Summary:

- I am upgrading Meta to a ‘Buy’ rating with a fair value of $620 per share due to Llama AI models’ transformative potential.

- Meta’s Llama 3.1 405B model is competitive with leading AI models, enhancing Meta’s advertising and social media platforms.

- Meta’s partnerships with major hyperscalers and the introduction of lightweight Llama models for smartphones could revolutionize AI adoption and monetization.

- Despite potential headwinds from Chinese advertisers, I anticipate 20% annual revenue growth for FY24, driven by AI investments and digital advertising market growth.

Kenneth Cheung

In my previous article in February 2024, I expressed a bearish view on Meta (NASDAQ:META) (NEOE:META:CA) because of the rising capital expenditure and future depreciation costs. I now believe Meta’s Llama AI models could potentially transform the company’s growth prospectus. I have revised both revenue growth and margin expansion assumptions, and I am upgrading to a ‘Buy’ rating with a fair value of $620 per share.

Progress In Llama 3.1

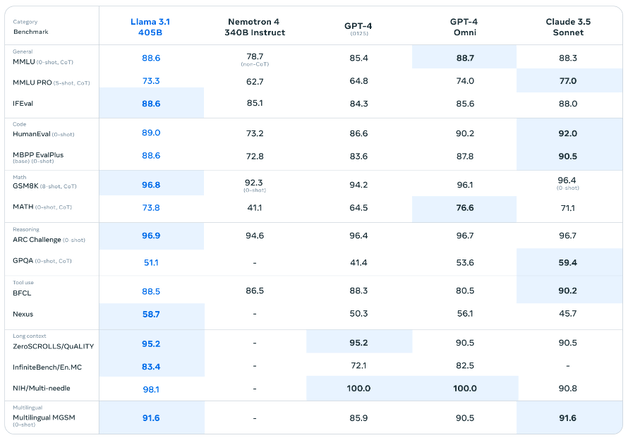

In July 2024, Meta introduced their Llama 3.1 405B, a leading openly available AI foundation model. As shown in the table below, Meta’s internal evaluation suggests that the Llama 3.1 405B model is competitive with leading foundation models including GPT-4, GPT-4o, and Claude 3.5 Sonnet.

I think Meta’s investment in their Llama AI model is mission-critical for Meta’s future growth. Key reasons are:

- Meta has been building its AI ecosystem around their Llama model, partnering with major hyperscalers, including Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL), NVIDIA (NVDA) and Databricks. Enterprise customers could leverage Llama AI model to perform their own AI training and inference tasks in the public or hybrid cloud infrastructure. These models can seamlessly integrate with GPUs, servers, and software platforms.

- Meta can utilize their AI features within their own advertising business and social networking platforms, enabling a more targeted marketing experience for marketers. In addition, AI-powered social media platforms could potentially enhance user engagement.

- On October 24th, Meta introduced their first lightweight quantized Llama models that can run on smartphones. The compressed versions of its Llama 3.2 1B and 3B models could enable developers to build their AI applications on mobile devices. I think the compressed version of AI model could be a game changer for AI adoptions, shitting from centralized AI training model to personal computing.

Q3 Review and Outlook

Meta is set to release its Q3 result on October 30th after the market close. The company is guiding for around 17% year-over-year revenue growth for Q3, which incorporates a weak growth among Chinese advertisers, as well as a high comparable for Reels impression growth in Q3 FY23. In addition, Meta expects 2% growth headwinds from FX. I think their guidance has reflected most headwinds but does not include any incremental growth driven by their AI models.

WPP (WPP), one of the largest advertising agencies, reported its Q3 result on October 23rd, with 4.8% organic revenue growth in their GroupM business, accelerating from 1.4% growth in Q2 FY24. During the earnings call, WPP’s management expressed strong confidence in their GroupM business growth for the next quarter.

As such, I anticipate strong advertising business growth in Q3 FY24. I expect Meta will maintain its recent growth momentum, delivering 20% annual revenue growth for FY24. From FY25 onwards, I have revised the organic revenue growth to 15%, up from 10% in my previous model, based on the following assumptions:

- Grand View Research predicts digital advertising market will grow at a CAGR of 15.5% from 2023 to 2030. I believe Meta’s investments in AI models could potentially accelerate their core advertising business growth, as the AI-powered platform could potentially improve ROI for targeted marketing campaigns.

- Meta has been building its AI ecosystem with key partners, making it easy for develops to access Meta AI models via public cloud and hybrid cloud infrastructures. With more AI applications being developed, Meta could potentially monetize their AI technology in the future.

