Summary:

- Meta demonstrates massive revenue growth and profitability improvement momentum, expected to continue in 2024.

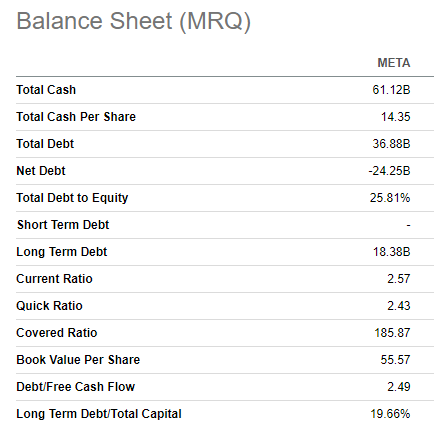

- The company has a fortress balance sheet with $61 billion in cash, which is a big power in Meta’s hands given the company’s historically high ROIC.

- My valuation analysis suggests the stock has a 25% upside potential.

COM & O

Investment thesis

I was a big Meta (NASDAQ:META) bull in 2023, and it paid off. My first bullish thesis about Meta went live in mid-March, and since then, the stock price soared by more than 80%. The latest coverage update was in October, and that “Strong Buy” thesis also outpaced the broader market’s dynamic. Many developments happened over the last three months, and today, I want to share with my readers why I am still very bullish on Meta. The company demonstrates massive revenue growth and profitability improvement momentum, which is expected to continue in 2024. Being a cash-generating machine with a fortress balance sheet opens vast opportunities for the company to reinvest in new endeavors. This will highly likely build more value for shareholders over the long term as the company has a staggering track record of generating superior ROIC. Furthermore, my valuation analysis suggests that Meta is still undervalued, even after its stock price quadrupled over the last fourteen months. All in all, I reiterate my “Strong Buy” rating for Meta.

Recent developments

The latest quarterly earnings were released on October 25, when the company smashed consensus estimates. Revenue grew by 23% on a YoY basis, and the adjusted EPS more than doubled, from $1.64 to $4.93. Meta generated a massive $8 billion free cash flow [FCF] margin, which allowed it to substantially improve its financial position. The company had $61 billion in cash as of the latest reporting date, and the net cash is above $24 billion.

Seeking Alpha

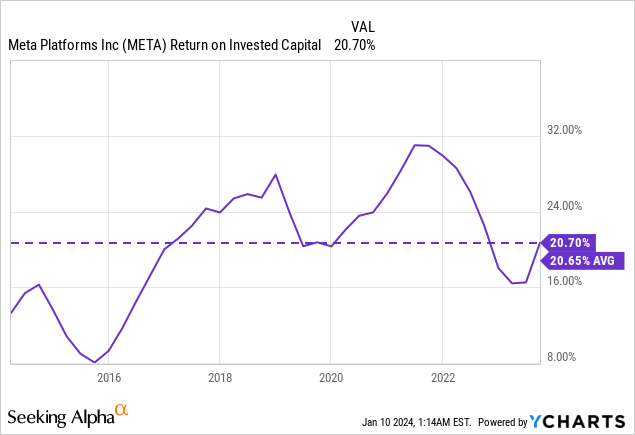

Such a balance sheet is a massive power in Meta’s hands, given the company’s historical ability to reinvest in profitable growth. Over the last ten years, the company delivered an average 20.65% return on invested capital [ROIC], which is substantially higher than the company’s cost of capital. This historical stellar performance gives me a high conviction that the company will be able to invest its vast financial resources efficiently into new profitable revenue growth drivers.

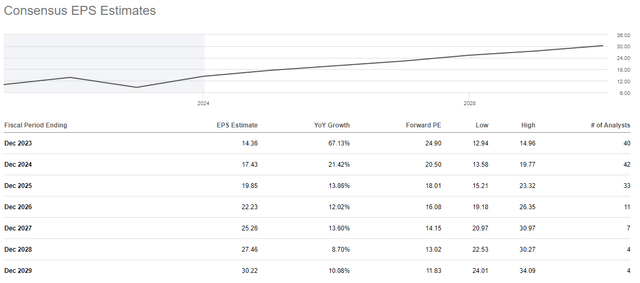

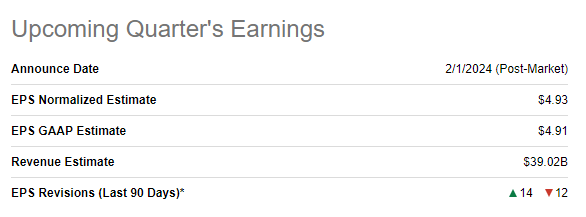

The earnings release for the upcoming quarter is scheduled for February 1. Strong revenue growth momentum is expected to sustain as consensus estimates forecast a 21% YoY growth. The adjusted EPS is expected to more than double on a YoY basis, from $1.76 to $4.93. For the full fiscal 2023, consensus estimates forecast a 14.4% revenue growth accompanied by a staggering 67% adjusted EPS expansion.

