Summary:

- Meta investors who trust Mark Zuckerberg have been rewarded as the stock outperformed the market significantly over the past year.

- The market likely understated Meta’s ability to embed AI and drive growth in its core business previously.

- Zuckerberg has upped the ante against its big tech peers, as AI CapEx is expected to surge through 2025.

- META’s valuation isn’t expensive when adjusted for its growth prospects.

- I argue why AI growth investors should consider META’s recent pullback as a solid buying opportunity.

Alex Wong

Meta: Outperformance Isn’t A Fluke

Meta Platforms, Inc. (NASDAQ:META) investors who remained on the Mark Zuckerberg train saw the stock power to new highs in October 2024. As a result, META has significantly outperformed the market over the past year, delivering a total return of more than 80%. It has also beaten Google’s (GOOGL) (GOOG) one-year return, as the Mountain View-headquartered company struggled with convincing the market about the superiority of its Gemini AI models while facing regulatory challenges.

In my previous bullish META article, I urged investors to stay on board even though the stock is no longer assessed as undervalued. The Menlo Park-headquartered company has demonstrated its ability to infuse AI into its core business while lifting engagement in its new growth optionalities (Threads, Reels, WhatsApp).

Therefore, I’m not unduly concerned with META’s pullback from its highs in October 2024 as the market navigates some near-term concerns about its ability to monetize AI while lifting CapEx to new heights through 2025. There’s little doubt that Meta’s AI data center infrastructure is highly competitive, allowing it to take on the best AI companies in the market. CEO Mark Zuckerberg emphasized Meta’s AI clusters are more significant than what was reported as leading in the market. He highlighted:

The Llama 3 models have been something of an inflection point in the industry but I’m even more excited about Llama 4 which is now well into its development. We’re training the Llama 4 models on a cluster that is bigger than 100,000 H100s or bigger than anything that I’ve seen reported for what others are doing. (Meta Q3 earnings conference)

Therefore, Meta has upped the ante in training its open-source Llama LLM, iterating and evolving its technological advantage predicated on its market-leading AI infrastructure. Notwithstanding Zuckerberg’s enthusiasm, the stock’s pullback this week suggests the market could be concerned about the potential impact on Meta’s forward operating margins.

Meta’s Ability To Embed AI Remains Robust

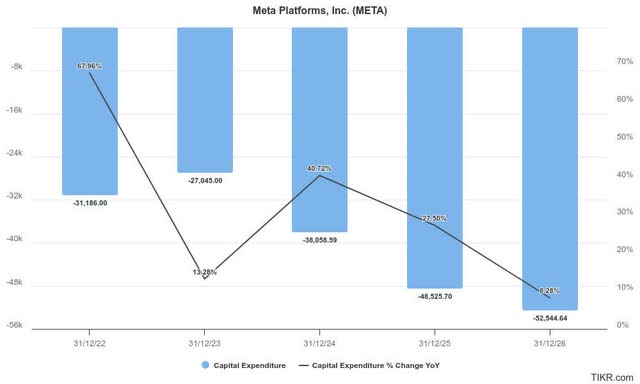

Meta CapEx estimates (TIKR)

Meta’s year of efficiency in 2023 has given way to a surging CapEx growth forecast through 2026. Wall Street analysts have dialed up their estimates to reflect the company’s enthusiasm and ability to compete with the other hyperscalers. Meta CFO Susan Li followed through her commentary on her boss’s optimism, telegraphing a 2024 CapEx outlook of between $38B and $40B. Furthermore, Li added more color to her CapEx commentary, enunciating that Meta anticipates “significant capital expenditure growth in 2025.” Therefore, it has also elevated the market sentiments on Nvidia (NVDA) stock as it surged to its October 2024 highs, corroborating that the AI infrastructure investment thesis isn’t slowing down anytime soon.

Less bullish or bearish investors on META’s thesis might contend with the company’s lack of a cloud computing business model. Hence, Meta must ensure AI monetization within its core digital advertising business model, potentially affecting its operating profitability.

While the concerns are justified, Meta has demonstrated its ability to continue lifting its near-term margins. In Meta’s Q3 report, the company delivered a 26% YoY increase in operating income, representing an operating margin of 42.7%. It’s a marked improvement over last year’s 40.3% metric, underscoring the company’s ability to embed AI.

