Summary:

- Meta Platforms recently reported arguably its best quarter in the last few years.

- With 52% operating margin for its core business, Meta demonstrated to the world its business dominance.

- After a grueling couple of years for the company and its shareholders, this was a welcomed respite from the almost endless controversies in which Meta has found itself embroiled.

- Today, we will walk through some historical perspective for Meta. We will then assess its runway for growth, its economic moats, its WhatsApp business, and its metaverse ambitions.

- I also touch on some valuation related topics. I’m looking forward to sharing these ideas with you today, so let’s begin!

Robert Way/iStock Editorial via Getty Images

Ascension

To get us started today, it is worth noting that, while Meta Platforms (NASDAQ:META) has had a challenging few years, these few years were approximately about as challenging for the company as the few years that preceded them.

In some sense, Meta has been in a perpetual state of “franchise-threatening” controversy and setbacks (e.g., privacy, elections, emerging competitive threats, Zuck as a person, etc.) for nearly a decade now, with its 2022 70%+ share price decline acting as a graphical depiction of its most recent obstacles.

But, like Ms. Katherine Graham, CEO of the Washington Post in the 1970s during which the company experienced consecutive years worth of scandals and setbacks, Zuck has remained a steadfast, intrepid business leader, stewarding Meta through each obstacle it has encountered.

I’ve also likened Zuck’s experience to the religious tradition on which billions of humans have predicated their existences over the last 2,000 years or so. That is, over the last 24 months, Meta has experienced a true cycle of life, death, burial, resurrection, and, as of Meta’s Q3 2023 earnings print, ascension into its kingdom.

