Summary:

- The META stock has nearly tripled in value since the inception of my coverage in October 2022. Time to reconsider the thesis, given the recent launch of Threads.

- Meta’s ability to attract and retain users made a positive reception for Threads predictable, especially with Instagram’s promotion.

- From what I see, Threads have a massive advantage over Twitter in some ways.

- Moreover, META seems to be one of the most attractively valued companies in the ex-FAANG group.

- Despite some risks, I decided to reiterate a Buy rating again, as I see an advantage of about 15-20% over a basket of other FAANG stocks.

Justin Sullivan/Getty Images News

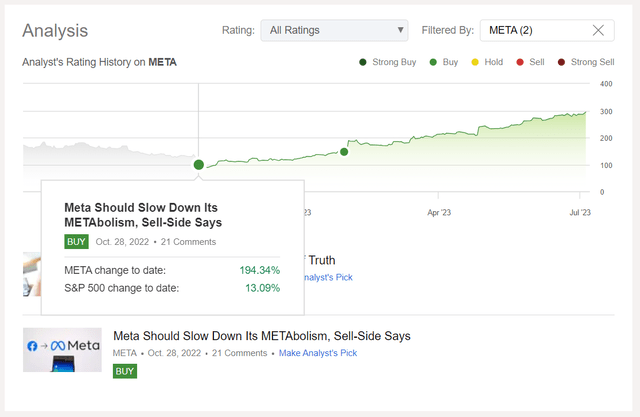

Meta Platforms, Inc. (NASDAQ:META), a well-known ex-FAANG (now – MAMAA), is one of my most successful bullish calls on Seeking Alpha. The stock has nearly tripled in value since the inception of my coverage:

Seeking Alpha, my META stock coverage

I’ve been avidly following the recent developments surrounding the highly anticipated fight between Zuckerberg and Musk. The whole situation appears peculiar – as if two immensely wealthy individuals sought to inject excitement into their otherwise mundane lives. However, with Zuckerberg’s introduction of Threads, it’s evident that his rivalry with Musk has escalated to a new height. Let’s delve into this matter and examine whether overweighting META stock, among other MAMAA stocks, still holds merit.

Threads Is A Game Changer For META

Meta has demonstrated considerable prowess in emulating rival products and enticing user adoption, and it was quite easy to anticipate a favorable initial reception for Threads, particularly due to Instagram’s promotion efforts. After the public launch of Threads on Wednesday, Mark Zuckerberg said more than 10M people had signed up for the app. However, as of late Thursday morning, he announced that over 30 million individuals have already signed up – this is an insane growth within just a few hours.

As BofA’s analyst noted on July 5th, integrating with Instagram is likely to provide a significant boost to the platform’s initial growth (what was confirmed already), but this move could also invite controversy due to the anticipated increase in regulatory scrutiny and opposition regarding the potential advantages in terms of data and market dominance enjoyed by large platforms. And that was a right prediction, too: Twitter (TWTR) has issued a legal threat against Meta, accusing the latter of unlawfully misappropriating trade secrets and intellectual property, alleging that Meta had hired former Twitter employees with access to confidential information for the development of a competing product. Elon Musk, the owner of Twitter, expressed his opinion on the matter, stating that competition is acceptable, but cheating is not.

Regulatory issues, of course, cannot be avoided by META. But a big plus for the company in this story is its experience from previous disputes. Court cases can drag on for a long time, and during that time the most important thing is to keep the new audience’s attention. Threads have a massive advantage over Twitter – it’s a new project that a) has the world’s largest user base from Instagram, so it’s easy for advertisers to integrate and understand, and b) advertisers who have left Twitter due to potential reputational risks will feel much more comfortable with Threads as they don’t have to get used to it. Also, the extent and variety of celebrity participation will be a crucial measure of sustained success for Threads. And that’s what’s happening now – from Gordon Ramsay to Michael Strahan to Jennifer Lopez, Meta has filled its new Twitter competitor with a whole host of well-known users so that the app does not feel so empty at launch, theverge.com writes in its latest article.

