Summary:

- Meta’s suite of social networking apps offers a compelling entertainment and communication platform for users and attractive advertising opportunities for marketers.

- Meta has shown resilience against regulatory and competitive pressures, and strong financial performance on the back of the company’s incredible user network should continue.

- While Meta’s valuation may appear expensive, we think the price is justified by the company’s growth and profitability outlook.

- We rate META a ‘Strong Buy’.

stockcam/iStock Unreleased via Getty Images

Despite writing over 175 articles on Seeking Alpha since joining this site in 2021 as an analyst, we’ve never covered Meta Platforms (NASDAQ:META) as a standalone investment opportunity.

The company is relatively easy to wrap your arms around, with a compelling suite of social networking apps that provide an excellent entertainment & communication platform for users and a strong advertising proposition for marketers.

This is the simple bit.

To us, the issue that has prevented us from writing on META before has been, in our view, its overall blandness as an investment opportunity.

First off, with the exception of 2022, the stock has almost always traded with a premium to what we thought appeared to be a reasonable ‘Fair Value’ zone, even given the above-average profitability and growth prospects. Secondly, the company has always been under assault from regulators and potential competitors. Finally, bottom-line profits have swung somewhat over time in line with broader economic cycles, which introduces another set of risks to the pot.

Overall, the lack of attractive pricing combined with META’s net risk profile has prevented us from recommending shares in the past.

However, our opinion has since changed. META appears to be withstanding regulatory and competitive pressures quite well, and the company has done a good job navigating the genAI revolution while simultaneously increasing profitability. As the company has continued to execute, it has become best-of-breed in the big tech platform space when it comes to growth, profitability, and value (by some measures).

With an incredible moat around its incredibly popular products, we think that META enjoys a level of competitive advantage that’s difficult to imagine for almost any other company. This should translate to better-than-average long-term returns to investors.

Today, we’ll cover the company’s recent results and strengths in-depth to explain why we now find ourselves willing to pay META’s premium price tag.

Sound good? Let’s dive in.

Meta’s Financials

As always, let’s begin with the company’s financials.

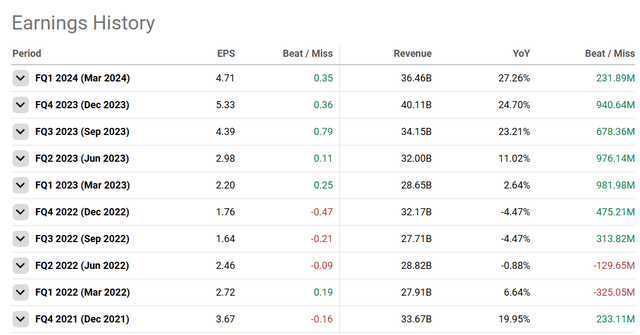

From the top, META has done well over the last few years in terms of earnings. While EPS has missed here and there (largely as a result of the company’s failed VR push and advertising slowdown), top-line results have almost always topped analyst estimates:

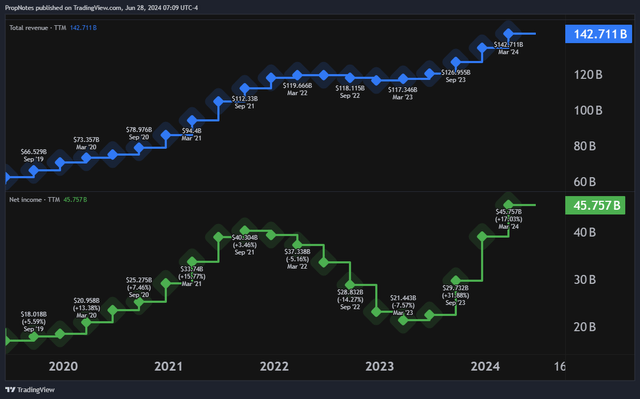

Recently, revenues have begun to re-accelerate following a slowdown in 2022, which has helped power TTM Results to all-time highs, both in terms of revenue and net income:

Much of this re-acceleration has been due to better overall economic conditions and higher advertiser spend, but falling VR development costs have also helped margins.

