Summary:

- Meta Platforms, Inc. is the only mega-cap stock in my portfolio, with a price target of $630 by summer 2025.

- I believe in Meta’s prospects and aggressive investment in AI, predicting around 18% CAGR in 2024.

- Meta’s stock valuation at 22x next year’s free cash flow is considered attractive for new investors, supported by strong free cash flow margins and balance sheet.

Derick Hudson

Investment Thesis

Meta Platforms, Inc. (NASDAQ:META) is my only mega-cap stock. The next biggest stocks I own are PDD (PDD) and Arista (ANET), with market caps of $200 billion and $100 billion, respectively.

As an inflection investor, I have space to go anywhere. If I chose to invest in Meta, it’s because I believe in Meta’s prospects being as good as GigaCloud Technology (GCT) or LifeMD (LFMD) or Sezzle (SEZL).

Without being a hero, I believe that Meta is capable of growing next year in the mid-teens, while it’s being priced at approximately 21x next year’s free cash flow.

In short, I’m eagerly anticipating its Q2 earnings results next week (reports July 31st), as I see a path toward my price target of $630 by the summer of 2025.

Why I Don’t Use Stop Losses

On 25 April, I said to subscribers:

Heading into its Q1 2024 earnings report, Meta’s share price has remained solid while the rest of the market took a breather. Investors naturally assessed this earnings report with a finger over the sell button. But as you’ll see, Meta’s thesis is very much intact. Nothing has changed.

Further, I can assure you, that without any bravado, this stock will continue to head higher in the coming weeks. Stick with the plan. Don’t give into fear.

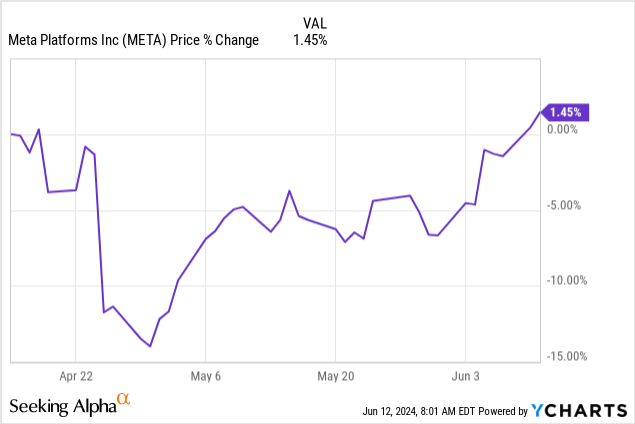

Here’s a graph that zooms in on the period around the previous earnings report.

Chart

Meta was crushed on the back of its Q1 results. The stock plummeted. A couple of subscribers reached out to me, asking me if this changed my thesis. I explained that nothing had changed for me. Less than 30 days later, the stock is back to where it was. And now?

The same again.

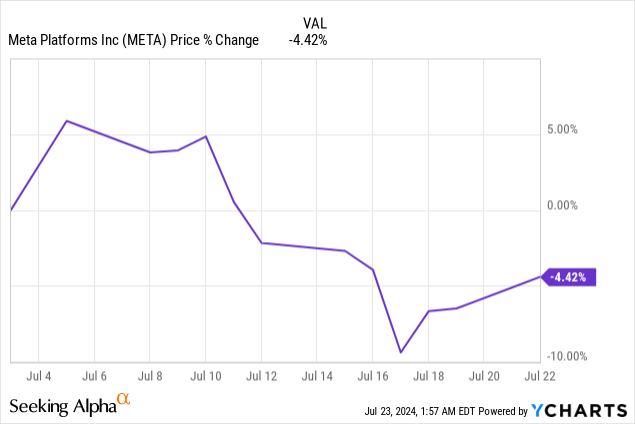

Since the start of July, Meta gave up about 10% of its market cap (not fully shown in the smoothed data point above). Had I invested with a stop loss, I would have once again been out of this stock.

I believe there are only two drivers for a stock’s return, getting the starting valuation right and time. You don’t need to give a stock endless time, but around 12 to 18 months is enough if your thesis is accurate. In other words, the money is made in the holding, not the buying or selling. And absolutely never made on a stock with a stop loss.

Why Meta? Why Now?

Let me speak of Meta’s bear case. Meta is heavily investing in AI to enhance user experiences and drive business growth. This is the key concern with the market. Investing. The market doesn’t want investments from in any company. Especially in a mature company. They are fearful that Meta may not pull off a reasonable return on investment.

Next Wednesday, after hours, Meta will report its Q2 2024 results. And the market is anxious heading into earnings results. Why?

Because what the market craves is predictability. The market wants to price in its future free cash flows. So, I fully get the market’s concern. But this period of uncertainty over its heavy investment won’t last forever. And there’s a high likelihood that Meta’s aggressive investment into the metaverse may deliver a fair return on investment.

Furthermore, central to Meta’s strategy is utilizing AI models like Llama 3 to improve user interactions, boost engagement, and strengthen connections among its 3.2 billion daily active users. Isn’t this the same playbook that nearly all other companies are striving to do? To use AI to maximize the efficiency of engagement with the end user.

