Summary:

- Meta Platforms has recently raised their FY2024 capex guidance while highlighting significant CapEx growth in 2025, thanks to its ongoing AI investments.

- The same has been reported by multiple hyperscalers and advertising giants, despite the market’s recent pessimism surrounding the delayed monetization.

- For now, META prefers to “risk building capacity before it is needed rather than too late, given the long lead times for spinning up new inference projects.”

- With the giant continuing to report rich Free Cash Flow generation and healthy balance sheet, we shall discuss why we believe the intensified spending remains judicious.

monsitj/iStock via Getty Images

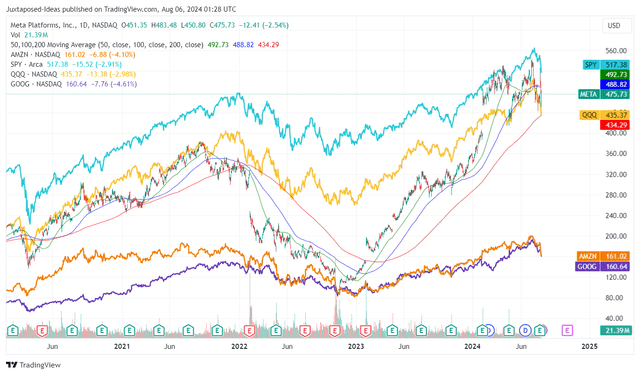

We previously covered Meta Platforms, Inc. (NASDAQ:META) (NEOE:META:CA) in April 2024, discussing its robust AI investments which had contributed to the massive rebound in its revenues/ operating margins/ FCF generation in FY2023 and FQ1’24, with the Apple (AAPL) privacy headwind well behind us.

Combined with the potential tailwinds from the TikTok ban, we believed that META was likely to continue dominating the global social media scene moving forward, made significantly attractive by its inherently cheaper valuations compared to its Magnificent Seven peers.

Since then, META has rallied by +23.4% at its peak, before drastically pulling back despite the robust FQ2’24 earnings results and promising FQ3’24 guidance, attributed to the ongoing market rotation from high-growth stocks and the market’s uncertainty surrounding slower AI monetization.

Even so, we are reiterating our Buy rating here, with its advertising prospects still excellent during the ongoing US election and the recent correction bringing forth attractive entry points for those looking to dollar cost average.

Combined with the consistent shareholder returns through dividend payouts and share repurchases, we maintain our optimism surrounding META’s long-term investment thesis, thanks to the management’s strategic focus on AI related investments.

META Raised Its FY2024 Capex Guidance Again – Has Generative AI Delivered Improved Financial Performance?

META 4Y Stock Price

After charting an impressive +491.8% return from the October 2022 bottom, it appears that META has finally exhausted the uptrend as the stock market rotates from Big Tech and “the fallout quickly spreading across the globe.”

This is despite over 80% of companies (that reported earnings this week) surpassing profit expectations, highlighting areas of strength due to the artificial intelligence and broader economic trends.

The same has been reported by META, with FQ2’24 revenues of $39.07B (+7.1% QoQ/ +22.1% YoY) and adj EPS of $5.16 (+9.5% QoQ/ +73.1% YoY), thanks to the robust advertising demand and the higher average price per ad by +10% YoY.

The tailwinds are naturally attributed to the growing Family daily active people of 3.27B (+0.03B QoQ/ +0.2B YoY), with the inherent stickiness of its well-diversified social media platforms triggering exemplary ad impression growth by +10% YoY.

Readers must also note that META has been reporting growing WhatsApp user base globally at an estimated number of 2.78B globally in 2024 and 100M in the US by FQ2’24, along with Threads at nearly 200M (+33.3% QoQ/ +100% from FQ3’23 levels).

This is especially since WhatsApp has also been primarily contributing to the Family of Apps revenue growth to $389M (+2.3% QoQ/ +72.8% YoY), with Threads only set to introduce ads by H2’24, implying its ability to further grow advertising dollars while directly competing with Elon Musk’s X (previously Twitter).

It is apparent from these developments that META’s moat remains undisputed, especially since the TikTok ban seems highly likely with numerous US states supporting the notion.

Therefore, despite the market’s previous over-reaction to the supposed reversal in its 2023 Year of Efficiency initiatives, as observed in the raised FY2024 capex midpoint guidance to $38.5B (+37% YoY), compared to the previous guidance of $37.5B (+33.4% YoY) and the original guidance of $33.5B (+19.2% YoY), it is apparent that these AI-related investments are already bearing fruit in its top/ bottom-line performances, as discussed above.

This also explains why META has highlighted “significant CapEx growth in 2025 as we invest to support our AI research and our product development efforts,” mirroring the sentiments offered by hyperscalers such as Google (GOOG), Microsoft (MSFT), and Amazon (AMZN) in their recent earning calls.

At the same time, the management has already hinted at their ambitions to be a marketing giant as well, with “advertisers will basically just be able to tell us a business objective and a budget, and we’re going to … generate creative for advertisers as well.”

This new strategy allows META to tap into the growing global digital marketing market from $366.1B in 2023 to $1.02T in 2032, expanding at a CAGR of +11.8%, naturally triggering further AI monetization opportunities from its existing advertising platform.

As a result, we maintain our previous conviction that the intensified capex and the massive Blackwell purchases worth $10B are well worth it, since they will eventually be accretive to its top/ bottom-lines.

