Summary:

- Meta Platforms, Inc. launched Threads with a lot of fanfare, but the usage seems to have dropped after initial growth.

- A recent Financial Times report shows that Threads daily active users has declined after the initial week while Twitter’s user base is intact.

- Meta has already shown success with Reels, and we could see similar success with Threads over the next few years.

- Meta’s user base is saturated, but it can increase engagement rate by adding new social platforms to its ecosystem and increase the average revenue per user.

- Meta’s addressable market is “infinite” as the company effectively uses its network effect, making it a good growth stock.

Justin Sullivan

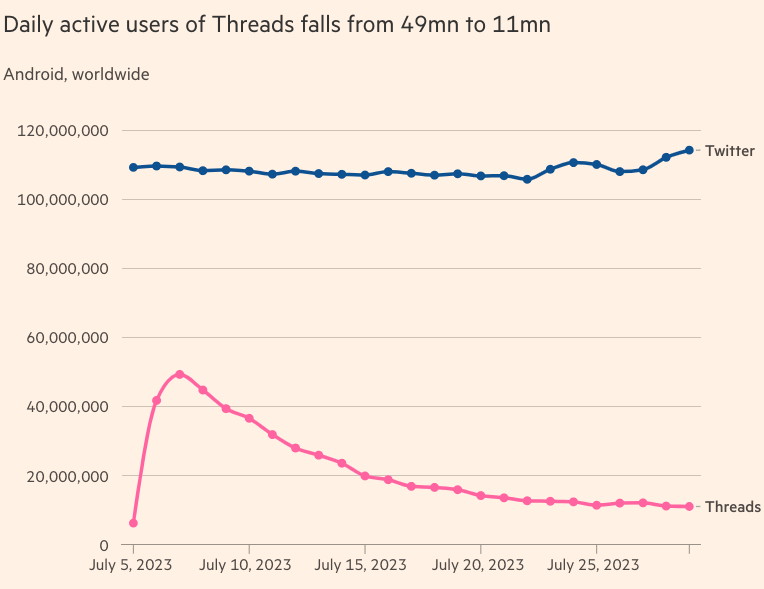

Meta Platforms, Inc. (NASDAQ:META) has seen some big swings in the usage of Threads since the launch. After the initial bump in the first few days, the daily active user base seems to have shrunk back. According to a report by Financial Times, Threads daily active users jumped to 50% of Twitter’s daily active user base after the first day of launch. It has now declined substantially and is now only 11 million.

Meta has a successful strategy for Reels. However, it took the company over 2 years before it could monetize Reels effectively. We could see a similar timeline for Threads, and it might take until the end of 2025 before Meta could report a strong active user base. Twitter has been throttling links to Threads, which shows that it is facing some heat from this competitor. Good active user base and monetization of Threads will have a major impact on the sentiment towards the stock. Wall Street will likely view the company with a wider addressable market and a better growth potential compared to other big tech peers.

Threads will take time

After the initial robust launch of Threads, it was expected that Meta could soon overtake Twitter in terms of daily active users. However, recent reports suggest that most of the initial users were merely experimenting with the platform and they have not become daily active users. This was likely as all new initiatives with Meta take time to build a stable engagement with users.

Financial Times

Figure 1: Trend of daily active users within Threads. Source: Financial Times.