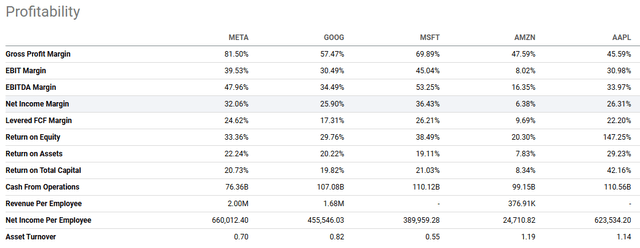

Speaking of margins, META has some of the best in the industry:

Sure, Microsoft (MSFT) is currently sporting a higher level of net income margin by a few percentage points, but down the income statement, META is a highly efficient cash conversion machine. Gross profit margins stand north of 80%, EBITDA margins are nearly 50%, and the company returns a best-in-class 22% on assets.

This can largely be attributed to the company’s powerhouse ‘Family Of Apps’.

Meta’s Economic Moat

META is in a unique position when it comes to the global content, entertainment, and communication ecosystem.

While other companies like Apple (AAPL) and Verizon (VZ) create and iterate on the hardware that power users’ ability to ‘get’ to META’s digital properties, the company has done an excellent job at monetizing its top brands as a ‘digital only’ layer that sits atop more asset-heavy internet infrastructure.

This, in part, explains the company’s incredibly strong gross margin profile – a relatively asset light, low cost business model.

META’s current ‘family’ of properties includes Facebook, Instagram, Messenger and WhatsApp. Between these four core apps, META offers users the ability to read and watch content, connect with family, friends and groups, and directly message any one of the billions of people who are within the network.

This is META’s core strength – the network. Social apps function on their ability to connect you with friends and loved ones, but building a network like this from scratch is extremely difficult, which is why there are so few real competitors.

Sharing content, messaging, and posting are all only valuable if you can do them with the people you want to do them with, and META is one of the only platforms that (likely) has all of your favorite people on it.

Why go elsewhere if META’s apps let you connect with the people you need to?

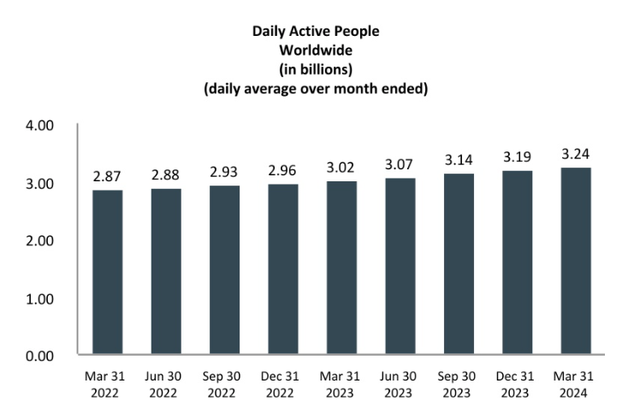

This network flywheel has led to an astounding number of people using META’s apps on a daily basis. As of Q1, this number was 3.24 billion, which continues to grow consistently QoQ:

Ultimately, we don’t think that there are many threats, going forward, to META’s hegemony. META has shown an incredible aptitude for copying popular content formats from other upstart competitors, which has kept the family of apps on top.

Instagram, at this point, is really just a mashup of popular content formats that were pioneered by competitors like Snapchat (SNAP) (Stories) and TikTok (Reels).

Zooming back out, the good news here for META is that it’s not just users that are growing, average revenues per user are also trending up and to the right:

During the first quarter of 2024, worldwide ARPP was $11.20, an increase of 18% from the first quarter of 2023.

As it turns out, being able to harness the attention of billions of people on a daily basis is a highly profitable position to be in.

Finally, META has strong competitive advantages on the CAC front.

In short, the company doesn’t have a high associated cost when it comes to acquiring user attention. GOOG, the other large internet marketing juggernaut, by contrast, has a high TAC cost for users and searches that it breaks down in its financial statements. META’s products are more habit-forming, which require less in the way of up-front cost. Billions of people open the Instagram app, daily, free of charge.

All in all, in our view, META’s results and advantages should continue well into the future as the network effects compound and the company collects more and more in the way of tolls from marketers.

Meta’s Valuation

But what is the company worth? As we mentioned at the beginning of the article, we’ve often found META’s valuation to be just a bit too expensive, but our view has changed somewhat.

