilities and support the development of advanced models like Llama 3.1.

After last quarter, Investors became uneasy, fearing that the high costs might not yield immediate returns. The market’s swift reaction reflects skepticism about the long-term payoffs of these investments. I think investors need to actually understand that the way Meta will benefit from these models is not through direct AI monetization like other AI giants are trying to do. They are trying to use the market to get free innovation. Meta is cutting their effective R&D costs for tools they know they need internally, and they know will make them money if they are created and leveraged to make the world’s largest social media company bigger. This is genius.

Zuckerberg has defended the heightened CapEx, and emphasized that massive investments in AI are crucial for maintaining competitive edge and driving innovation across Meta’s platforms, including Facebook, Instagram, and WhatsApp. He acknowledged the necessity of these expenditures to support AI advancements that could eventually enhance ad targeting and user engagement.

Zuckerberg’s strategy to enhance Meta’s AI infrastructure involves perfecting every layer of their stack, as Meta itself has reported. This helps ensure that Meta can handle the demands of large-scale model training to keep their AI services highly efficient and market leading. I’m writing this follow-up to show how the company is really one of the best AI plays through this open-source strategy and what it means for investors.

What Is Meta’s AI Strategy?

Meta’s open-source AI strategy has enabled the Llama 3.1 model series to outperform many closed-source models, according to the company. By expanding the context length to 128K and supporting eight languages, the Llama 3.1 models cater to a broader range of advanced use cases such as long-form text summarization, multilingual conversational agents, and coding assistants. It’s clear that Meta capitalizes on the growing demand for more capable and versatile AI tools.

Zuckerberg has a history of open-sourcing AI tools, which has accelerated the development and adoption of these technologies. For example, the release of the DINOv2 model, which performs advanced visual tasks, and the open-source animated drawings dataset have provided valuable resources for researchers and developers. As these tools were refined and placed back into the public, so others could leverage them, Meta has been able to use these refined tools (refined by millions of developers with new, cutting-edge perspectives).

While most businesses are trying to expand their business lines and break into new industries, Zuckerberg already commands this highly profitable ad placement system through Meta’s family of social media platforms. I often referred to as a “money printer,” due to its ability to generate exceptional returns for customers who place ads on the platform and for Meta itself through their targeted advertising.

Zuckerberg does not need another business line to get into. He is solely focused on making this current business model stronger. With this, he’s using the open-source community to carefully open-source the technology he needs to refine but does not want to pay to refine on his own. He knows what tools he needs to mine better gold (ad dollars) but requires the market to help bring them into existence.

Vox did a great piece on this last year when Meta released one of their first open-source models. Keep in mind, they have not open-sourced all of their data or algorithms. Meta did not open-source the training data they used for these models. They also have not open sourced the core ad-tech algorithm they use at Meta. This is intentional. They open-source the stuff they need refined, yet keep the tools they use to maintain an edge private. Genius.

