Summary:

- Investors who followed my Meta $127 buy call from January 2023 will be doing very nicely indeed seeing a near 350% increase.

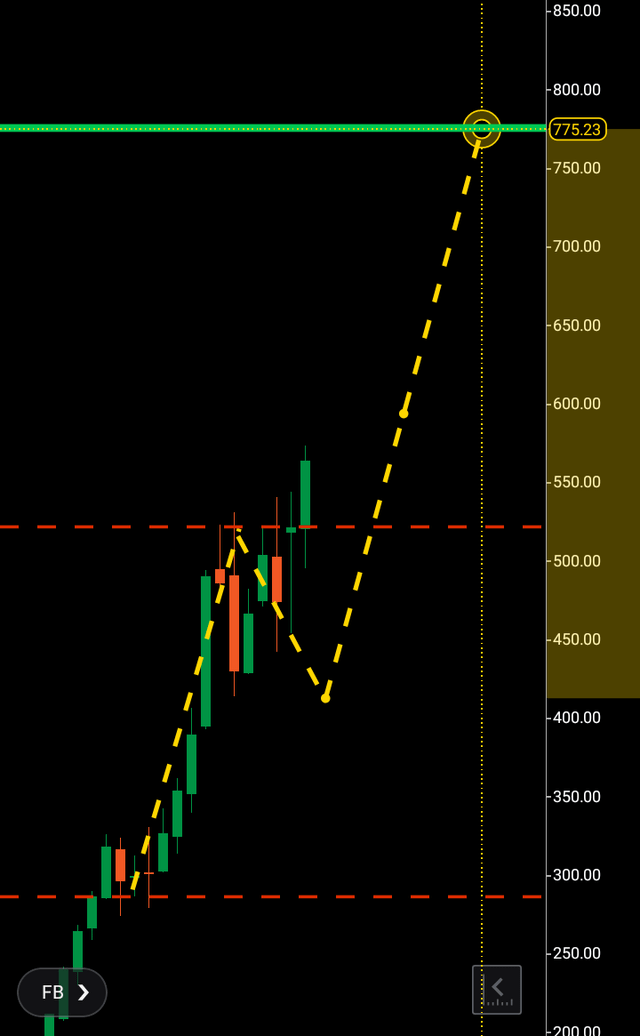

- However, the social media giant is potentially looking for another sizable move in its share price, with $775 as a next stop.

- I am Justin Ward, a future pricing analyst for major financial markets and author.

M.photostock/iStock via Getty Images

Do you remember years ago when you visited somebody’s house, they would take a sleeve of pictures from their drawer and show you their holiday photos one after the other as they displayed such excitement against your pretence to match the emotion? Photo after photo of them smiling in a blue skyied background got shoved in front of your face as you calculated how far the door was from the couch you were clearly being held hostage on.

If every fifth photo that was pulled from that sleeve contained targeted advertising you would have an analogue version of today’s social media right?

That’s just my take after firstly encountering Facebook in 2007 and Instagram well I can’t quite remember and What’s App which the majority of the world can’t live without.

Cudos to Mark Zuckerberg, combining these three platforms from a dorm room that have stood the test of time as the digital world evolves rapidly. I remember the day the news broke that Mr Zuckerberg had paid $19 billion for was app, and that the share price had got it (dipped) on that news. A remarkable piece of visionary in hindsight combining a social media powerhouse while we use it for free and companies pay to advertise.

Personally, when covid hit and the lockdown was enforced here in the Mediterranean, I was glued to Facebook as take after take of our impeding unknown took shape looking for comfort and the latest news on this unraveling and bizarre scenario.

What did that tell me? As the world becomes more volatile if a serious event materializes, we look to social media to find news and comfort. Because we are all going through something affecting, and we want to engage with our closest or like-minded fellow people.

What is that doing behind the screen, churning revenue….

The Fed rate decision of a half a point rate cut was taken as a positive by Wall Street last Wednesday and as the S&P broke the all-time high of 5670 still on course for my target of 6500 from April, Meta (NASDAQ:META) too charged out of the blocks with ferocity breaking its high of $542 in pre-market trading.

As the market in general looks to move upwards, being let off the leash by the Fed, it has to be said that Meta is one of the leaders making meaty gains.

Let’s dive into the company news before moving to the share price analysis, but before we do, I will quickly recap on my Meta charting history. In January 2023, I identified a breakout on the weekly chart with a buy signal for investors at $127. In July of that year I identified potential resistance at $325 with Meta subsequently bouncing off $325 exactly, trying to then envisage what the stock may look to do if the rejection came at $325, Meta would look to the $509-$550 region next.

Meta, with a market cap of 1.3 Trillion and 3.3 Billion daily users, the powerful combination of Facebook, Instagram, WhatsApp and messenger shows no signs of abating. This quarter gone saw net income come in at 13.5 billion, which is an incredible increase of 73% year-on-year.

Q2 advertising revenue figures revealed a 22% jump in sales, which was double that for advertising rival Alphabet (GOOG) (GOOGL) for the same period, coming in at $39 billion compared to $31 billion for the same period in 2023. The average price per ad also increased by 10%. Meta’s CFO has said that third quarter earnings are expected at $38.5 – $41 billion. Citi analyst, Ronald Josey expects revenue to come in at $40.7 which would be a 17% increase from the same period last year.

Last month UBS raised their price target to $635 for Meta, I encounter this regularly where a major financial institution will issue a target with the true picture being that the stock is looking to go quite a bit higher according to my analysis so let’s move over to the charts to technically examine where this equity could be looking to go next.

Companies or indexes that continue to grow overtime create what is termed “waves” of buying and selling, which can lead to a picture of what that financial market will do in the future. The Theory I have written, the Three Wave Theory, has had an excellent rate of success in predicting not only the future price direction but exact future price point too, this is why our readers that follow my analysis here at Seeking Alpha have enjoyed an abundance of an accurate analysis against all the market noise. However, you will also know my saying, I don’t have a crystal ball and in this case, of my latest Meta buy signal it is simply termed as what this equity is “looking” to do next.

Meta has broken into an additional third wave towards $775in fact, it technically broke into that wave in January of this year by piercing resistance at the $520 region only to retreat back into its structure.

This too is normal as often a financial market will break out into a third wave only to fall back into its wave one two set up before re attempting resistance, breaking above and holding.

So far, this month, this is having happened by taking out that key $520-$540 area. I will now go through the structure before finalizing.

We can see in the chart below the low of this latest wave one as Meta looks to climb us at $280 seeing a large amount of bullish action on its way to resistance at $520. The wave two moves down to $410 while technically initiating the third wave, all in the same month. However, that $410 region has been the low of this three wave structure so far while the following months were spent gathering momentum towards resistance again while also printing another rejection candle at that region enabling the path for Meta to breakout and hold there.

I am issuing a buy signal for this equity on the basis of an additional third wave breakout from the $520-$540 resistance area. Meta must stay above $280 in order to retain its technical structure to $775. If the economy were to fall into recession, we could again see dip in as spending which would affect the bullish momentum and cause a drop of the share price like we saw in 2022, however this may not happen in the near future and earnings forecasts appear to be positive for the company which of course will help it get from this breakout zone towards my forward going target. I expect Meta to arrive at $775 within the next twelve months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.