Summary:

- While Meta’s advertising growth potential might seem limited with over 3 billion users already, it still has plenty of growth levers that allow it to drive strong growth.

- Apart from advertising, which remains the most important part of the investment thesis, the company’s efforts in AI and the Metaverse could potentially boost its growth.

- The growth outlook for the company remains excellent with expected low-double-digit sales growth and above mid-teens percentage EPS growth in the medium to long term, according to my estimates.

- Right now, on a TTM basis, margins are still down by approximately 20% compared to their 5-year averages, leaving plenty of upside.

- With shares currently trading near fair value, I believe now is still a good moment to buy the shares as I believe current prices should allow for double-digit returns in the medium to long term.

Kira-Yan

Meta’s strong digital presence should ensure a solid growth outlook

I initiate my coverage of Meta Platforms, Inc. (NASDAQ:META) with a Buy rating following my in-depth research of the company and the underlying digital advertisement industry. While the last couple of years have been far from easy for Meta shareholders and the company itself, it is now on a clear upward trajectory, driven by a recovering advertising industry and an improved capital allocation strategy.

Of course, that growth for Meta would eventually slow down was inevitable. In the period 2012-2021, the company did not see its growth slow to below 10%, with most quarters sitting above 30%. In the end, the rule of large numbers would kick in and Meta would start reaching its ceiling in terms of daily active users on its platforms. Still, the company’s performance has been nothing short of stellar, with shares delivering a return of over 500% over the last ten years, and while these incredible growth rates are probably behind it, the company remains excellently positioned for decent growth going forward.

Cutting right to the chase, from an advertising standpoint, the bull case for Meta is a very clear one. The company controls the growing social media market by a wide margin and has a 20% market share in the digital advertising industry through its family of incredible apps.

As of 2023, Meta’s apps account for 41.8% of daily social media spend by the adult population or for around half an hour a day, highlighting the company’s incredible market share in social media activity. This incredible market share has also allowed it to capture a significant share of the digital advertising industry. Ultimately, advertisers follow the eyeballs, so the platform that attracts the most views will rank in the most advertising dollars.

Its market share is approaching 20% in the US digital advertising industry, making it the second-largest trailing Google (GOOG) (GOOGL). Yet, while YouTube also takes up around half an hour per day, it only has a 5.8% market share in the US digital advertising industry. What this shows is how effective Meta’s platforms are in terms of ads per minute or user, leading to advertisers likely preferring Meta’s platforms. While Meta is often operating on or over the line regarding user privacy in my view, this makes the company and its platforms a preferred advertising option as it leads to excellent ad targeting, driving a higher ROI.

This is highlighted by the total number of social media ad dollars spent, of which Meta takes up 75%, sitting far above its 42% share of time spent on social media. Meta is simply able to generate many more clicks with each minute of time viewed, carrying higher value to advertisers due to a higher ROI. Not even TikTok can match these metrics as Meta is the only company claiming a higher market share than its share in time spent.

eMarketer

Nevertheless, Meta has seen its market share fall over recent years, according to data from Statista. Whereas the company held a market share of over 23% in the US digital advertising industry in 2020, this fell to just above 20% in 2022 and is expected to drop further to 18.4% in 2025.

US advertising market share (Statista)

The primary reason for these losses is Amazon (AMZN), which has been rapidly outgrowing its peers in terms of advertising revenues in recent years. As this is not expected to slow down, this will hurt the market share of Meta and Google. However, looking through the data and developments, I believe Meta should be able to hold onto its market share slightly better than projected by Statista, most likely holding it in the 19% -20% range.

I expect Google to be struggling more to hold onto its market share, mainly due to its advertising model being more comparable to that of Amazon, while Meta can distinguish itself through a different model, generating more clicks and keeping users engaged for longer, as highlighted by its 7.6% share of all media consumption.

Further helping Meta are particular trends in the digital advertising industry. This includes the faster-growing influencer ad spend vertical. Brands are increasingly looking for influencers to promote their brand to their millions of followers, which has proven to be an excellent strategy. As a result, this industry vertical is expected to grow 3.5x faster than the overall industry in 2023, and this trend will likely persist.

This shift in how ads are placed benefits Meta as its social platforms are some of the most popular places for influencers to express themselves. This is highlighted by the growth in influencer ads spent on both Facebook and Instagram, growing double digits and only trailing TikTok. As this trend persists, I believe it should help Meta maintain its share of the digital advertising industry, among others.

