Summary:

- Meta Platforms, Inc. may similarly expand WhatsApp Pay’s capabilities to include e-wallet systems, utility/deliveries, gaming, and e-commerce, emulating WeChat and KakaoPay’s success thus far.

- While the fintech segment is still at nascency, an aggressive market grab exercise may yield surprisingly robust results, given WhatsApp’s leading 2.2B user base.

- Meta Platforms’ WhatsApp Pay may potentially deliver $22B in revenue over the next few years due to its strategic partnerships in India, Brazil, and potentially in the U.S.

Khosrork

We have previously covered Meta Platforms, Inc. (NASDAQ:META) here as a post-FQ3’22-earnings article in November 2022. Its long-term trajectory remains robust, due to the massive improvement in its monetization effort across its platforms. The company has also scaled back its metaverse spending and focused on developing its AI capabilities, advertising, click-to-messaging ads, and Reels against TikTok. Lastly, its Free Cash Flow [FCF] margin is expected to expand over the next few years, reducing its reliance on debts then.

For this article, we will be focusing on WhatsApp Pay, one of Meta’s key products with massive monetization potential. The platform may potentially deliver up to $22B in revenue over the next few years, due to its strategic partnerships in India, Brazil, and potentially in the U.S. While the fintech segment is still in its nascency, an aggressive market grab exercise may yield surprisingly robust results, attributed to Meta’s global social media market share of 78.29% in December 2022.

The WhatsApp Investment Thesis Is Not To Be Ignored

As previously discussed, Meta has started to monetize WhatsApp, with notable success thus far. The platform boasted an impressive 80% YoY growth to $1.5B in run rate by FQ3’22, while growing a total of $9B in annual revenue from Messenger and Instagram Direct as well.

This is partly attributed to JioMart-on-WhatsApp‘s accomplishment in India. Consumers have been able to browse JioMart’s entire grocery catalog and make payments without leaving WhatsApp. The model is likely to be replicated globally as well, with a massive potential to build an all-encompassing business communication/ e-commerce/ payment ecosystem in the WhatsApp/ Family of Apps in the near future.

A leading success story has been observed in WeChat, offered by Tencent (OTCPK:TCEHY), proving to be a “Super-App” as a one-stop shop for a variety of services, including messaging/ video calls, utility payments, e-wallet systems, meal deliveries, gaming, and e-commerce.

With 1.26B of active users, 82 minutes of daily engagement, and diverse technological offerings, it is no wonder that the Chinese fintech platform delivered a robust $26.18B of revenue over the last twelve months [LTM] and an estimated ARPU of $20.7 against WhatsApp’s $0.75. Notably, WeChat also processed over $400B of Total Payment Volume [TPV] in 2021, suggesting its fintech prowess compared to PayPal’s (PYPL) global TPV of $1.25T at the same time.

Something similar has been observed in South Korea as well. KakaoTalk, a social media company in South Korea, previously launched KakaoPay, a digital wallet in 2014 and a buy-now-pay-later (BNPL) service in 2021. With a 51% market share in South Korea’s digital wallet market in 2021, KakaoPay has been able to create excellent synergies with its sister companies, including Kakao messaging app, Kakao Bank, Kakao Mobility (ride-hailing service), and Kakao Games. As a result, the company reported impressive revenues of $0.42B and approximately TPV of $90B in the LTM.

While Zuckerberg has previously wanted to emulate the success of “Super-Apps” back in 2019, his aggressive commitment to Metaverse by 2021 is confusing indeed. Nonetheless, all hope is not lost, due to the company’s expanded partnership in India and Brazil in 2022.

MercadoLibre (MELI), a Latin American e-commerce giant, will be partnering with Meta to process payments for WhatsApp Pay in Brazil. The partnership includes in-app transactions with credit or debit cards across the former’s business platforms, including in-app e-commerce. Brazil proves to be a highly attractive market for WhatsApp’s business offerings indeed, due to the tremendous 99% market penetration among smartphone users in the country.

This suggests Meta’s eventual success in onboarding customers on WhatsApp Pay, especially given MELI’s leading e-commerce market share of 27% in the country and over 30% in the Latin America region.

In addition, Brazil only ranks second in terms of WhatsApp’s user base at an estimated 165M users in 2022, with India reigning with 487.5M users. Therefore, it is unsurprising that Meta chose these two countries as their test markets, signifying WhatsApp Pay’s massive opportunity, especially due to the relatively nascent e-commerce and digital payment market in the region.

India’s e-commerce market is expected to grow at an excellent CAGR of 21.27%, from $74.8B in 2022 to $350B by 2030. The country’s digital payment prospects are stellar at an accelerated CAGR of 35.1% as well, from $3T in 2022 to $10T by 2026. Market analysts are similarly bullish about the growth of e-commerce and digital payments in Latin America, at a CAGR of 25% through 2025, with an ARPU of $228.1 as well.

