Summary:

- While META may have delivered an exemplary FQ1’23 double beat and guided for excellent FY2023 numbers, but Reality Labs’ rate of cash burn has accelerated.

- Then again, based on META’s current Enterprise Value and our projection of $62.3B in overall operating income, the projected NTM EV/ EBIT of 9.42x does not seem expensive.

- As a result, we maintain our thesis that the stock remains attractive here, especially given the potential expansion in the top and bottom line once the advertising dollars return.

- Meanwhile, with the macroeconomic outlook likely to normalize only by 2025, we are not in a hurry to add META just yet, since we have done so in the previous November 2022 bottom.

photoschmidt

META’s Year Of Efficiency Has Shown A Robust Investment Thesis

We have previously covered Meta Platforms, Inc. (NASDAQ:META) in April 2023 here, discussing the five key strategies that the social media giant has adopted to deliver sustainable results efficiently. It is apparent that its efforts have been more than successful, with it achieving double beats in regards to the recent FQ1’23 earnings.

META recorded revenues of $28.65B (-10.9% QoQ/ +2.6% YoY) and GAAP EPS of $2.20 (+25% QoQ/ -19.1% YoY) in the latest quarter, easily beating its previous guidance, and this was compared to its previous revenue (-17.1% QoQ/ +6.6% YoY) and EPS (-26% QoQ/ -17.6% YoY) cadence in FQ1’22.

Much of this achievement is attributed to the drastically reduced operating expenses of $14.05B in FQ1’23 (-4.3% QoQ/ +5% YoY), or most notably by -11.9% from its peak expenses of $15.95B in FQ3’22. Particularly, the SG&A expenses declined to $5.47B for the quarter (-14.6% QoQ/ -3.5% YoY), or down by -21.9% from FQ3’22 levels, while R&D expenses remained stable.

In addition, the number of META’s employees has drastically declined to 77.11K (-10.8% QoQ/ -0.8% YoY) by the latest quarter, or by -11.6% from 87.31K in FQ3’22. With more headcounts potentially on the chopping block through late May 2023, we suppose the advertising giant may further unlock efficiency and profitability ahead.

There are already hints of outperformance, from the highly promising FQ2’23/ FY2023 forward guidance. The social media giant has guided higher FQ2’23 revenues of $30.75B (+7.3% QoQ/ +6.6% YoY), with lower FY2023 operating expenses of $88B (-3% YoY) and capital expenditure of $31.5B (inline YoY) at the midpoint.

Based on these numbers alone, META may achieve an expanded operating income of approximately $62.3B (+25.5% YoY) and a Free Cash Flow [FCF] generation of approximately $23.4B (+26.9% YoY) in FY2023. This feat is highly impressive indeed, despite the uncertain macroeconomic outlook and the deceleration in advertising spend in 2023, further demonstrating that its “Year Of Efficiency” has been a highly prudent strategy.

Naturally, none of this would have been possible without its Family of Apps, which recorded exemplary growth in Daily Active People [DAP] to 3.02B (+2% QoQ/ +5% YoY) and Monthly Active People [MAP] to 3.81B (+1.8% QoQ/ +5% YoY) by the end of March 2023.

META’s investments in AI infrastructure have also paid off by FQ1’23, with ad impressions on its Family of Apps increasing by +26% YoY while decreasing the average price by -17% YoY. This has improved its global Average Revenue Per User [ARPU] to $9.62 (+0.8% YoY), seemingly unimpressive due to the tougher YoY comparison of +2.9% growth in FQ1’22. Otherwise, it comes with an excellent CAGR of 10.64% from FQ1’19 ARPU of $6.42.

The combination of these strategies has naturally lifted the segment’s profitability, with operating incomes of $11.21B (+5% QoQ/ -2.3% YoY) and margins of 39.6% (+5.7 points QoQ/ -2.5 YoY) by the latest quarter, despite the rising inflationary pressure.

On the other hand, META clearly has yet to retire its Metaverse ambitions, with it expecting “Reality Labs operating losses to increase year-over-year in 2023.” In FQ1’23 alone, it reported operating losses of -$3.99B (-6.5% QoQ/ +34.% YoY) and margins of -1,177.5% (expanding QoQ from -588.5% and YoY from -425.8%).

As a result, Reality Lab’s cash burn may increase moving forward, further negating Family of App’s stellar performance while dragging down its overall profitability, from the latest quarter’s overall operating margins of 25.2% (+5.4 points QoQ/ -5.3 YoY).

Then again, based on META’s current Enterprise Value of $587B at the time of writing and our projection of $62.3B in overall operating income in FY2023, the projected NTM EV/ EBIT of 9.42x does not seem expensive, in our view, especially in comparison to its 1Y mean of 13.05x, 3Y hyper-pandemic era mean of 17.74x, and 3Y pre-pandemic mean of 18.82x.

As a result, we maintain our thesis that the stock remains attractive at these levels, especially given the potential expansion in the top and bottom line once the advertising dollars return, likely by 2024. However, due to the increased likelihood of a mild recession in H2’23, the stock is only suitable for investors with higher risk tolerance and long-term investing trajectory.

So, Is META Stock A Buy, Sell, or Hold?

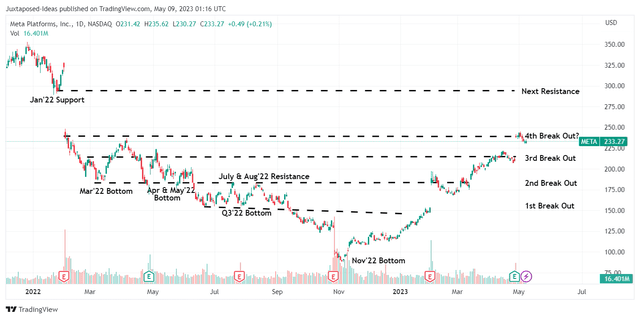

META 1Y Stock Price

The META stock has recorded an impressive recovery since the November 2022 bottom indeed, rallying by +164.8% since then. Assuming a similar cadence, we may see it further break out for the fourth time to retest the January 2022 support around the $290s.

The stock continues to trade below our price target of $327.84 as well, based on the market analysts’ projected FY2024 EPS of $13.66 and its normalized P/E of 24x (prior to the AAPL privacy changes headwind). Therefore, we are cautiously rating the META stock as a Buy here, with the caveat that the portfolio must be sized appropriately in the event of volatility.

Meanwhile, we will not be adding any more META to our portfolio, since we have done so in the previous November 2022. With the macroeconomic outlook likely to normalize only by 2025, we are not in a hurry to add just yet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.