Summary:

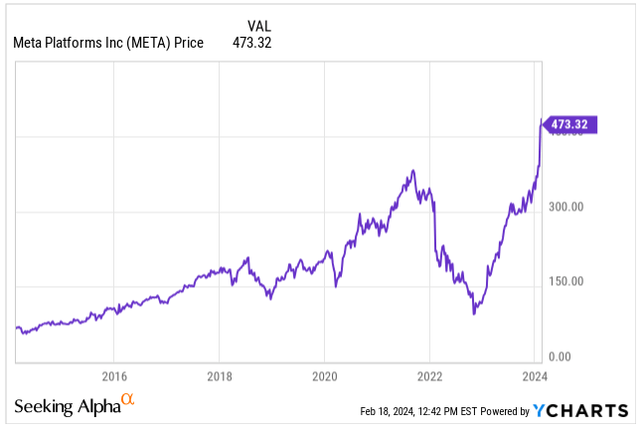

- Meta’s stock has seen a significant comeback, delivering a return of 408% in just 14 months.

- Smart cost-cutting measures and successful AI-powered advertising have contributed to Meta’s resurgence.

- Strong Q4 earnings have led to a $50 billion buyback and a first-ever dividend, showcasing Meta’s leadership and advertising dominance.

- Though trading at higher end of the historical valuation, strong forward EPS growth indicates double-digit returns despite potential P/E contraction.

Andriy Onufriyenko/Moment via Getty Images

Meta Platforms (NASDAQ:META) has come roaring back from its October 2022 low of $88, delivering a return of 408% in just 14 months.

Since I wrote my last bullish article on Meta in November, praising the company’s expanding profit margins and its management’s decision to become a leaner organization, the stock has risen by more than 49%.

Price Development (Seeking Alpha)

But what’s driving this comeback?

Smart cuts like slashing spending in the money-draining Reality Labs and reducing headcount by 22% are part of the story.

Meta’s AI-powered advertising is hitting the mark, and the overall ad spending rebound is giving them a boost ahead of the US presidential election.

Q4 earnings stole the show, exceeding expectations and paving the way for a whopping $50 billion buyback and a new quarterly $0.50 per share dividend.

This alone speaks volumes about their strong leadership and their dominant advertising position on the market.

But with the stock already on a tear, should you buy in now? Let’s have a look.

Business Update

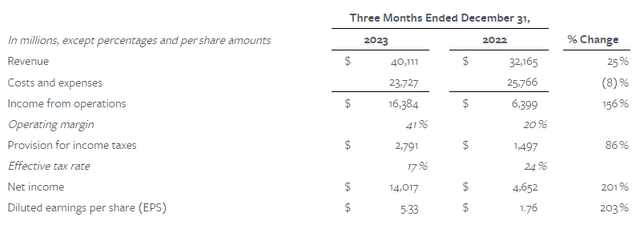

Meta’s Q4 earnings report, released in early February, brought smiles to investors’ faces.

The stock jumped 21% after the company beat analyst expectations by nearly $1 billion, reporting revenue of $40.1 billion, a 25% year-over-year increase.

Meta put its cash pile to good use by authorizing a new $50 billion stock buyback program, adding to the existing $30.9 billion program. This is expected to reduce outstanding shares by another 6.7% at current stock prices.

Further enticing investors, Meta announced its first-ever quarterly dividend of $0.50 per share. While the current yield is minimal at 0.42%, history suggests companies often rapidly increase dividends in the early stages. Within next year, Meta’s yield could easily reach 1% to 1.5%.

This dividend announcement sparked speculation about similar moves from other “Magnificent 7” tech giants, particularly Alphabet (GOOG) (GOOGL) and Amazon (AMZN). However, it’s important to remember that dividends often signal slower future growth as companies prioritize returning cash to shareholders rather than reinvesting it.

Despite this, Meta’s Q4 performance was arguably “big tech’s best earnings of the season.”

Total expenses for the quarter dropped 8% year-over-year to $23.7 billion. This included an 8% decrease in cost of revenue, primarily due to lower restructuring costs, partially offset by rising infrastructure costs.

Marketing & Sales and G&A expenses also saw significant reductions of 29% and 26%, respectively, mainly due to lower marketing spend and restructuring costs. While the company’s headcount shrank 22% year-over-year, it did increase 2% from Q3 as hiring resumed.