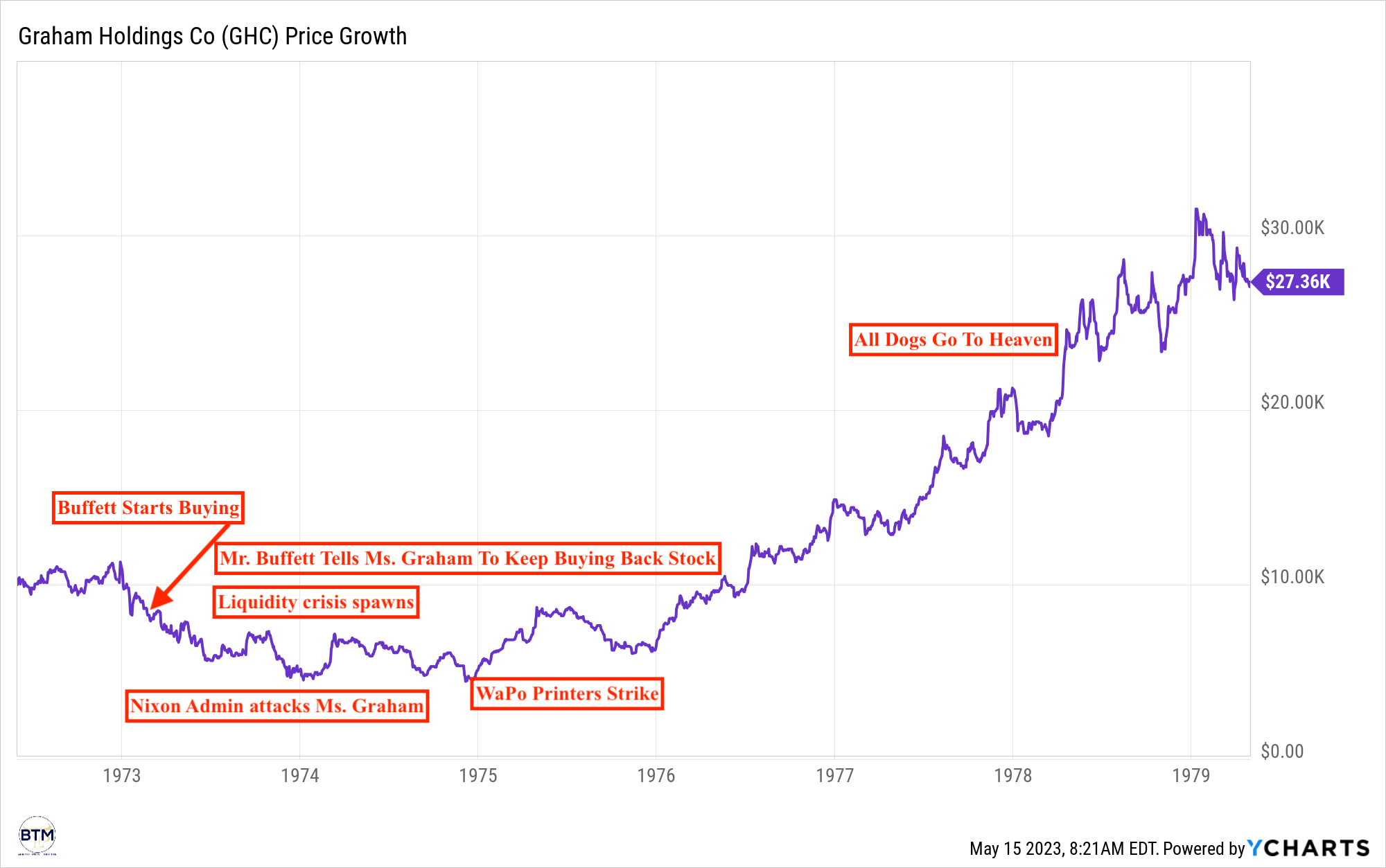

Washington Post’s 1973-1975 Meta-Like Trading Dynamics, Along With Subsequent Ascension

YCharts

- In short, Mr. Buffett bought the WaPo about a year before “all hell would break loose” for the company, e.g., its advertisers would strike, its printers would strike, and it would be targeted directly by the Nixon Administration for its Pentagon Papers coverage.

- Quite notably, Ms. Graham and the Washington Post executed a series of sustained and aggressive share repurchases, resulting in an acceleration in the growth of free cash flow per share, which served to boost the share price once the ’73-’74 recession ended and once the company resolved the controversies in which it found itself during the early 1970s. Similarly, Meta has done the same. We will discuss Meta’s brilliant leveraged recapitalization together later today.

Indeed, Meta’s Q3 2023 report was truly spectacular, with the company beating estimates across the board:

- Meta grew EPS from $1.67 per share to $4.39, beating its Q3 estimate for EPS by $.79.

- Meta grew revenue by 23.2% in the quarter, decimating expectations for 20% growth.

- It also reported a 52% operating margin for its core Family of Apps business.

In no uncertain terms, this quarter represented a genuine act of corporate ascension, though Mr. Market appears to still have not gotten the memo (he’s dealing with competing memos at the moment, including what to do with the news that, for instance, Bank of America has ~$140B in unrealized losses on its balance sheet astride a total book value of ~$240B. Should the prime rate rise to 7% in the quarters ahead, there’s some likelihood that Bank of America’s unrealized losses reach $200B+, effectively zeroing out Bank of American’s book value. This is the 2nd largest bank in the U.S… So I understand Mr. Market’s apathy to the recent quarter, to be very sure.).

With this introduction in mind, here’s a short outline of what we will discuss together today:

- In the next section, we will discuss a component of my thesis for Alphabet (GOOG) (GOOGL) and how it also applies to Meta. This relates to total addressable market over the long run for Meta.

- We will then cover the other pillar of my Meta thesis, i.e., that it operates a series of “near monopolies” and duopolies.

- We will then discuss Meta’s WhatsApp asset, and I will use this as a platform to consider the foundational investment frameworks within which Meta fits.

- Lastly, I will share some concluding thoughts, tying it all together, and I will discuss Meta’s virtual reality/metaverse investments which heretofore have been unmitigated money furnaces.

Let’s begin!

How Much Room For Growth Does Meta Still Have?

I recently published a quarterly review of Alphabet for the first time in years, and I enumerated my thesis for business, within which I remarked that a core pillar of the thesis is that YouTube’s TAM will continue to grow by virtue of 1) global population growth and 2) more and more of earth’s population digitally industrializing.

YouTube is the second most visited website on earth, and its powerful network effects, in which content creators attract viewers who then attract more content creators who then attract more viewers, and so on and so forth, make it likely that it will remain so for decades to come. YouTube’s monetization only really began in earnest in the late 2010s, and, alongside the growth of the digital ad industry, likely has a good runway for growth still ahead. Additionally, YouTube is an international phenomenon, and, as more of earth digitally industrializes and as more of earth reaches the middle class, YouTube’s viewership and sales growth will continue to grow each year.

