Summary:

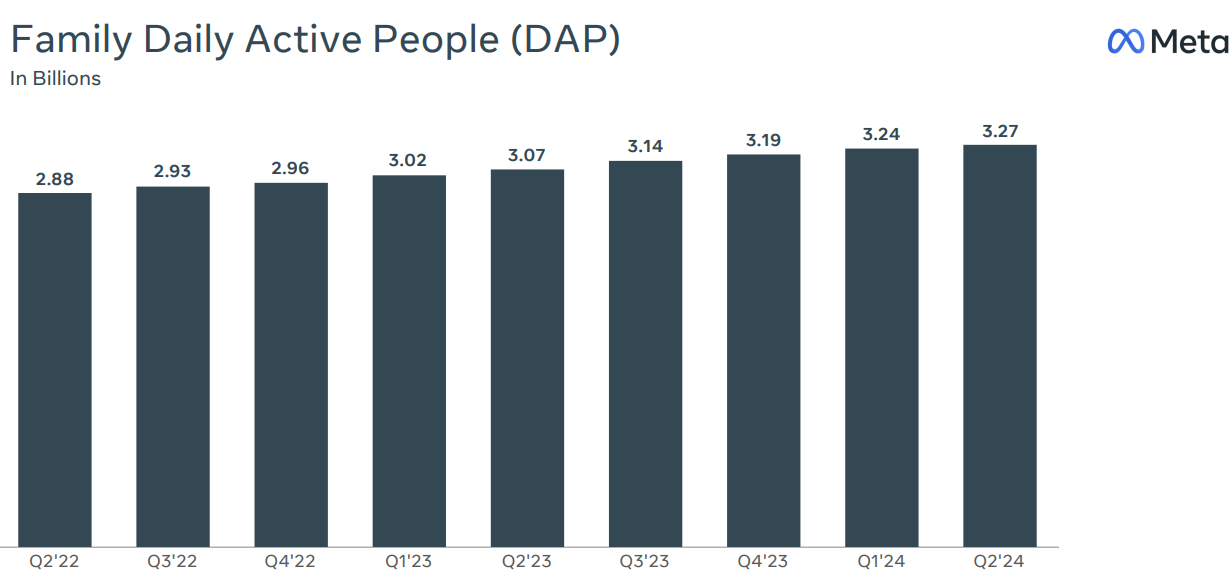

- Meta hit 3.2 billion daily active users in Q2 2024, with WhatsApp reaching 100 million monthly U.S. users.