Among those interested in marketing, Elon Musk is considered a modern phenomenon. This man is a genius when it comes to drawing attention to his person and his projects, which repeatedly attracted colossal valuations even without having stable operating procedures. Zuckerberg is now apparently trying his hand in this field as well. The hype surrounding the real-life battle in the octagon with Elon Musk was an excellent backdrop to draw the world’s attention to anything related to the rivalry between the two businessmen – which is exactly how I explain the rapid escalation of Thread’s usage within a few hours. It’s a great move by Zuckerberg that has not cost him anything so far – it might cost him a few bruises at worst. But from a marketing standpoint, I think it’s a brilliant move.

At this point, it is difficult to assess what impact Threads will have on META’s financials. Even Wall Street analysts are still guessing – here’s an excerpt from recent BofA and KeyBank reports:

BofA [July 5, 2023 – proprietary source] KeyBank [July 5, 2023 – proprietary source]![BofA [July 5, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/7/49513514-1688703280229895.png)

![KeyBank [July 5, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/7/49513514-16887033067541578.png)

In my opinion, it is not so important now to try to estimate the most likely financial impact on META – we will make a mistake anyway. I think it is much more important to look at the general sentiment on the Street, and how quickly the pundits are pricing the Threads opportunity into the price by adjusting their forecasts. As far as I can tell from META’s EPS revisions, there has not been significant repricing yet – FY2016-FY2028 EPS figures have only grown by an average of 2.35% in the last month.

Seeking Alpha Premium, META’s EPS estimates

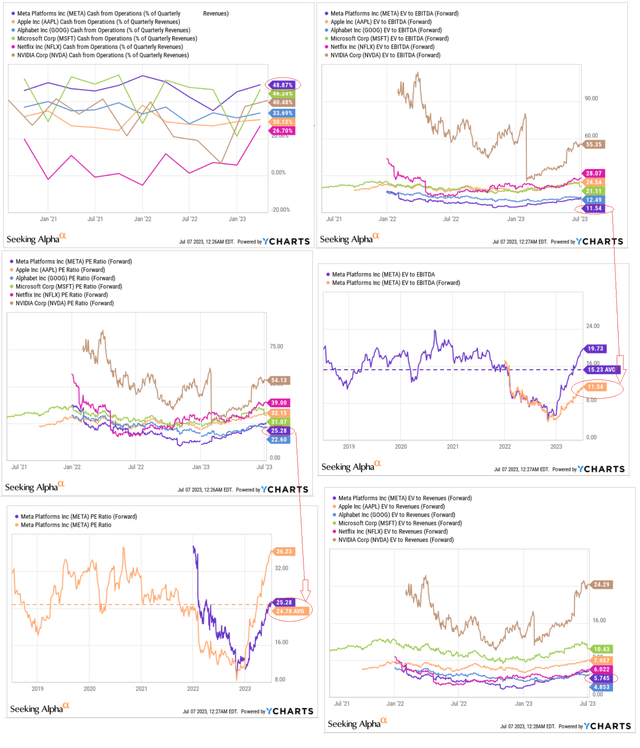

By almost all the valuation and efficiency metrics I look at, META seems to be one of the most attractive companies in the ex-FAANG group – this primarily concerns forwarding valuation multiples:

And this is even though META has one of the best shareholder return policies among the other mega-caps (judging by stock buybacks as a % of market cap):

The Bottom Line

META will definitely have a hard time when the recession, which I expect to happen at the end of this year/beginning of 2024, hits. Corporate advertising budgets will likely shrink significantly, causing META growth to slow or stagnate. Investors should keep this risk in mind before buying META stock as high as it is currently trading. In addition, the share can already be described as fairly valued in terms of the P/E ratio (forwarding ratio is almost equal to the long-term average), and the FCF yield of META does not stand out at all from the general background:

Despite these risks, I decided to reiterate a Buy rating again, as I see an advantage of about 15-20% over a basket of other FAANG stocks. The launch of Threads and user activity have shown that META is likely to add an additional revenue stream for itself in the next few years as advertisers move smoothly to the platform. I really like that Zuckerberg has shifted his focus away from the CAPEX-rich metaverse projects and is now concentrating on what the company has always been good at – copying and improving other companies’ advertising business models.

Tell me what you think about it in the comment section below. Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!