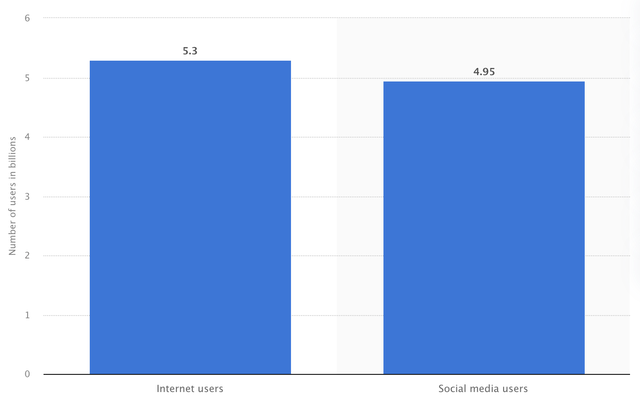

Internet Users Vs Social Media Users: October 2023

Statista

In answering the question of “how much room do Meta’s legacy assets, e.g., Facebook and Instagram, have left for growth?”, I believe the following points should be considered:

- Meta will grow by virtue of more of earth gaining access to the internet.

- Meta will grow by virtue of earth’s population growing.

- Meta will grow by virtue of more ad dollars seeking programmatic/AI-driven digital ad placements, such as those that Meta offers.

If Coke (KO) can grow internationally at 8% 140 years after it was founded, then I believe Meta can grow its globally appealing offering for many decades to come as well, and I think its ~20% expect sales growth over the next twelve months, ~20 years after the company was founded, is a testament to this idea.

On the subject of international growth, Meta shared,

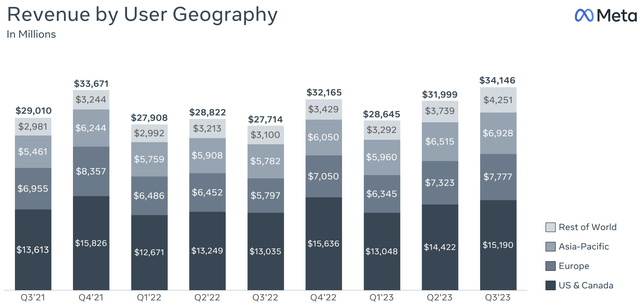

Within ad revenue, the online commerce vertical was the largest contributor to year-over-year growth, followed by CPG and gaming. Online commerce and gaming benefited from strong spend among advertisers in China reaching customers in other markets. On a user geography basis, ad revenue growth was strongest in Rest of World and Europe at 36% and 35%, respectively, followed by Asia Pacific at 19% and North America at 17%.

And we can see this data articulated graphically in the chart below:

Meta Q3 2023 Earnings Presentation

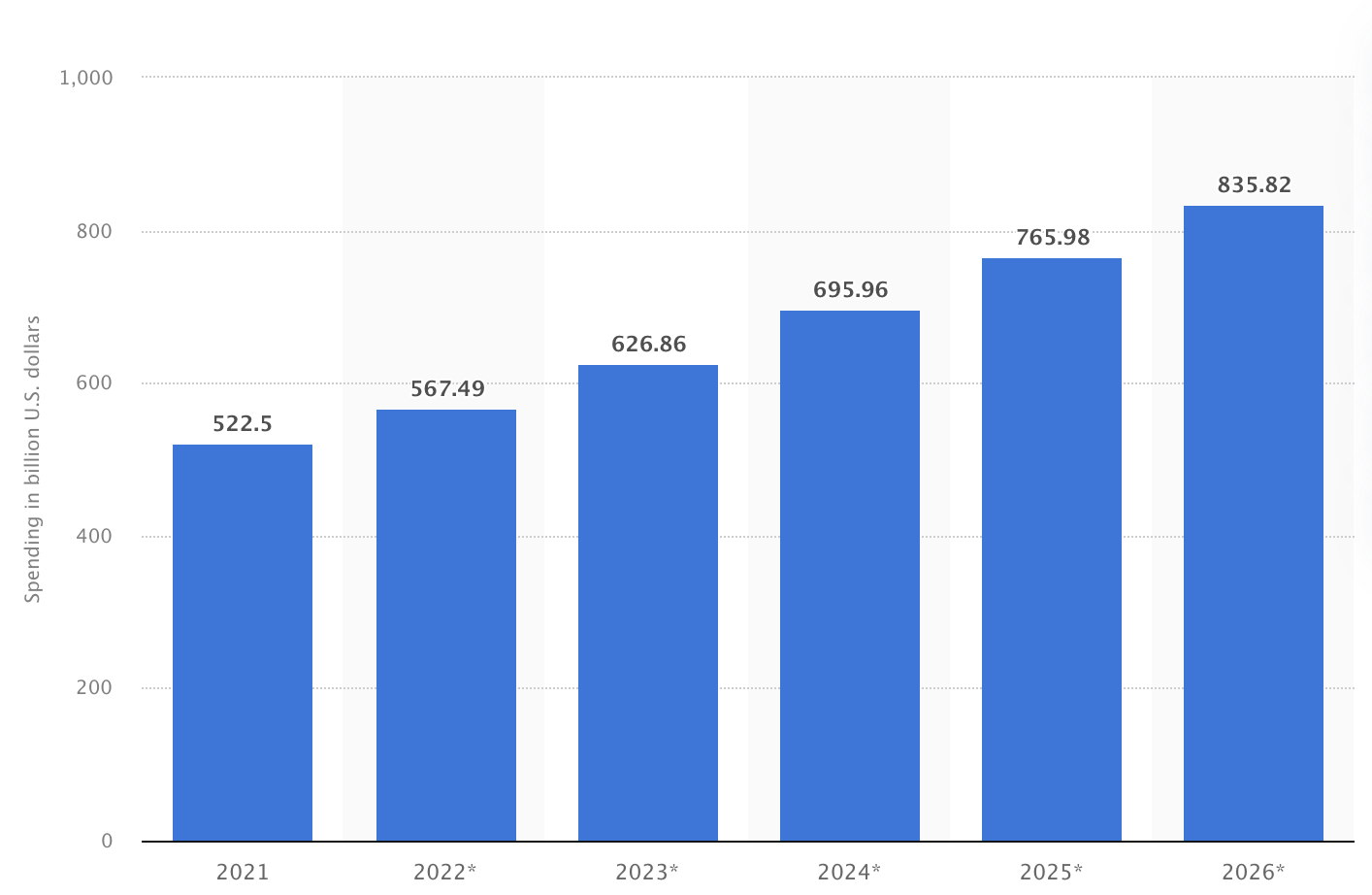

Digital Ads Total Addressable Market

Statista

With this data in mind, I believe, even without successful new product launches, such as WhatsApp for Business or Oculus’ long run commercial success (i.e., the long run commercial success of Meta’s metaverse), Meta would be a highly successful investment from its current valuation.

And, of course, its recent growth indicates that there are powerful tailwinds inflating its growth sails.

Q3 total revenue was $34.1 billion, up 23% or 21% on a constant currency basis. Q3 total expenses were $20.4 billion, down 7% compared to last year.

Incredible growth. Incredible operating leverage.

With this data as our foundation, let’s now review Meta’s recent user metrics.

Meta’s Global “Near Monopolies” And Duopolies

In this section, we will consider Meta’s globally dominant platforms. Before we continue, I think it’s always worth touching on why these platforms are so dominant, and, in so doing, we will demonstrate Meta’s economic moats; specifically its network effects moat.

- Network effects is defined as a system in which each additional user makes the system as a whole more valuable. As more users join the system, the system’s value increases, and, as it increases, it attracts more users, and because there are more users, the system becomes more valuable, and because it is more valuable, more users are compelled to use the system, and so on and so forth until the system reaches global, entrenched dominance.

- In order for a new system to gain meaningful traction, it must siphon users from the large and extremely valuable network that already exists, but the new system cannot possibly be as valuable as the current system due to a vastly lower user count. The large system is valuable because it is large. The new system is not nearly as valuable because it is small, so it is very difficult for this new system to gain traction. This is the network effects moat.

Add in some government-mandated/regulatory data-privacy moats (known as, in a sense, regulatory capture moat), brand moats, and embedding moats, and we have a near monopoly that cannot be broken by competition, with the user metrics that we will review below.