Seeking Alpha

Apart from the strong revenue growth and profitability expansion momentum, I have several reasons to remain bullish on Meta. The company continues reinvesting more than a quarter of sales into R&D, which increases the probability of unlocking new revenue drivers. As I mentioned above, the company has a stellar track record of delivering ROIC far exceeding its cost of capital, which means that the current investments in innovation will also highly likely create more value for shareholders in the future. To add context, Meta invested around $27 billion in R&D during the first nine months of 2023.

As we are currently experiencing a major transformation in IT related to the rapid expansion of artificial intelligence [AI] capabilities, the fact that Meta reinvests massively in innovation is crucial for the company to improve the efficiency of its digital advertising services for businesses. The AI-powered digital advertising analytics will likely add more intelligent ad targeting, ultimately leading to improved advertising ROI for Meta’s customers. Adding more value to customers will inevitably lead to more digital marketing budgets allocated to advertising in Meta’s owned social networks. This potential improvement for customers will highly likely help Meta expand its already substantial digital advertising market share. The fact that the global market for digital advertising is expected to compound at almost 15% yearly till 2027 is a massive tailwind behind Meta’s back. I think that the company’s already solid market position, multiplied by its strong commitment to innovation, makes the company very well-positioned to capture this favorable secular trend.

It is also crucial to remember that Meta has a massive ace up its sleeve. WhatsApp, with its vast user base, is anticipated to surpass 3.14 billion active users within the next two years. At the same time, WhatsApp has not been monetized aggressively yet. This app generated four times less revenue than Instagram in 2022, $13 billion versus $51 billion. At the same time, I see vast monetization opportunities for WhatsApp, given the messenger’s vast active audience. Having data about almost $3 billion users means that this data can be utilized both to improve advertising services for the whole Family of Apps as well as to monetize by providing advanced analytics to businesses. Premium subscriptions for both individuals and businesses are also a solid potential revenue growth driver. Messenger already offers payment services in India and Brazil, which are large markets, but they are still just two countries. Given the fact that the global digital payments industry is expected to compound at 11.6% annually, this also looks like a promising venture for Meta. To provide a more quantitative view, I would like to perform a high-level analysis of how WhatsApp’s monetization prospects will look from the capitalization perspective.

According to businessofapps.com, Instagram generated around $51 billion in revenue in 2022, having around 2 billion active users. This gives us around $25.5 of annual revenue per user. Let us be super conservative and assume that WhatsApp will be able to achieve only 50% of Instagram’s per-user monetization, which gives us around $13 in revenue per active user. That said, with a 3 billion audience WhatsApp has the potential to generate around $39 billion per year. Given Meta’s historical P/S ratio of around 7, this gives us WhatsApp’s standalone capitalization of $273 billion. Let me remind you that less than ten years ago, Facebook paid $19 billion to acquire WhatsApp. Looks like a fantastic investment with bright prospects ahead.

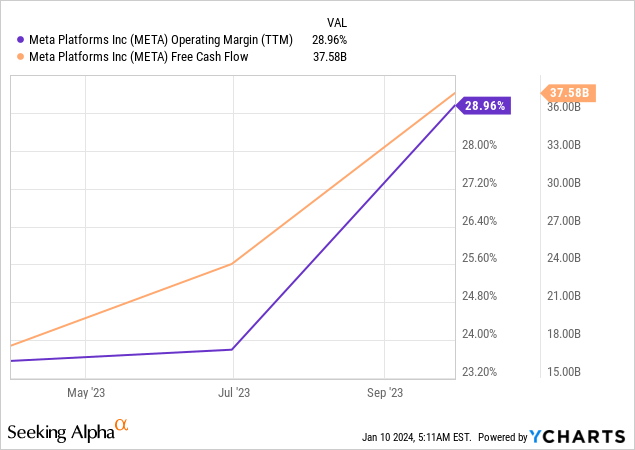

Apart from substantial revenue growth prospects, I would also like to underline the changed mindset of the management from the financial discipline perspective. As we can see above, the company’s operating margin and FCF grew dramatically in 2023, thanks to the announced “Year of efficiency” in early 2023, when the company made strong moves to expand profitability margins. I like that the execution was in line with the efficiency plan, as this year’s adjusted EPS is expected to increase by 67%, with a very strong outlook for the years beyond as well. Strong revenue growth prospects, together with improving financial discipline, are the two crucial factors why I am still very bullish about Meta.