Beyond user applications, Meta’s AI investments include tools for creators, businesses, and internal development. These efforts highlight Meta’s commitment to advancing AI research and infrastructure, positioning the company to explore new revenue opportunities through technological innovation.

Given this perspective, let me press ahead to discuss its fundamentals.

Meta To See Around 18% CAGR in 2024

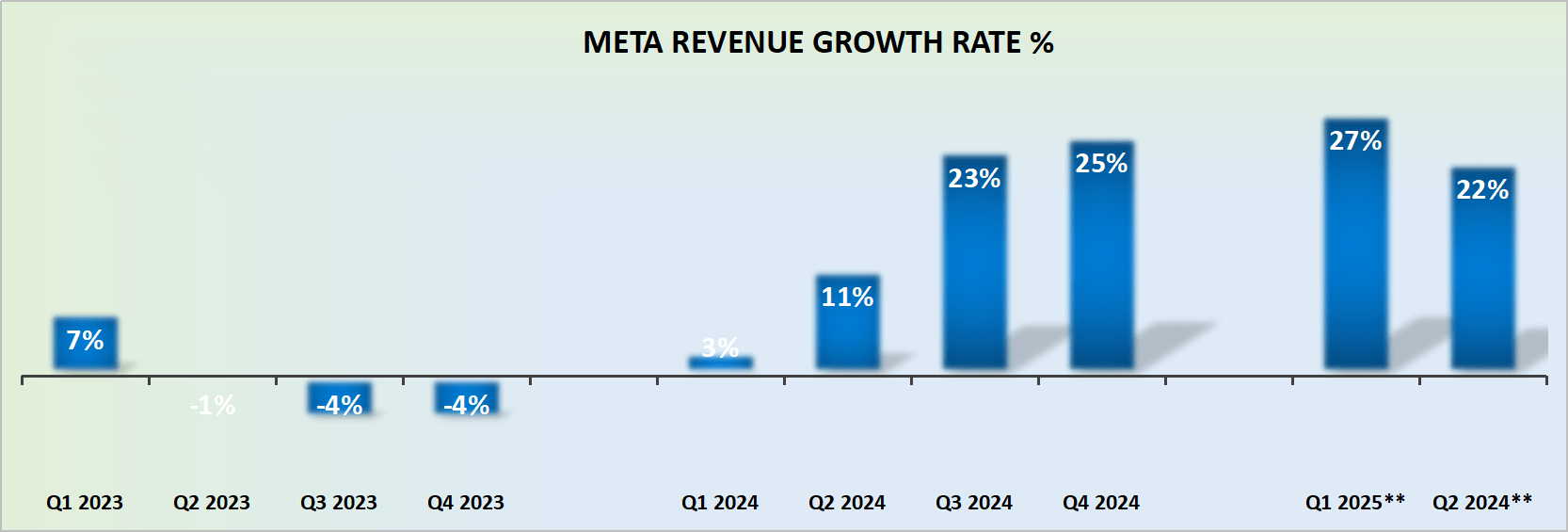

META revenue growth rates

Meta’s revenue growth rates will be up against very tough comparables in the second half of the year. Yet another reason for concern heading into Q2 2024 earnings.

That being said, keep in mind that this year there is the US election. Hence, this will imply that Q4 will be stronger than many investors would have normally factored in, particularly for companies with exposure to advertising spend.

Nonetheless, one way or another, starting next quarter, Meta will have to figure some way to reignite its growth rates, as investors start to ponder over 2025.

And yet, for now, I continue to believe that approximately 18% CAGR could be on the cards. Even if Meta’s growth rates slow down slightly, it’s still one of the few mega caps aside from Nvidia (NVDA) which is still delivering high teen growth rates.

But that’s not where my thesis is built because that’s what we discuss next.

META Stock Valuation — 21x This Year’s Free Cash Flow

The central tenet of my thesis is this. I welcome Meta’s aggressive investment philosophy. The way to outpace the competition is by astutely spending more than they do, whilst remaining self-funded.

Meta’s free cash flow margin hovers at around 30%. There are good quarters and there are bad quarters, but starting around 30% free cash flow provides us with ample room for error.

Given this profitability profile, there’s a path for Meta to deliver approximately $50 billion of free cash flow this year. This leaves the stock priced at 26x this year’s free cash flow.

Furthermore, keep in mind that we are already halfway through 2024. If we extrapolate this free cash flow forward by 15% y/y, assuming some topline growth being expected next year, plus some operating leverage. In that case, there’s the potential for Meta to deliver $58 billion of free cash flow in 2025. This puts Meta priced at 21x next year’s free cash flow.

And just to sweeten my investment thesis even further, Meta holds approximately $35 billion of net cash. That’s a rock-solid balance sheet with impressive free cash flow. There’s a lot to be compelled about Meta, even now.

The Bottom Line

For investors looking at Meta, investing in Meta now makes sense.

Meta’s considerable investments are likely to be more rewarding than investors presently fear. These investments are a smart move, which are expected to drive significant user engagement and business growth.

Paying 21x next year’s free cash flow is an attractive price for new investors, given Meta’s robust free cash flow margins and strong balance sheet. These factors support my price target of $630 per share by summer 2025, as Meta’s aggressive investment in technology positions it well for sustained growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Deep Value Returns is long all stocks mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.