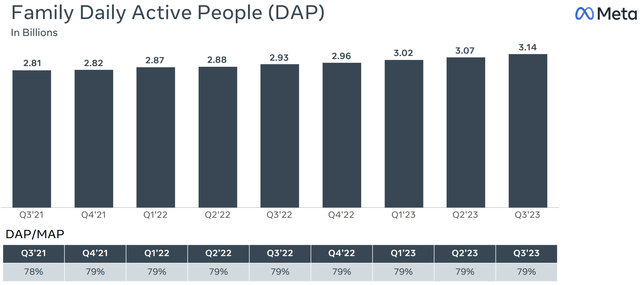

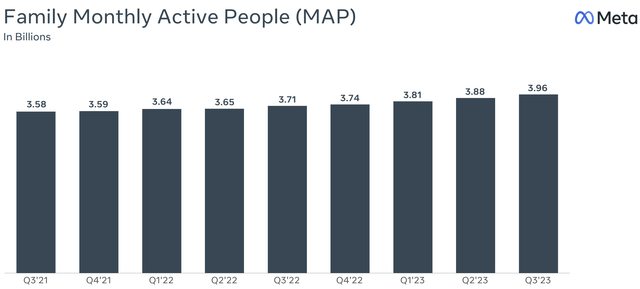

Moving now to our segment results. I’ll begin with our Family of Apps segment. Our community across the Family of Apps continues to grow. We estimate that approximately 3.14 billion people used at least one of our Family of Apps on a daily basis in September, and that approximately 3.96 billion people used at least one on a monthly basis.

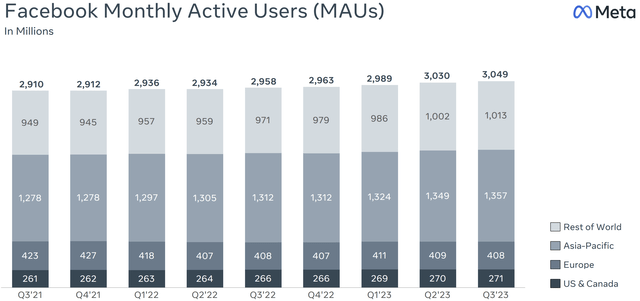

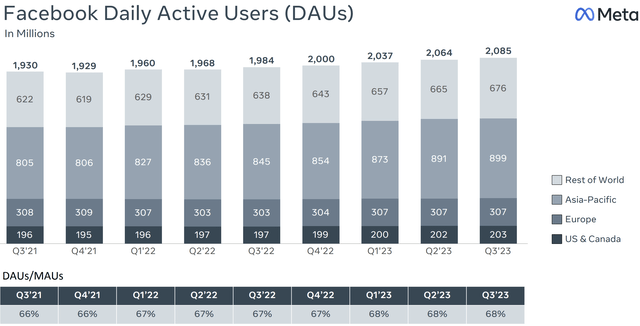

Facebook continues to grow globally and engagement remains strong. Facebook daily active users were 2.09 billion, up 5% or 101 million compared to last year. DAUs represented approximately 68% of the 3.05 billion monthly active users in September. MAUs grew by 91 million or 3% compared to last year.

This data can be graphically seen in the charts below:

Family of Apps (Facebook, Instagram, WhatsApp, Messenger, Etc.) Daily Active People

Meta Q3 2023 Earnings Presentation

As we can see, Meta added a healthy number of people that used one of its apps daily in Q3 2023. This was actually its best quarter for sequential additions of users in at least two years.

This is incredible, of course, but we, as informed investors are not surprised: We just reviewed data that indicated that this number could surpass 5B and beyond in the years and decades ahead.

There’s still healthy runway for this metric, and we should expect quarters such as Q3 2023, in which we experienced our best user addition in years, to occur again in the future.

Like the daily active user metric for Meta’s Family of Apps shared just above, its monthly active add was the best in the last two years.

Family of Apps (Facebook, Instagram, WhatsApp, Messenger, Etc.) Monthly Active People

Meta Q3 2023 Earnings Presentation

As you likely divined, this is not on a percentage basis; instead, on a net add basis, but it’s noteworthy nonetheless. I believe it’s noteworthy because so many have remarked that Meta’s platforms are dead, akin to Yahoo in the early 2000s.

However, the data has simply not substantiated this thinking; in fact, even “Grandma’s Old Blue Facebook” remains a platform that is growing at a healthy rate.

Facebook Monthly Active Users

Meta Q3 2023 Earnings Presentation

Of course, I say “Grandma’s Old Blue” a bit tongue-in-cheek. Facebook is a platform for friends and family to connect.

It is not a platform for the rich and famous to flaunt their lifestyles or influence our mindsets: It’s arguably (and somewhat ironically) the most wholesome app on earth.

It’s the central nexus of communication for grandma, brother, daughter, sister, and father. It’s where you seek out your old friend from high school and reunite with a military buddy. If you want to connect with someone with whom you once shared a bond or with whom you currently share a bond, young or old, you can almost surely do this on Facebook.

