Summary:

- Meta’s stock surged over 20% after announcing a tripling in Q4 profit and the initiation of its first-ever dividend.

- I believe the dividend announcement represents a game changer for the Company, as dividend-paying stocks tend to have higher stock prices. I discuss academic papers and thoughts – read on.

- Despite the risks surrounding Meta, the recent news of initiating dividends makes the stock attractive with a growth potential of 14.6% by the end of 2025.

- Perhaps “value hunters” should wait until the price falls before buying META, but I think they risk missing out.

- I’m in any case reiterating my previous “Buy” rating today.

Kira-Yan

Intro & Thesis

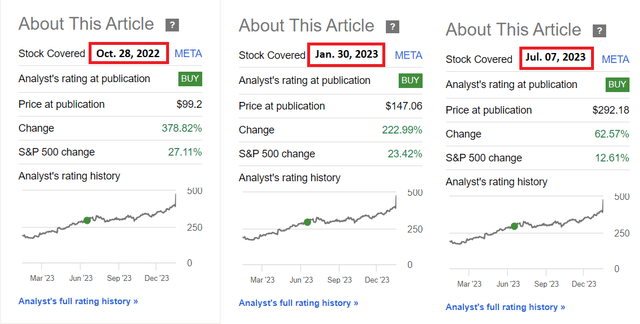

I initiated coverage of Meta Platforms, Inc. (NASDAQ:META) stock in October 2022, when one share was trading at $99.2. While it may seem today that META “was an obvious Buy at $100”, that “obviousness” at the time was not what it may seem in hindsight: many people liquidated their META long positions, and daring ones even went short, expecting lower lows in 2023. History has decided otherwise.

Meta’s stock surged >20% on Friday following the announcement of a tripling in Q4 profit and the company’s initiation of its inaugural dividend. Literally, all the headlines were filled with META’s first-ever dividend news:

META’s one-day rise was the fastest increase in market capitalization in the history of modern American companies, slightly outperforming Apple (AAPL), according to Bloomberg data:

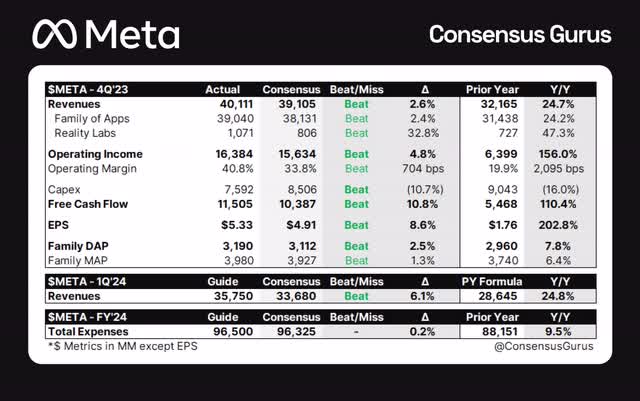

With a 25% increase in revenue to $40.1 billion, the fastest growth rate since mid-2021, Meta’s Q4 showcased the ongoing rebound in the online ad market. The firm’s net income soared to $14 billion from $4.65 billion a year earlier. The company’s first-ever quarterly dividend of 50 cents per share, scheduled for March 26, and a $50 billion share buyback were well-received by investors.

As far as I can see from the comments under various news outlets, the dividend announcement was particularly lauded, signaling to investors a new phase of maturity for the tech giant.

I believe that the market reaction was absolutely justified and that META, while not “mountains of gold”, should have a fairly comfortable total return with less selling pressure from insiders.

Why Do I Think So?

Due to the abundance of articles on what exactly we’ve seen from META’s Q4 FY2024 report, I don’t want to draw your attention to dry numbers – you can check out META’s earnings review in other SA writers’ articles here.

Instead, I want to talk about the dividend announcement and why I believe it represents a real game changer for META (very few people write about it).

I suggest that we first turn to the academic research on the topic in question. In March 2018, the International Review of Financial Analysis published an article entitled “Dividend premium: Are dividend-paying stocks worth more?” by Sigitas Karpavičius and Fan Yu. The researchers examined the relationship between dividend payouts and firm value and concluded that the stock prices of dividend payers are on average 12.5% or 17.4% (depending on the methodology) higher than those of non-payers. That means, in their opinion, dividend-paying stocks command a pretty impressive premium over their non-dividend-paying peers. Pay attention to the average size of that premium (about 15% in the mid-range) and remember how much META rose immediately after announcing its first dividend. Now there should be fewer questions about whether the stock’s 20% growth is an anomaly: I think META simply absorbed the premium for the dividend initiation. That’s it.

Yes, META’s Friday surge turned out to be slightly higher than the average premium, but don’t discount the very strong quarterly report, which I promised not to analyze in this article in detail so as not to waste your time and emulate other writers. But the company’s accelerated growth rates are truly amazing.

