Summary:

- After a grueling 2022, Meta has rebounded with gusto, proving that the epitaphs written in late 2022 were misguided.

- Free cash flow margins have rebounded immensely, reaching over 30% in Q2 2023, and the company guided for ~20% growth in Q3 2023, at the midpoint of guidance.

- Meta’s CFO has been firing on all cylinders, and the company’s legacy platform, Facebook, continues to exhibit solid growth, relatively speaking.

- With robust free cash flow margins, a series of defensible moats, an excellent CEO and CFO (notwithstanding the excessive VR spend), and more room for its legacy platforms to grow, I believe Meta will continue to perform well as a stock and business for the decade to come.

Kira-Yan

A Foundational Three Part Series

As a student of market history over the last 100 years or so, I can say with a fair degree of certainty that Meta’s price action over the last 18 months will be studied possibly for the next 100 years.

In no uncertain terms, Meta’s share price collapse amounted to something akin to a Great Depression-style decline, falling from nearly $400/share to below $90/share in the span of about 12 months.

Interestingly, throughout the entire process, the business continued to produce fairly solid earnings reports, and I documented these solid earnings reports via a three part series, in which I likened Meta’s experience to that of the Washington Post (formerly GHC before being sold to Jeff Bezos) from 1973-1975.

- Meta: The Modern Day Washington Post, Part III (NASDAQ:META)

- Meta: The Modern Day Washington Post Part II (NASDAQ:FB)

- Facebook: The Washington Post Of Our Time (NASDAQ:FB)

Today, I still believe that this remains an apt analogy, and we considered it extensively in the three part series linked above.

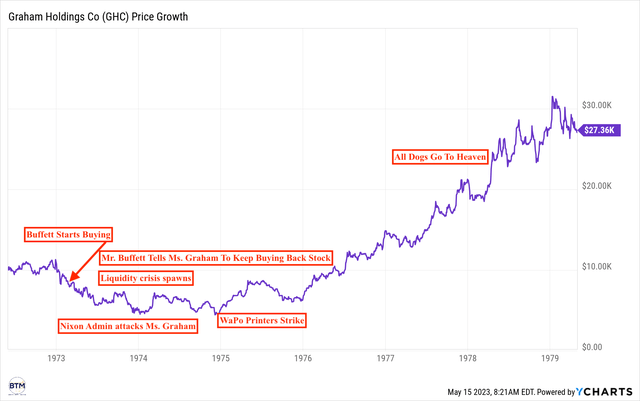

The Washington Post Analogy Depicted In A Chart

- In short, Mr. Buffett bought the WaPo about a year before “all hell would break loose” for the company, e.g., its advertisers would strike, its printers would strike, and it would be targeted directly by the Nixon Administration for its Pentagon Papers coverage.

- The stock price fell 30-70% multiple times over a three year period.

In the same way I’ve studied the share price dynamics of Walmart (WMT) and the Washington Post (formerly owned by ticker symbol: GHC, before being purchased by Mr. Jeff Bezos in 2014) circa 1973-1975, I believe students of market history will study late 2022; specifically Meta, for possibly the next 100 years of American capitalism.

In the interest of brevity, I will conclude this introduction here; however, I would highly encourage you to study the WaPo analogy, if you’ve not already, as it very intimately illustrates what it’s often like to own businesses in the stock market. That is, we will often have to endure exceptional volatility, and our businesses will often face substantial obstacles, just as we, as individuals, do in our own lives, and these periods of adversity can and will span years, if not a decade plus, in some instances.

The stock market is a device for transferring money from the impatient to the patient. – Warren Buffett

My Five Point Meta Thesis

In the three part Meta series in which I analogized Meta to the Modern Day Washington Post, I would often share a distilled thesis for the business/stock with you.

