Summary:

- Meta Platforms, Inc.’s shares have surged 24.55% due to strong advertising performance driven by AI, with Q2 revenue up 22% year-over-year from improved ad impressions and pricing.

- Despite $55 billion in lifetime losses from Reality Labs, Meta’s Ray-Ban smart glasses could revolutionize user interaction and drive long-term growth, akin to the iPhone’s impact.

- Meta’s new AI-enhanced Ray-Ban glasses offer hands-free content capture and integration with apps like Spotify, potentially boosting user engagement and advertising revenue.

- Meta’s forward P/E ratio is lower than Apple’s, but the potential of their hardware innovations suggests an 18.96% upside given their forward PEG ratio, making shares a strong buy pre-earnings.

Justin Sullivan/Getty Images News

Investment Thesis

Meta Platforms, Inc. (NASDAQ:META) shares have risen 24.55% since the summer, largely driven by their stronger advertising performance as AI has helped them serve better ads to users. In Q2, the social media giant reported a jump in revenue, with total revenue clocking in at $39.07 billion—up 22% year-over-year, driven by a 10% increase in ad impressions and a similar rise in the average price per ad. AI capabilities, particularly in generative AI, are boosting their clients’ ad performance and helping advertisers hone in on their target audiences.

Meta CEO Mark Zuckerberg noted that the company’s AI tools have allowed for improved ad delivery systems, which predict audience engagement more effectively than traditional methods.

While much of the Q3 earnings preview commentary will likely discuss the company’s use of AI, I actually want to focus on another part of the company that has been lagging: Meta Labs.

Meta’s Reality Labs division, which includes the Ray-Ban Meta glasses, has been a money sink for the company, with rumored losses exceeding $55 billion since 2019. Critics argue that Meta should cut this division to enhance their earnings per share, particularly given the original underwhelming performance of their smart glasses. A 2023 WSJ study shows less than 10% of the solid units being used actively.

However, I think this perspective overlooks an important element of Meta’s long-term strategy.

Zuckerberg’s vision appears to extend beyond immediate profitability. I think he’s aiming to redefine the way users interact with social media through new form factors like smart glasses.

This has a strong potential to create a new computing platform, akin to the impact the iPhone had on mobile technology. By investing in the evolution of smart eyewear, Meta is leading a disruption in consumer technology where augmented reality (AR) becomes more useful in everyday life, and can help refine the technology and enhance user engagement. So, while the division has suffered from heavy losses so far, the long-term benefits of this venture could outweigh short-term financial setbacks. I think we are just now starting to see this.

With this, I continue to believe shares are a strong buy going into earnings.

Why I’m Doing Follow-Up Coverage

Meta’s stock has continued to outperform the market since my last piece of analysis in late July. Their Reality Labs division, despite its historical losses, is now gaining momentum, particularly driven by their new Ray-Ban Meta smart glasses. They are reportedly selling out and have emerged as the top-selling product in about 60% of all Ray-Ban stores across Europe, the Middle East, and Africa. Revenue grew 28% in this division last quarter YoY.

The big reason for my follow-up coverage pre-earnings is driven by this division. The market sees this division as a money sink (hence why the benchmark is less on revenue and more on losses). I think we need to understand where this is going. This division could one day be the biggest revenue driver (much like how iPhones are for Apple (AAPL)).

Investors need to pay closer attention here (more than just watch losses) now that Meta is more than a social media company. Their wearables division is not the same one as the Web3 hype of late 2021. This is a real business that, I think, is scaling.

Ray-Ban Deep Dive

Meta released their latest smart glasses as a wearable accessory designed to improve user interaction with the environment. As of their September announcement, these Ray-Bans are equipped with features such as an integrated camera and advanced audio capabilities to allow users to capture their experiences effortlessly, and easily share their content on social media platforms.

One of the advantages of the Ray-Ban Meta glasses is the hands-free operation, so users can capture images and videos using voice commands, especially during outdoor sports. By saying commands to record, this makes the process of sharing experiences much more immediate and less intrusive, which, I think, is the future of form factor with technology. One user reported successfully documenting a fly-fishing trip, where they could easily capture the moment without needing to set up bulky equipment like GoPro. This is really a game changer.

Meta is also preparing to unveil key AI features in their Ray-Ban smart glasses, which include live translation, reminders, and advanced integrations with applications such as Spotify and Audible. For instance, users will be able to ask the glasses about landmarks while exploring new places or seek assistance in grocery stores based on visible products to facilitate content generation that is both spontaneous and relevant.

A device that real-time translates, allows you to listen to music or audiobooks, and captures some of your key moments with a built-in camera? These are a lot of the value propositions of modern smartphones.

The smart glasses already work well with the Apple Watch, according to one user, although the battery life could be improved.

Here’s what’s driving this push: historically, Meta faced challenges due to Apple’s implementation of App Tracking Transparency (ATT) that changed digital advertising. By restricting access to the Identifier for Advertisers (IDFA), Apple made it more difficult for Meta to track user interactions across apps, directly impacting the effectiveness of targeted advertising. Meta estimated that these changes resulted in a $10 billion revenue loss for the company. This was just a one-year loss, too. Meta gaining control of the hardware we interface with is key to their future.

