Summary:

- Meta Platforms has a strong fundamental setup and is greatly positioned in an industry that is forecasted to grow substantially over the next decade, while its stock is seemingly undervalued.

- Meta has completed its downward impulse sequence and is forming its next wave, but it’s still too early to define it as part of a corrective or a new upward sequence.

- In this technical article, I discuss important price levels and metrics that investors could consider to gain an overview of the stock’s likely price action.

- By considering multiple outcomes and setting up an adequate contingency plan, investors are less inclined to act driven by emotions, as this could come at a higher cost.

- It is time to secure some gains and I discuss two strategies that investors could consider to avoid giving back their profits, leading me to qualify META as a hold position from a technical perspective.

Dzmitry Dzemidovich

Investment thesis

Meta Platforms (NASDAQ:META) has lost 77% since the beginning of its decline and fell significantly under its pandemic low, extending until price levels not seen since 2015. The stock performed well since my last call in November 2022, returning 25% profit, and is still hovering under my target price, but the actual situation is not suggesting taking any new position, while it’s also time for investors to secure their gains and consider the next most likely scenarios. In this article, I discuss a contingency plan with multiple strategies and outcomes, while I also examine the situation in Meta’s most relevant industry and sector.

A quick look at the big picture

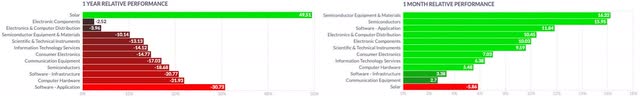

Companies in the communication services sector have been the leaders in the past month, while the US technology sector still struggles to achieve a consistent positive momentum. Both groups have been among the laggards in the past year, losing between 20-30% of their value. Companies offering information technology services, or active in the internet content and information industry, as well as companies in the advertising business, performed better in the past month, after being severely sold off during the past year.

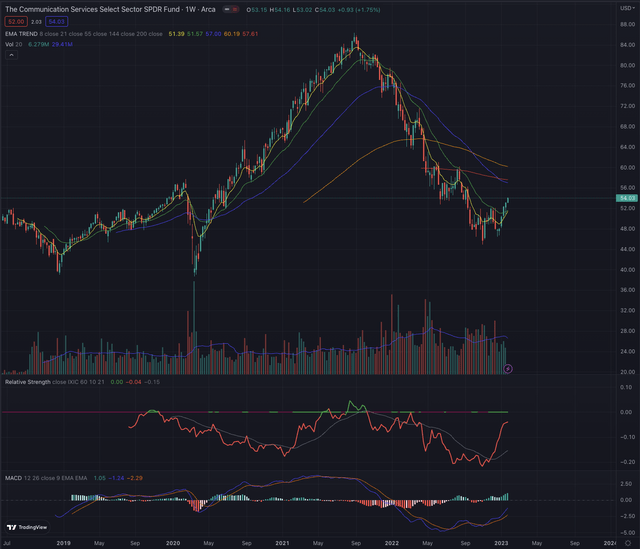

The Communication Services Select Sector SPDR Fund (XLC) bottomed on November 4, 2022, and has since begun retracing its losses, by establishing a short-term inversion while still being negatively extended. On its weekly chart, the sector reference has overcome its EMA21, while facing its EMA144 on its daily chart, with prevailing positive weeks on below-average buy-side volume. In the past two months, the industry reference could significantly reduce its relative weakness, when compared to the broader technology market, the Nasdaq Composite (IXIC), or more narrowly the Nasdaq-100 tracked by the Invesco QQQ ETF (QQQ), and is building increasingly positive momentum, confirmed by the rising MACD, a sign that the sector may continue in its favorable development in the coming months.

Where are we now?

In my article Alphabet Vs. Meta Platforms: Which Stock Is The Better Investment?, published on November 19, 2022, I wrote an in-depth fundamental analysis of Meta comparing the company to its peer Alphabet (GOOG)(GOOGL), and underscored its significant undervaluation, while finally qualifying it as a buy position and a long-term investment opportunity, mostly because of its strong product portfolio and monetization optionality. Since my buy rating, the stock has performed well, returning 25%, while still hovering under my price target. I now want to discuss how the stock looks from a technical perspective, and if the actual price level offers an opportunity also from a more short-term perspective.

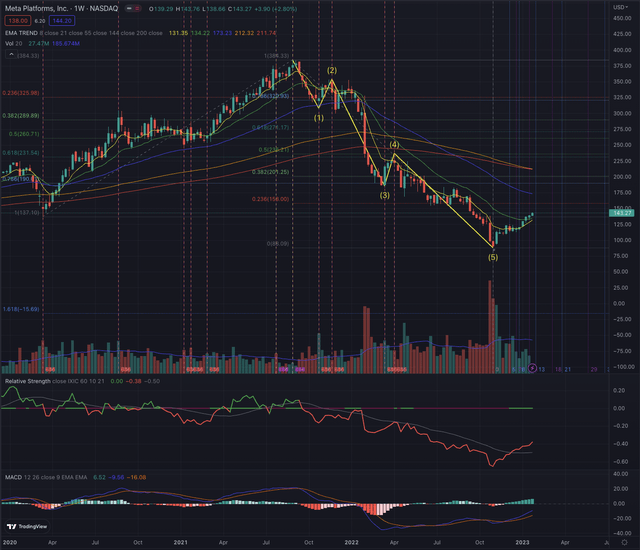

META has been severely sold off since its All-Time-High [ATH] on September 1st, 2021, retracing all gains achieved since the pandemic-crash, and even projecting the stock back to prices not seen in the past 6 years. The stock bottomed on November 4, 2022, and completed its downward Elliott impulse sequence, after a long-lasting decline which projected META deep into its stage four on massive relative weakness with substantial selling pressure.

