Summary:

- Meta’s Q2 ad revenue growth of 23% YoY exceeded expectations, with Q3 guidance for 15-22% YoY revenue growth.

- AI-driven improvements in ad targeting and engagement are driving growth, with increased investment in infrastructure and AI technology.

- Despite strong performance, the stock is rated as Hold due to limited upside potential and a need for a more attractive valuation.

Tim Robberts

Summary

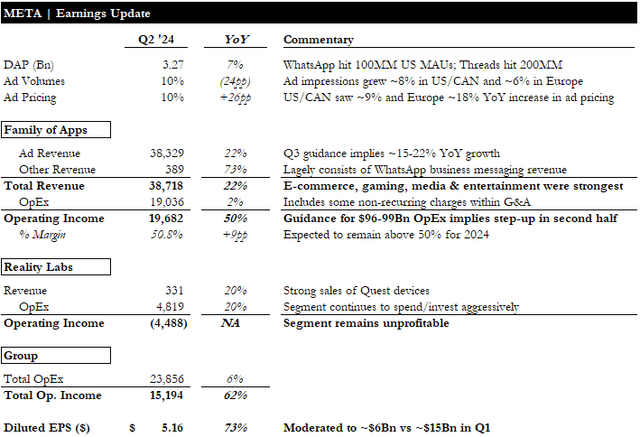

Meta’s (NASDAQ:META) Q2 ad revenue growth of 23% YoY was stronger than expected, a few points ahead of the consensus expectation of 20%. However, analysts were more impressed by the company’s Q3 guidance for 15-22% YoY revenue growth, vs. the consensus at ~17%.

This is particularly noteworthy given that growth is increasingly coming from price increases rather than volume. In 2023, it was unclear how much of the company growth was attributable to AI-driven targeting improvements compared to the ramping ad load in Reels. However, it now seems credible that AI is improving core business performance, by driving higher engagement and improving ad targeting. Meta clearly does not intend to hold back from fully monetizing this opportunity.

Capex guidance for 2024 was raised again to $37-40Bn from $35-40Bn previously, and management warned that the depreciation and opex associated with the growing infrastructure footprint drive considerable expense growth into next year. This aggressive investment pace makes sense, with the ROI of previously speculative AI investments beginning to gain credibility.

Offering just ~6% upside to our ~$560 target price, we maintain the shares at Hold. We accept that Meta appears increasingly well-positioned in the digital advertising market and the emerging AI space, and we would like to see a more attractive valuation before changing our rating.

Earnings Update

Q2 ad revenue grew 23% YoY, with online commerce, gaming, entertainment, and media being the strongest verticals. This strength appeared to be driven in no small part by AI-related service improvements, boosting engagement and ad performance.

Management highlighted its unification of the recommendation engine for short and long-form video on Facebook in June, a move that was described as having made a greater impact on engagement than its systems’ shift to GPUs from CPUs. The company was optimistic this would drive additional opportunities in short video, with the full quarter benefit to be seen in Q3.

Management spoke positively about the improvements it has been making to the recommendation systems powering IG Reels. They plan to leverage these improvements across the Family of Apps, which should drive further engagement improvements.

Though less relevant in the near-term, Meta highlighted that Threads now has >200MM MAUs and that WhatsApp crossed 100MM MAUs in the US.

Earnings Update (Empyrean; META)

On the earnings call, Zuckerberg described how Meta’s ad systems are already able to better at predicting which users will be interested in particular ads than advertisers themselves, and that +1MM advertisers had used at least one of Meta’s GenAI ad editing tools in the last month. In the backdrop, Meta is working towards AI tools which can help produce better ads.

Another noteworthy data point was that Meta has been seeing particular strength among smaller advertisers. Many of its ad tools are designed to help level the playing field so that smaller advertisers can effectively compete with larger competitors. This strategy appears to be unlocking incremental ad dollars, boosting Meta’s and the sector’s growth rates.

Cost guidance for 2024 was reiterated at $96-99Bn. Given the results of the first half of the year, this guidance implies +15-22% growth YoY for the second half, which could suggest conservatism in the forecast or that cost growth will accelerate in the second half. We find the latter more convincing, and believe this higher cost growth will bleed into 2025.

Meta spent $8.5Bn in capex during the quarter (n.b., incl. capital leases). Share buyback activity slowed significantly to ~$6Bn in Q2, with the company having spent ~$15Bn in Q1. Free cash flow increased just 1% YoY.

Valuation & Conclusion

Our previous approach to Meta’s valuation focused more on its ability to grow into what appears to be a premium multiple. For portfolio monitoring reasons, we are changing our approach to set a target price. We are applying a 22.5x P/E multiple, a slight premium to the S&P, to our ’25E EPS forecast of $24.85. We believe a slight premium is warranted, given the company’s dominant position and strong growth outlook. Today’s price implies ~6% upside to our target price – a bit too slim for us. Hence, we are moving our rating to Hold. We believe that Meta should continue to deliver strong operating results that will eventually flow through to the share price; however, we do not see a compelling risk/reward at this time.

Special Mention: FBL

Given our downgrade of the shares, we see a heightened risk profile for GraniteShares 2x Long META Daily ETF (NASDAQ:FBL). You can read about more about the particular risks of leveraged ETFs, with a focus on FBL, in this article. If we are correct, and Meta shares experience greater volatility in the near-term, with the valuation getting stretched and a fresh opex/capex investment cycle kicking off, investors should be weary of such leveraged instruments, which can behave in erratic ways.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.