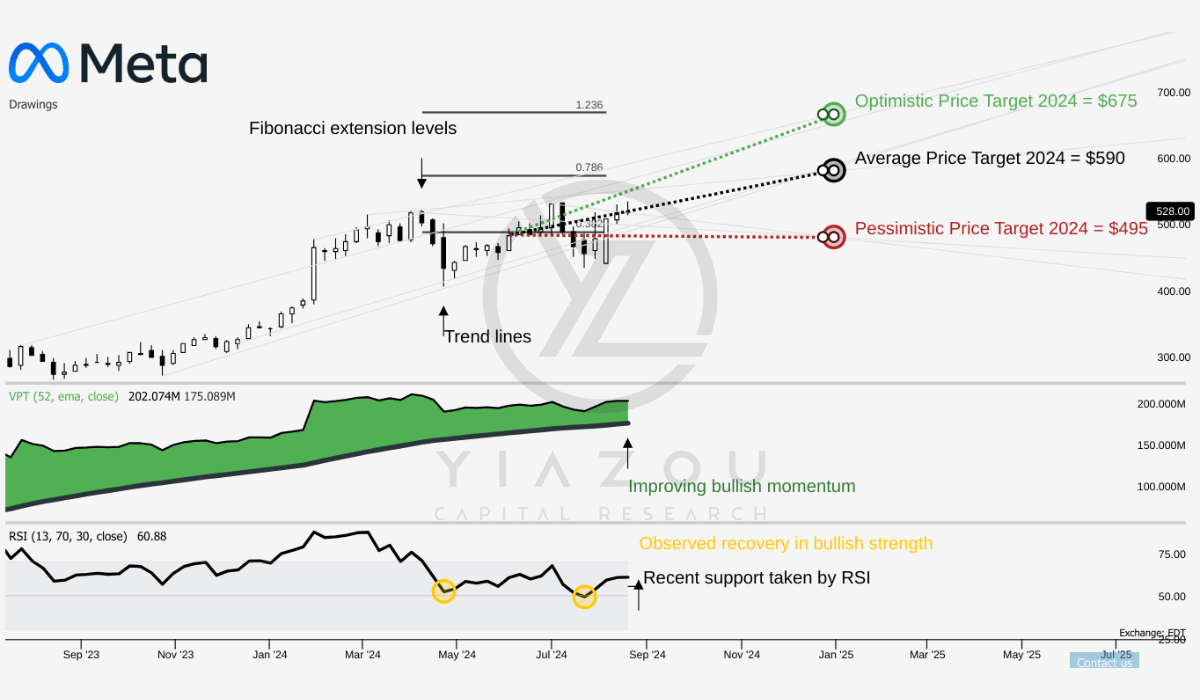

- RSI at 60.88 indicates upward solid momentum for META ahead of its October earnings.

- Meta shows strong support at $590, with a bullish target of $675 based on key Fibonacci levels, indicating potential for a breakout.

- Despite a $4.5 billion loss, Reality Labs posted a 28% revenue increase, focusing on AR/VR and metaverse growth.

- Family of Apps revenue grew 22% annually in Q2 2024, driven by $38.3 billion in ad revenue.

Urupong

Investment Thesis

While Meta Platforms’ (NASDAQ:META) (NEOE:META:CA) performance has been muted since our last coverage, it has shown resilience and the ability to grow in the long term. The stock is poised to build momentum as we approach its earnings report in late October, with the Relative Strength Index (RSI) showing a bullish divergence that suggests growing upward momentum.

Meta’s forward P/E ratio of 24.5 increased from the five-year average, and its peers essentially reflect an elevated expectation for market earnings. This premium valuation is justified because of Meta’s strategic investment in AI, advertising, and its fast-growing metaverse initiatives, all combined to show increased revenue growth.

With Meta’s strong market position and indications of technical gain, holding the stock until 2024 to attain the updated optimistic target price of $675 remains a sound strategy.

META on the Verge of a Breakout: Bullish Indicators Align for Potential Surge to $675

The technical analysis of META’s stock price involves a detailed examination of various indicators and projections, which offer insights into potential future movements. The current price of META stands at $521, and the average price target for 2024 is projected at $590, which aligns with the 0.786 Fibonacci retracement level. This suggests that, given historical price retracements, this target represents a strong support level where the stock might find equilibrium before further movement.

The optimistic target of $675 aligns with the 1.236 Fibonacci extension level, indicating a potential bullish scenario where the stock could surpass its historical high and continue to ascend. Conversely, the pessimistic target of $495, in line with the 0.382 Fibonacci retracement, reflects a scenario in which the stock could experience a retracement to a lower support level if bearish conditions prevail.

The RSI is currently at 60.88, which indicates that META is in bullish territory but not overbought. The RSI shows a bullish divergence, meaning that the stock’s price is rising while the RSI is also trending upwards, reinforcing the potential for further gains. The RSI line trend is upward, suggesting continued positive momentum.

Lastly, the Volume Price Trend (VPT) line is also upward and reversing upwards. The current volume price trend is $202.10 million, above its moving average of $175.10 million. Hence, this indicates that the volume supports the price movement and that the stock is in a long setup phase.

