Summary:

- Meta is my portfolio’s newest holding, and I’m working to bring up my weighting in the months ahead.

- The company’s revenue and diluted EPS soared in the second quarter, and there is a path for robust growth in the years ahead.

- META boasts a net cash position of nearly $40 billion.

- Shares could be trading at a 17% discount to fair value.

- Meta looks to be set up to deliver 45% cumulative total returns through 2026.

Tourists posing in front of the Facebook like button. Sundry Photography/iStock Editorial via Getty Images

As I have refined my investing process, I have placed an increasing emphasis on investment quality and growth in recent years. Simply put, I’m looking to buy leading businesses in industries with undeniable growth trends.

The digital advertising industry arguably fits this bill.

Thanks to rising internet penetration around the world and businesses ramping up their online advertising budgets to reach target customers, the industry outlook is bright: The market research firm Grand View Research anticipates that the global digital advertising industry will compound by 15.5% annually from $420.6 billion in 2023 to top $1.1 trillion by 2030.

Via its widely popular Facebook, Instagram, WhatsApp, and Messenger platforms, Meta Platforms (NASDAQ:META) reaches approximately half of the world. When I initiated coverage in Meta with a buy rating last month, I appreciated this vast user base. I also liked that there is much more room to incorporate AI into the business to further optimize targeted ads. The impeccable financial position was another strength. Shares also seemed to be moderately undervalued.

Today, I’m upgrading the tech giant to a strong buy. Meta’s second-quarter results shared last month demonstrated that its AI investments are creating value for shareholders. The company’s free cash flow generation and balance sheet bode well for dividend growth. Lastly, shares are significantly discounted versus my fair value estimate.

AI Investments Are Paying Off

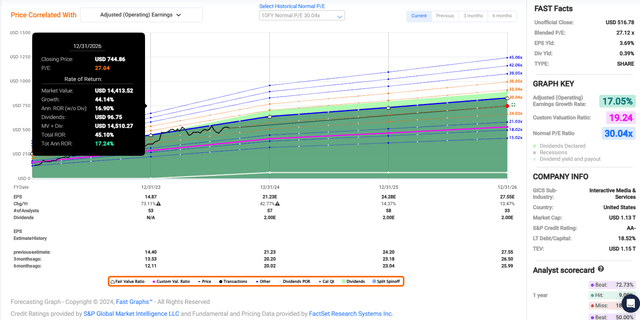

Meta Q2 2024 Earnings Press Release

On July 31st, Meta released what, I thought, were excellent results for the second quarter ended June 30. The company’s total revenue surged 22.1% higher over the year-ago period to $39.1 billion in the quarter. For context, this was $760 million greater than the Seeking Alpha analyst consensus during the quarter.

What was behind this sizzling topline growth? More people around the world have ascended into the global middle class in the past year. This uptick in the number of people with disposable income helped Meta’s daily active people rise by 7% year-over-year to 3.3 billion for the second quarter. The network effect was also another element in play driving this user base growth for the company.

Paired with greater usage, this explains the 10% growth rate over the year-ago period in ad impressions in the second quarter. According to CFO Susan Li’s opening remarks during the Q2 2024 Earnings Call, Meta’s average price per ad rose 10% during the quarter. This was fueled by better ad performance and partially countered by impression growth in lower monetization regions like Asia-Pacific and Rest of the World.

Moving down the income statement, Meta’s diluted EPS soared 73.2% year-over-year to $5.16 for the second quarter. This was $0.40 better than the Seeking Alpha consensus in the quarter.

Meta’s expanded topline wasn’t the only thing that drove this bottom-line growth during the second quarter. The company pulled some levers to keep total expenses in check at $24.2 billion for the quarter. For more color, this was up by just 7.2% over the year-ago period.

The marketing and general and administrative cost categories experienced a combined 12.8% year-over-year decline in those category expenses in the second quarter. This was made possible by general cost cuts and a 1% lower employee headcount versus the year-ago period.

That led to an 860 basis point expansion in Meta’s operating margin to 38% during the second quarter. This is how diluted EPS growth far outpaced revenue growth for the quarter.