Lastly, with an extremely rich Free Cash Flow generation of $48.56B (+108.3% sequentially/ +135% from FY2019 levels) and margins of 32.4% over the LTM (+13.1 points sequentially/ +3.9 from FY2019 levels), META remains more than well capitalized to aggressively “risk building capacity before it is needed rather than too late, given the long lead times for spinning up new inference projects.”

Despite the ongoing cash burn reported in the Reality Lab segment, the social media giant continues to report a healthier balance sheet with a net cash position of $39.69B (in line QoQ/ +13.2% YoY) and 0.24B/ 8.3% of its float retired since FY2019.

It is apparent from these developments that META has been rather judicious in its cash flow allocation thus far, significantly aided by the quarterly dividends paid out since early 2024.

The last question on our minds is, when will the Reality Lab efforts bear fruit, especially since they “expect 2024 operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem,” with the next few years likely to remain similar.

Only time may tell.

The Consensus Forward Estimates

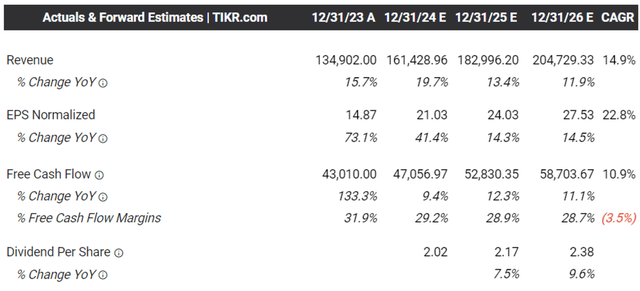

Perhaps this is why the consensus has raised their forward estimates, with META expected to generate a top/ bottom-line growth at a CAGR of +14.9%/ +22.8% through FY2026.

This is compared to the original estimates of +9.24%/ +11%, while nearing its historical growth at a CAGR of +33.7%/ +26.6% between FY2016 and FY2021 (prior to AAPL privacy changes), respectively.

With META’s AI investments already bearing fruit and driving engagement across consumers, advertisers, and developers, we believe that these consensus estimates are not overly aggressive as well, especially given the robust FQ2’24 performance above.

This is on top of the FQ3’24 revenue midpoint guidance of $39.75B (+1.7% QoQ/ +16.4% YoY), implying the management’s conviction of delivering robust growth despite overlapping a tougher YoY comparison to FQ3’24 growth at +6.7% QoQ/ +23.2% YoY.

So, Is META Stock A Buy, Sell, or Hold?

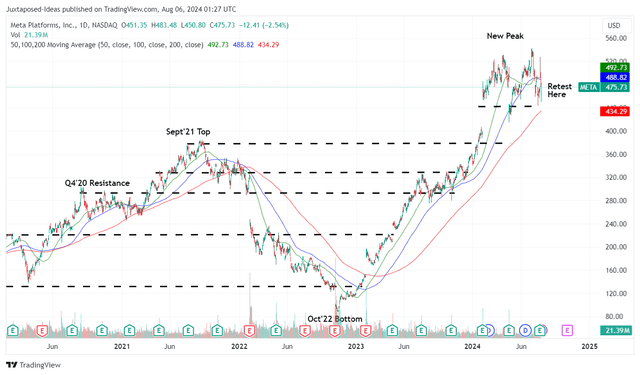

META 4Y Stock Price

For now, META has failed to break out of its 2024 peak of $530s while returning most of the recent FQ2’24 gains – likely attributed to the skittish market sentiments and the ongoing correction.

For context, we had offered a fair value estimate of $414.10 in our last article, based on the LTM adj EPS of $17.41 ending FQ1’24 and the 1Y P/E mean of 23.79x (near its 5Y mean of 23.05x). This is on top of the long-term price target of $634.20, based on the consensus FY2026 adj EPS estimates of $26.66.

Based on the LTM adj EPS of $19.56 ending FQ2’24 and the same 1Y P/E mean, we are looking at an updated fair value estimate of $465.30, implying that META’s recent profit taking has been warranted indeed.

Even so, based on the consensus raised FY2026 adj EPS of $27.53 (+3.2%), we are looking at an updated long-term price target of $654.90, with there remaining an excellent upside potential of +37.6% from current levels.

As a result of still attractive risk/ reward ratio at current levels, we are maintaining our Buy rating for the META stock.

Risk Warning

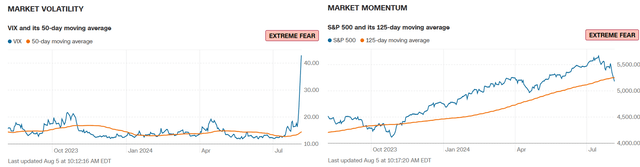

Market Momentum Turning Pessimistic

It is no secret that the wider stock market has been rather volatile over the past few weeks, with the CBOE Volatility Index hitting new heights and the SPY breaching the prior 125 trading days rolling average.

Combined with the impacted labor market triggering intensifying recession fears, we believe that the next few months may bring forth more volatility until the Fed pivots as projected by the September 2024 FOMC meeting.

Therefore, while META has been reporting robust advertising revenues in FQ2’24 with it likely to benefit from the ongoing US election through November 2024, we believe that the stock’s near-term performance is likely to be impacted prior to the reversal in market sentiments.

As a result, while we remain optimistic about its long-term prospects, our Buy rating comes with the caveat that investors hold on to their dry powders and observe the stock’s movement for a little longer, before adding upon a pullback to the established support levels of $450s for an improved margin of safety – with those levels also lower than our fair value estimates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.