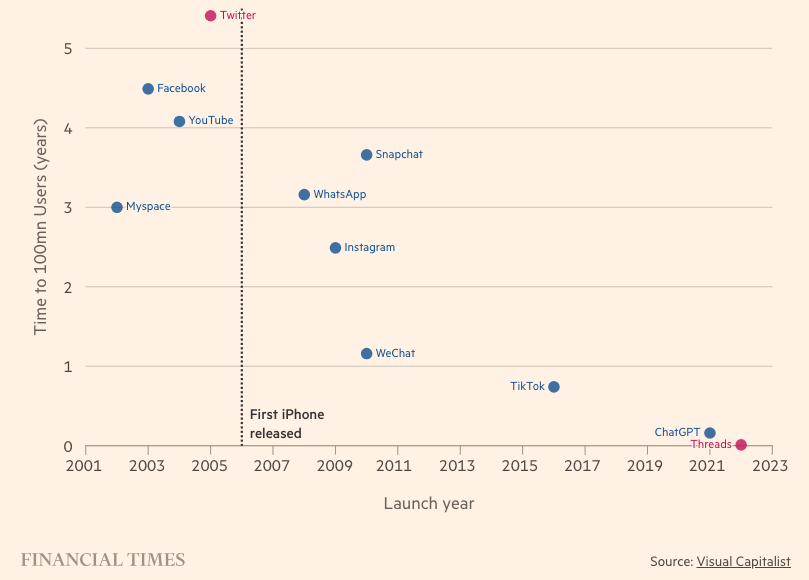

Meta will need to make some more iterations on Threads to improve the user experience. The initial bump in user base shows the massive reach of Meta and the ability of the company to divert customers to new social features. Threads reached 100 million users within a few hours compared to over 5 years for Twitter, over 3 years for WhatsApp, and close to a year for TikTok.

Financial Times

Figure 2: Time to reach 100 million users. Source: Financial Times.

Good long-term potential

Meta has almost saturated the ad placement within its legacy social media platforms like Facebook and Instagram. Prior to the growth in Reels, Meta was reporting single digit YoY growth in ad impressions apart from a bump during the pandemic. As an example, in Q2 2021 Meta reported 55% YoY revenue growth which was supported by 47% YoY growth in price per ad and a mere 6% growth in ad impressions. Pushing higher ad impressions on legacy Facebook and Instagram would hurt user experience which has limited the ability of the company to increase ad placement on these platforms. Hence, Meta needs new social features where customers spend incrementally more time.

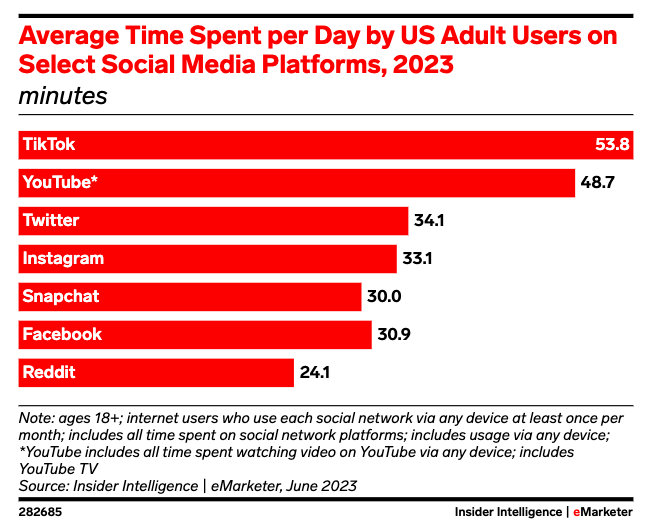

Insider Intelligence

Figure 3: Time spent per day by U.S. adult users on social media platforms. Source: Insider Intelligence.

Reels has reached annualized revenue rate of $10 billion according to Zuckerberg’s statement in recent earnings call. This is up from a mere $3 billion revenue rate in last summer. The impact of Reels can also be seen on key metrics of the company. The recent 11% YoY revenue growth of Meta was supported by 34% YoY growth in ad impressions. This is a clear sign that monetization of Reels is having a big impact on Meta.

If Threads is able to increase the daily active user base and the average time spent by users, then we could see a similar growth spurt in ad impressions. Meta has a strong network effect which the company has used to launch new social features. According to Insider Intelligence report, average U.S. adult spent 54 minutes on TikTok, 34 minutes on Twitter, and 30 minutes on Snapchat. Meta is trying to add social media features from all these platforms, and we could see more user time spent on Meta’s platform compared to other competitors. This should help in improving the average revenue per user.

