Summary:

- The EU has passed the first global act to regulate artificial intelligence, which will impact social media apps like Meta.

- The Act bans certain AI applications that use social scoring and predictive policies.

- META’s use of AI in its advertising and content delivery may be affected by the new regulations, potentially limiting its earnings growth.

Thai Liang Lim/E+ via Getty Images

Here comes the AI regulation

The EU passed the first global act that regulates artificial intelligence, with a specific focus on the GenAI.

The act is expected to be officially enacted in May and implemented gradually over the next three years, but the most important regulation impacting the social media apps will be implemented within 6 months, which means by the end of 2024. This law will most significantly affect Meta (NASDAQ:META). The EU AI Act implies that social media platforms with certain AI applications could be banned from the EU – the word is banned.

Banned applications?

Here is the specific language:

The new rules ban certain AI applications that threaten citizens’ rights, including biometric categorisation systems based on sensitive characteristics and untargeted scraping of facial images from the internet or CCTV footage to create facial recognition databases. Emotion recognition in the workplace and schools, social scoring, predictive policing (when it is based solely on profiling a person or assessing their characteristics), and AI that manipulates human behaviour or exploits people’s vulnerabilities will also be forbidden.

The law also needs to be formally endorsed by the Council. It will enter into force twenty days after its publication in the official Journal, and be fully applicable 24 months after its entry into force, except for: bans on prohibited practices, which will apply six months after the entry into force date; codes of practice (nine months after entry into force); general-purpose AI rules including governance (12 months after entry into force); and obligations for high-risk systems (36 months).

How will this affect META?

Are META’s Facebook and Instagram engaged in 1) social scoring, 2) predictive policies, and/or 3) uses AI to manipulate human behavior or exploit people’s vulnerabilities; using the AI?

Here is what META’s CEO Zuckerberg said during the February 1st earnings conference call:

…Now moving forward, a major goal, we’ll be building the most popular and most advanced AI products and services. And if we succeed, everyone who uses our services will have a world-class AI assistant to help get things done, every creator will have an AI that their community can engage with, every business will have an AI that their customers can interact with to buy goods and get support, and every developer will have a state-of-the-art open-source model to build with.

Turning now to the business outlook. There are 2 primary factors that drive our revenue performance: our ability to deliver engaging experiences for our community and our effectiveness at monetizing that engagement over time.

Meta earns 98% of its revenue from advertising on its “family of Apps”, mostly Facebook and Instagram. Essentially, businesses advertise on Facebook and Instagram to sell their goods/services. Also, content creators advertise on social media to expand their followings – and earn more profits.

Meta is developing/using an “AI assistant” to improve the efficiency of these ads, likely by social scoring and predictive policies – that’s called ad targeting. These ads and the content delivered potentially affect the target’s behavior and potentially exploit the target’s vulnerabilities. Meta calls this “engaging experience”.

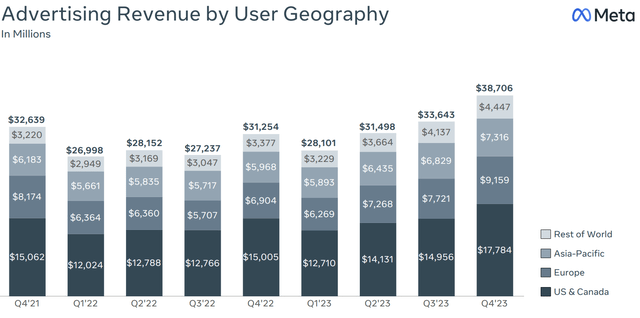

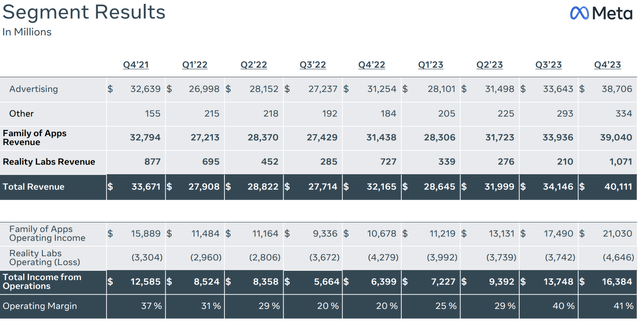

Here is the revenue breakdown for Meta – it’s all ad money:

META Revenue breakdown (Seeking Alpha)

Could Facebook and Instagram be banned in the EU? The AI Act language is clear, the AI Apps with social scoring and predictive policies are banned.

Meta will have to explain the “AI Assistant” and the model variables and either prove that it’s not based on social scoring and predictive policies, or abandon the use of the “AI assistant”.

Thus, it’s likely that Meta will have to dial down the use of AI in the EU. Given that almost 25% of ad revenues come from Europe, the exposure is significant.

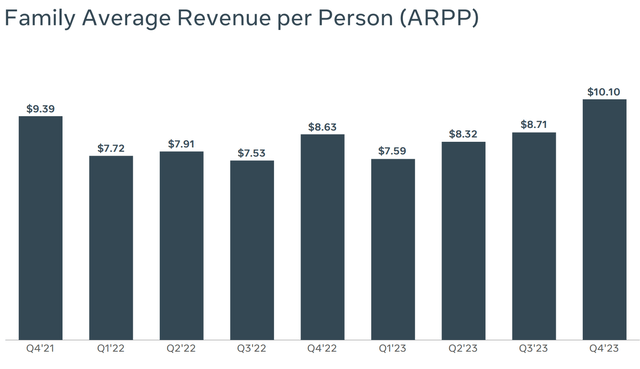

Why is this important? Meta’s strategic plan is to, first, expand the market, and second monetize the market. The key measure of effective monetizing is the family of apps’ average revenue per person ARPP. Meta just reached the highest level in ARPP in the recent quarter at $10.10, and that’s due to the increased use of AI.

