Summary:

- The amazing turnaround of Meta gained steam after second quarter results and guidance that exceeded expectations.

- Fueled by the recovery in ads and industry-leading targeting capabilities, Meta was able to sustain its momentum, showcasing an impressive 11% growth and a 441 bps adjusted margin expansion.

- CEO Mark Zuckerberg and CFO Susan Li tried to keep investors honest, as they repeatedly reiterated the company’s focus on Reality Labs, which surpassed $40B in cumulative losses.

- Let’s quantify the remaining upside and assess the magnitude of value destruction that is caused by Reality Labs.

panida wijitpanya

The amazing turnaround of Meta (NASDAQ:META) gained steam after second quarter results and guidance that exceeded expectations. I reiterate a Buy rating with a price target of $427 per share.

Introduction

Fueled by a recovery in the ads market and new industry-leading AI-based targeting capabilities, Meta was able to sustain its stock momentum with 11% revenue growth and 441 bps of expansion in its adjusted operating margin.

The social media giant upgraded its outlook for the remainder of the year and provided guidance that at its high point reflects 25% growth over the prior year period.

Presumably, CEO Mark Zuckerberg and CFO Susan Li tried to keep investors honest, as they repeatedly reiterated the company’s focus on Reality Labs, or as I like to call it, one of the largest cash burners in history.

As Reality Labs achieved the amazing milestone of being $40B in the hole, it seems even that can’t tame Meta’s stock, with its core business looking unstoppable.

Even with its CEO speaking enthusiastically about a passion project that can’t be justified financially, and probably won’t be justified in the foreseeable future, there’s plenty of meat left on the Meta bone.

So, let’s quantify the remaining upside and how large the reality labs’ burden is in terms of value destruction.

Quick Note: In my previous article covering Meta, I provided a detailed catalyst timeline for the last few years, analyzed its operating segments, described what I believe should be the investor takeaway from the Threads launch, and explained my investment thesis in detail. I encourage you to read it if you haven’t, you can see a link here: ‘Threads Launch Shows Huge Potential Post ‘The Year Of Efficiency.’

Financial Overview

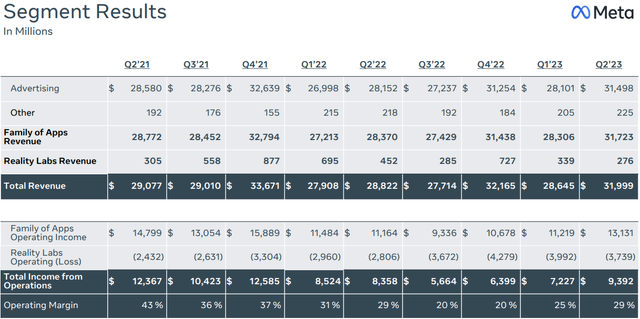

Meta Q2-2023 Earnings Presentation

Meta announced consolidated revenues of $32.0B in the second quarter, up 11.0% Y/Y. Family of Apps revenue grew 11.8% to $31.7B, whereas Reality Labs revenues declined 39% to $276M.

Family of Apps operating margin was 41.0%, still materially below its historical highs. For reference, the segment’s operating margin in Q2’21 was 51.4%, reflecting the immense remaining potential for future expansion.

Operating loss in Reality Labs continues to be appalling, coming in at $3.7B. For every dollar of revenue the segment generates, it loses an astounding $13.50. However, there isn’t a point in trying to connect the expenses with revenues when it comes to the Reality Labs segment, as the overwhelming majority of expenses go for R&D which is very far from producing a revenue-generating product.

On a consolidated basis, operating margins amounted to 29%. The underlying operating margin, which excludes non-recurring restructuring ($780M) and legal expenses ($1,184M), was 37.6%. While restructuring costs will continue to weigh on profits over the next two quarters, no additional legal expenses are expected. Thus, even with no operational improvement, we should see a very significant increase in GAAP operating margin in the third and fourth quarters.

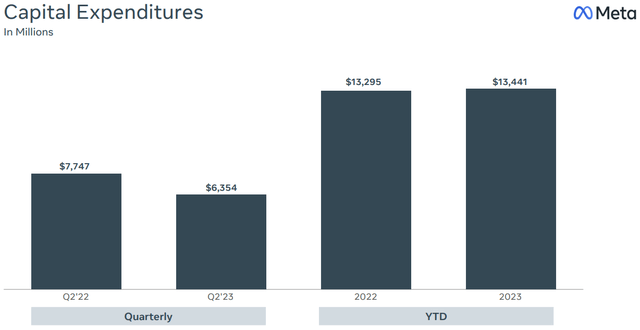

Meta Q2-2023 Earnings Presentation

As we can see, Capex decreased materially in the second quarter, primarily due to delays in several projects. This resulted in a new outlook for capex spending for the year, but management stated that these aren’t projects that are going to be canceled, as they now expect 2024 Capex to be higher than 2023, with the majority of Capex going to AI, infrastructure, and of course, the Metaverse.