This should mean it is very well positioned to benefit from the expected growth in the digital advertising industry. In 2023, the digital advertising industry is projected to grow by 8.4% from 2022, showing a solid performance from which Meta is able to benefit. Furthermore, the outlook for the advertising industry is also looking good with digital ad spending expected to grow at high single digits to low teens, differing between different research firms but all fluctuating around the 10% mark. This is partly driven by a continued shift from physical advertising to digital and smartphone engagement remaining on an upward trajectory and the social media industry’s global importance. With Meta holding a 20% market share in the industry, these factors will drive strong top-line growth for the company.

Meta does not need to grow users to drive growth

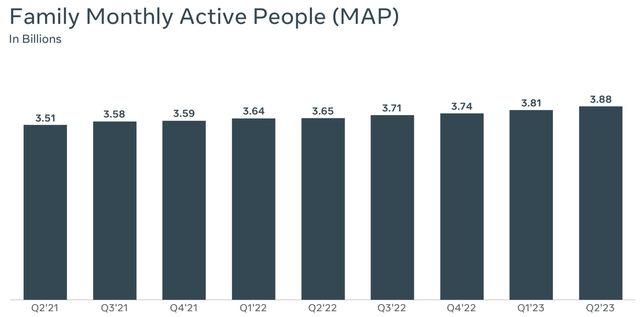

Getting a bit more company-specific when looking at its growth potential, a very important metric, of course, is the number of people on the platforms. The company has been increasing its daily active people (DAP) at a very respectable rate with this growing at a CAGR of approximately 5.5% over the last two years, reaching 3.07 billion. And while this is already impressive, its monthly active people (MAP) now stand at 3.88 billion or closing in on 50% of the world’s population. Furthermore, DAP as a percentage of MAP consistently sits at 79%, indicating that once people start using Meta’s apps, they are highly likely to use them daily, highlighting excellent user engagement. And while the company continues to grow users, this is not even the most significant growth driver for the company. At some point, the company might reach a user ceiling as there are only that many people it can reach.

The real potential for the company going forward lies in increasing its revenue per user, or average revenue per person (ARPP) as Meta calls it, and I believe this is where the company has massive growth potential remaining. This metric has been fluctuating for Meta over the last two years, but I am expecting this to show more of an upward trajectory over the next few years, driving growth on top of user growth.

As digital advertising budgets are expected to keep growing rapidly over the remainder of the decade with more and more advertising focused on digital sources and moving away from physical, this should result in ARPP growth for Meta. Furthermore, more of this digital advertising is moving to mobile formats and streaming as these attract the most eyeballs. Simply put, each ad will increase in value and so will each click.

The result is that while Meta might not be able to grow its users at a rapid pace or at all, its platforms continue to attract the most eyeballs every month and this makes its platforms some of the best advertising platforms available. Therefore, the advertising dollars thrown at Meta will continue to grow solidly, resulting in a growing number of revenues per user.

Helping grow ARPP are the potential growth levers the company still has within its current app portfolio. While these are often perceived as having reached their full potential with billions of users, I see plenty of opportunities for Meta to drive meaningful growth.

A great example is reels, a format Meta has taken from TikTok and has integrated into multiple apps. The format has been performing great, already having an annual run-rate of over $10 billion, only a couple of years after its release and up from $3 billion a year ago. This integration of a single feature has massively increased the value of existing apps and still carries significant potential as the monetization of reels has been strong over recent quarters and in terms of revenue per user still sits at just 28% of other ad activities from the company, highlighting the sheer potential remaining for this part of the business. As a result, I expect reels growth in terms of engagement and revenue to keep growing at a strong clip in the medium term. There clearly lies a lot more revenue potential in this feature.

This is a testimony to the social media vision of Mark Zuckerberg. While criticized in recent years due to his unsupported dedication to the reality labs segment and focus on the so-called Metaverse (a criticism that might be warranted), he is still the king of social media and has shown in the past to have a great forward vision allowing him to steer this social media giant in the right direction and making the right acquisitions and integrations.

Giving another example of future growth potential within the existing app portfolio, it is worth mentioning that the company also still has considerable potential in leveraging the strong market position of WhatsApp, an app from which the company currently derives little revenue. However, there are clear opportunities for Meta to leverage the app’s popularity without damaging its free use case. We should not forget that WhatsApp has 2 billion monthly active users spread across 180 countries.