Yiazou (TrendSpider)

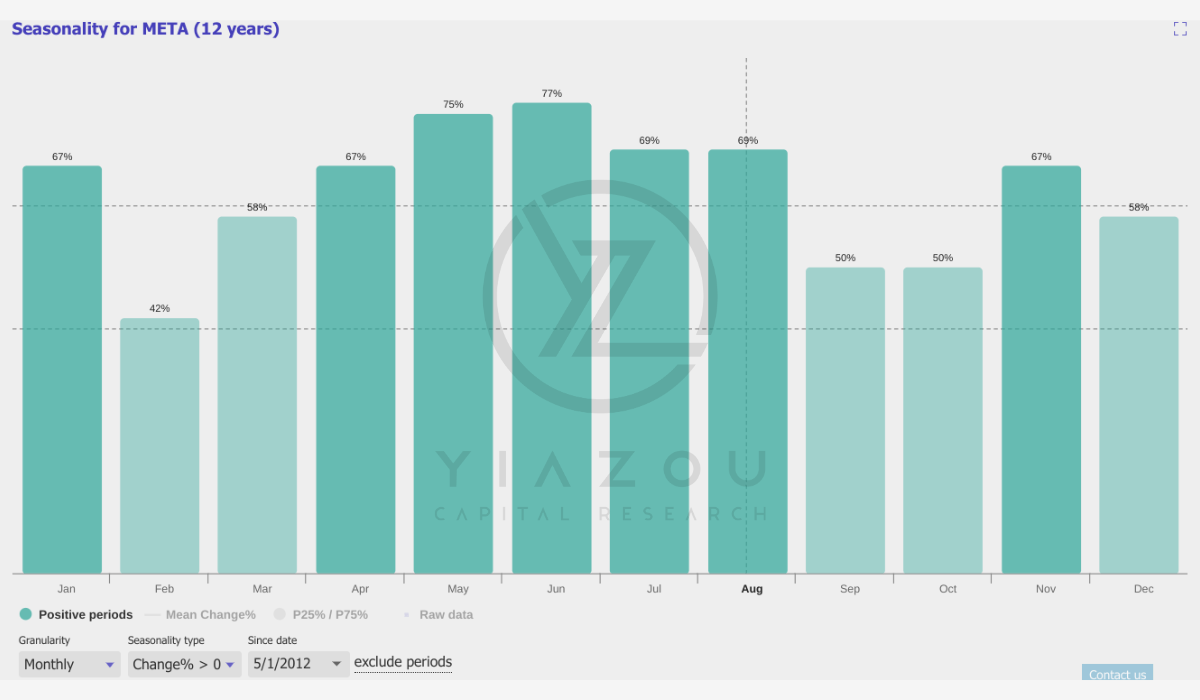

August shows a 69% probability of a positive return based on historical seasonality (12 years), suggesting that investing in META this month could be favorable. Overall, the analysis indicates a generally positive outlook for META.

Yiazou (TrendSpider)

Meta’s AI: Unified Systems and Llama Models Propel Ad Innovation and Metaverse Advancements

AI is becoming central to Meta’s operations increasingly, with significant developments like the rollout of a unified video recommendation service on Facebook that has extended Meta’s unified AI systems. Notably, these AI systems have already driven more engagement on Facebook Reels, with this increase surpassing the initial boost attained by switching from CPUs to GPUs.

With that, Meta aims to power all content recommendations across its platforms with a unified recommendation system. Although still in progress, Meta’s AI initiatives are also transforming its ad services. Advertisers on Meta can now predict audience interests more accurately than previous methods of collecting demographics and interest data.

In the coming years, Meta may automate creative development for advertisers, allowing them to focus solely on business objectives and budgets. Over time, AI will handle the rest of the ad process, which could significantly simplify the ad process on Meta. The potential for AI-driven advertising is enormous as Meta is incrementally moving toward this vision, which will have a long-term impact on its ad revenue.

Moreover, Meta’s AI efforts extend beyond recommendations, and ads with Meta AI are on track to become the most used AI assistant by 2024. It offers various use cases (information search to creative tasks like image generation), as AI’s flexibility and general nature allow for a wide range of applications.