I recently articulated my latest version of this distilled thesis for Meta in our recently published series, “Investment Theses Simplified.” I shared that thesis, with a few updates based on Q3 2023 earnings, below:

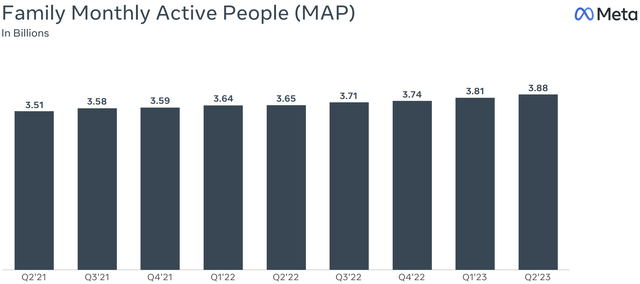

Total Monthly Meta Users On All Apps: WhatsApp, Facebook, Instagram, Threads, and Messenger

Meta’s Q2 2023 Earnings Slides

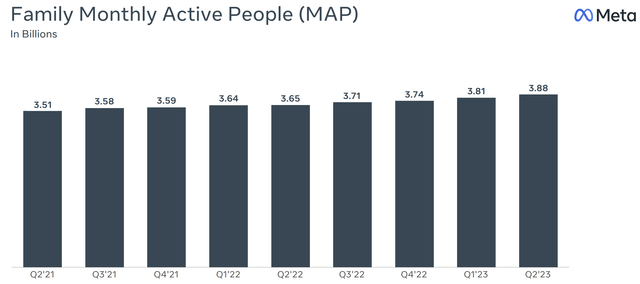

- Meta has room to grow its Family of Apps user base to 5B+ in the next decade (as we can see in the chart above, we’re at 3.88B currently). While not all of these new users will be exceptionally valuable, I believe earth’s digital industrialization trend will actually afford Meta more value capture than most may appreciate from new, emerging cohorts (regions) from around the world.

- I believe (others may disagree) that Facebook (referencing the app; not the company itself) is a monopoly (there’s infinite competition for attention, but there’s only one Facebook), and I believe the app to be “the most wholesome app on earth;” by which I mean it is the app where people go to engage with family and friends (looking at baby photos, sharing family reunion photos, etc.), not with celebrities, entrepreneurs, and, oftentimes, unrealistically attractive people.

- I believe (others may disagree) that WhatsApp is a something very, very close to a monopoly for global communications. In America, we largely use SMS, but, in LatAm or APAC or the EU, WhatsApp is the dominant platform for communications. Further, WhatsApp for business achieved 200M users in Q2 2023, and this will likely create noteworthy embedding moats + further room for monetization of the WhatsApp platform in the years ahead, atop the already noteworthy network effects moat that WhatsApp possesses.

- Instagram operates in a duopoly with TikTok (which is owned and, quite likely, at least in part, operated by the CCP, which should be noted), and Instagram has been gaining share here. “Reels is a key part of this discovery engine, and Reels plays exceed 200 billion per day across Facebook and Instagram. We’re seeing good progress on Reels monetization as well with the annual revenue run-rate across our apps now exceeding $10 billion, up from $3 billion last fall.” (Meta’s Q2 2023 Earnings Call).

- Meta has ~$53B in cash, robust free cash flow, and ~$18B in convertible debt, the raising of which I praised effusively in our recent note on Meta.

Let’s now turn to a review of Meta’s Q2 2023 earnings. We will start with an exploration of point number 5 just above: Meta’s CFO’s work, which has been stellar.

Meta Hired A Fantastic CFO

Many revered Meta’s former CFO, Ms. Sheryl Sandberg, over the last decade or so, and it appears Meta has once again selected a fantastic CFO, at least based on the strategy she has executed over the last year or so, during which Meta’s share price experienced the previously mentioned “Great Depression-style” collapse.

Specifically, Meta’s CFO has executed a leveraged recapitalization over the last 12 months, which has been the perfect time in which to do so.

