Summary:

- Meta Platforms is coming off of perhaps its most difficult year in the markets since its founding in 2004, having lost more than 66% of its market value year-to-date.

- Mark Zuckerberg’s social media empire faces a number of difficult headwinds as his attention gradually shifts to his Metaverse “pet project”.

- The social media giant found friends in unlikely places, with politicians calling to ban its rapidly growing rival TikTok, owned by the Chinese parent company ByteDance.

- Former House Speaker Nancy Pelosi, known as one of the best investors among policymakers, threw her support behind the bipartisan bill that will likely see TikTok banned from government phones.

- Meta remains arguably the most attractively priced FAANG stock, but circumstances around its hold of the social media space remain debated by analysts and investors alike.

Alex Wong/Getty Images News

Mark Zuckerberg’s social media giant Meta Platforms (NASDAQ:META), formerly known as just Facebook, is coming off of perhaps its most difficult year since its founding in 2004. It kicked off the year by releasing a very problematic earnings report that brought to light a number of fundamental issues with the company’s business model. The report unleashed a wave of selling pressure that caused META’s market cap to decline for the remainder of the year. A company that had a market valuation of about $900 billion at the beginning of the year is now a company with a market capitalization of just a little more than $300 billion.

Meta had to face several challenging headwinds that, when combined, posed a significant risk to the underlying business. First, the seemingly ever-degrading macroeconomic environment amid surging inflation and rising interest rates led to what many might consider a long-overdue market cooldown, pulling most stocks down. The difficult economy also resulted in the “weakest advertising market since 2020”, which heavily affected Meta. Second, Meta’s social media empire has grown to a point where it has become increasingly difficult to attract new users. Third, many investors heavily dislike Zuckerberg’s recent pivot to the “Metaverse” and the increased spending that came with it.

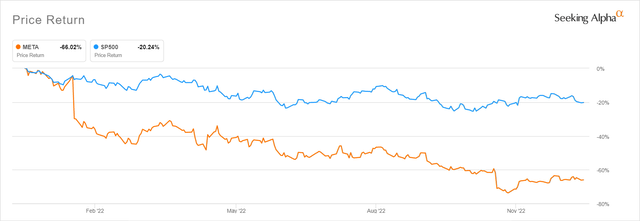

On top of all of the issues they have experienced, their almost undisputed reign over the social media space was increasingly being challenged by Chinese-owned TikTok, which seems to have captivated users around the globe and topped the charts as the fastest-growing app. All of this negative sentiment paved the way to the worst year-to-date performance among the so-called “FAANG” stocks, as well as one of the worst performances among social media app operators. Given that it had a negative year-to-date performance of 66.02%, the company ended up significantly underperforming the S&P 500 (SPY) for the first time in years. Currently, shares of the META can be acquired for just a little bit more than $130.06 per share, down from a high of $325.05 at this time last year.

META vs S&P500 YTD Return (Seeking Alpha)

Is TikTok potentially getting banned?

Only days ago, it was revealed that former House Speaker Nancy Pelosi, one of the most successful investors among legislators, threw her support behind a bipartisan bill that will likely prevent the popular app from being used on the devices of public servants. It is a surprising turn of events, given that the company has previously struggled to find friends in high places due to its failing reputation.

Meta and its CEO, Mark Zuckerberg, have had to face their fair share of scandals throughout the years, mostly related to the misuse of private data and other privacy-related concerns. The Cambridge Analytica controversy, which ended up with Zuckerberg testifying before Congress, was probably the most well-known incident.

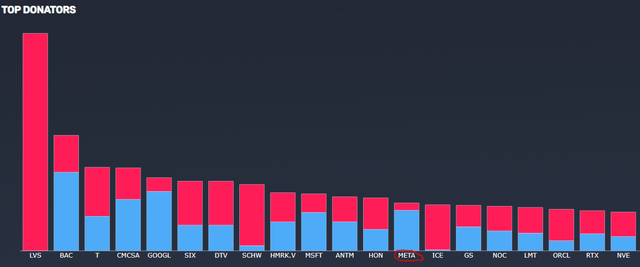

All of these instances had a big impact on the decision to rebrand the company as “Meta Platforms” in the end. The company fought a long and hard battle to regain favor, eventually leading them on a path that will see company executives spend $24.2 million in political donations over the last three election cycles. Meta is one of the top political donors among publicly listed companies.