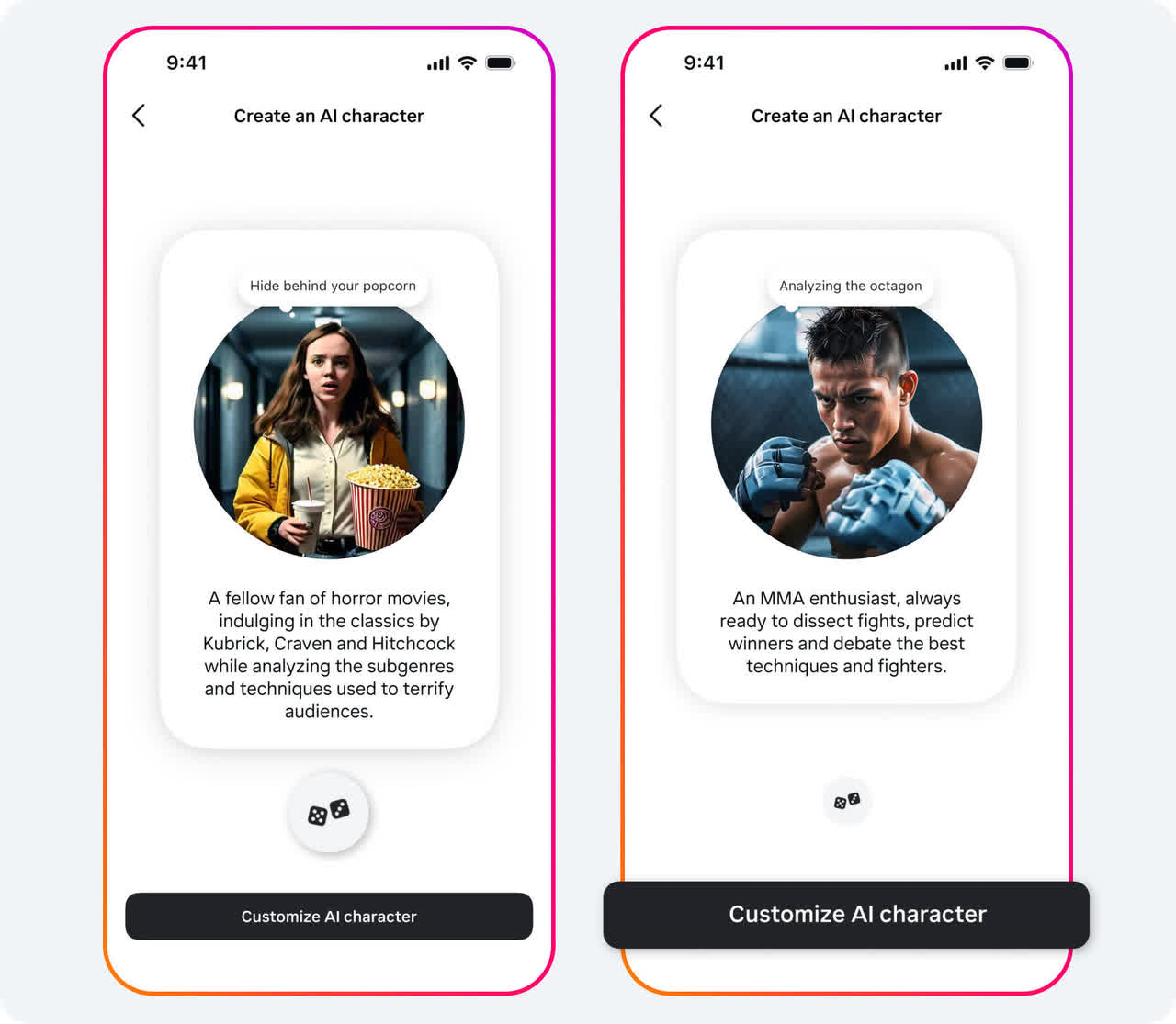

Meta also enables users to create their own AI agents. For instance, AI Studio, a new tool, lets users build custom AIs for interaction across Meta’s apps. This feature is sharp for creators, allowing them to engage with their communities more effectively. Businesses are also beginning to test AI agents to interact with customers, as these AI agents will streamline customer interactions, potentially boosting sales and reducing costs.

Meta AI Studio

Meta’s Llama family of foundation models is the engine behind these new AI experiences. Llama 3.1, the latest release, includes advanced open-source models. These models offer better cost performance than leading closed models. Meta’s focus on open-source AI is strategic, with open-source models fostering a robust ecosystem of tools and improvements. This approach mirrors Meta’s success with open-source projects like PyTorch and React.