Company Filings

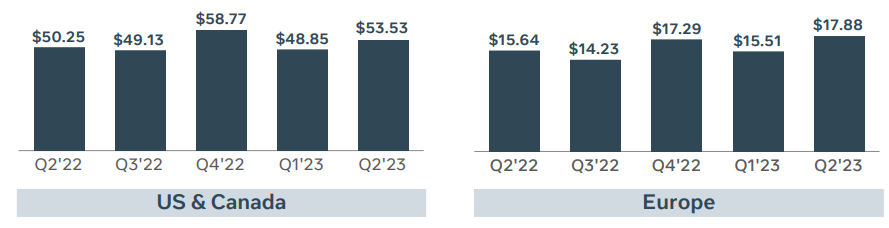

Figure 4: Meta’s ARPU in U.S. and Europe. Source: Company Filings.

Meta’s ARPU in U.S. & Canada region increased by 6.5% compared to the year-ago quarter. The increase in ARPU in Europe was higher at 14% despite the recent regulatory issues faced by the company in this region. If Meta is successful in building a good engagement rate on Threads and monetizing the user base, we could see another big jump in the ARPU, which should help in improving the growth trajectory for the company.

“Infinite” addressable market

Most of the products and services have a limited addressable market. Mature companies like AT&T (T) and Verizon (VZ) have shown stagnant revenue because they have covered the addressable market. Wall Street has given very low valuation multiple to these mature companies. Social Media is a relatively new industry and we are still seeing new platforms build rapid growth. A good example is TikTok, which has built significant user engagement from scratch in a short time. Meta has been good at replicating social features from Snapchat, TikTok, Twitter and other platforms.

It is highly likely we will continue to see new social media platforms in the future that can rapidly build strong user engagement. It is also likely that Meta can use the network effect in building its own social media features which can compete with other platforms. This gives Meta a long growth runway, and we could see the company deliver average compound annual growth rate in double-digit for the next few years. Growth in Reels has shown that there could be swings due to different monetization timelines, but Meta is in a good position to deliver revenue growth in the near to medium term.

Impact on stock

It is likely going to take a few more quarters before we see a material impact of Threads on the top line and bottom line growth of Meta. Success in Threads will likely have a bigger impact on Meta stock as it will assure Wall Street that the company can add new social features and build monetization on new platforms. This should help in improving the valuation multiple of the stock. Meta stock is trading at 22 times its forward P/E, which is quite low compared to other big tech companies.

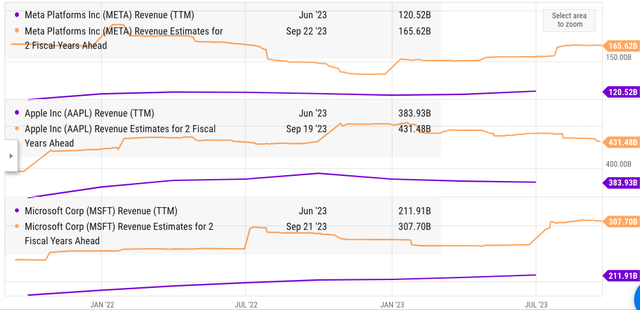

Figure 5: Revenue growth estimates of Meta, Microsoft, and Apple. Source: Ycharts.

The forward revenue growth estimates of Meta are quite strong. The company is estimated to report over 40% cumulative growth in revenue for the next 2 fiscal years. This is higher than both Apple (AAPL) and Microsoft (MSFT). On the other hand, Meta is trading at 25% discount in terms of forward P/E when we compare it to Microsoft and Apple, both of which are trading at close to 29 times the forward P/E.

The trajectory of user engagement and monetization in Threads will be very important for Meta’s stock price. It is likely that Meta can replicate the success of Reels in Threads and build a good advertising platform on Threads.

Investor Takeaway

Recent reports have suggested that daily active users on Threads have declined after the initial jump. It could take a few more quarters before Meta can deliver strong user engagement on this platform. However, the company is in a good position to build another successful platform. Zuckerberg has mentioned that Reels is showing annualized revenue rate of $10 billion, which is having a big impact on the top line growth of the company.

Success in Thread will help in giving the company a good platform for ad placement. It will likely improve the valuation multiple of the stock as it shows that the company can add new social media features and monetize them. Meta Platforms, Inc. stock is reasonably priced when we look at the long-term growth trajectory, making it a good buy-and-hold option.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.