To name a few examples of how Meta could potentially use WhatsApp to boost revenue, it could start offering subscription formats with additional functionalities or integrate payment options and/or a Facebook marketplace format. Additionally, the company could integrate subtle ads into the app, which the company might be looking at, according to the Financial Times. This included displaying ads in lists of conversations with contacts on the WhatsApp chat screen without massively interfering with the user experience. However, the head of WhatsApp, Will Cathcart, quickly denied this.

Still, I can’t imagine the company not exploring new ways to use these 2 billion users to generate additional revenue, and I believe the company should have plenty of opportunities to derive significant revenue through it. For example, a premium subscription format of, say, $5 monthly and used by only 5% of total users would result in $1.5 billion in additional quarterly revenue – an increase of almost 5% as of the most recent quarter, highlighting the potential significance of such an offering.

By highlighting this, I am not saying investors should award any value to it today. It is not part of the so-called “sum of parts” and carries no direct value yet. More importantly, I believe it should highlight the growth levers and opportunities Meta still has within its existing app portfolio. I often hear people around me speak about Meta having little growth left with it already recording over 3 billion daily active people on their apps, leaving little growth upside. Yet, this example shows that this could be completely wrong, and Meta still has opportunities plenty to drive meaningful growth.

Finally, another way to drive growth is by acquiring competitors or launching newly developed platforms to compete with them. The latest in the category is Threats, for which I view the recent performance as mixed. While there are good things to be said about the platform, it has so far not performed as hoped, despite a strong performance at launch. By now, the platform has roughly lost over half of its 100 million initial users and seems to create little enthusiasm today.

I believe a large part of this disappointing engagement and enthusiasm is due to the platform being launched too early. While I am not in a position to doubt Zuckerberg’s approach here, I am just not convinced this was the right way to go at it.

The company is now planning on releasing a desktop version and search functionality to boost retention, but these releases are coming a bit late. In my eyes, the sheer enthusiasm for the platform in the first week was great, but after that, the platform has proven to offer little functionality or value to users, making it hard to imagine this platform blowing X (previously Twitter) away in coming years, limiting the revenue potential. As a result, I am not yet awarding a lot of value to the platform today. Keeping a close eye on user numbers and engagement will be critical for investors to understand the platform’s potential.

Now, looking at everything discussed so far, it is not hard to see why the top-line growth outlook for Meta is looking really solid. Based on these findings and recent data, I believe Meta’s family of apps alone should be able to drive revenue growth at a CAGR in the range of 9%-12% for the remainder of the decade.

AI and Reality Labs efforts are speculative for now but carry significant potential

While Meta’s family of apps already drives a very compelling growth outlook by itself, there is even more to the company that could boost growth further, although this is somewhat more speculative to me.

This includes the company’s AI exposure. The company is fully benefitting from its early focus on AI with this market now really taking off. Historically, Meta has been using AI as a way to increase its ad targeting capabilities and the algorithms in its apps to improve user engagement. Recent developments in AI will only improve Meta’s abilities on this front, but the company is now also exploring new ways to use its AI knowledge to offer even more to users and potentially find new ways to generate revenue.

The Wall Street Journal recently reported that the company is developing an AI model aimed to be as powerful as OpenAI’s latest ChatGPT version GPT-4. The company aims to release the model by next year and it should be far more powerful than Llama 2, released two months ago. Reuters reported in August that OpenAI was set to achieve the $1 billion revenue milestone over the next 12 months as, clearly, businesses are very much willing to pay a few hundred dollars a year for these premium functionalities or an AI assistant. For OpenAI, this is up massively from just $28 million in revenue in 2022, and highlighting the growing demand for these services.

I believe this gives us some visibility on the potential market Meta could enter with its OpenAI alternative. If it were able to build a similarly strong model, this could generate a multi-billion dollar run-rate revenue stream by 2025. Furthermore, Meta is working intensively on building advanced AI assistants to integrate into its apps to increase their value to users, also potentially offering new ways to generate revenue through subscriptions. Yes, for now, this is all a lot of speculation, but it is essential to acknowledge the potential for Meta here and the company deserves to be seen as an AI leader, along with the likes of Microsoft (MSFT) and Google.