As I shared recently,

META has ~$53B in cash and ~$18B in debt as of Q2 2023. It’s currently executing a leveraged recapitalization, so its debt will likely hit $50B in the year ahead, and that debt capital will be used to buy back even more shares than they’ve bought back over the last 5 years (which has been a lot). I am okay with this decision. That said, it’s supposed to discipline capital allocation as well as optimize cost of capital.

Reality Labs, as it’s been executed, is antithetical to this strategy.

I suppose… In Zuck we trust (with respect to Reality Labs)

“Optimizing cost of capital” suggests lowering “WACC” which suggests “maximizing NPV of the business’ future cash flows.”

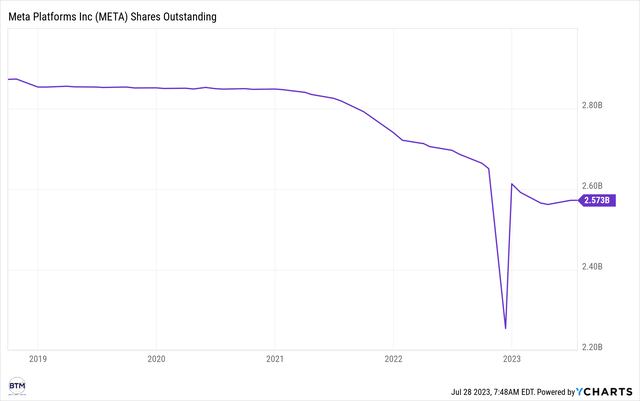

Meta’s Shares Outstanding

As I alluded to above, Meta has been using its debt capital to buy back shares, and it will likely continue to do so, especially in light of the discount at which Meta continues to trade to what I, and likely management, believe to be fair value.

Meta Shares Outstanding

Meta’s continued execution of its leveraged recapitalization will further reduce shares outstanding in the quarters and years ahead, while lowering its cost of capital [WACC in finance parlance] and maximizing the NPV of the firm (lower WACC = lower discount rate = higher value on future cash flows that Meta produces).

I understand there’s a lot of finance jargon here, and we’re not all finance professionals, but this is the reality of what’s underway at Meta presently, and it’s quite exciting for future valuation creation from a share price perspective!

Turning To Results Via A Series Of Charts

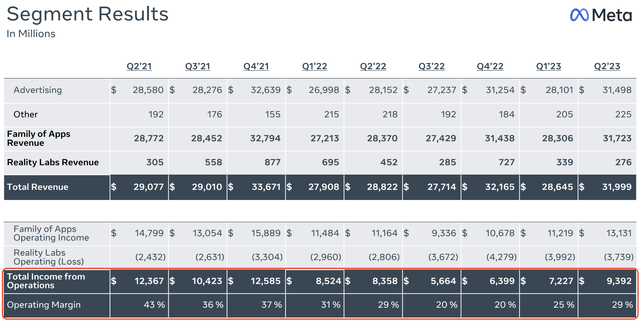

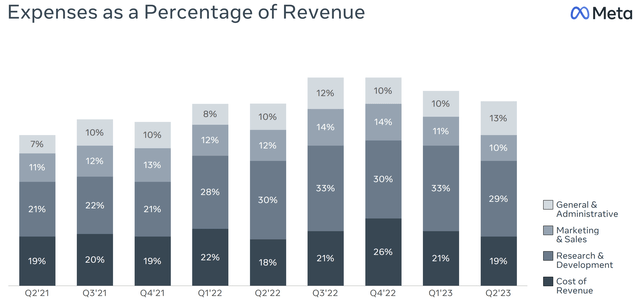

One of the most important components of Meta’s recent report was its expense control, which we can see highlighted in the chart below:

Meta’s Operating Margin Continues To Trend Upward

Meta’s Q2 2023 Earnings Slides

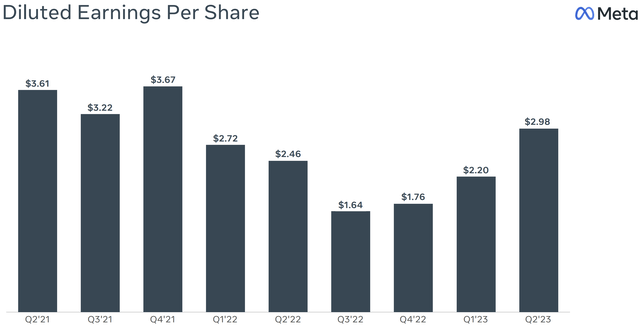

As expenses have fallen, operating margin has expanded, which has created growth in Meta’s earnings:

Meta’s Earnings Per Share Has Been Growing

Meta’s Q2 2023 Earnings Slides

Notably, these earnings would be materially higher, and Meta’s share price would likely be over $400/share, were it not for Meta’s extremely aggressive Reality Labs spend, which has objectively not been great thus far.

I think Meta was far too aggressive far too early in its allocation of capital to this promising, though very long term opportunity.

Meta’s Expenses As A Percentage Of Revenue Continue To Decline

Meta’s Q2 2023 Earnings Slides

In short, notwithstanding the likely excessive Reality Labs (virtual reality) spend, I’m very happy with Meta’s management of its expenses, i.e., it has substantially reduced its expenses, e.g., it reduced headcount 14% year over year.

User Growth

As you may know, my thesis for Meta could be summarized simply by the phrase:

Onward to 5B users!

In my last review of Meta, I noted that the company added more users to its Family of Apps than it had in years:

As the above chart illustrates, monthly active people continues to inch closer to 4B, and, in Q1 2023, we experienced our largest sequential add in years.

I say again: We experienced our largest sequential addition of users to Meta’s Family of Apps in years!

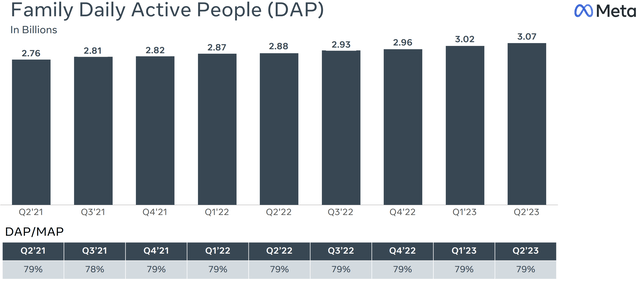

Meta’s Family of Apps Daily Active Users

Meta’s Q2 2023 Earnings Slides

While Q2 2023 wasn’t exactly as great as last quarter from a DAUs perspective, from a sequential addition of users perspective, it was still quite good.

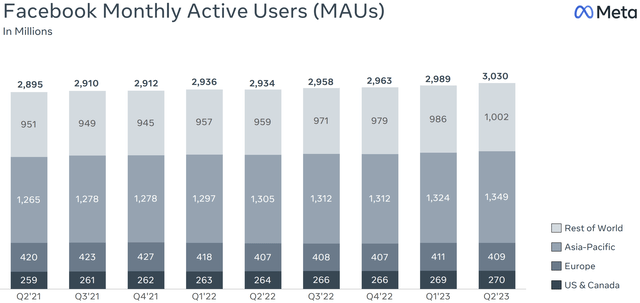

From a MAUs perspective, Q2 2023 was quite stellar, akin to last quarter:

Meta’s Family of Apps Monthly Active Users

Meta’s Q2 2023 Earnings Slides

Onward to 5B users!

The Monopoly Of Old Blue Rumbles Forward

- Note: It is my personally held belief (with which others will certainly disagree, and that’s what makes a marketplace of ideas) that Facebook is a monopoly through a certain lens.