Additionally, Llama 4, currently in development, aims to be the most advanced model in the industry. The compute needed to train Llama 4 is expected to be nearly 10 times that of Llama 3. Meta is planning infrastructure investments to support these advancements, which will ensure Meta remains at the forefront of AI technology.

Finally, AI is also influencing Meta’s work in the metaverse. Advances in AI have accelerated the timelines for some metaverse products. For instance, AI is vital in developing Ray-Ban Meta Glasses and Quest 3. Therefore, these AI-driven advancements boost Meta’s hardware portfolio, leading to stronger-than-expected sales.

Q2 2024 User Growth and Ad Revenue Spike, Driven by Young Adults and Threads Success

Meta Platforms reported strong user growth in Q2 2024. The company estimates over 3.2 billion daily active users across its apps, representing a significant increase in global user engagement. A standout statistic is WhatsApp’s growth in the US, with over 100 million monthly active users, which marks WhatsApp’s growing influence in the US market.

Earnings Presentation – Q2 2024

Similarly, Facebook, Instagram, and Threads have also shown robust annual growth in User Base in both the US and international markets. Facebook’s user base among young adults (particularly those aged 18-29 is expanding). This growth contradicts the public narrative that younger users are abandoning the platform. Threads is another bright spot for Meta, with nearly 200 million monthly active users, which points to its rapid adoption.

Meta’s success with Threads indicates its potential to become a significant social app against X. The company is seeing deeper engagement on the platform, reflecting a positive trajectory. In short, the company’s focus on younger demographics and new platforms like Threads is paying off, as these trends may lead to a strong foundation for Meta’s top-line growth.

Meta’s Family of Apps segment also had solid growth in Q2 2024, with revenue up 22% annually. Here, Ad revenue is the most significant contributor, reaching $38.3 billion with a 23% on a constant currency basis. The online commerce vertical was the most significant growth driver of yearly ad revenue, ahead of gaming, entertainment, and media.