In addition to AI, there is also the much-discussed reality labs segment of the company, which, in terms of revenue today, mainly consists of the company’s VR products. Cutting right to the chase here, I don’t believe investors should award much value to this segment yet. Yes, there is clear potential within the metaverse market, but with no significant products out there and not much consumer interest, I see this segment offering little value today, apart from potential success in their Quest products.

According to Baird analyst Colin Sebastian, Meta could report revenue of $3 to $4 billion from the Quest 3 over the next year, but these estimates might be too optimistic. Furthermore, at a price of $500, I doubt the product will generate a profit.

On a more positive note, the fact that Apple is getting started in VR/AR technology is not a headwind for Meta, at least not primarily. Of course, the company now has a fierce competitor, but at the same time, Apple has a global popularity that could massively increase consumer interest in VR/AR technologies and Meta is there to benefit as well. Furthermore, the two companies offer very different products, catering to different end solutions, which results in this primarily being a benefit for Meta.

For now, I do not see much value in comparing the offerings in terms of quality or performance. The Apple product is not available yet, but one thing is for sure: Meta’s years of development have allowed it to put more affordable options on the market. As Apple creates enthusiasm through its premium product, Meta is here to pick up the customers not willing to spend multiple thousands on a headset for some fun. As a result, I am quite bullish on the near to medium-term outlook for Meta’s headset business (although not as optimistic as Baird analysts), as this might get a boost in the years following the launch of the Apple product in early 2024.

Overall, apart from the core ad operations, the company might also be able to leverage its AI capabilities and the efforts it has put into the metaverse vision, including solid VR technology, to further drive growth and develop a new meaningful revenue stream. Yet, most importantly, even if these efforts turn into nothing, the family of apps segment offers plenty to be enthusiastic about and to drive a solid growth outlook, as discussed before.

Significant margin improvements fuel a strong EPS growth outlook

One aspect that has always stood out for Meta was its incredible margin profile, which allows the company to generate significant amounts of cash flow, as highlighted by the fact that the company has generated over $118 billion in free cash flow over the last five years. This resulted in an average FCF margin of 20% over this time frame.

Meta FCF period 2010-2022 (Macrotrends)

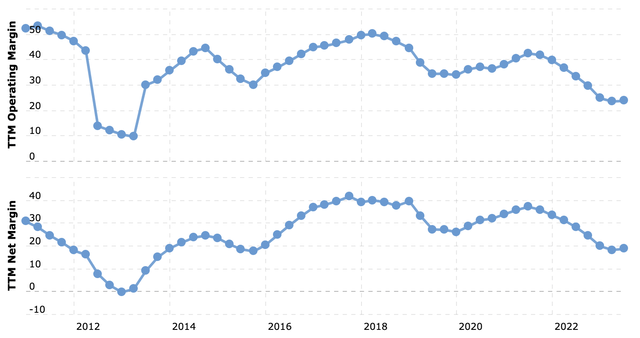

Furthermore, the company was able to report these sorts of cash flows while burning significant amounts of cash through its reality labs segment, meaningfully impacting margins in recent years. While Meta was able to report an operating margin that sat consistently above 30% from 2014 onward, this fell to a low of 23.5% (on a TTM basis) in 1Q23 due to a combination of significant Metaverse investments and a slowing top line as a result of a challenging operating environment for the company’s advertising business.

Luckily, management has acknowledged this, calling FY23 the year of efficiency. In order to boost its profitability, the company decided to lay off a significant part of its workforce with a total of over 21,000 employees let go.

Clearly, and as acknowledged by the man himself, Zuckerberg and management had overestimated the near-term company performance, resulting in the company being everything but lean from a workforce standpoint, with revenue per employee falling from a high of $1.6 million to $1.3 million, down approximately 19% in terms of efficiency. Clearly, there was a lot of ground to regain, and I expect these layoffs not just to help it in the near term but also management might now see that it can operate much leaner than it used to, boosting future margins and therefore profits as well.

Furthermore, the company also cut back on its reality lab investments for good reasons. The company was bleeding money, and no matter how strong your money printing capabilities are, these sorts of numbers are not sustainable and will result in investor pushback. In a 4-year period up to the start of this year, Meta lost $35 billion in the reality labs segment, with another $7.7 billion lost YTD.

In the latest quarter, this number was a negative $3.7 billion and although this is still pretty significant, it is down from a peak loss of $4.3 billion two quarters ago. This is due to Meta limiting its investments slightly, as highlighted by an increase of just 7.5% in R&D expenses in Q2, lowering this as a percentage of revenue to the lowest point since the start of 2022 to 29%. And while these are still very significant numbers, this is an improvement from 33% two quarters ago, improving its operating efficiency. Do note that Meta still expects Reality Labs’ losses to increase YoY.