Moving forward, Meta may have to seek banking and payment licenses in many countries, triggering further headwinds in its expansion plan, due to the regulatory hurdles in the U.S. and the EU thus far. However, its fintech dream remains highly promising in our opinion, given MELI’s Mercado Pago’s (fintech segment) excellent revenues of $1.87B YTD and 2.43B in FY2021. While the Latin American giant did not break down the segment’s margins, we do not have to look too far, indeed.

PYPL, as a global digital payment leader, reported stellar revenues of $20.1B over the LTM, with EBIT margins of 21.0% and net income margins of 17.3% at the same time. While these numbers may pale in comparison to Meta’s previous margins of 41% and 26.1% in FY2019, it is not too far from its impacted margins of 30.1% and 24.4% over the LTM. Notably, PayPal achieved these results with only 35M active merchant accounts and 400M active consumer accounts in the latest quarter.

With Family of Apps’ leading 3.7B monthly users and WhatsApp’s 2.2B active daily users, Meta has an immense untapped monetization potential indeed, especially if expanded to the offline retail segment as well. Since its survival and stock recovery largely hinged on its diversified monetization strategy, we anticipate the management to aggressively expand beyond its outdated advertising model.

CEO Mark Zuckerberg has no choice but to replicate WeChat’s strategy, indeed. Assuming that WhatsApp Pay is able to achieve the latter’s success at a halved ARPU of $10, it is not overly ambitious to assume an annual fintech contribution of $22B then. While these numbers may pale in comparison to the company’s annual revenue of $118.15B in the LTM, the diversification may help ease market analysts’ pessimism attributed to the Apple (AAPL) privacy changes.

So, Is META Stock A Buy, Sell, or Hold?

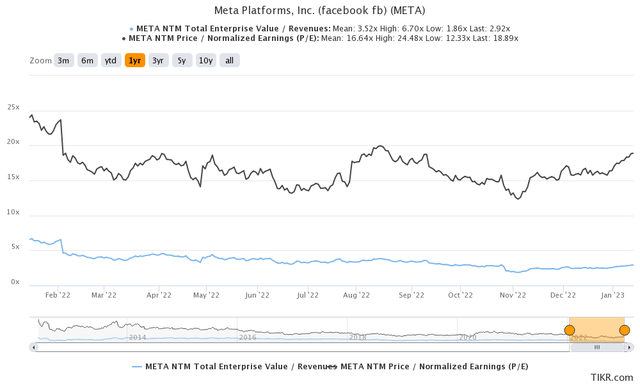

META 1Y EV/Revenue and P/E Valuations

Meta is currently trading at an EV/NTM Revenue of 2.92x and NTM P/E of 18.89x, drastically lower than its 3Y pre-pandemic mean of 8.06x and 24.68x, respectively. Otherwise, it still moderated from its 1Y mean of 3.52x, though improved from 16.64x, respectively.

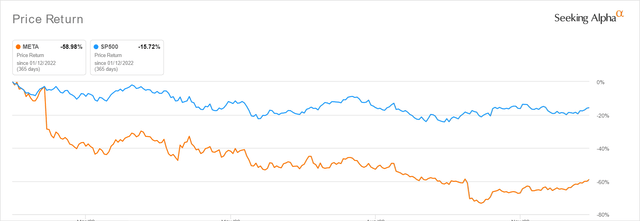

META 1Y Stock Price

Based on Meta’s projected FY2024 EPS of $9.90 and current P/E valuations, we are looking at an aggressive price target of $187.01. Market analysts are more prudent, however, at a price target of $151.89, suggesting a minimal 11.10% upside potential from current levels. This is unsurprising, due to the massive 44.24% stock recovery since our previous article/ November bottom.

Depending on individual investors’ risk tolerance and investing trajectory, the Meta stock may remain volatile for the next few quarters as well, before sustainably recovering once the macroeconomics improves and market sentiments lift.

However, we are more bullish since Meta continues to report an unrivaled global user base with immense untapped monetization prospects. While profitability has notably taken a hit from the Metaverse strategy, privacy changes, and reduced ad spending, market analysts already predict that these may normalize from FY2024 onwards.

As a result, we cautiously rate Meta Platforms, Inc. stock as a Buy, with the caveat that the exercise adequately reduces investors’ dollar cost average. Naturally, those adding here must recognize the reduced margin of safety, especially when the Fed’s recent meeting minutes suggest terminal rates of over 5%. These may, unfortunately, trigger prolonged interest pain through 2023, if not 2024, reducing corporate ad spending momentarily.

On the other hand, Meta Platforms, Inc. bulls should recognize the company’s excellent prospects and hold on through the short-term volatility.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of META, MELI, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.