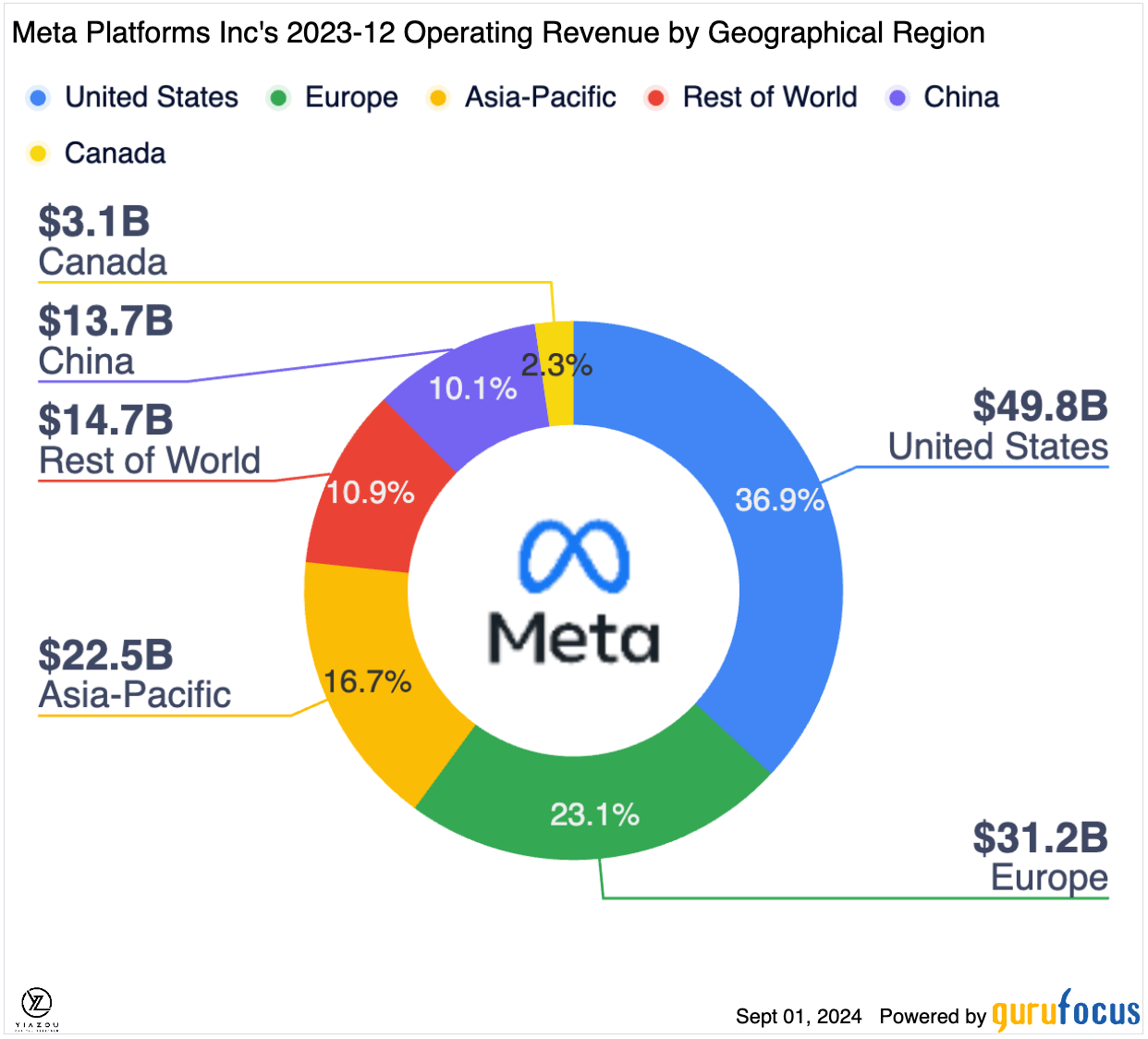

Geographically, ad revenue growth was strongest in the “Rest of World” and Europe. These regions saw growth rates of 33% and 26%. Asia Pacific grew by 20%, while North America increased by 17%. On an advertiser geography basis, Asia Pacific led with 28% growth, which was lower than the first quarter’s 41% growth due to a prior surge in demand from China.

The slower growth in Asia Pacific, Meta’s largest market for Meta AI usage, indicates challenges in maintaining rapid growth in all key regions. Geographic revenue growth discrepancies could impact Meta’s ability to achieve consistent global expansion. Slower growth in significant regions like Asia Pacific could hinder Meta’s overall revenue potential and its ability to capitalize on emerging markets.

GuruFocus

Additionally, the total number of ad impressions increased by 10% in Q2, with pricing also growing by 10%, driven by higher advertiser demand. Lower monetizing regions and surfaces partially offset this increase. Family of Apps’ other revenue was $389 million, up 73% from the previous year. This growth was primarily driven by business messaging revenue from WhatsApp’s business platform.

Expenses for the Family of Apps segment were $19.4 billion, which makes up about 80% of Meta’s overall expenses. These expenses increased by 4% due to higher infrastructure and headcount-related costs, but lower restructuring costs partially offset these increases. Operating income for the Family of Apps segment was $19.3 billion, representing a 50% operating margin. This high margin reflects the segment’s robust profitability.

Reality Labs, Meta’s other major segment, also saw growth. Revenue for Reality Labs was $353 million, up 28% year-over-year. This increase was driven primarily by sales of Quest headsets. However, Reality Labs expenses were $4.8 billion, up 21% from last year’s period due to the higher headcount-related costs and inventory costs.

Lastly, Reality Labs contributed an operating loss of $4.5 billion, reflecting the high investment cost in developing new technologies. Despite the loss, Meta invests in Reality Labs, but over the long term, the segment will pay off as it continues to develop its metaverse and AR/VR products.

Concluding Thoughts

With a forward P/E ratio above its historical average, Meta is trading at a premium, indicating investor confidence in its ability to capitalize on emerging technologies and market opportunities. The momentum-building potential is strong as we approach the upcoming earnings report in late October. Holding Meta stock with a target price of $675 in 2024 is supported by its strategic positioning and continued innovations across its product lines, making it a sound investment choice for long-term growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.