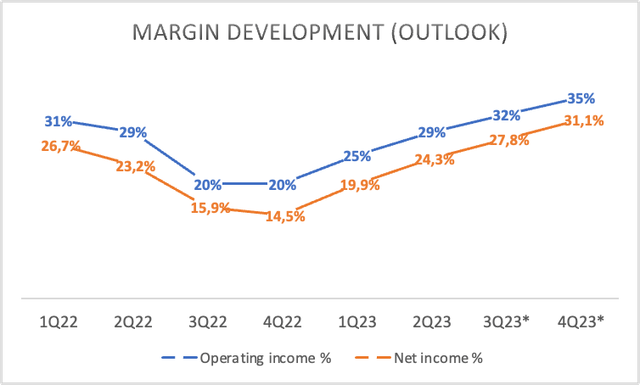

As a result, the company reported an operating margin of 29% in the latest quarter, significantly improving from 4Q22 and 1Q23 levels of 20% and 25%, respectively. Furthermore, the FCF margin increased to 34%, reaching $11 billion in FCF.

Going forward, I expect Meta to keep increasing its margins back to at least their averages in the near term but probably approaching new highs in a few years. Right now, on a TTM basis, margins are still down by approximately 20% compared to their 5-year averages (depending on which metric you use), leaving plenty of upside and this will drive impressive EPS growth, especially with the net income margin still sitting 40% below its 5-year average.

A faster-growing top line will support these margin improvements due to the recovering and strongly growing advertisement operations and improved operating efficiencies. Overall, I believe this will support EPS growth of above mid-teens percentages based on my earlier discussed revenue growth expectations.

Analysts from Morgan Stanley even expect Meta to generate as much as $20 per share in 2024 due to a strong anticipated recovery in the core ads business, highlighting a strong performance in reels. This brings me to the near to medium-term outlook for Meta.

Outlook & META stock valuation

Following a solid Q2 earnings report in which the company delivered revenue of $32 billion, up 11% YoY and outperforming the consensus by close to $1 billion, and reported EPS of $2.98, beating the consensus by $0.07, management issued bullish guidance for the third fiscal quarter.

Management expects to report revenue to be in the range of $32 billion to $34.5 billion, up 20% at the midpoint and highlighting a further growth acceleration, which I am expecting to persist going into Q4 as well. Furthermore, I expect Meta to significantly improve margins in Q3 again, most likely returning to an operating margin of above 30% in Q3 and Q4. This should also result in a considerably stronger net income margin, which I expect to also move to a level of above 30% in Q4, as highlighted below. This should support strong EPS growth.

Following this guidance from management, my margin expectations, and my in-depth research of the company fundamentals and underlying industry, I now expect the following financial results through FY26.

Financial projections (By Author)

(these estimates include Q3 revenue of $33.68 billion and EPS of $3.61)

Based on this FY23 EPS projection, shares are valued at close to 24x this year’s earnings, meaning they are valued at a slight premium to their 5-year average. However, Meta is still valued below the 24.5x P/E Alphabet (Google) is currently trading on. Furthermore, I believe a 24x multiple is far from expensive for a company as high quality as Meta when considering its size, global presence, and the great medium-term outlook shown above.

In fact, I believe a 24x multiple is quite fair for the company, all things considered. I think it correctly factors in the company’s cyclicality and the competitive industry it primarily operates in. However, to take into account the current economic uncertainties and continued risks of a recession, I suggest going slightly more conservative using a 23x multiple, resulting in a price target of $378 based on my FY24 EPS estimate. Going with an annual return of 10%, I believe a current fair value share price to sit around $327 per share, meaning shares are currently undervalued by approximately 1.5% or trading near fair value.

With shares currently trading near fair value, I believe now is still a good moment to buy the shares as I believe current prices should allow for double-digit returns in the medium to longer term despite the share price being up over 150% YTD. All this tells us is that the share price at the start of the year offered an even better entry point, but this says nothing about potential value today.

For those who missed more favorable prices earlier this year, based on my projections and research, shares still offer very decent value and should outperform the SP500 index through 2026, potentially delivering double-digit returns annually. Therefore, I rate shares a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.