Summary:

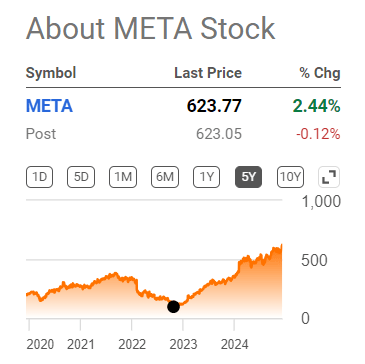

- META’s stock has surged over 6x since October 2022, driven by strong ad revenue, AI investments, and potential TikTok ban benefits.

- Despite high P/E ratios, META’s robust financials, including $70.9 billion in cash and $15.5 billion in free cash flow, support continued growth.

- Reality Labs’ losses and regulatory risks present challenges, but AI efficiencies and short-form video growth via Reels bolster META’s market position.

- Maintaining a “Buy” rating, I anticipate META’s price target at $697.7/share by end of 2025, reflecting a 12% upside from the last close.

Kira-Yan

Introduction

I initiated coverage of Meta Platforms, Inc. (NASDAQ:META) stock in October 2022, when one share was trading at $99.2. While it may seem today that META “was an obvious Buy at $100”, that “obviousness” at the time wasn’t what it might seem in hindsight: many people liquidated their META long positions, expecting lower lows in 2023. History has decided otherwise as the stock has managed to grow by a factor of >6x since October 2022:

Seeking Alpha, from my very first META article

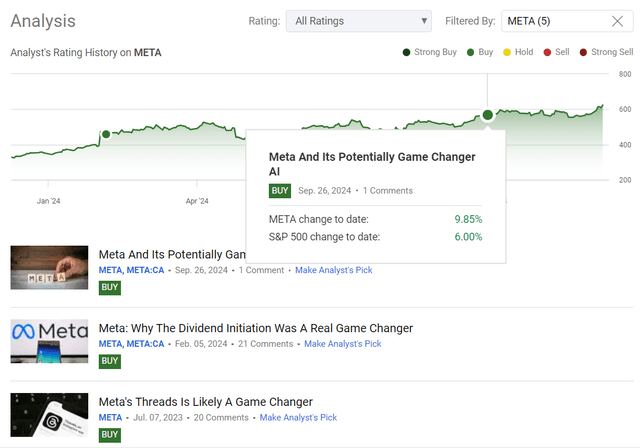

I was reiterating my “Buy” rating on META since that first October 2022 bullish call and it’s been aging quite well so far:

Seeking Alpha, the author’s coverage of META stock

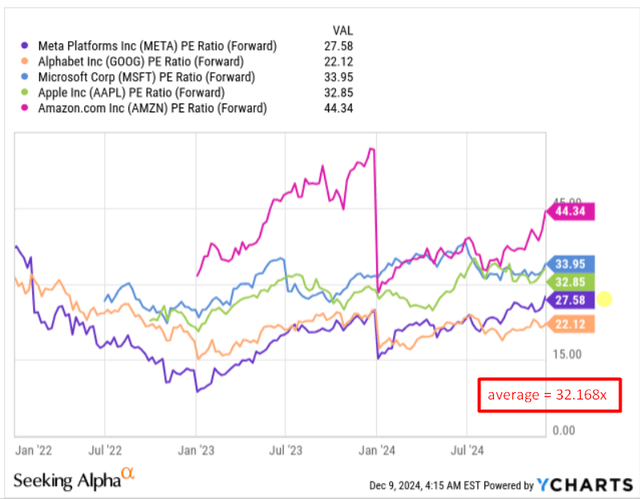

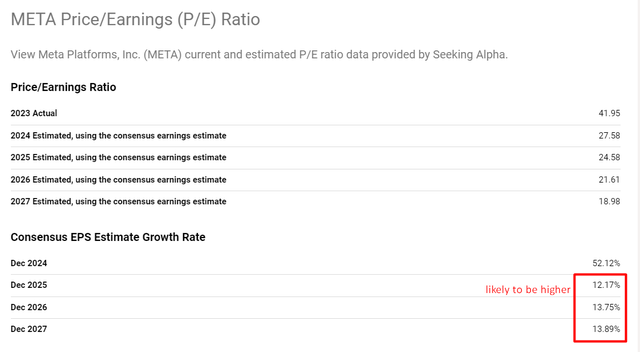

With the stock currently trading at nearly 28x forward P/E and carrying a concerning “F” Valuation grade from Seeking Alpha’s Quant Rating, many investors are considering passing on META or selling off all or part of their long positions in the stock.