These spending improvements fueled a surge in net income, reaching $14 billion or $5.33 per share, double the previous year’s result.

Meta ended the year with a strong financial position, holding $65.4 billion in cash and marketable securities against $18.4 billion in debt.

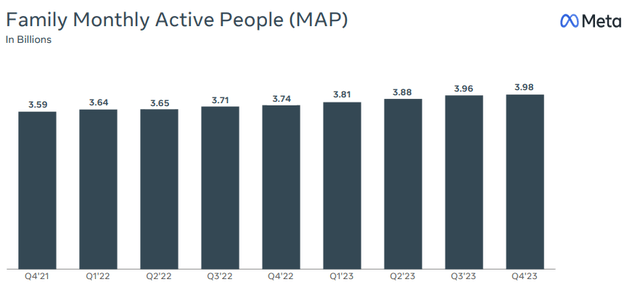

Meta’s family of apps, including Facebook, Instagram, and WhatsApp, boasts a staggering 3.98 billion active users.

This translates to nearly half of the world’s population actively engaging with one of their products. The sheer reach of the company is mind-boggling, granting it immense influence.

This is particularly noteworthy considering the upcoming 2024 elections, expected to draw a record-breaking 4 billion voters globally. Such a massive audience presents a significant advertising opportunity not just for Meta, but also for Alphabet.

Despite its already expansive user base, Meta’s monthly active users continue to grow, with a 6.4% year-over-year increase. I anticipate this growth to persist in the low single digits, further solidifying Meta’s position as a top social media platform.

Family Monthly Active People (META IR)

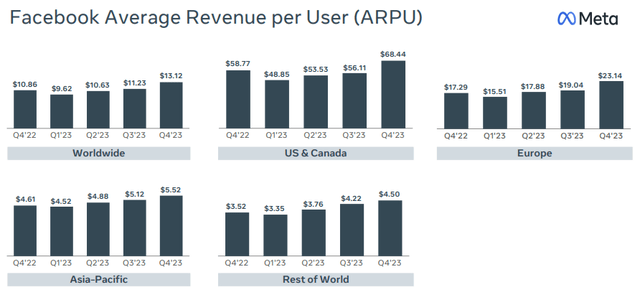

While Meta is moving away from reporting individual Facebook user numbers starting in Q1 2024, the company will begin reporting year-over-year changes in ad impressions and average ad price at the regional level.

In Q4, the company saw growth in average revenue per user across all regions, with the US and Canada leading the charge in terms of the highest average revenue per user, followed by Europe.

Facebook Average Revenue per User (META IR)

2023 was a strong year for Meta, marked by high engagement across its apps, exciting new product launches like Ray-Ban Meta smart glasses and Quest 3, and the establishment of a world-class AI effort. This emphasis on AI is seen as crucial for driving engagement, introducing new products, and tailoring ad offerings.

However, the key to successful AI implementation lies in a robust computing infrastructure. By the end of 2024, Meta aims to have around 600,000 H100 equivalent GPUs, representing a staggering $18 billion investment. While initially met with skepticism, this heavy spending seems justified as Meta strives to provide superior user experiences through AI advancements.

Meta’s long-term vision also heavily involves the metaverse, and significant investments are being made in both areas. With rapid advancements in AR, VR, and MR technology, Meta believes these platforms will create a realistic sense of presence, forming the foundation for future social and other experiences. Similar to Apple’s (AAPL) Vision Pro ambitions, Meta sees this as a potential future revenue driver.

Despite having VR headsets (Quest 3 and 2) on the market at lower prices than Apple’s offering, Meta’s market leadership is not guaranteed. However, their early entry into the VR space grants them an advantage in developing apps, potentially positioning them well for future market expansion.

Here’s a glimpse into Meta’s main AI initiatives on the user side:

- They introduced an Assistant accessible across all messaging experiences and smart glasses, allowing users to ask questions, access real-time information, and generate photorealistic images, similar to Chat-GPT or Bard.

- Meta launched the Studio platform, enabling users to create and interact with various AIs for assistance with tasks and entertainment.

- They introduced Emu, an image creation model that produces high-quality images and stickers rapidly.

- Meta released an early alpha version of business AIs, enabling every business to have an AI interface for customer sales and support.

- They revealed plans to launch creator AIs next year, enabling every creator to engage with their fans and build their community with the help of AI.

