Summary:

- Turns out the TikTok threat was a blessing in disguise, because the moves it forced Meta to make positioned it favorably for the AI revolution in an unexpected manner.

- Most investors are focused on the great performance of Reels as a fightback against TikTok, but this could be just the tip of the iceberg.

- However, Meta faces problems that may hamper its AI ambitions.

David Ramos

The rise of TikTok indeed shook up the social media landscape, forcing social media platforms like Meta’s (NASDAQ:META) Facebook/ Instagram, as well as YouTube and Snapchat, to offer their own versions of short-form entertainment videos. Facebook/ Instagram Reels (Meta’s version of TikTok) has indeed been gaining traction among social media users, enabling Meta to drive engagement on its platforms, as well as opening the door to new advertising avenues to sustain advertising revenue. However, this may have just been the tip of the iceberg in terms of TikTok’s impact on Meta. The competitive threat also induced Meta to alter its algorithm for in-feed recommendations, enabling much wider user data collection. Amid the AI revolution, data is king. Building and training powerful AI models can require enormous amounts of data, and Meta is sitting on a treasure thanks to an algorithmic shift. Nonetheless, Meta also faces certain risks that may hamper its AI ambitions. Nexus Research maintains a ‘hold’ rating on the stock.

Before the rise of TikTok, Facebook and Instagram feeds primarily consisted of content posted by users’ existing connections, including their friends, the Groups they are part of, and Pages they follow. However, observing the success TikTok witnessed by showing content from accounts that users don’t follow, which enabled a powerful discovery mechanism for content creators and addictive user engagement, Meta decided to follow suit.

A few years ago, Meta altered its algorithm to show more content to users from accounts they are not connected to, but are likely to be interested in given their past activities on Meta’s platforms. Meta found success with this algorithmic shift, as CEO Mark Zuckerberg proclaimed on the last earnings call:

Our investment in recommendations and ranking systems has driven a lot of the results that we’re seeing today across our discovery engine, Reels and ads, along with surfacing content from friends and family. Now, more than 20% of content in your Facebook and Instagram feeds are recommended by AI from people groups or accounts that you don’t follow. Across all of Instagram, that’s about 40% of the content that you see.

Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram. Our AI work is also improving monetization. Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter.

Note that this algorithmic shift doesn’t just recommend Reels, but also other forms of content from unconnected accounts, as CFO Susan Li highlighted on the call:

“Our in-feed recommendations certainly go well beyond Reels. They cover all types of content, including text, images, links, group content, et cetera.”

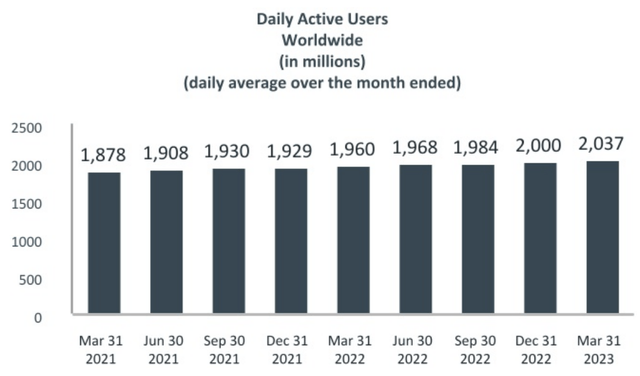

Hence, this algorithmic shift has enabled greater user engagement on Facebook/ Instagram, which drives Daily Active Users (DAUs) higher. Meta does not disclose the DAUs for Instagram, but only for Facebook, which has been growing over the past several quarters:

Higher DAUs attracts more advertisers, and subsequently driving revenue growth for investors. Meta’s ‘Family of Apps’ segment, which derives majority of its revenue from advertising, saw consecutive quarters of revenue declines last year, contracting by 3.6% in Q3 2022, and by 4.1% in Q4 2022 on a year-over-year basis. The segment finally returned to growth in Q1 2023, delivering 4% revenue growth.

In its pursuit to continue driving advertising revenue growth, Meta now strives to build massive AI recommendation systems. To gain a profound comprehension and representation of individuals’ preferences, Meta strives to build recommendation models that “can have tens of trillions of parameters — orders of magnitude larger than even the biggest language models used today”.