Looking ahead, Meta has tailwinds that can sustain firmly double-digit diluted EPS growth. The company operates in a market with double-digit percentage annual growth prospects.

Simply retaining market share is enough to achieve respectable growth. Just as I outlined in my previous article, Meta could have a path to even grow its market share in the coming years. This is because the company is focused on integrating its AI recommendation system into more posts on Facebook and Instagram.

Thus far, these efforts have paid dividends by translating into higher average ad prices. Coupled with ad volume growth from an expanding user base, that’s a recipe for continued success.

That’s why beyond the 42.8% surge in diluted EPS to $21.23 that’s anticipated in 2024, the future is encouraging. Meta’s diluted EPS is expected to rise by another 14.4% in 2025 to $24.28 per FAST Graphs. The analyst consensus for 2026 is for an additional 13.5% growth in diluted EPS to $27.55.

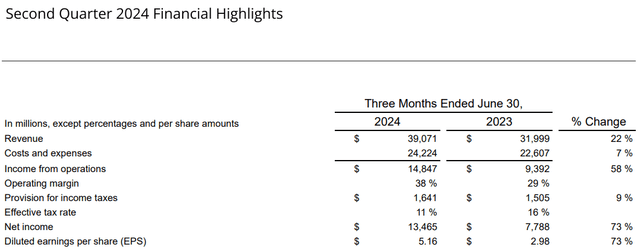

Meta Q2 2024 Earnings Press Release

Meta is also an undeniable financial fortress. As of June 30, the company’s net cash and marketable securities position was $39.7 billion. That is what translated into $624 million in net interest and other income through the first half of 2024. In other words, the elevated interest rate environment has been a boon to Meta. This financial strength explains why the company enjoys an AA- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Meta’s Q2 2024 Earnings Press Release, Meta’s Q2 2024 10-Q Filing, and Meta’s Q2 2024 Earnings Presentation).

Fair Value Is Now $630 A Share

Since my last article, shares of Meta have dipped by 2% as the S&P 500 index (SP500) has been flat. Coupled with my higher fair value estimate, that makes shares a more compelling pick now than they were seven weeks ago.

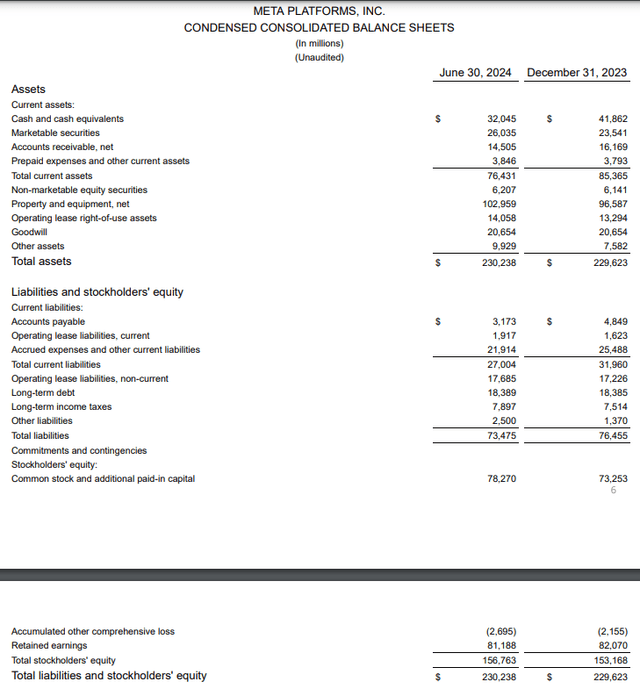

Meta’s current-year P/E ratio of 24.6 is under its 10-year average P/E ratio of 30 per FAST Graphs. Now, the days of shares being valued at a multiple of 30 are probably in the rearview mirror.

However, I believe there’s still a case to be made that a valuation multiple of one standard deviation below the 10-year average is realistic. This would equate to a fair value P/E ratio of roughly 27.

In the past 10 years, Meta’s diluted EPS has compounded by 26.8% annually. There’s only so much a trillion-dollar company can grow versus the Meta of five or 10 years ago that was much smaller. Still, the three-year forward annual analyst growth consensus of 17.1% is impressive for the company’s size.