For Q1 2024, Meta projects total revenue of $34.5 billion to $37 billion, potentially translating to 31.6% top-line growth. Full-year expenses are expected to be $94 billion to $99 billion, slightly higher than previous estimates due to anticipated infrastructure-related costs.

In summary, Meta is heavily invested in AI advancements and the metaverse, believing these areas hold immense potential for future growth and user engagement.

Their aggressive infrastructure spending and early entry into VR are strategic moves designed to maintain their competitive edge.

Valuation

408%.

That’s how much Meta’s stock has risen since its $88 low in October 2022, amidst skepticism about cash burn and investments in the unproven Metaverse.

Remarkably, the stock rebounded to become the second-best performer in the S&P 500 (SP500) in 2023, trailing only Nvidia (NVDA).

Naturally, this surge might spark concerns about an overvalued stock operating in a mature market with a mature business model with no growth left.

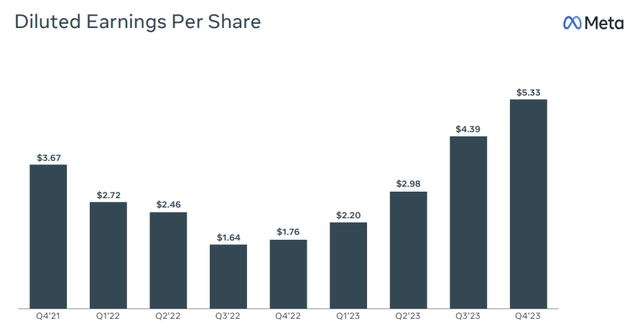

However, Meta delivered a stellar 73% EPS growth in 2023, reaching $14.87 per share.

Even more impressive, since 2013, the company has grown its EPS at a remarkable 29.9% annually, placing it among the top performers of the “Magnificent 7” companies.

Analysts polled by S&P Global foresee continued growth, fueled by a recovery in ad spending, the US presidential election, and AI-driven ad solutions that enable highly targeted demographics for advertisers. They project an average growth of 21% over the next three years:

- 2024: EPS of $20.00E, representing 34% YoY growth.

- 2025: EPS of $23.04E, reflecting 15% YoY growth.

- 2026: EPS of $26.26E, indicating 14% YoY growth.

While this growth is slower than the historical pace, adjusting the valuation is crucial.

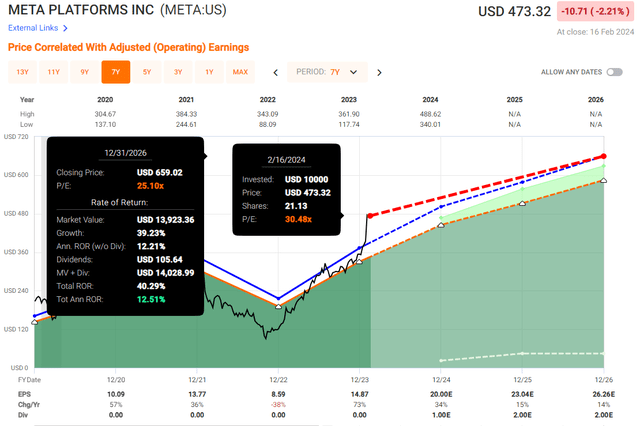

Currently, Meta’s stock trades at 30.48x its blended P/E, aligning with its historical average since 2013.

However, anticipating the growth deceleration, a P/E contraction is likely. Considering the 21% expected annual EPS growth, a more reasonable P/E might be around 25x.

Assuming both the growth and P/E contraction materialize, Meta could still deliver a respectable annual performance of approximately 12.5%, including the newly announced dividends.

This favorable outlook suggests the company could outperform the market, which I project to deliver no more than 10% annually over the same period.

Takeaway

Meta’s Q4 report exceeded expectations, propelling the company to one of the strongest earnings seasons. Reduced headcount, strategic AI spending, and rebounding ad revenue put them on a profitable path, prompting a $50 billion share buyback and the first-ever dividend announcement, delighting investors.

The hefty investment in AI infrastructure highlights Meta’s commitment to remaining at the technological forefront and delivering superior user experiences.

However, the introduction of the dividend raises questions about a potential shift in focus, prioritizing returning cash to shareholders over aggressive future investments.

Despite a valuation in line with its history, a growth deceleration is expected, possibly leading to a valuation contraction. Yet, even with this adjustment, Meta is projected to deliver double-digit returns, potentially outperforming the market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.