Summary:

- Meta Platforms has crossed the $1 trillion threshold and had a strong quarter with over $40 billion in revenue.

- The company’s Reality Labs operating loss for the quarter was over $4.5 billion, but its assets are strong enough to overshadow this.

- Meta’s monthly active users were just under 4 billion, showing the strength of its apps and its incentive to grow internet users worldwide.

Galeanu Mihai

Meta Platforms (NASDAQ:META) has crossed the $1 trillion threshold. The company is one that we consistently recommended through mid-to-late 2022, with our last BUY recommendation in October 2022. However, soon after that we shifted our views, recommending to SELL based on the company’s continued massive investments in Reality Labs.

Here, as we’ll see throughout this article, we were wrong. While we still disagree with the Reality Labs investments, the company’s assets are strong enough to overshadow that.

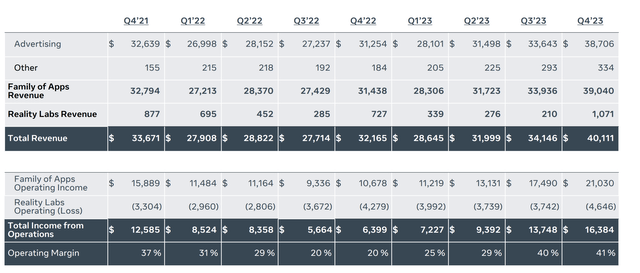

Meta Segment Performances and Expenses

The company had a stellar quarter. Total revenue of more than $40 billion is the company’s strongest quarter ever, and ~18% YoY improvement.

Meta Investor Presentation

The company had a more than 50% conversion rate to operating income. The company earned more than $20 billion in family of apps operating income, which is double where the company was last year. Given the company’s “year of efficiency” along with fairly fixed expenses, a growth in revenue has led to much faster growth in operating company.

However, there is a sore spot, one that we discussed above. The company’s reality labs operating loss for the quarter was more than $4.5 billion. That’s an annualized loss of more than $18 billion. The company might have the profits to account for the impact of Reality Labs, and it has improved its operating margin dramatically.

That doesn’t change the fact that the business remains a massive loss we expect to never pay-off.

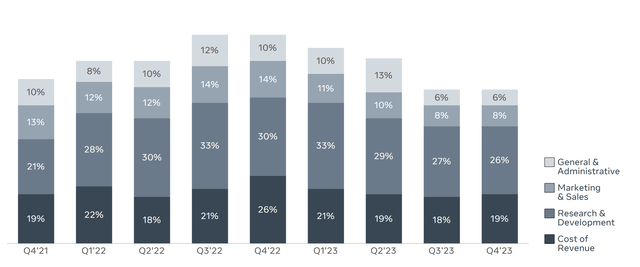

Meta Segment Expenses

The company’s year of efficiency is clearly evident in its expense improvement.

Meta Investor Presentation

While the company’s cost of revenue has returned back to normal, other costs have improved substantially. Specifically, marketing & sales expenses along with G&A expenses continued their strength in the prior quarter and are near all-time lows. This continued improvement in the company’s expense profile is exciting to see.

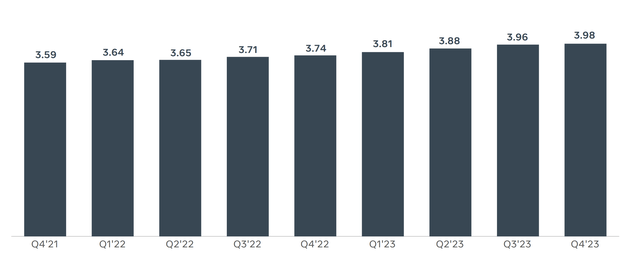

Meta User Count

At the same time, the strength of the company’s apps remain stronger than ever, with higher demand.

Meta Investor Presentation

The company’s monthly active users in the 4th quarter were just a hair under 4 billion. The global population is ~8.1 billion and globally there are ~5.6 billion internet users. That means that ~70% of global internet users use Meta’s family of apps. Given the closed off nature of China, the company’s position is much higher in internet users.

It also shows the company’s incentive to grow internet users worldwide. While the company won’t have rapid growth, growing internet access will help the company’s long-term growth.

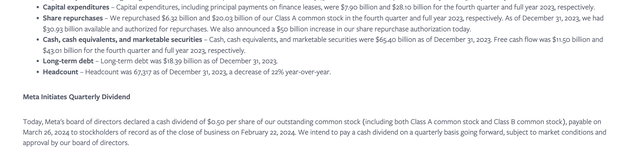

Meta Shareholder Returns

The company’s massive cash flow means a new focus on shareholder returns for the $1.2 trillion company.

Meta Investor Presentation

The company is continuing to invest massively in capital expenditures, and artificial intelligence will fund that. Big tech companies are saving big from extending their useable server life, which will help with artificial intelligence savings as well, and we expect 2024 to have abnormally high capital expenditures as a result.

However, from that point onwards, we do expect capital expenditures to slow down. The company has continued to aggressively repurchase shares. The company repurchased $20+ billion of stock through the year. It’s worth noting the company’s share based compensation expense is more than $10 billion, which even with ~$60 billion in annual profits, that’s a massive expense.

Still the company has extended its share repurchase authorization by $50 billion and announced a dividend. The company’s long-term debt remains low and manageable and the company’s headcount has declined substantially. FCF remains more than comfortable to handle the company’s debt.

Thesis Risk

The largest risk to our thesis is whether Meta’s blowout quarter is the sign of something new. The company managed to greatly improve its margins in 2023, however, we don’t expect that improvement rate to continue. The company needs growing revenue to justify its valuation. Whether it can accomplish that remains to be seen, and Reality Labs will cost it a lot in the meantime.

Conclusion

We were wrong about Meta. We were once massively bullish. When that growth slowed down and Reality Labs losses ramped up massively, the company’s position was much worse. We switched to a negative opinion on that company. With the company’s recent earnings, as its “year of efficiency” has ended, it’s proven us wrong.

The company has shown an ability to continue growing and generating massive ad cash flow. The company has ramped up share repurchases and started a dividend. The company is massively impacted by Reality Labs, and we’d like to see it back up that bet and focus on its core business, especially now that it has new competition.

However, regardless of how that pans out, we believe the company is overall a good investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.