Valuation update

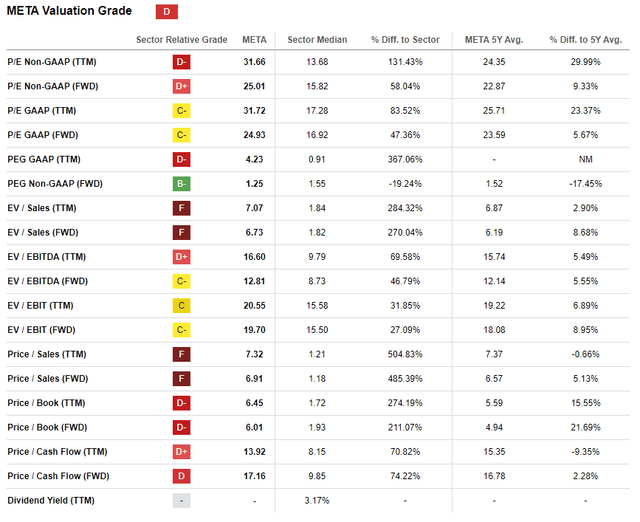

META rallied by a massive 176% over the last 12 months, multiple times outperforming the U.S. stock market. Meta’s market position and profitability are unmatched, which means the stock deserves a massive premium compared to peers. Therefore, please ignore the comparison of the company’s valuation ratios to the sector median. Instead, we should look at Meta’s current valuation ratios vs Meta’s historical averages. From this perspective, the stock looks fairly valued, given that the multiples we see today are close to historical averages, mostly with single-digit percentage point discrepancies.

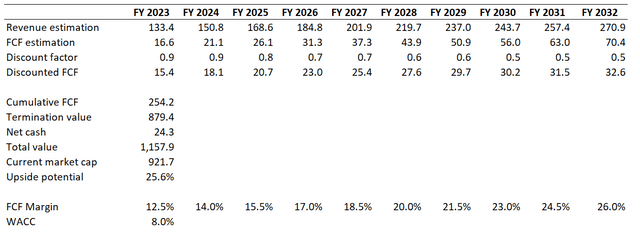

As usual, for a growth company, I will proceed with the discounted cash flow [DCF] simulation. I use the same 8% WACC as I did previously; this one is within the range recommended by valueinvesting.io. Revenue consensus estimates project an 8% CAGR for the next decade, which I consider very conservative given the company’s strong growth profile. But I will use consensus projections to be conservative and on the safe side. I use a 12.5% TTM FCF margin ex-stock-based compensation [ex-SBC] for my base year and expect a 150 basis points yearly expansion. This might look too optimistic for META bears, but the projected FCF peak in 2032 is 26%, the level that the company already demonstrated in its history. Please also note that the FCF margin with SBC included is already at the 23% level; therefore, my FCF assumptions are conservative as well.

According to my DCF valuation, the business’s fair value is $1.16 trillion, which is around 26% higher than the current market cap. That said, the stock is still substantially undervalued, and a 25.6% upside potential from the current $357 level gives me a target price of around $448 per share.

The last time I simulated a DCF model for META, I arrived at the business’s fair value of $1 trillion. The fair valuation is almost 16% higher this time, which was driven by the strong Q3 earnings release with a notable earnings guidance upgrade and the substantial improvement of the TTM FCF ex-SBC margin. That said, I consider my upgrade of the company’s fair value as sound.

Risks update

The stock price has quadrupled over the last fourteen months compared to the November 2022 bottom, which was a kind of exponential stock price growth. The further the rally goes, the higher the risk that investors might start taking profits, which might lead to a notable pullback in the stock price. I consider this risk to be substantial at the moment, given the overall massive greed that drives the stock market. At the same time, it is also important to acknowledge that there are real reasons why investors might prefer to rotate to less risky assets since the macro environment is still very uncertain: we have two large ongoing military conflicts in Ukraine and Gaza, presidential elections in Russia and the U.S. in 2024, struggles of the world’s second economy, and inflation still flying high in Europe.

Regulatory risks, which especially involve antitrust issues, are substantial for Meta. The company has private data about over 3 billion users, which cannot avoid thorough antitrust scrutiny. The company’s Family of Apps unites the most widespread social networks and messengers, and there is a potential risk that regulators might eventually force the company to undergo restructuring and division into separate entities. This might be a massively adverse factor for shareholders as such news could add a substantial extent of panic.

Bottom line

To conclude, Meta is still a “Strong Buy”. The stock is still massively undervalued, according to my valuation analysis. Meta demonstrates strong revenue growth momentum, and profitability is also soaring. The company has vast room to continue investing substantial amounts in innovation, which will highly likely ensure sustainable, profitable growth over the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.