What’s Next For META?

Despite the quite high multiples recently, I think META is likely to continue to rise, driven by a) strong bullish catalysts such as the TikTok ban in the US and b) the still quite depressed EPS estimates from Wall Street analysts, which should allow the company to continue to continue beating expectations and thereby stimulate stock price growth due to the re-rating.

Why Do I Think So?

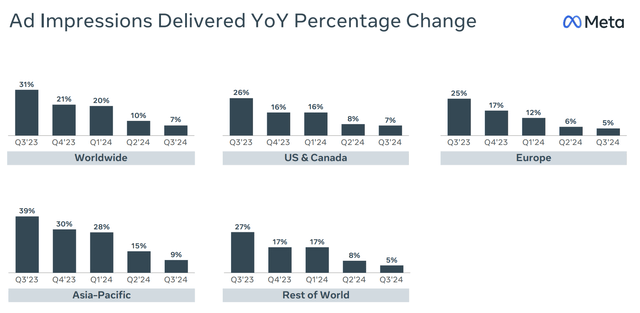

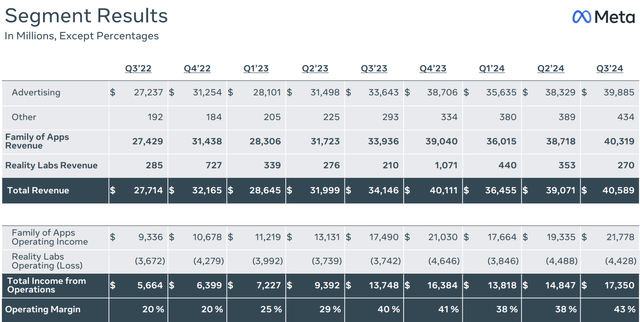

META’s Q2 FY2024 revenues totaled ~$40.6 billion, up 19% YoY, beating the consensus by almost $160 million. The increase was accompanied by an 11% rise in average price per ad and a 7% increase in impressions (both evidence of advertiser interest and ad effectiveness, in my view). “Facebook’s Family of Apps” – Facebook, Instagram, WhatsApp, Messenger – generated ~$40.3 billion in revenue and remained Meta’s main revenue generator. Reality Labs’ addition of $270 million in revenues showed growth of ~29% YoY with $4.7 billion in expenses, so Meta’s loss-making but ambitious AR/VR and metaverse division remains a big bottom line drag on the consolidated performance – and that’s just the start of what’s coming down the pipeline.

For Reality Labs, we continue to expect 2024 operating losses to increase meaningful year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem.

Source: META’s Q3 FY2024 earnings call

I’m not really concerned by Realty Labs’ negative EBIT, as Meta’s advertising business still reaps the rewards of its AI investments which boosted targeting and performance. This is the power of generative AI, and the tools, deployed by the company’s over a million advertisers, have already produced over 15 million ads, which lead businesses to an additional 7% increase in conversions. Also, Meta’s redoubledown of short-form videos (through Reels) has also been a growth engine: Reels engagement keeps increasing as more than 60% of recommendations on Instagram now come from the original post which opens the doors to creators and advertisers reaching engaged audiences. AI has also enabled 8% time-spend growth on Facebook and 6% growth on Instagram this year due to “the addition of content recommendations, adding to the ad inventory and revenue opportunities.”