- As discussed in my previous article, AI-powered search engines, such as OpenAI’s SearchGPT, might capture some market share in the global digital advertising market in the future, as conversation-based search is likely to be superior to traditional keyword search. Some marketers may choose AI-powered search engines for ads. As such, I assume Meta’s digital advertising revenue will be affected by 2% in the future.

- As such, I calculate Meta’s total revenue growth will be 15%, projecting: 15% overall market growth, 2% structural decline due to AI-powered search engines, and 2% growth from AI models.

In addition, I have adjusted the operating margin assumptions in the current DCF model, assuming the company will experience 20bps margin contraction over time. As discussed in my previous article, Meta’s heavy investments in AI, virtual reality and capital expenditures will increase their R&D and depreciation expenses.

For instance, Meta’s depreciation costs as a percentage of revenue rose from 4.2% in FY18 to 6.3% in FY23. The company anticipates a significant CAPEX increase in FY25, which will likely continue to create margin pressure in the near future. On the positive side, Meta’s restructuring costs have started to normalize in recent quarters. Consequently, I project Meta will improve its gross margin by 10bps, driven by growth in business associated with its AI models. I calculate that their depreciation costs will grow by more than 20% in the future, resulting in a 30bps margin pressure. As such, I project a 20bps margin contraction in the model. As a result, I anticipate Meta’s operating margin to decline to 34.2% by FY33.

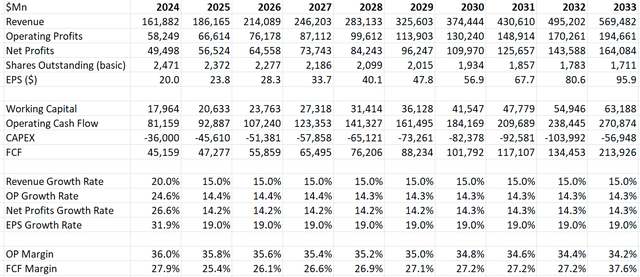

I adjusted WACC to 11.9% assuming: risk-free rate 3.6%; beta 1.32; equity risk premium 7%; cost of debt 5%; equity $153 billion; debt $18 billion; tax rate 16%. With these assumptions, the DCF can be summarized as follows:

Discounting all the FCF, the fair value is calculated to be $620 per share, as per my estimates.

Key Risks

As mentioned in my previous article, China-based advertisers, including Shein and Temu, contributed 5% of growth in FY23. On September 3rd, 2024, two leaders from the Consumer Products Safety Commission released an open letter asking commission staff to look into how Shein and Temu comply with US safety regulations.

The potential investigation could impact Shein and Temu’s operations, possibly leading these advertisers to reduce their digital advertising activities on Meta’s platforms.

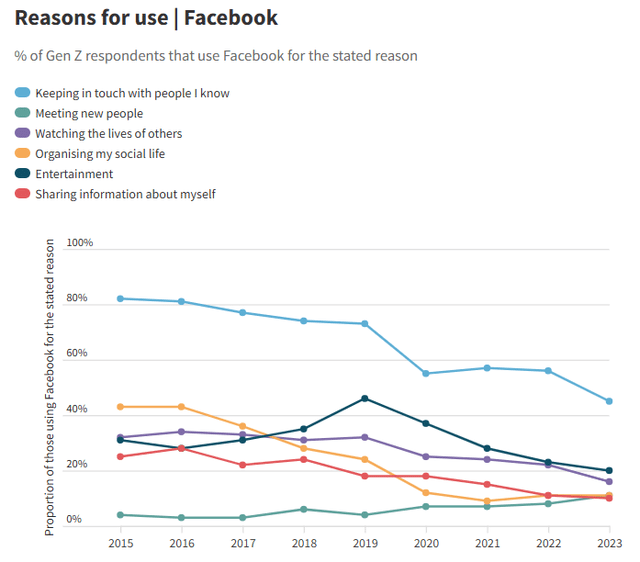

In addition, as shown in the chart below, Facebook has experienced a steady decline in Gen Z’s engagement over the past few years. If fewer young people continue to use Facebook, the platform might face some structural challenges over time.

Survey By State of the Youth Nation

Conclusion

Meta’s investment in Llama AI models could potentially accelerate the company’s core advertising business, and their partnership with major hyperscalers, hardware and software players will gradually build a strong AI ecosystem for developers. I am upgrading to a ‘Buy’ rating with a fair value of $620 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.