With the aforementioned network effects in mind, it is easy to understand why the platform continues to grow long after its eulogy was read.

Facebook Daily Active Users

Meta Q3 2023 Earnings Presentation

When we consider why Meta has never broken out Instagram user metrics, it’s clear to me: In Facebook, they know that they have an app that no one else offers, with, at this point, an almost impenetrable series of moats. Sure, you can follow your favorite celebrity on Instagram, such as the most followed one on earth, Cristiano Ronaldo, who, as an aside does not have TikTok, and you can watch your favorite content creator post short form videos on YouTube or TikTok, but there’s only one “family app,” where you connect with your “boring old” loved ones (I say this in such a way to articulate a point), and that is Facebook.

Meta knows this has further runway, and it’s confident that it’s almost impossible to disrupt as of today, especially with Apple and regulatory bodies around the world strengthening its moat by making the business model almost impossible to execute (via their privacy initiatives, which Meta has had to overcome via tens of billions of dollars in infrastructure spend).

So, by now, we’re confident that:

- Meta still has a solid runway for growth from a variety of perspectives.

- Meta is executing well in capturing that runway.

- Meta’s platforms are more dominant than ever.

Let’s now turn to a consideration of Meta’s WhatsApp business, and, in this next section, we will walk through the Foundational Investment Frameworks within which Meta fits.

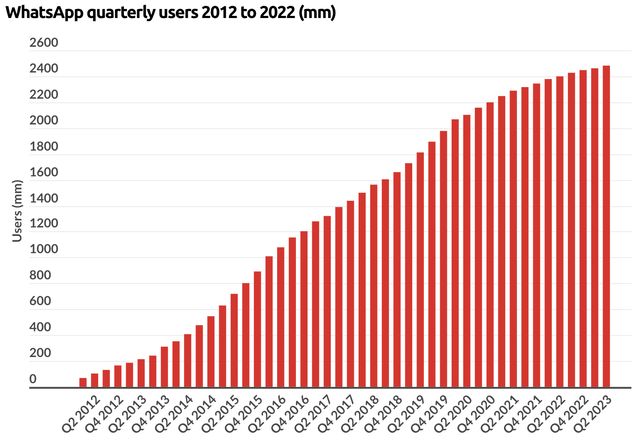

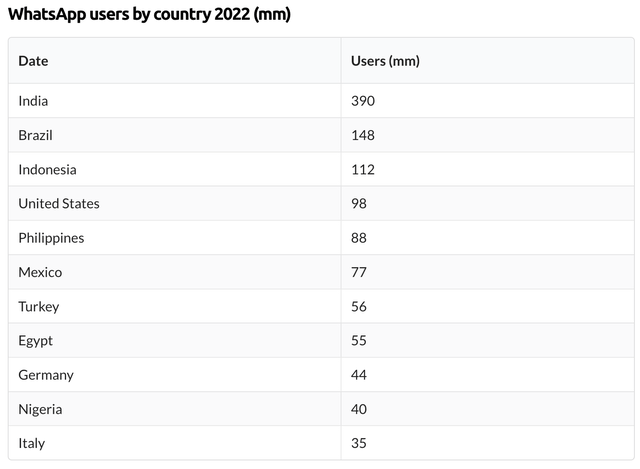

WhatsApp: A 2.5B Globally Dominant Leviathan

Business of Apps

As something of an aside, as I typed the title of this section and shared the above chart, I was reminded of something Elon Musk recently remarked following the launch of Threads. It went something like, “If Threads succeeds and X fails to defend its franchise, then Zuck will control all of earth’s social media, and we don’t want that.”

I found this noteworthy: one of the most “tapped in” businessmen on earth sees Zuck as a man with a series of “near monopolies” and duopolies that dominate earth’s consciousness, with WhatsApp being yet another globally dominant platform.

With approximately half of earth’s population using Meta’s properties, there’s of course, a great deal of truth to Mr. Musk’s publicly shared thoughts.

Getting back to the focus of this section, Meta has been in the process of monetizing its 2.5B+ user platform that is WhatsApp. I found the following commentary very noteworthy to this end.