WhatsApp’s monetization efforts are expanding, particularly with click-to-message ads, which are increasing strongly in countries such as Brazil and are growing in the US. Paid WhatsApp messaging is likewise taking off, leading to a 48% YoY increase in Family of Apps Other revenue.But monetization on Meta’s Twitter/X competitor Threads is in the early stages: With 275 million active users in its monthly report, and counting, Threads could become a major social app, but it won’t be an important revenue source in 2025, the management says.

Meanwhile, the consolidated EBIT margin has reached 43% – the highest mark over the past few years at least:

Of course, META’s Reality Labs is still a major drain on the margins, with losses now in excess of $58 billion since 2020. Yet Meta continues to spend a lot of money in the market with innovations such as the Quest 3S mixed reality headset and Ray-Ban Meta AI glasses. AR/VR devices are still a small niche market and there is no real indication when or if such investments will be paying off big time. The launch of holographic AR glasses, named Orion, confirms Meta’s vision long term, though commercialization is still years away. On the other hand, Quest 3S for $300 is the cheaper choice than Apple’s (AAPL) Vision Pro. I believe that Ray-Ban’s technology, with its AI-driven translation and much more, will be much more suitable for everyday use than the Vision Pro, so META is likely to gain a large market share. By the way, the AR/VR hardware market is projected to grow to >$389 billion by 2030, exhibiting a CAGR of 37.5%, according to Market Research Future’s data. The demand for AR/VR is likely to be there and so META is doing everything it has to do to pioneer the market.

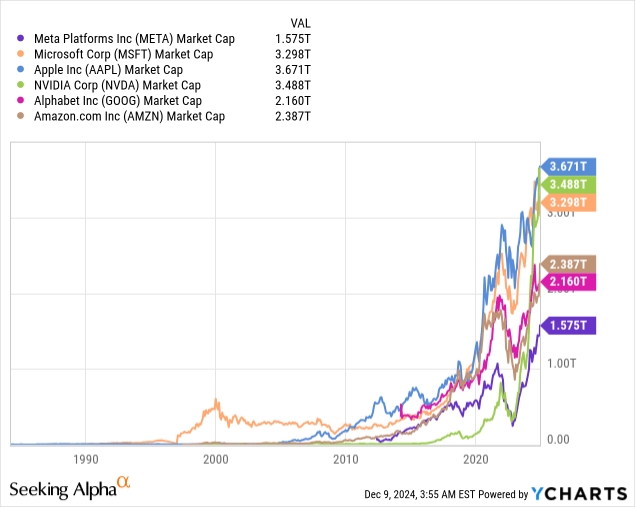

The company’s cash and marketable securities balance sheet still looks healthy, with ~$70.9 billion of cash and marketable securities and just $28.8 billion of debt. In the quarter, the company posted $15.5 billion in free cash flow, which was up 37% compared to last year. This healthy cash position has allowed Meta to repurchase $8.9 billion in shares and pay out $1.3 billion in dividends during the quarter, all of which it used to return capital to shareholders. So the total amount returned to investors stands at $10.2 billion. Compared to Microsoft’s (MSFT) $8.4 billion or Amazon’s (AMZN) $1.5 billion in total shareholders’ capital returns in their latest fiscal quarters, that’s quite much, while META is 109% and 51% smaller than those two firms in terms of market cap, respectively:

META’s quarterly capital spending amounted to $9.2 billion and included “servers, data centers, and network infrastructure investments for AI and other projects.” Meta anticipates $36-40 billion CapEx for the full year 2024, and big growth in 2025 as it expands AI infrastructure. But again – the FCF generation capacity seems to be offsetting that drag, so I expect META to keep doing a great job in terms of capital returns to investors during FY2025.

As any other Mag 7 firm out there, Meta uses AI operationally to increase efficiencies and innovation at the company level. In the company, AI tools are boosting productivity like code reviews and content moderation; AI is also improving user experiences and engagement. For instance, Meta AI – the company’s generative AI assistant – now has more than 500 million monthly active users and is already being baked into Ray-Ban spectacles and AI Studio. I expect further enhancements in terms of unit economics metrics thanks to these efficiencies, so the peak marginality levels are likely to stay with META for a few years at least.