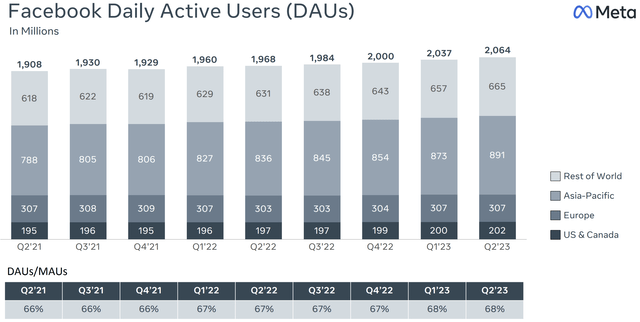

Meta’s Q2 2023 Earnings Slides

Interestingly, legacy Facebook had a fantastic showing in the quarter, with even U.S. and Canada showing growth in daily actives (darkest segment of the bar chart at the very bottom).

And Facebook’s Monthly Active Users likewise showed great growth.

Meta’s Q2 2023 Earnings Slides

As the only app that does what it does, it’s likely that Facebook continues to experience growth for years and decades to come, though there may be periods where it does not experience growth, and there may be periods, like Q1 and Q2 of 2023, where it experiences exceptional growth.

Cash Dynamics

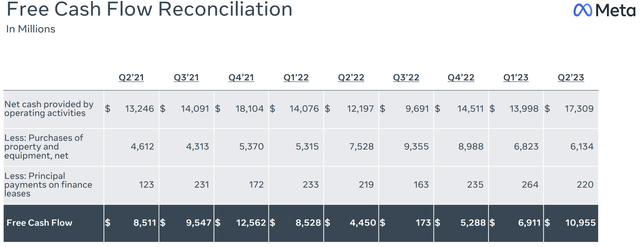

We’ve already covered this topic to a large degree in discussing Meta’s balance sheet strategy/execution of a leverage recapitalization; however, it’s worth noting that the business has returned to producing very robust free cash flow.

While its 34% free cash flow margin in the quarter was bolstered by a one-time tax benefit, the reality is that Meta’s free cash flow margin could easily sustain 35%, if not more, granted it wasn’t reinvesting into its business so aggressively. Eventually, the very aggressive near-term reinvestment will revert to the mean.

Meta’s Cash Flow Production (Very Bottom Of Chart)

Meta’s Q2 2023 Earnings Slides

Over the long run, I expect its free cash flow margin to hover around 35%, if not a bit higher.

Meta’s Q2 2023 41% EBIT margin for its core Family of Apps business gives me confidence that it will achieve this over the long run (of course, Reality Labs spend, presently, is depressing this margin for the entire conglomerate).

Concluding Thoughts: The Microsoft Of Social Media

Akin to our analogizing Meta to the Washington Post, I believe it’s a worthwhile exercise to analogize Meta to Microsoft of ~2000.

In the same way Meta has been hated by many over the last five or so years, and, specifically, in the same way Zuck has been hated by many over the last five years or so, so too were Microsoft and Mr. Gates hated by many in the late 1990s and early 2000s.

In the same way the FTC has targeted Meta over the last five years, the FTC targeted Microsoft in the late 1990s and early 2000s.

In the same way Microsoft has captured the majority of economic value in software, in accordance with Pareto’s Principle, so too has Meta captured the majority of economic value in social media, in accordance with Pareto’s Principle.

The similarities are striking.

But the one difference in my mind, and it’s the difference I’ve noted often, is that Zuck is a thoroughbred dog.

Zuck is a stone-cold operator through and through, and, while imperfect, I believe he’s a good man as well.

He has not been derailed by the antitrust attacks; by the media attacks, nor by the Great-Depression-style share price collapse of late 2022.

In fact, he’s arguably the best he’s ever been as a CEO, and, at 39 years old, he still has ample stamina to evolve Meta into the next version of the business in the years and decades ahead, just as he has time and time again over the last 20 years.

Within my equity research coverage universe, I mostly own/cover businesses with Founder-CEOs at the helm who can adroitly deploy capital in such a way that they “spawn” new lines of businesses that ultimately serve to create compounding, outlier growth, and I believe Zuck fits perfectly into this category, and, as such, I am excited for our decade ahead in partnership with Meta.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.