Operational Overview

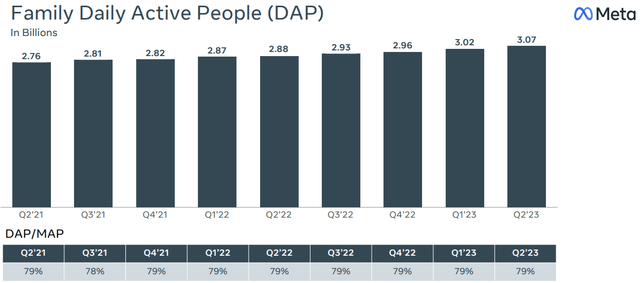

Meta Q2-2023 Earnings Presentation

Daily active people reached 3.07 billion users across the entire suite of the Facebook, Instagram, Threads, WhatsApp, and Messenger applications. Growth of five million people Q/Q and 199 million people Y/Y was broad-based across all geographies and apps.

The company mentioned there are over 200 million users of our WhatsApp Business, and more than 200 billion Reels played per day. On Reels, they announced that monetization is improving impressively, exceeding a $10 billion annual run-rate, up more than 3x from $3 billion last fall.

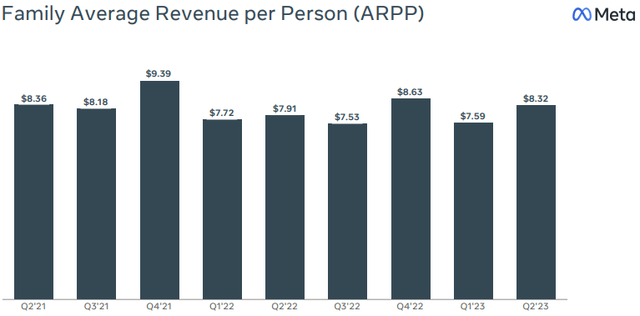

Meta Q2-2023 Earnings Presentation

The monetization improvement in Reels, along with early signs of recovery in the ads market, resulted in a very impressive increase in ARPP, which amounted to $8.32, almost exactly like the Q2’21 number. Notably, we can infer how significantly more expensive monetization is in the post-app-tracking-transparency era, with the Family of Apps margins being materially lower compared to 2021, even if we adjust for non-recurring items.

However, as ad recovery accelerates and Meta continues to improve and develop new solutions for ad efficiency, I believe it’s not unreasonable to expect a return to historical levels in Family of Apps margins.

Quantifying The Reality Labs Burden

Over the last three years, Reality Labs caused an operating loss of almost $30B. Since its inception, it’s now in the $40B range. As of last quarter, this segment generated $276M in revenues, a 39% decline from the prior year. Even after the Apple Vision launch, VR and AR remained a relatively niche market, with flat demand among teens.

Well, Meta doesn’t seem to care.

There are lots of components to the Reality Labs portfolio across VR, AR, Metaverse, social platforms, neural interfaces. And we really have a long-term time horizon for evaluating the return on our investments here.

Susan Li, CFO, Q2-2023 Earnings Call

So, there are a lot of components, and they have a very long-term horizon for calculating ROI. That’s great.

So in the near-term, we’re focused on growing adoption of the existing products and we’re constantly learning more about demand and use cases that inform our future plans. But lot of the investment that’s driving the growth here is around conducting the fundamental R&D to solve hard technology problems that are going to enable our vision here. A lot of is around clearing technical hurdles that will make subsequent devices smaller, cost less, weigh less, et cetera. So that’s really on the Reality Labs side. Again, as we said, we expect operating losses to increase meaningfully year-over-year in 2024. In 2024 specifically, I think that will be driven by a combination of both headcount-related and operating costs. But again, our ambitions in Reality Labs haven’t changed and it continues to be a significant long-term opportunity for us.

Susan Li, CFO, Q2-2023 Earnings Call

How much more meaningful could the losses be? In the last quarter, Meta could have generated an additional 25% in operating profit if Reality Labs did not exist.

I also think that a lot of this is going to be that it unlocks a lot of value for the other experiences, the current apps that we have, when you think of Family of Apps, just a lot of the potential value, whether it’s just engagement that could be created, features that we would love to build that we’re not allowed to because Apple or others just don’t allow us to build those things. And I think that that’s really unfortunate for the industry. I think that there’s a lot of lost engagement that would have happened, a lot of the monetization value that gets created.

Mark Zuckerberg, CEO, Q2-2023 Earnings Call

In my view, this is the real reason for the entire thing. Zuckerberg understood that Meta is the only big-tech company that doesn’t control any kind of direct-to-consumer access in terms of hardware, and decided that VR was the solution to reduce his dependency on Apple. However, it seems the opposite has happened. Meta is more reliant than ever on the success of its core, software-based businesses because it just burns so much cash on hardware and related products.