Earnings Expectations

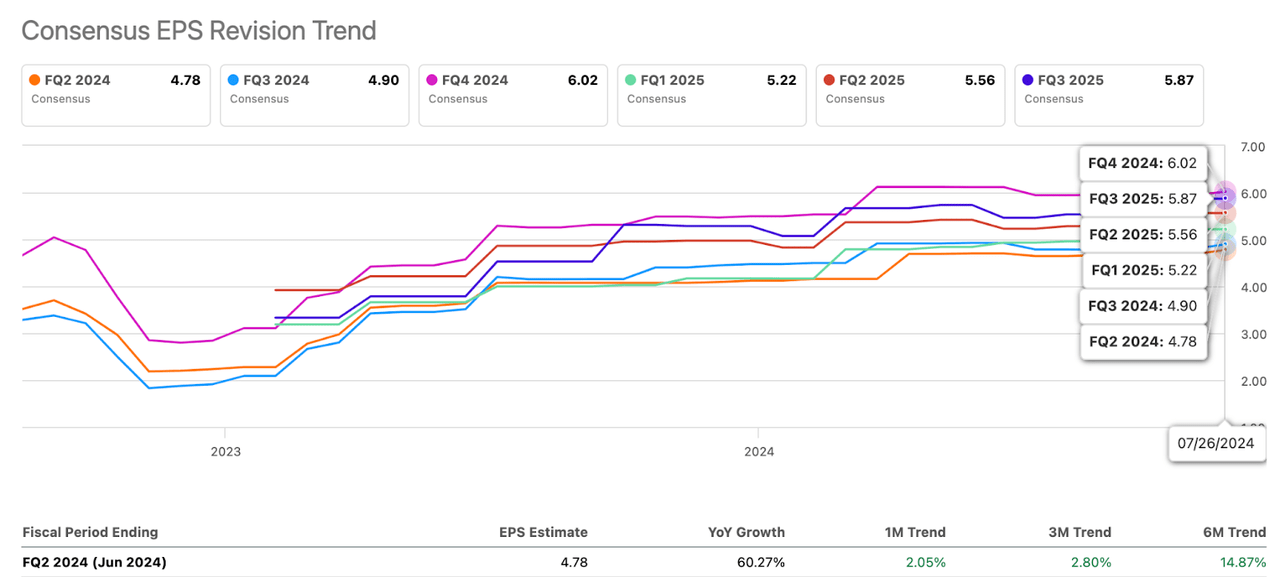

While the market was bearish after the last quarter, I believe Meta’s upcoming earnings expectations reveal low expectations. For the upcoming quarter (earnings come after the bell on Wednesday), the consensus EPS estimate stands at $4.78, reflecting a 60.27% year-over-year growth. Revenue projections for 2Q 2024 are expected to be around $38.28 billion, showing a 19.65% increase. Looking forward, revenue growth for the next few years is projected to maintain a conservative 10-12% year-over-year increase, with some years anticipated to be lower. I think this (in hindsight) will look really conservative.

While the market has started to revise up earnings expectations after the last quarter CapEx raise, I actually think that’s a good thing. Some analysts are starting to understand what this open-source strategy can do for the company. I think once this becomes more obvious, the market will price it in, creating upward pressure on shares.

Meta EPS Revisions (Seeking Alpha)

Valuation

The company’s forward PEG ratio stands at 1.16, far below the sector median of 1.42, reflecting an -18.55% discount. I believe this indicates that some investors are skeptical about Meta’s ability to achieve their projected EPS growth rates, despite strong historical performance. Some investors believe that these large CapEx projects will drag performance more than the analyst numbers indicate. I think this means the market hasn’t priced in the AI strategy.

Despite these reservations, I believe Meta is well-positioned to exceed these growth expectations. The company’s open-source strategy is anticipated by the developer community so they can enhance their technological capabilities. It’s cost-effective and can better accelerate innovation on Meta’s behalf. It’s a win-win.

If Meta were to be valued at the sector median forward PEG ratio of 1.42, their stock would reflect a more accurate valuation based on their forward growth potential. Specifically, recalibrating Meta’s stock to align with the sector median forward PEG ratio represents an approximate 22.41% increase from current levels. It’s a good upside for a company that, I think, has a best-in-class AI strategy.

Risks

Meta’s business model is based mainly on ad sales on their platforms. Ad sales are dependent on the economy. I believe the U.S. economy has shown signs of slowing down, with GDP growth decelerating and consumer spending tightening (the earnings report today from McDonald’s also shows this).

When consumers cut back on spending, companies typically reduce their advertising budgets to conserve cash, which results in a downturn in ad revenue for platforms reliant on advertising, such as Meta, despite their strong positioning and innovative strategies. The company is not immune to these macroeconomic trends, as revenue slumped in 2022 as ad dollars got tighter. The cautious economic environment, coupled with higher interest rates and tighter consumer budgets, may hammer Meta as they meet these economic headwinds.

The company’s heavy reliance on an advertising-based revenue model also exposes the company to risks. As economic conditions fluctuate, so does consumer spending, which directly impacts advertising budgets. During economic slowdowns, companies often reduce their ad expenditures, which can lead to substantial revenue shortfalls for Meta.

Meta also continues to face antitrust risks, particularly from the European Union. Earlier this month, the European Commission signaled their intent to issue a substantial fine against Meta for allegedly abusing their market dominance by tying their Facebook Marketplace service to the Facebook platform.

I think Meta’s open-source strategy actually provides a strong defense against both of these headwinds. Open-source is a good way to show that they foster innovation and transparency, which can counteract claims of market dominance and unfair practices.

Their ad network also benefits from their open-source AI strategy, as these model innovations help them serve ads far better than other ad networks, meaning they can grab market share even in a hypothetical ad market slowdown.

Bottom Line

Meta has emerged as a strong leader in AI, driven by their open-source strategy with models like Llama 3.1. While shares have underperformed due to investor concerns over substantial CapEx, these investments are already yielding innovations that won’t translate into dollars directly, but help the company do what they do best. Given the company’s forward PEG ratio is below the sector median, I believe this indicates market skepticism about future EPS growth. This presents an opportunity.

Given the company’s robust open-source strategy, AI advancements, and potential for exceeding growth expectations, I think Meta’s shares remain a strong buy going into earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.