In just a few more days, the calendar year 2024 will be 67% behind us. Put another way, another 33% of 2024 and 67% of 2025 are still to come in the next 12 months. That’s how I arrive at a 12-month forward diluted EPS input of $23.28.

Assuming a P/E ratio of 27, I compute a fair value of $630 a share. This is equivalent to a 17% discount to fair value from the current $522 share price (as of August 29th, 2024). If Meta matches the growth consensus and returns to my fair value, it could post 45% cumulative total returns by the end of 2026.

Meta Is A Free Cash Flow Machine

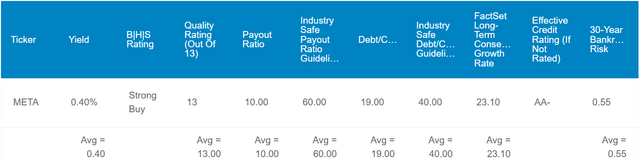

The Dividend Kings’ Zen Research Terminal

Just as I noted in my previous article, Meta’s 0.4% dividend yield is anything to get excited about at a glance. This is a fraction of the communication services sector’s median forward dividend yield of 3.2%. That warrants an F grade from Seeking Alpha’s Quant System for the metric.

Meta shines as a long-term dividend growth play, though.

For one, the company’s dividend payout ratio is poised to register below 10% in 2024. This is much better than the 60% payout ratio that rating agencies prefer from the industry, per The Dividend Kings’ Zen Research Terminal.

Taking this one step further, Meta also has the free cash flow to handily support this dividend. In the first six months of 2024, the company has put up $24 billion in free cash flow. Against the $2.5 billion in dividends paid in that time, this is a free cash flow payout ratio of merely 10.6% (calculations sourced from data in Meta’s Q2 2024 Earnings Press Release).

That not only means that the dividend is very safe. It also has a years and potentially decades-long runway for growth to expand the payout ratio. Combined with a net cash position and teen annual diluted EPS growth prospects, this is why I expect generous dividend growth in the years ahead.

In summary, I’d be surprised if Meta didn’t hand out at least 15% to 20% annual dividend raises to shareholders for the foreseeable future.

Risks To Consider

Meta is a business that’s objectively firing on all cylinders, but even it has risks that could break the investment thesis.

The company’s stratospheric success in its 20-year corporate history has become both a blessing and a curse. Meta’s immense reach is something that competitors can only hope to match, let alone best.

The downside is that this has drawn the ire of politicians and citizens of just about all beliefs around the world for various reasons. No matter what Meta does with content moderation, it’s in a position where it can’t please everybody, per Global Counsel.

Appeasing one political party in one market brings the risk of the opposing political party gaining/returning to power. This could come with political retribution exacted on Meta. If unfavorable regulations happened in enough major markets, that could put a damper on the company’s growth prospects.

As I noted in my prior article, the network effect could be a double-edged sword for the company. As long as its daily/monthly active people base keeps growing, this should provide a virtuous cycle of growth. If Meta’s platforms lose popularity to competitors, this could begin a downward spiral where users leave the platform and advertisers follow. That could also weigh on the company’s fundamentals.

One final risk to Meta is the potential for cyber breaches that are successful on a major scale. If this happens, sensitive data could be compromised, and services could be interrupted. That could bog the company down in litigation and hurt its reputation among users and advertisers alike.

Summary: A No-Brainer Buy For Me

As a starter position from last month, Meta is a modest 0.7% of my total portfolio value. As I indicated last month, though, I envision growing my position to overweight versus the S&P’s current weighting of 2.4%. Meta’s growth profile remains impressive. The company is a free cash flow monster and the balance sheet is loaded with net cash/investments. Not to mention that the valuation is exceptionally appealing here on a forward basis.

Rome wasn’t built in a day, and neither will my position in Meta. At any rate, I do plan on upping my weight in the stock by at least 50% in the next few days. I believe this is a step in the right direction for my portfolio. Meta’s 17% annual total return potential through 2026 is why I’m upgrading shares to a strong buy right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.