In addition to all that, a potential TikTok block in the US (slated to go into effect on January 19, 2025) could be a big opportunity for Meta. Since TikTok already has 170 million US users, most of whom are young and want short videos, Instagram and Facebook are natural peers. Meta has already been spending a lot of attention to developing short-form videos via Reels and it’s positioning itself to get a major share of TikTok’s traffic. As another Seeking Alpha analyst Lighting Rock Research noted in their recent article, if even half of TikTok’s U.S. subscribers transferred over to Meta, Meta’s total daily active users (DAU) could grow by more than 2.5% and reinforce its social media supremacy (while it seems like a little figure, the fight for growth in DAU among social media providers is usually measured in bps, so that 2.5% is actually a lot).

Meta’s management anticipates Q4 FY2024 (set to be published on January 31, 2025) revenue to reach $45-48 billion as it is buoyed by the holiday season and continued growth in its core advertising business. This entire year management has cut its expense estimates and upped its CapEx guidance indicating faith in its investment plan.

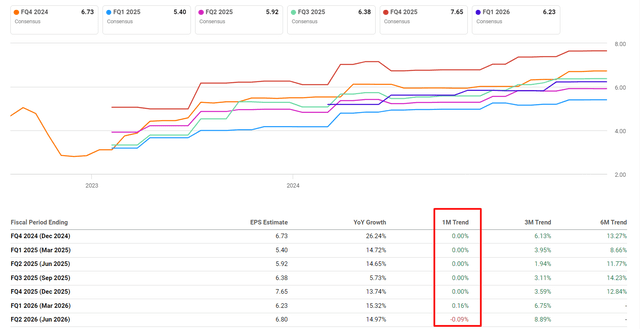

Wall Street anticipates $46.98 billion in sales for Q4, so it’s just 1% above the mid-range of the management’s guidance. But what’s more important to see, the analysts haven’t managed to price in a) the potential TikTok block in the US, and b) potentially higher EBIT margins thanks to more AI efficiencies. I come to this conclusion by looking at the EPS revisions – there weren’t any over the past month:

Seeking Alpha, META, notes added

I think the EPS growth should be higher compared to what’s expected from META to date – so that’s why the FWD P/E figures look nonsense to me:

Seeking Alpha, META, notes added

And even at today’s P/E figure for the next year, META would be trading at a 14% discount to other Mag 7 companies (Nvidia (NVDA) and Tesla (TSLA) are excluded from the sample):

Assuming that today’s consensus is 10% off in terms of its EPS projection for FY2025, and also anticipating that META should trade at 25x earnings by the end of 2025, then META’s price target arrives at $697.7/share. That’s 12% above the last close price.

Where Can I Be Wrong?

Even though Meta has a decent financial track record, things are not so smooth. It’s subject to regulation risk, particularly in Europe, where the company is struggling with the Digital Markets Act and any other rules that might apply to its ad business. Meta in the United States is already under lawsuits for allegedly abusing teens on its social media platforms, leading to fines or jail time.

Also, the company’s heavy investments in Reality Labs and AI infrastructure strained margins, with annual expenses in 2024 of $96-98 billion expected. These are investments sacrosanct to Meta’s market position but add to the firm’s execution risk, which shouldn’t be ignored by investors.

I also may be wrong in the way I calculated META’s price target. If there’s no EPS beating, or it’s below 10% for FY2025, the resulting price target will be much lower than I calculated above.

The Bottom Line

Despite the risks I outlined higher, I believe Meta has some of the benefits from secular change to digital advertising, an increase in AI-based tools, and business messaging. Yet the headwinds of regulation, rivalry from other tech titans, and innovation costs might slow growth. But anyway, the regulation has always been there. Meanwhile, Meta’s Q3 results in general reflected its ability to deliver on shareholders’ returns expectations and hinted that META is well positioned for long-term growth in the digital revolution. Based on my updated analysis today, I decided to leave my “Buy” rating for META unchanged, although the price target I have in mind is a bit low now after the stock rally.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!