These AI models would be trained on existing data that Meta holds on user preferences, activities and behaviors. In order to successfully build proficient AI models, Meta needs to ensure it can keep users on its platform over time as they age and move through different stages of their life, and avoid users fleeing to competing platforms like TikTok, as Meta needs to be able to collect as much data on its users as possible. In the recent blog post, the social media giant explained:

“Our recommendation system needs to understand people’s interests as they evolve over time, and it must work effectively with the nuances that distinguish different pieces of content. Someone may be an avid runner for a while but then develop a passion for mountain biking, for example.”

Understanding how users’ interests progress over time can offer lucrative insights and data to feed into Meta’s AI models, to make the AI recommendation systems versatile enough to be able to predict people’s evolving preferences over time. The ultimate goal is to convince advertisers that Meta platforms can offer powerful reach to lucrative audience bases that the company holds intricate knowledge about, and consequently drive advertising revenue higher for Meta shareholders.

Thanks to the TikTok-induced algorithmic shift continuously recommending new types of content to users, Meta is gaining an increasingly deeper understanding of people’s preferences across a widening range of topics, granting it larger datasets to feed into training its AI models.

Moreover, it should also support Meta’s advertising efforts in the near-term. As users discover new interesting content thanks to Meta’s recommendations, it expands the types of ads Meta can show its users based on their newly discovered interests. This consequently expands the reach of advertisers to a growing ‘relevant audience’ base, resulting in more advertising revenue for Meta investors.

So, it’s ironic how just a few years ago the market was fretting over TikTok taking users away from Meta platforms, but the threat turned out to be a positive catalyst for Meta to alter its algorithms that enable much wider data collection, just in time for the era of AI where data is king.

Risks to consider

Are complex AI recommendation systems the right approach? While theoretically the AI recommendation system sounds intriguing from an investors’ perspective, it remains to be seen whether it can be executed successfully in practical terms. After all, human behaviour is irrational, and historical insights about how preferences tend to evolve and may not necessarily be able to predict future inclinations accurately, especially from one generation to another.

So, while Meta strives to convince both advertisers and investors that its enormous and complex AI models can drive higher conversion rates across its user base, conducive to higher advertising revenue, investors should zoom out and consider whether this approach is worthwhile in practical terms. Collecting data on users’ every move and trying to formulate signals and predictions off of these behavioral traits could potentially lead to AI recommendation systems becoming ‘over smart’, with no guarantee that the recommendations will always please users.

The intention behind companies incorporating AI into their processes is to make people’s lives more convenient through increasingly automated processes. In the context of social media, while to a certain extent users could find it useful for recommendation systems to know what they want, after a certain point there is indeed a risk of annoying users by watching their every move for advertising purposes.

Complexity at what cost? As mentioned earlier, Meta is striving to build recommendation models that “can have tens of trillions of parameters — orders of magnitude larger than even the biggest language models used today”.

First thing first, what are parameters? Parameters are like the building blocks that help the model understand and learn from the data it’s given. They are numbers or values that the model uses to make predictions or decisions based on the input it receives. For instance, if Meta were to train an AI model to recognize different objects within images posted on Instagram, the parameters can include things like the color, shape, and size of the objects. The computer then tries to find patterns in the data to figure out how to identify different items, by using these parameters to create rules for distinguishing between different types of objects.

During the training process, the computer adjusts these parameters based on the errors it makes. It tries to minimize the difference between its predictions and the correct answers by tweaking the parameter values. This iterative adjustment helps the model become more accurate over time.

Now that we understand what parameters are, we can appreciate that a larger number of parameters can certainly make models more versatile. However, investors need to recognize that more parameters in AI models also incurs trade-offs in terms of computational resources, training time, and potential overfitting.

Moreover, increasing the number of parameters in a model typically leads to increased computational requirements during training and inference. More parameters require more memory to store them and more computational power to perform calculations. Models with more parameters generally also require more training time. The optimization process becomes more computationally intensive as the number of parameters increases. This translates to higher operating expenses in terms of building, training and inferencing models, impacting bottom line profitability.