One quote that I found funny is that Mark Zuckerberg pitched the VR idea like a complete start-up founder, saying:

There are 1 billion or 2 billion people who have glasses today. I think in the future they’re all going to be smart glasses.

Not as funny, however, was the following quote:

I understand the discomfort that a lot of investors have with it because it’s just outside of the model of, I think, even most long-term investors.

So, we get the point. The company is focused on the Metaverse, despite the fact the CEO says, in his own straightforward words, it has no value even in the eyes of the very long-term investor.

Before getting into valuation, let’s quantify the value destruction of Reality Labs with some back-of-the-envelope math.

Today, Meta’s market cap at the time of writing is $834.1B, and its net cash position is $17.2B, so we arrive at a $816.9B enterprise value. Over the trailing twelve months, Meta generated a consolidated operating profit of $28.7B, reflecting a 28.5x EV/EBIT multiple.

Over the last twelve months, Reality Labs’ operating loss equals $15.7B. Excluding Reality Labs, Meta’s LTM operating profit would be $44.3B, reflecting an 18.4x EV/Multiple.

Some might argue that the Reality Labs segment provides incremental multiple, which means that without it, Meta would be trading at a lower consolidated multiple. In my view, that is not true, and it seems Mark Zuckerberg agrees. While I could argue the opposite, that Meta would be trading at a higher multiple, I’ll go easy on Reality Labs enthusiasts.

Let’s say, that Meta would trade in the middle. Taking a 24x multiple, and keeping in mind it seems high because the last twelve months are not representing in terms of profitability, we arrive at an enterprise value of nearly $1.1B, reflecting more than 30.0% upside over today’s price.

I’m sorry, but that’s just hurtful. Will Reality Labs, ever, recover those $40B losses? I’m doubtful.

Quantifying The Remaining Upside

Let’s shake the Reality Labs problem off our heads and focus on reality. It’s not going away any time soon, and we have to model Meta accordingly. Fortunately for Mark Zuckerberg, his core social media empires are amazing businesses, which are more than able to fund his passions.

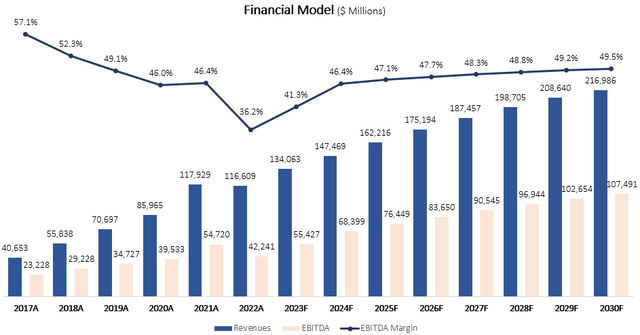

I forecast Meta will grow revenues at a 7.1% CAGR between 2023-2030. Based on my expectations, Reels will continue to take share and improve monetization, WhatsApp businesses will continue to grow, and the ad market will return to its historical trendline. My projections are pretty much in line with the consensus but are significantly below Meta’s past 6-year CAGR of 23.5%.

I project EBITDA margins will increase incrementally up to 49.5% in 2030, as margins recover to historical levels. Keep in mind that Meta achieved margins higher than 57% in the past, but that was before ATT and Reality Labs, and the competitive landscape was more favorable.

Thus, I estimate 49.5% is a reasonable target, which reflects lower losses in Reality Labs and only a partial recovery in Family Apps.

Overall, my assumptions result in EBITDA growth above revenue, reflecting operational leverage, efficiency, and recovery from temporary headwinds.

Created and calculated by the author based on Meta financial reports and the author’s projections

Taking a WACC of 8.3%, I estimate Meta’s fair value at $427 per share, which represents a 31.1% upside compared to the market price at the time of writing.

This valuation reflects a 2024 P/E of 24.4x based on my EPS projection for 2024, which is significantly above the consensus, reflecting ongoing buybacks and a faster margin recovery to 29.1% (rather than the consensus of 27.8%). Keep in mind that after adjusting for restructuring and legal expenses, the company already achieved 26.3% in the second quarter.

Conclusion

Reality Labs is a shareholder’s nightmare, and with the stock surging more than 4x since its bottom, it seems Meta’s management is once again determined to increase the investments in the founder’s vision.

In my opinion, Reality Labs won’t be value accretive for the foreseeable future, or in the legendary CEO’s own words – it’s outside the model of even very long-term investors.

On the flip side, Meta’s core businesses are firing on all cylinders, fueled by improved Reels monetization and advertising recovery. Every arrow is pointing up, and the company should see revenue growth accelerate to the 20% range, along with a significant margin expansion.

I still estimate there’s a lot of upside remaining, and reiterate a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.