This brings me to the smart glasses’ similarity to the iPhone’s emergence in 2007. iPhones changed the smartphone game because they combined advanced hardware with user-friendly software. If the iPhone brought photography and Internet access into a portable device, Meta & Ray-Ban are doing the same by reshaping how consumers capture and share experiences within the realm of augmented reality. They are doing it through a compact device with a stylish form factor.

Speaking on the future of the smart glasses, Zuckerberg said in a recent interview:

You really want to be able to not only ask the AI questions but also ask it to do things and know that it’s going to reliably go do it. We’re starting with simple things, so voice control of your glasses, although you can do that on phones, too, and things like reminders, although you can generally do that on phones, too. But as the model capabilities grow over the next couple of generations and you get more of what people call these agentic capabilities, it’s going to start to get pretty exciting.

Zuckerberg is explicit about his goal here: he wants these glasses to replace your phone. They very well might eventually.

Q3 Preview

To be clear, the rest of Meta right now (advertising) is firing on all cylinders, so expectations are highly optimistic for the social media giant. Wall Street analysts anticipate EPS to reach $5.27, sporting 19.99% year-over-year growth. Revenue estimates are equally strong, with expectations of approximately $40.30 billion, up 18.01% from the previous year.

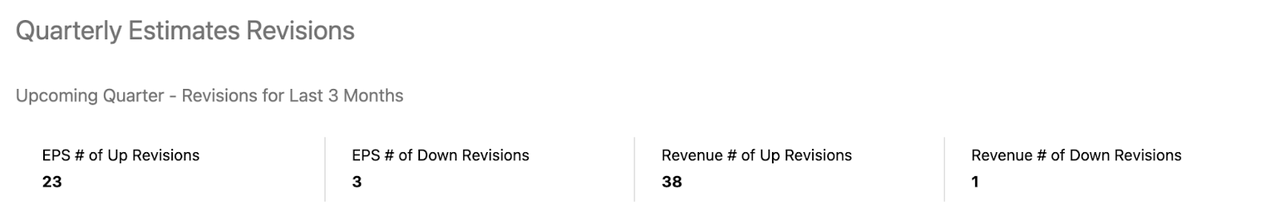

To be clear, heading into this quarter the street is becoming increasingly bullish, with 23 upward EPS revisions and 38 for revenue.

EPS & Revenue Revisions (Seeking Alpha)

Personally, on the earnings call, I’ll be focusing on qualitative insights showing that the new Ray-Ban Meta glasses are becoming a real hardware platform.

Specifically, I want to hear more about how these glasses have improved AI features to boost user interaction with the Meta family of apps. By simplifying the process of capturing and sharing content, these glasses should lead to increased user engagement on the platform. More content being shared directly correlates to higher advertising revenue for Meta. It is an added bonus on top of hardware sales.

Valuation

Meta currently trades at a non-GAAP forward P/E ratio of 26.78, which is lower than that of hardware competitors like Apple, which trades at a P/E of 34.84.

I think a big part of this discrepancy is driven by the controversies surrounding the company, including recent lawsuits regarding child safety on their platforms. Although some of these lawsuits pose reputational risks, many have been dismissed. I think the legal risks may be less impactful than what analysts are currently pricing in.

Despite the ongoing controversies, I am not arguing for a P/E ratio that matches Apple’s P/E. Rather, I think we need to focus on the forward PEG ratio vs. the sector median.

Forward PEG Ratios (Seeking Alpha)

If Meta shares were to converge with the sector median forward PEG ratio, this would represent an additional 18.96% upside in shares.

Risks

Following Apple’s clampdown on data sharing in 2021 and 2022, and the resulting slowdown in revenue for Meta, the company still faces data privacy issues, but I’m optimistic about the ways they have found to adapt. The company has focused on enhancing their advertising capabilities (to work around these privacy issues) and leveraging AI models to help build a digital copy of each users’ digital footprint so they can continue to serve high-quality ads.

Recent legal victories, such as the dismissal of lawsuits alleging that Meta misled investors about the impact of Apple’s privacy changes, is also helping the heavy market skepticism around the legal bill the social media giant could be facing. The legal threats are not done, however.

The company still faces continuous scrutiny from regulators and privacy advocacy groups. The scrutiny is bad enough that Apple has rejected the plans of AI partnership with Meta because of these privacy concerns.

Ironically, these new AI glasses (through Ray-Bans) offer an answer. If the company can fully control the tech stack (from software down to hardware) they’re going to be in a much better spot. This offsets much of the Apple/device risk, and reduces the need for external AI partnerships. It’s really a win-win to help mitigate many of the lingering concerns surrounding the tech giant.

Bottom Line

Despite losses exceeding $55 billion from their Reality Labs division, the launch of Ray-Ban Meta smart glasses, (coupled with their new AI features) is really a wise long-term strategy by Meta to redefine user engagement with social media through augmented reality features. We’re now starting to see the traction.

Meta’s Ray-Ban glasses possess key features that could revolutionize how users interact with their social media accounts, such as hands-free content capture and integration with applications like Spotify (SPOT) and Audible. I believe Meta’s shift towards innovative hardware could parallel the iPhone’s 2007 introduction, which transformed mobile technology and consumer behavior.

Given the potential of these new glasses to generate additional advertising revenue and increase hardware sales, I continue to believe Meta shares are a strong buy heading into earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.