Summary:

- Meta stock has surged 30% in the last two months.

- Upside retracement corrects extreme undervaluation.

- Earnings multiple of 16.4x seems inappropriate and reflects a high margin of safety.

Justin Sullivan

Despite a 30% increase in valuation since November, Meta Platforms Inc. (NASDAQ:META) still provides investors with a very compelling valuation based on earnings.

Despite having 3.7 billion people using Meta’s products on a monthly basis, the social-media company is currently valued at only 16.4x earnings.

In my opinion, investors are still overly concerned about the decline in digital advertising. I believe Meta’s high operating margins and strong cash flow are compelling reasons to purchase the stock.

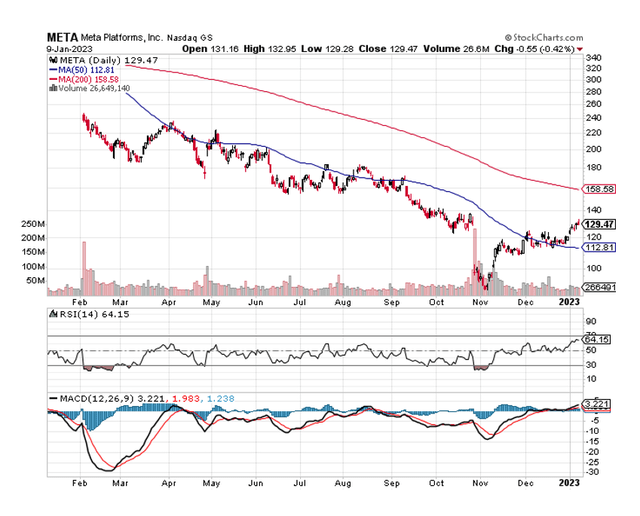

Furthermore, Meta has broken out above the 50-day moving average line, resulting in a much more positive chart profile.

Substantial Improvement In Investor Sentiment, Gap Close, Breakout Above 50-Day Moving Average

Since crashing to new lows following the release of 3Q-22 results in November, a significant upside retracement has occurred, culminating in a textbook closure of the earnings-related gap in Meta’s stock chart.

Aside from closing the gap completely, Meta broke out above the 50-day moving average line, which can be interpreted as a bullish signal from a technical sentiment standpoint.

Meta’s chart profile has significantly improved in recent weeks, and I see upside potential to $158.58, where the 200-day moving average line currently runs.

If META can also break through the 200-day moving average line, the stock has the potential to reach $200 in the short term.

Moving Averages (Stockcharts.com)

Investors Discount Strong Underlying FCF, High Operating Margins

The chart above shows that buyers have returned to the market after concluding that the selloff in October and November 2022 was overdone. Two months ago, after the social-media company reported earnings for 3Q-22 and Meta lost roughly a quarter of its market value, the consensus was that the social-media company was experiencing a significant advertiser pullback, which would have a significant impact on sales and free cash flow.

The market was not entirely incorrect in its assumption, but investors have a tendency to overreact to news, such as Meta’s slowing ad sales growth late in October.

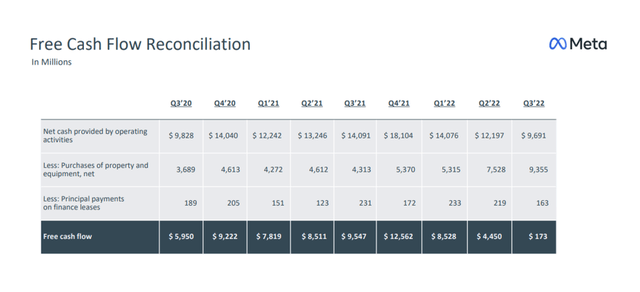

Meta did report a rather steep YoY decline in free cash flow in 3Q-22, but this was not due to the company’s advertising-focused business model being obsolete. Meta earned $173 million in free cash flow in 3Q-22, compared to $9.5 billion the previous year, owing primarily to accelerated capital expenditures. Meta’s capital spending has more than doubled YoY to $9.4 billion.

Meta’s average quarterly free cash flow over the last nine quarters was $7.4 billion, so despite a slowdown in ad sales, I believe the business is still in good shape, and the total dollar amount of free cash flow will remain highly valuable to the company’s shareholders, regardless of how Meta uses it.

Free Cash Flow Reconciliation (META Platforms Inc)

Highly Attractive Operating Margins

Meta has reported operating margins ranging from 37% to 20% over the last four quarters, with a clear downward trend over the last year. Even if Meta only maintains 20% margins in 2023, the social-media company stands to profit billions of dollars. Meta’s operating margins stand to profit handsomely once the ad market recovers and advertisers are more comfortable spending larger budgets.

In my opinion, Meta’s market valuation does not currently reflect the possibility of an upside retracement in operating margins in a strong ad market.

Very High Margin Of Safety

Meta’s current year earnings are expected to be $7.91 per share, according to the market. With expected earnings of $7.91 per share in 2023, the company’s earnings potential is valued at 16.4x.

Given that Meta Platforms provides advertisers with significant advertising value, and that Meta’s products have nearly 3.7 billion monthly active users, I believe the valuation reflects a very high margin of safety.

Earnings Estimate (Yahoo Finance)

Why Meta Could See A Lower Valuation

Meta’s stock price has fallen from $337 to $128, and the stock is now a bargain in my opinion, based on raw earnings power and the potential for operating margins to increase to 30% or higher in a stronger ad market.

Having said that, an extended downturn in the ad market would almost certainly be a significant headwind for the social-media company’s sales growth and valuation.

Considering Meta’s dominant market position in social media as well as the size of its free cash flow, I believe the upside potential vastly outweighs the downside potential.

My Conclusion

Even though I am up about 30% since buying into the stock’s weakness in the first week of November, I believe the stock has a lot more room to rise.

Given that Meta has significant earnings potential once the ad cycle corrects to the upside and operating margins retrace from 20% to 30%, I believe America’s largest social-media company is worth more than 16.4x.

What investors may be mistaken about here is that they believe the ad market downturn will continue through 2023. If there is only a glimmer of hope that advertisers will reopen their wallets and spend money on Meta’s ad platforms, I believe the social-media company’s valuation will grow as quickly in 2023 as it fell in 2022.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.