Top Political Donators (Quiver Quantitative)

The goal of the bill, which was put out by Senator Marco Rubio, is to restrict the impact and scope of social media businesses operating in the United States that are “under the sway of, China, Russia, and numerous other foreign governments of concern.” In other words, the bill was created in response to growing fears that TikTok and its Chinese parent company, ByteDance, would provide Chinese authorities access to data on US users. Policymakers included the bill as a part of a critical $1.7 trillion fiscal 2023 spending package, effectively ensuring its passage later in the week.

Even if enacted, the measure is only intended to restrict TikTok use on the phones of government officials, which is a far cry from a nationwide ban. However, the growing consensus in favor of such a move amid deteriorating US-China ties and growing security concerns paves the way for a possible outright universal ban on the app. In that context, it becomes next to impossible to view last week’s actions as anything other than a huge win for Meta and its ecosystem of social media apps.

What does it mean for Meta’s app ecosystem?

Over the past couple of years, TikTok has grown to become one of the most formidable adversaries to Meta’s app ecosystem. The Chinese-backed app’s incredibly viral and addictive short-video format helped it relatively quickly gain more than a billion users. It even forced Meta’s hand into rapidly launching its counterpart solution, called “Reels” which has so far proved moderately successful in countering TikTok’s rapidly rising influence.

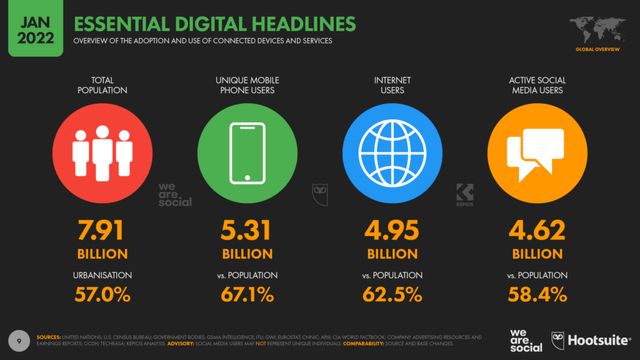

There are reportedly 7.91 billion people in the world, only 5.31 billion of whom have access to mobile phones, and 4.95 billion of whom have internet access, according to a “We Are Social” study done earlier this year. Out of those, it is estimated that only 4.62 billion actively use social media. That represents a 10.1% year-on-year change or 424 million new active social media users.

Population and Active Users (We Are Social)

Out of the 4.62 billion active social media users, Meta is reported to have reached 3.71 billion through its family of apps, according to its latest quarterly report. This marks an 80.2% market penetration, speaking volumes about the size and reach of Zuckerberg’s social media empire.

In that context, the pure strength of Meta’s ecosystem is often overlooked by both analysts and investors. The Family of Apps consists of Facebook, Instagram, Messenger, and the still unexplored economic potential of WhatsApp, among a couple of other less relevant products.

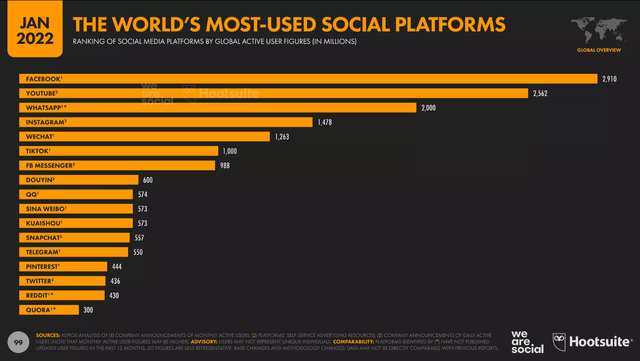

Most Used Social Media Platforms (We Are Social)

As we can see from the chart, Meta owns four out of the ten most-used social media applications in the world. With the likes of Pinterest (PINS), Twitter (TWTR), and Snapchat (SNAP) lagging behind with far under one billion users, there are only two true challenges to the ecosystem. Those are Alphabet’s (GOOG) owned YouTube and ByteDance-owned TikTok, with the latter coming under the corsair of US lawmakers. In other words, from where we stand today, it seems highly unlikely Meta’s dominance over the social media space will be more seriously jeopardized anytime soon.