The point is that the AI Assistant under development makes META more profitable by increasing the ARPP. However, the EU’s AI Act is the major threat to this strategy. Meta will have to dial down the usage of the AI assistant by the end of the year – and this will negatively affect the ARPP in Europe.

More importantly, the EU’s Act is only the first global regulation, and other countries are likely to follow. This will limit Meta’s profitability growth by limiting the ARPP growth.

META’s valuation metrics

META is rightfully seen as one the major beneficiaries of the GenAI revolution, with immediate effects – that’s what’s reflected in Meta’s earnings in the last quarter – and also reflected in Meta’s stock price.

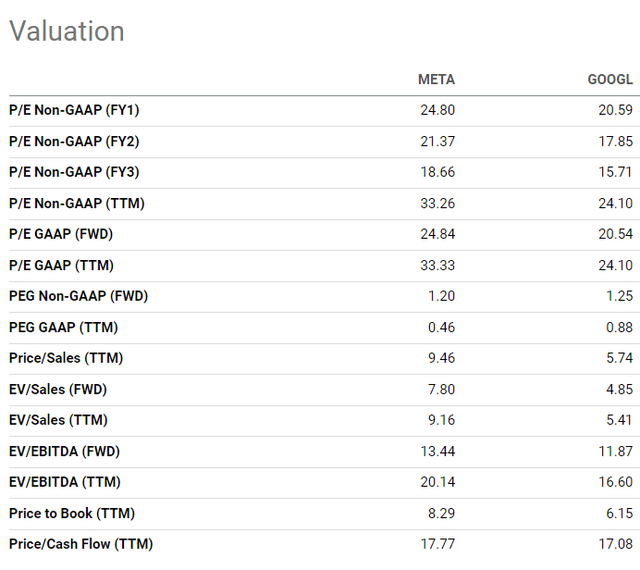

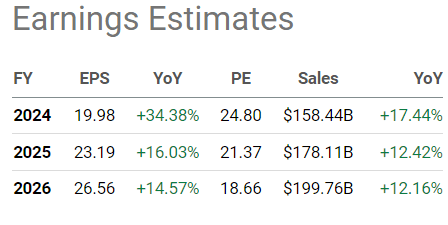

Meta’s earnings are expected to grow by 17% in 2024, and then slow to 12% over the next two years in 2025 and 2026, as reported in the table below. The assumption is that these are the official current analyst estimates.

META (Seeking Alpha)

Thus, Meta is also generously priced, with a PE ratio of around 33 and a PS ratio of around 10. It’s not a bubble, but the valuation metrics do imply significant growth in the future.

The current earnings projections of around 12% for 2025 and 2026 don’t really justify this valuation, so the stock is overvalued. But more importantly, the unfolding AI regulation is likely to limit Meta’s growth potential, and the risk is that the earnings expectations could be downgraded.

Meta’s valuation metrics are also significantly higher compared to Alphabet’s valuation metrics (GOOG) (GOOGL), which is the closest peer to META based on size, and industry. Alphabet is trading at TTM non-GAAP PE of 24.1, much lower than 33.26 for Meta. Similarly, Alphabet is trading at a PS ratio of 5.74, while Meta has a PE ratio of 9.46.

Thus, Meta is not only overvalued based on the absolute metrics but also relative to the major peer.

The macro risk

Meta is also facing a significant macro risk, given that 98% of its revenues come from advertising, which is cyclical.

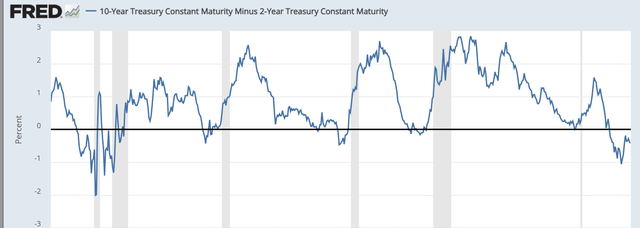

Specifically, we are facing a recession – we just made a new record for the length of the yield curve inversion. The research shows that the probability of a recession depends on 1) how deep the yield curve inversion is and 2) how long the yield curve remains inverted – deep and long inversion produce deeper and longer recessions.

Yes, it does appear that the recession has been avoided for now, and that’s due to the fiscal policy. But the fact is that the yield curve still remains inverted – and thus the recession remains very high. The advertising budgets are likely to shrink during a recession, which will negatively affect Meta’s profits.

The momentum

Meta’s stock is one of the key momentum stocks, together with Nvidia (NVDA) – both are seen as the main GenAI beneficiaries. But the rising stock price is also attracting the technical trend-followers who buy the stock just because it’s rising. The strong momentum can continue as long as the price uptrend remains intact – which can extend Meta’s momentum despite the industry-specific risks (regulation) and the macro risks (recession).

Implications

Meta is facing a serious threat as the global regulation of AI unfolds. The EU’s AI act seems to be going after the ad targeting policies, if these are based on social scoring and predicative policies, and if the content delivered is exploring the target vulnerabilities.

The regulatory environment will become more challenging for the social media apps, and this is likely to limit the Meta’s earnings growth capabilities. The Meta’s stock price is still a momentum stock, so the uptrend could continue. However, given the industry-specific challenges as well as the rising macro risk, I would use this as an opportunity to sell META – before the momentum reverses.

Obviously, there are two risks to this bearish outlook for Meta. First, the economy could avoid a recession, which would positively affect all momentum stocks, including Meta. Second, it’s questionable how the EU will implement and enforce the AI Act.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.