However, Zuckerberg’s caution that AI might not accrue significant profits in the near term could have ruffled some feathers and raised concerns about its AI CapEx spending. However, Meta’s encouraging progress in Reels and WhatsApp should mitigate the CapEx growth risks as the company competes with its peers on the leading edge of AI developments. Furthermore, Meta reported a robust adoption of its Llama AI model, accruing over 500M monthly active users across its ecosystem. Therefore, I’m confident the company can maintain robust profitability over the next two years as it scales its AI infrastructure.

Meta’s Long-Term Growth Optionalities With AI

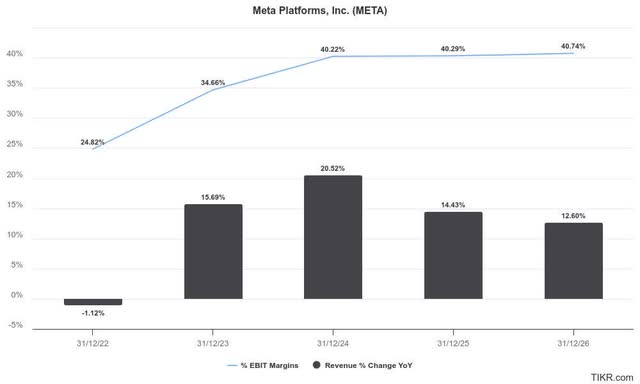

Meta estimates (TIKR)

In addition, Meta’s ability to drive ad impressions (up 7% YoY) while delivering an 11% increase in average price per ad has bolstered its monetization potential. Meta’s Q4 revenue outlook suggests a growth deceleration (16% YoY increase) against Q3’s 19% growth.

However, investors should remain focused on Meta’s AI monetization thesis and the potential uplift to its operating profitability over time. Wall Street’s estimates on Meta’s revenue and adjusted earnings have also been upgraded, underpinning my bullish proposition.

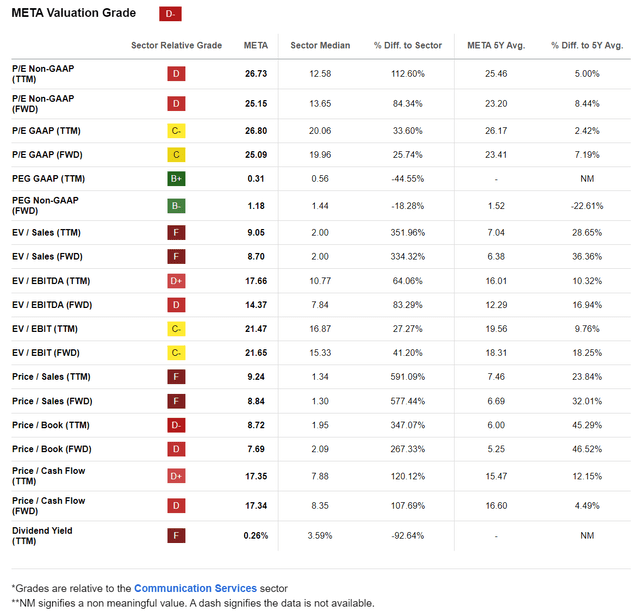

META Quant Grades (Seeking Alpha)

META’s “D-” valuation grade suggests it’s no longer undervalued. However, investors should assess it as a growth stock (“B+” growth grade) when comparing it against its communications sector (XLC) peers. META’s forward adjusted PEG ratio of 1.18 remains markedly below its sector median of 1.44, justifying its solid buying sentiments (“A” momentum grade). Hence, I assess that investors are expected to support dip-buying opportunities on META, given its long-term AI growth optionalities.

Despite that, investors must still cautiously assess META’s digital advertising thesis. Meta’s exposure to small and medium-sized advertisers in its ecosystem could expose it to the vagaries of the economy, particularly in a hard-landing scenario. Although it isn’t my base case, Meta’s lack of a solid cloud computing hyperscaler business could hinder a more robust valuation re-rating.

In addition, META’s losses with its Reality Labs business are not expected to slow down, as the company seeks to overcome its ecosystem disadvantage by establishing its own “walled garden.” Meta’s ability to invest could be hindered by the cyclicality of its core digital advertising model, potentially worsened by its more aggressive AI infrastructure investment.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, NVDA, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!