Does it leave Meta attractively valued?

As we mentioned earlier in the article, the stock of the company has been simply crushed and is currently trading down 60.77% over the last year, at a point even trading down 73.11% earlier in November when it hit the 52-week low. The social media titan last traded at these prices in the beginning of 2018, thus the typical long-term investor has virtually lost four years’ worth of capital gains. However, META’s top and bottom lines have significantly improved since then, even though the company went through a rough patch for the past two quarters. This was largely a combination of a slow ad market, increased spending to combat Apples iOS changes, as well as a significant investment into the Metaverse project, which saw more than $10 billion invested up until today.

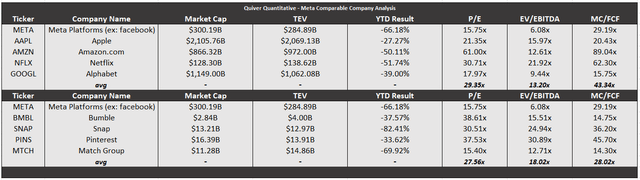

Only Netflix (NFLX), whose price briefly fell below $170 per share back in June, ever truly came close to challenging Meta for the title of most-beaten-down FAANG stock of the year. The streaming juggernaut has lately made a huge comeback, leaving Meta with the unfortunate title. Apple on the other end of the spectrum tops the chart, but even the iPhone maker experienced a 27% decline for the period. Despite suffering substantial losses this year, Alphabet (GOOGL) and Amazon (AMZN) both fell short of Meta’s losing streak.

When compared to its closest competitors among the owners of significant social media apps, Meta actually comes in third, trailing Snap, which fell 82% in 2022, and Match Group (MTCH), which has fallen slightly more than 69% in the same time frame. The other two social media companies, Bumble (BMBL) and Pinterest, have only had declines of 37.5% and 33.6%, respectively, since the beginning of 2022

As of the time of writing this article, Zuckerberg’s social media empire has been trading at an arguably very attractive 15.75x NTM P/E, 6.08x NTM EV/EBITDA, and a 29.19x NTM MC/FCF.

Meta Comparable Company Analysis (Author Spreadsheet)

Closing arguments

The entire situation surrounding the potential ban of TikTok draws eerie similarities to the United States banning the then-popular Chinese phone and equipment maker, Huawei, in 2020. Similar concerns over national security were raised, and what began with minor restrictions and other limitations only slightly impacting Huawei’s day-to-day operations has since grown to become one of the largest crackdowns on a foreign-owned business entity in modern history. Huawei, a once serious rival to Apple’s and Samsung’s dominance over the smartphone market, remains nothing but a mere shadow of its former self today. While the current pressures will likely amount to little more than a slap on the wrist for TikTok, it will be interesting to see to what extent US policymakers’ scrutiny will impact the social media app.

Meta is in a unique position to maybe be one of the few companies that can truly benefit from the deteriorating relationship, unlike many other businesses that stand to lose money as a result of the complexities of US-China relations. If so, the scrutiny would serve to reaffirm Meta’s dominance over the social media space and would be welcomed open handed by investors. Possibly even more importantly, it would help detract some much-needed focus from Zuckerberg’s costly and time consuming Metaverse venture, which cannibalized the discussion of an otherwise brilliant company that utilized its app-ecosystem to construct a monopoly-like dominance over the social media space. Until Meta’s strategic priorities related to the Metaverse have been reassessed, it remains very difficult to rate it as a “Buy” at this point.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.