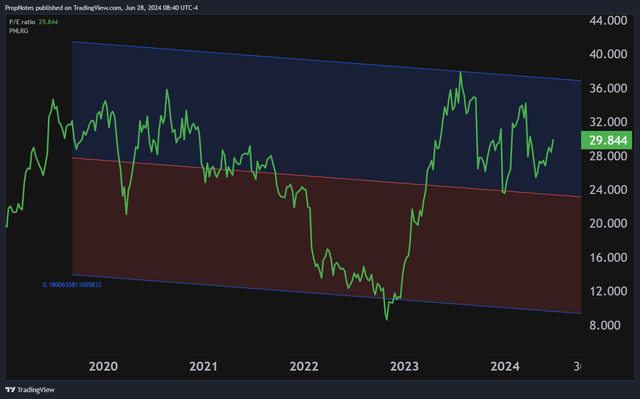

Right now, META is trading at roughly 29x earnings and 9x sales, which appears to be very nominally expensive vs. the S&P 500.

However, on a historical basis, shares are actually within the higher band of the 5-year standard deviation range:

As you can see, the green line is well within the upper blue band.

Additionally, if you were to remove the company’s 2022 profitability disaster, META’s average multiple in that time was roughly around where things are now. Thus, we think the price appears reasonable.

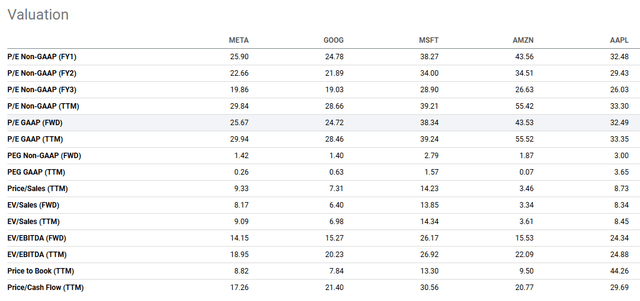

On a comps basis, META does look somewhat expensive, although GAAP FWD P/E is on the lower end of the range, which shows that things may not be as extended as some may think:

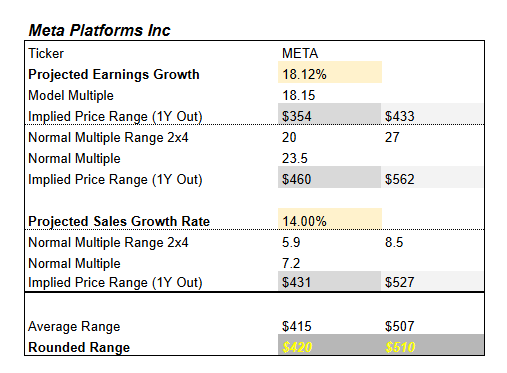

Finally, if you try to work out a fair value range for META, we’d argue that it comes in somewhere between $420 per share and $510 per share:

PropNotes

This model uses historical and model earnings and sales multiples to get an average range of where the stock ‘should’ be trading, based on potential growth.

While META is trading above this price slightly (the last close was around $520), we’re alright paying a slight premium for shares given the aforementioned advantages.

Shares are expensive vs. the S&P 500, but META’s growth and profitability outlook is stronger.

All in all, we think the whole package here appears to be an attractive entry point for the long term.

Risks

Normally, we’d write out a big, long risks section that explains all of the things that could go wrong with an investment into META, but this is one of the interesting cases where the company is quite de-risked here from a competitive and financial position. We expect META to grow sales and earnings over time with a high degree of predictability, minus the occasional economic slowdown that impacts things.

In theory, this lower risk profile also boosts the durability of the company’s long-term multiple.

That said, there are a couple of risks.

First off, if TikTok continues to gain ground, then META could be in trouble. There are a limited number of hours in the day, and if TikTok begins to gobble more and more of this time up when current users could have otherwise been using META apps, then that could hurt margins.

Instagram’s Reels release did a lot to stem the bleeding from this perspective.

Additionally, META’s multiple is quite expensive on a nominal basis, and a slowdown in results (which would likely be macro led), could send shares materially lower even if the overall impact on financials isn’t that big.

Summary

That said, despite the risks around TikTok and the valuation, we see META as a massive long-term winner on the back of its incredible network, strong user value proposition, and improving monetization trends.

All in all, META appears, to us, to be a ‘Strong Buy’.

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.