Shared by @ConsensusGurus on X

Continuing my research into the effects of the announcement of the first dividend on stock performance, I came across the CFA Institute’s monograph entitled “Initial Dividends and Implications for Investors“, which was published in December 1996, but in my opinion, has lost none of its relevance to this day.

The 76-page monograph examines various studies from Miller’s and Modigliani’s work from the 1960s to that of the early 1990s. But so as not to bore you with the abundance of financial theory, I ask you to pay attention to the following quote from the monograph, which particularly stuck in my mind:

The empirical evidence presented supports two potential reasons for this phenomenon (choosing between dividends and reinvestment): (1) Some companies commence dividend payments only when they believe they can consistently maintain them in the future, suggesting that investors may glean positive insights into a company’s earnings prospects from such initiations. (2) Other companies initiate dividends due to a broader decrease in investment opportunities; this category encompasses maturing firms choosing to return excess free cash flow to their stockholders instead of allocating it to substandard projects.

Source: CFA Institute, author’s notes and emphasis added

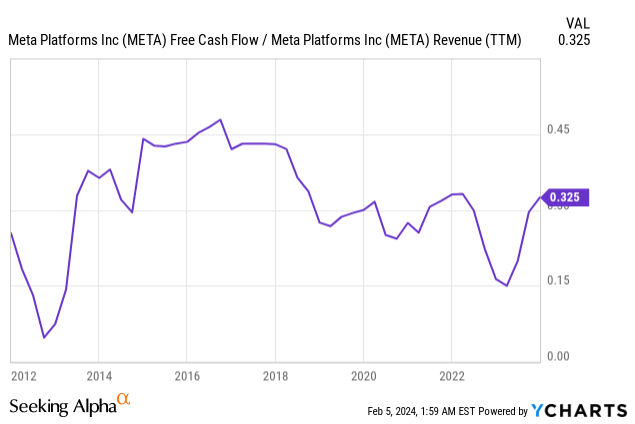

In my opinion, investors really don’t need to worry about maintaining META’s dividend yield over the long term and potentially increasing payments, as we are seeing strong recovery growth in FCF margin following the Q4 results announcement. META is now back above 30% on this metric, which means that the dividend payout should not cause any inconvenience to the operating business.

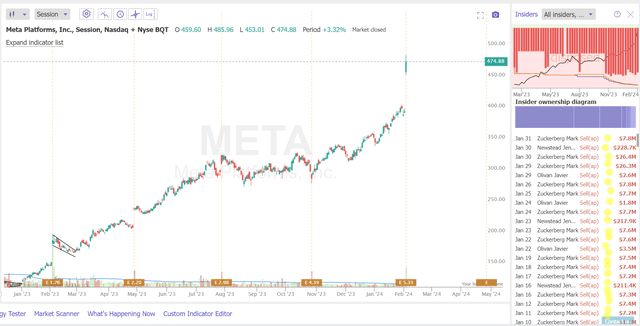

I would like to add to the conclusion of the authors of the monograph another thought that occurred to me while writing this article. For many, the announced dividend of $2 per share, yielding less than 0.5% at Friday’s close, was a disappointment. But firstly, this yield comes from a payout ratio of 11.1%, which offers plenty of scope for expansion if required. Secondly, the mere fact that there is a dividend should put more money in the coffers of Mark Zuckerberg and the rest of the firm’s executives – their need to sell shares will be much less than before.

TrendSpider Software, author’s notes

On the question of the “small dividend”: Mark Zuckerberg should earn around $700 million this year alone, taking into account his current stake in the company. Less reason for insiders to sell their shares means less pressure on market prices, which in turn means fewer obstacles to their growth.

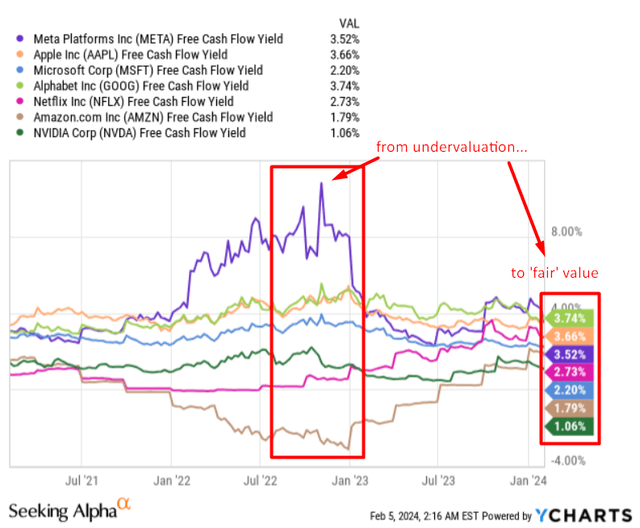

However, don’t expect META to continue to have strong growth potential. Yes, dividends are a game changer for the firm in the way the stock is now perceived and in terms of justifying the existing premium. But compared to the rest of the Magnificent 7, META is no longer undervalued when looking at the FCF yield:

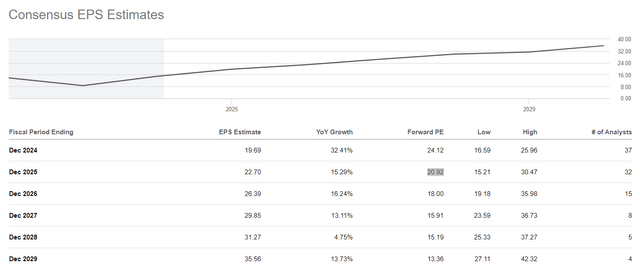

META is currently trading at 24x FY2023 earnings, 5.67% below its historical norm (5-year average). At the same time, the consensus forecast assumes compound annual EPS growth of around 10.35% (CAGR) for the next 6 years, with FY2025 at ~21x, according to Seeking Alpha data.

Assuming that a P/E ratio of 24x remains in place until the end of FY2025 and the analyst consensus of $22.7 is actually achieved, the META stock should be worth $544.8 in less than 2 years, which represents an upside potential of around 14.6% from the current price.

Even before the growth META showed on Friday, Goldman Sachs analysts (February 2, 2024 – proprietary source) set their 12-month price target at $500, which is generally in line with my conclusions.

Goldman Sachs [February 2, 2024 – proprietary source]![Goldman Sachs [February 2, 2024 - proprietary source]](https://static.seekingalpha.com/uploads/2024/2/5/49513514-17071182199968355.png)

I believe that META is a long-term ‘Buy’, but logic tells me that the stock must first correct from current levels to become a bargain. But if the investor’s goal, as I think most of my readers, is to hold shares for more than 2-3 years, then META already looks interesting for buying today if we expect the “dividend premium” to continue to increase in its valuation.

Risks To My Thesis

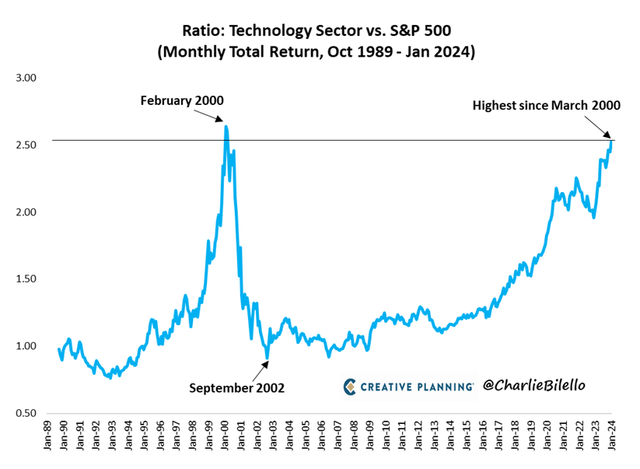

The biggest risk I see for META and the entire tech sector in particular is overheating. Today we have already reached the highest ratio of tech stocks to the S&P 500 (SPX) since the dotcom bubble, which looks very ugly and unsustainable to me:

Charlie Bilello’s latest newsletter

As Meta heavily relies on advertising revenue, especially from its social media platforms like Facebook and Instagram, any downturn in the online advertising market or regulatory changes affecting targeted advertising practices could adversely impact Meta’s financial performance. This risk also cannot be dismissed when considering META as a potential ‘Buy’ idea.

Meta’s business practices, especially related to content moderation and the impact of its platforms on society, face scrutiny. Negative perceptions regarding issues such as misinformation, hate speech, or the addictive nature of social media may lead to reputational damage and regulatory actions.

The Verdict

Despite the risks that currently surround META, I believe that the recent news of initiating dividends, even at such a modest yield level, still makes the company’s stock attractive after Friday’s 20% rise in the stock price. In my opinion, META stock simply reflected a premium to its valuation with this lightning-fast move, which it deserves based on financial theory and market dynamics.

Moreover, by receiving $2 per share this year, CEO Mark Zuckerberg and other executives are in a more advantageous position, which should incentivize them not to sell their shares in the public market. This should support META’s stock price as supply is now expected to be more limited.

According to my calculations, META has a growth potential of 14.6% by the end of 2025, which still makes the company look attractive in the long run. Perhaps “value hunters” should wait until the price falls before buying META, but I think they risk missing out. Given all the factors, I’m in any case reiterating my previous “Buy” rating today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!