Business messaging also continues to grow across our services and I believe will be the next major pillar of our business. There are more than 600 million conversations between people and businesses every day on our platforms. To give you a sense of what this could look like when it’s scaled globally, every week now, more than 60% of people on WhatsApp in India message a business app account. Revenue from click to message ads in India has doubled year-over-year. Now, I think that this is going to be a really big opportunity for our new business AIs that I talked about earlier that we hope will enable any business to easily set up an AI that people can message to help with commerce and support.

eMarketer

I found it quite noteworthy that Zuck believes WhatsApp for Business will become “the next major pillar” of the Meta business.

To put some quantification to this assertion, Meta now generates about $1.2B in annualized sales from its WhatsApp asset, and this is growing over 50%.

Family of Apps other revenue was $293 million in Q3, up 53%, driven by strong business messaging revenue growth from our WhatsApp Business Platform.

And, notably, Meta’s WhatsApp for Business product has not been scaled globally, as Zuck alluded to in qualifying the above quote, “To give you a sense of what this could look like when it’s scaled globally.”

It’s difficult to discern how large WhatsApp for Business could become over time; however, today:

- It’s not scaled globally.

- It has 2.5B users.

- It’s generating about $1.2B in sales.

- It’s growing over 50%.

How large could it be at scale and with all features fully rolled out in 5-10 years?

Well, Zuck believes it could be “the next major pillar!” It is unequivocally a line of business to monitor over time.

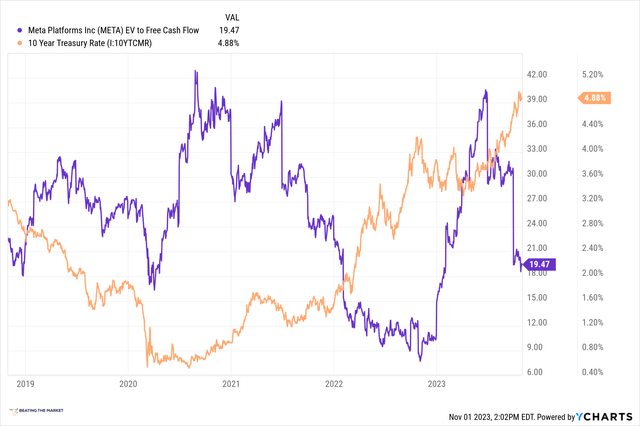

Concluding Thoughts: Understanding The Ungodly Amounts Of VR Spend

In closing, the business is exceptionally attractive from a valuation perspective, with a 5%+ fcf yield and ~20% growth.

YCharts

That said, following the release of Meta’s recent quarterly report, I noted that, if Meta shares trade down, it will be for one reason:

- The $10B to $20B per year in VR spend, for which we’re presently receiving about $800M in annualized revenue.

This is simply incredible in terms of the degree to which Meta is currently, in essence, lighting cash on fire.

But… I mean… We’ve long maintained that VR would be the next great computing platform to be won, and Meta continues to strive to win it. Meta’s CFO actually explicitly communicated this idea, which is certainly not immediately apparent to all of the investing community:

Longer term, obviously, we think there’s a lot of value from operating our Family of Apps experiences on top of a new computing platform that we helped develop/, for example, having glasses on that enable you to have our Meta AI assistant with you at all times. And as glasses scale, they’ll make it increasingly easy to capture compelling content from a first person point of view while you’re staying in the moment or the activity that you’re doing and sharing that content should enrich our content ecosystems even further. But again, the operating losses that are occurring within the Reality Labs segment are really driven by the Reality Labs work directly. And we think that over the sort of arc of the years ahead, there will be increasing shared benefits to our Family of Apps experiences.

Zuck has made it clear, since 2015 or thereabouts, that Meta is interested in winning the next great computing platform.

We have evidence of this idea via our examination of leaked memos that revealed Zuck was interested in buying Unity Software (U) in the mid 2010s as a means of advancing his goal of winning this computing platform, i.e., VR.

So Zuck has been hard at work on this mission for nearly a decade, though payoff for this work and the current fairly outrageous investments appears to be nowhere in sight.

Should there be some ROI on this spend or should this spend abate, all of my assumptions shared above would change: They would shift upward in some respect, whether through higher long term margins, a greater reduction in share count, higher exit multiple, or faster growth.

Though this remains to be seen, and the market has decided it prudent to value Meta strictly on the version of the company today, VR money furnace and all, and I frankly agree with this positioning by the market.

We shall see what happens in the future, though I’m optimistic!

In closing, I like Meta a lot at $300/share and certainly lower.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.