The stock has since formed a short-term rally, retracing some of its losses until reaching again the pandemic-low price level, which is now acting as resistance. Despite having overcome its EMA21 on its weekly chart, it’s important to note that the buy-side volume still lacks conviction and that META still shows massive relative weakness on its weekly chart compared to the broader technology market, the Nasdaq Composite (IXIC). The stock’s EMA144 is crossing its EMA200, which is another bearish signal that should be considered. More important than its past performance and the actual situation, are the hypotheses of the stock’s most likely future developments which I discuss in the coming section.

What is coming next?

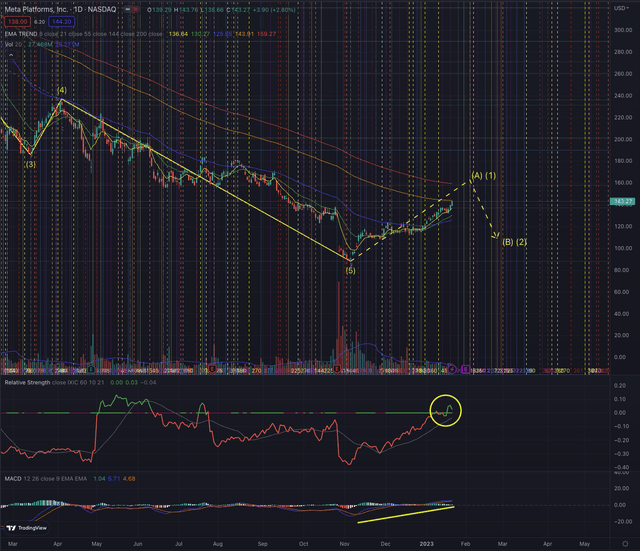

On its daily chart, META has successfully climbed over its EMA55, a major trailing resistance the stock didn’t manage to consistently overcome since the beginning of its decline. The stock has lately begun to build some relative strength against its major index, underscoring the most recent positive momentum, also confirmed by its MACD.

Despite the most recent positive developments, from a short-term perspective, I would be careful while considering investing in META. The stock is likely either forming its corrective wave sequence, with wave A undergoing or is already forming a new upward impulse sequence, with wave 1 forming from its bottom. While investors may ponder those scenarios as being positive, they have to consider that in both cases, META will have to retrace some of its recent gains while forming wave B or wave 2, consequently exposing investors to potential short-term losses. In case of a corrective wave sequence, the stock could then move sideways for some time or even fall further, while continuing in its long-term downtrend.

Although on its daily chart, META looks quite promising, the weekly chart is still very gloomy and a stock in stage four is usually not advisable to be invested in, with rare exceptions in terms of early-stage contrarian strategies with a high-risk tolerance. To get more clarity on the outcomes, let’s look at some of the most important price levels.

The positive momentum marked by the MACD is hinting at higher price levels, while META is facing its EMA144 and further its EMA200, where the stock would need high conviction on substantially increasing volume to overcome these trailing resistances. As we already observed, META has also reached its pandemic-low price level at $137.10, which is adding another layer of overhead resistance. Until overcoming these resistances, the chances of seeing significantly higher price levels are small. Despite this, the stock is capable of extended wave movements, and the undergoing wave could extend another 15-20% before peaking at the EMA200 and reaching the price target of about $167 I defined in my valuation model.

Investors who followed my call based on fundamental arguments on November 19, and want to secure some profits while still taking advantage of a possible extended rally, could consider one of the following strategies:

-

Sell half of the position and increase the stop-loss to their entry point at break-even, or at double the initial risk, allowing them to secure their profit on half of the position while financing their risk on the second half for free. For example, if the initial stop-loss has been set at -8%, investors could move it either at break-even or at +8% of their initial entry point.

-

Sell half of the position and move up their stop-loss by tracing the EMA55 or more narrowly the EMA21, or fixing an arbitrary percentage trailing stop from the last closing price and let the stock run with the risk exposure that everyone considers as tolerable.

With a likely risk-reward ratio of 0.5, I would not start a new position in META, instead, I would wait for the upcoming Q4 and fiscal year results on February 1, which could give a clearer view of where the stock may be heading.

META could also fail in its reversal attempt by dropping further, and we cannot ignore the likelihood of an extended weakness. It is therefore essential to set up suitable risk management, by defining a strict contingency plan with a reasonable stop-loss. Investors may want to focus on the EMA55 on META’s daily chart and on the EMA21 on the weekly chart. Dropping under these levels would expose investors to the risk of seeing the stock testing its bottom, which I consider as still likely.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security is listed on the markets. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

No one can predict with certainty the future price action of any security. My analysis offers multiple scenarios and outcomes with the most likely targets based on my hypothesis, which could progressively be tracked and accepted or rejected. I consider Meta Platforms as being a highly interesting company, financially strong, with great opportunities, while assessing the stock as fundamentally undervalued. META is hovering in its unfavorable stage four and the downside risk is still significant. The recent positive momentum hints at possibly some more limited upside, while the stock will most likely have to retrace part of its gains within its next wave, which will give more clarity if the movement will either be forming a corrective wave or a new upward impulse wave sequence. Before entering the stock as a new investor, or adding additional positions, I would certainly wait on the sidelines, secure my gains, and observe the price action, which leads me to change my ranking on META to a hold position.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned companies, as of the date of publication. Any opinions or estimates are subject to change without notice. I am not acting in an investment adviser capacity, and this article is not financial advice. I invite every investor to do their research and due diligence before making any investment decisions. I take no responsibility for your investment decisions but wish you great success.