On top of all this, having a large number of parameters can increase the risk of overfitting, especially when the training data is limited. Overfitting occurs when a model becomes overly specialized to the training data and performs poorly on unseen data. Models with excessive parameters have a higher capacity to memorize the training data, resulting in reduced generalization ability. That being said, Meta has access to large sets of training data given the popularity of its social media platforms, and can use various Regularization techniques to mitigate overfitting in models with a large number of parameters. Nonetheless, it is important to recognize that Meta’s larger models may not necessarily translate to superior performance.

Therefore, investors shouldn’t get too excited about Meta’s ambitions to build recommendation models that “can have tens of trillions of parameters”, as there are both cost and performance implications. In fact, competitor Google’s (GOOG)(GOOGL) most recent AI foundation model, PaLM 2, has intentionally been built using fewer parameters than its original PaLM. Instead, Google has focused on using more sophisticated techniques underpinning the construction of its new model. In a blog post introducing PaLM 2, Google reveals that it uses an advanced technique called compute-optimal scaling, explaining:

“The basic idea of compute-optimal scaling is to scale the model size and the training dataset size in proportion to each other. This new technique makes PaLM 2 smaller than PaLM, but more efficient with overall better performance, including faster inference, fewer parameters to serve, and a lower serving cost.”

Without delving too deeply into the technical matters, the ‘compute-optimal scaling’ approach essentially tackles the model overfitting issue, enabling better predictive capabilities. Furthermore, a smaller model (in terms of number of parameters), also reduces cost of training and computational requirements, improving cost efficiency.

Therefore, taking into consideration how competitors are approaching AI innovation more prudently, investors should question whether Meta is taking the right path by aiming to build recommendation models that “can have tens of trillions of parameters”. Not only would this be extremely capital intensive that undermines profitability, but it also doesn’t guarantee optimal predictive performance for both users and advertisers, undermining Meta’s ability to grow top-line advertising revenue.

Note that according to Seeking Alpha data, Meta trades at 26x forward earnings, which is nearly 11% above its 5-year average of 23.48x. Comparatively, Google trades at 23.46x forward earnings, nearly 12% below its 5-year average of 26.62x. Hence, Google is not only taking a more prudent approach to AI innovation, but is also offering investors exposure to AI-driven growth at a relatively more reasonable valuation than Meta. Though keep in mind that Google has its own share of problems.

Ethical issues. It is no secret that Meta has a long history of unethical business practices. A few years ago, Frances Haugen, a whistle-blower from the company, brought to light the fact that the company had knowledge of how its algorithm-based suggestions negatively impacting the mental well-being of young users by inducing “a toxic environment for some teen girls already experiencing negative feelings about their bodies”. More recently, we learned about “how Instagram’s Algorithm Connects and Promotes Pedophile Network[s]”. These are serious issues.

Meta is already under deep scrutiny from regulators and policymakers for the social/societal implications of its social media platforms and the underlying algorithms. Given Meta’s ambitions to build enormous AI recommendation systems now, consider that the harmful implications will be a lot more profound if Meta continues to fail at effectively curbing the negative impacts of its models. This poses numerous risks to investors. Firstly, it could mean hefty fines that undermine future financial performance. Secondly, depending on how grave the potential harms are, it could significantly hurt user growth/ engagement on Meta platforms, especially if alternative social media platforms arise, conducive to lower advertising revenue. Moreover, from the perspective of socially responsible investing, a persistence in Meta’s negligence towards the dire societal impacts of its algorithms/ AI models indeed sours the sentiment towards the stock among investors that refuse to profit from unethical and/or irresponsible business practices.

Furthermore, given Meta’s already poor track record and reputation issues, the company could indeed become target number one in the era of AI as regulators try to curb the negative impacts of this revolutionary technology wave. This could force Meta to allocate more resources towards battling legal issues, as well as slow down its AI innovations, causing it to fall behind competitors that face less scrutiny. Hence, from this perspective, Meta may not turn out to be the best investment choice for investors looking for high-growth AI exposure.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.